Asian share markets are not doing well despite a strong lead from Wall Street overnight with commodity volatility one of the culprits as oil prices move lower as silver explodes higher. Currency markets are seeing a little bit of stability with USD losing some ground against Yen but outperforming Euro and Loonie. The November inflation print keeps the February RBA rate bike on the table – just – which is giving the Australian dollar a small boost as it stays well above the 67 cent level.

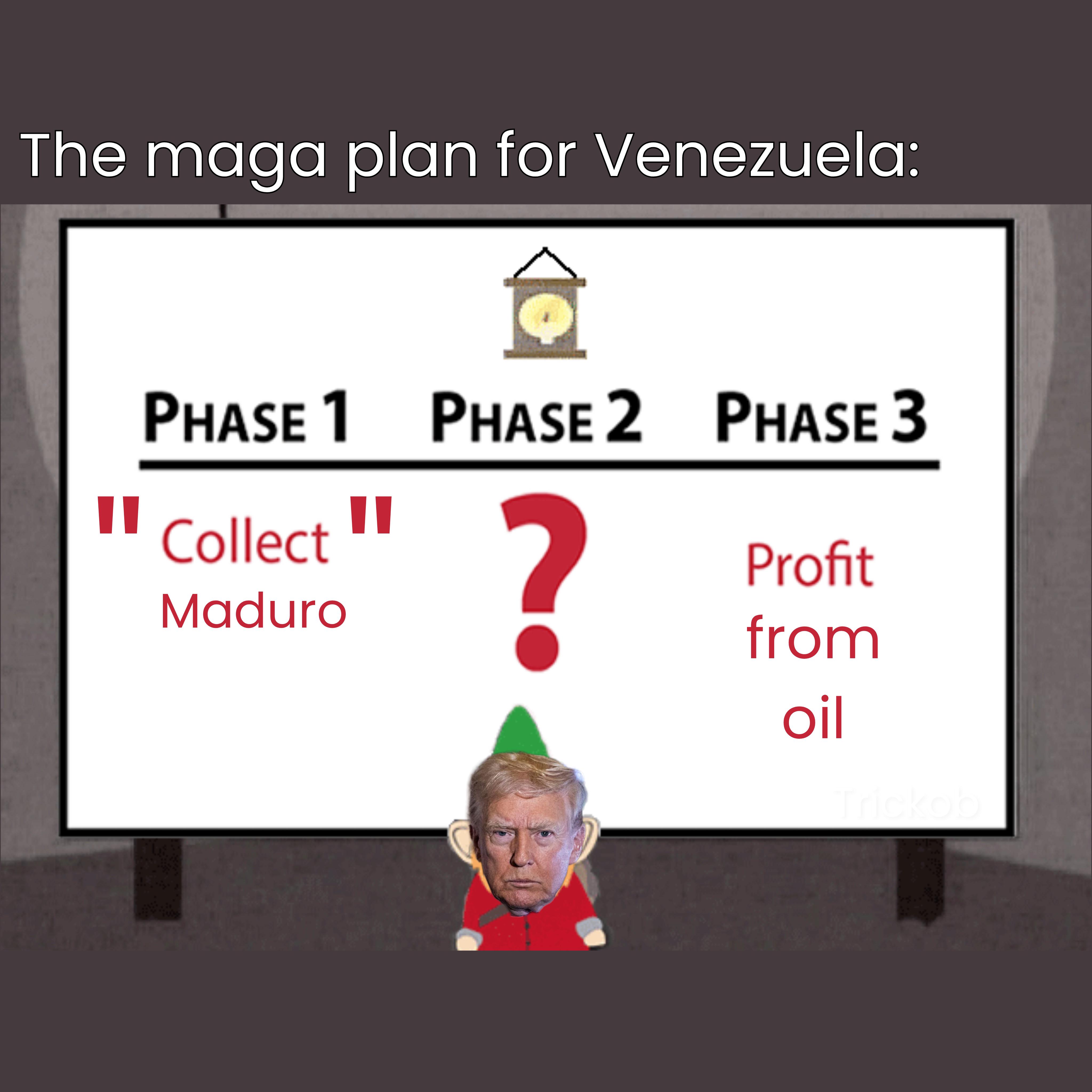

Oil markets remain unstable but weakness is starting to creep in again as Brent crude flops below the $60USD per barrel level while gold has eased off from its start of year rally to hold at the $4470USD per ounce level:

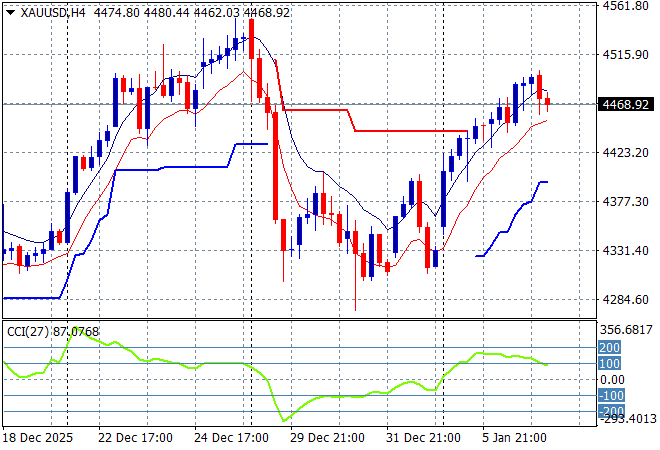

Mainland Chinese share markets are a bit wobbly going into the afternoon session with the Shanghai Composite down slightly but still above 4000 points while the Hang Seng Index has snapped back, falling more than 1% lower to 26383 points. Japanese stock markets are also seeing a small selloff after recent exuberance with the Nikkei 225 losing nearly 1% to retreat below the 52000 point level with the USDPY pair also losing ground to just above support at the 156 level:

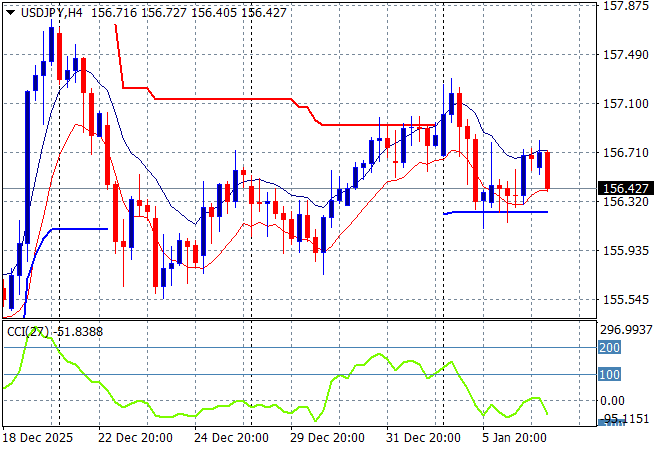

Australian stocks were the standout for a change with the ASX200 lifting nearly 0.2% higher to 8695 points while the Australian dollar spiked on the November inflation print before settling at the mid 67 cent level, still looking well supported:

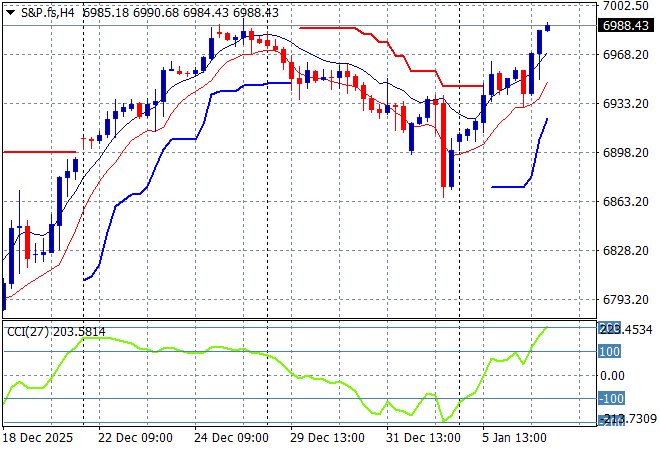

S&P and Eurostoxx futures are moving higher after the post Xmas/NY low volatility period with the S&P500 four hourly chart showing support building well above the 6800 key level as momentum becomes well overbought:

The economic calendar includes the latest US ADP employment figures plus the latest ISM services survey.