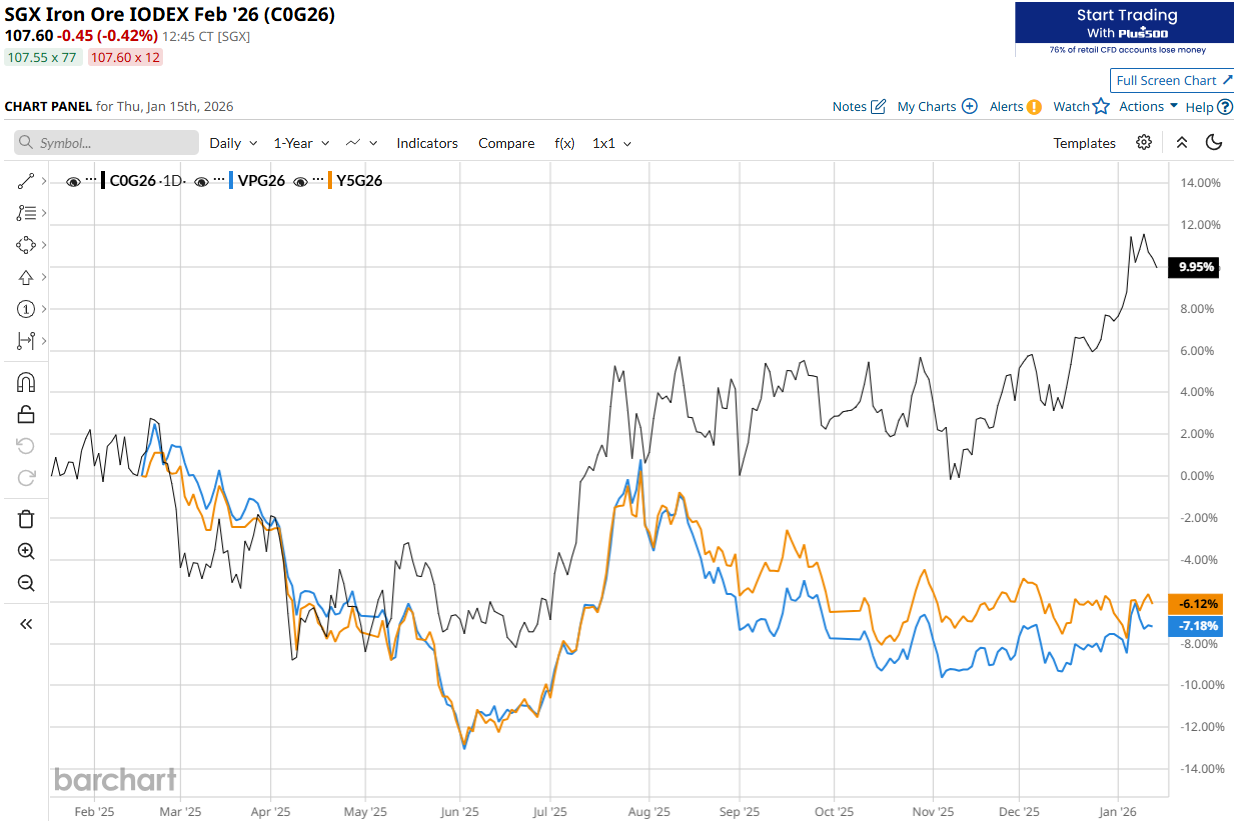

Wow. For a market that is falling apart, there are some amazing things happening to hold the iron ore price aloft.

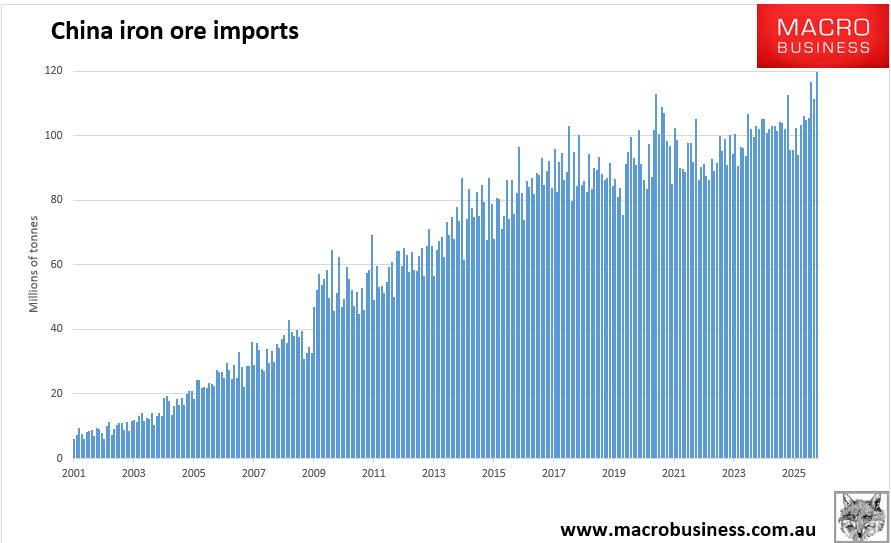

Chinese December trade data yesterday smashed record import volume at an astounding 119.65mt.

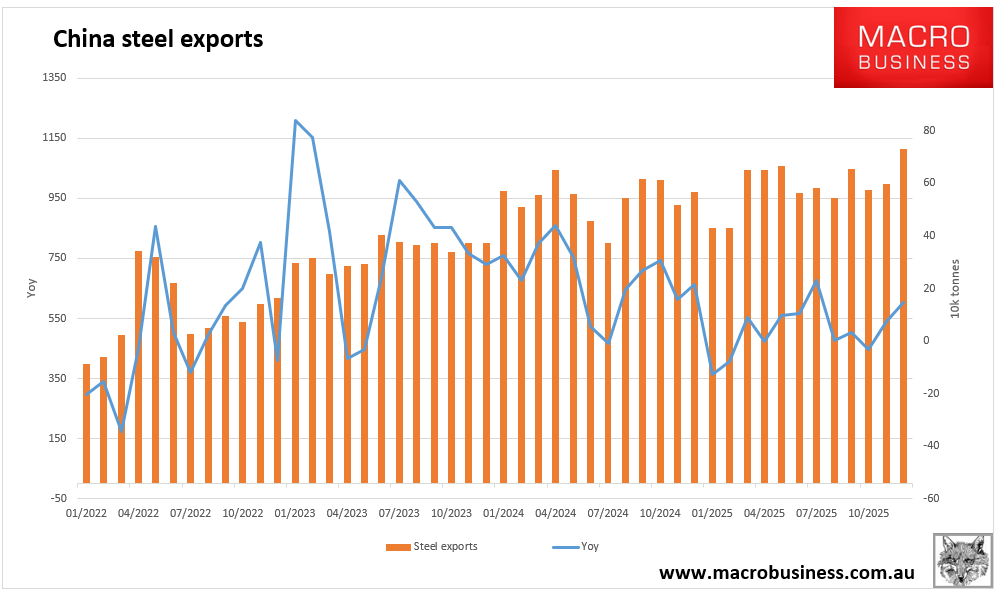

Steel exports were at a record, too, as some mills frontloaded ahead of the new export licensing system.

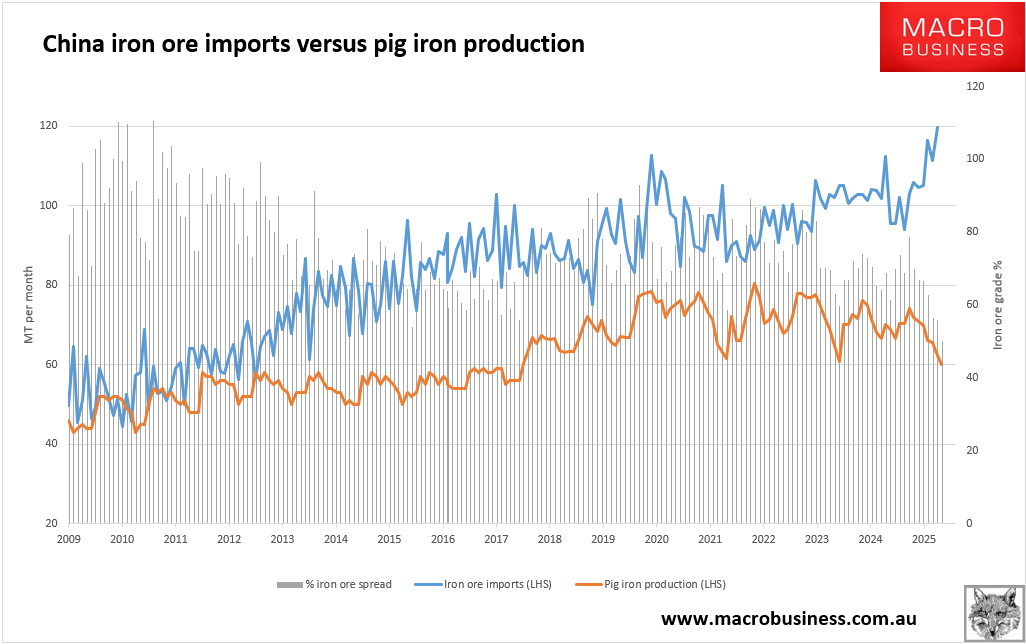

But the chart I really want to show you is this one. Pig iron ore production in China has declined by 67mt over four years, despite booming exports, while iron ore imports have increased by 112mt.

Some of the divergence can be accounted for by higher inventories, small declines in Chinese iron ore mining, and the use of direct injection in BOF over EAF, but most can be attributed to declining iron ore grades.

Most notably, the collapse of steel mill margins in the fourth quarter of 2025 pushed mills to buy as much crappy, cheap ore as is humanly possible, with the average grade per tonne collapsing to just 50%.

Such a swift decline is unrelated to the decline in global iron ore grades. This is a cyclical response to a margins problem created by the iron ore oligopoly, which is preventing the iron ore market from finding a clearing price.

Hence, the ferrous jaws.

When this paralysis ends, most likely as Simandou reaches material volumes, it will have a dual effect.

First, it will reduce the oligopoly’s pricing power.

Second, it will inject very high-grade ore for blending, displacing much larger volumes of lower-grade ore than it might normally.

In short, stability is creating the conditions for severe instability in the iron ore price in the not-too-distant future.