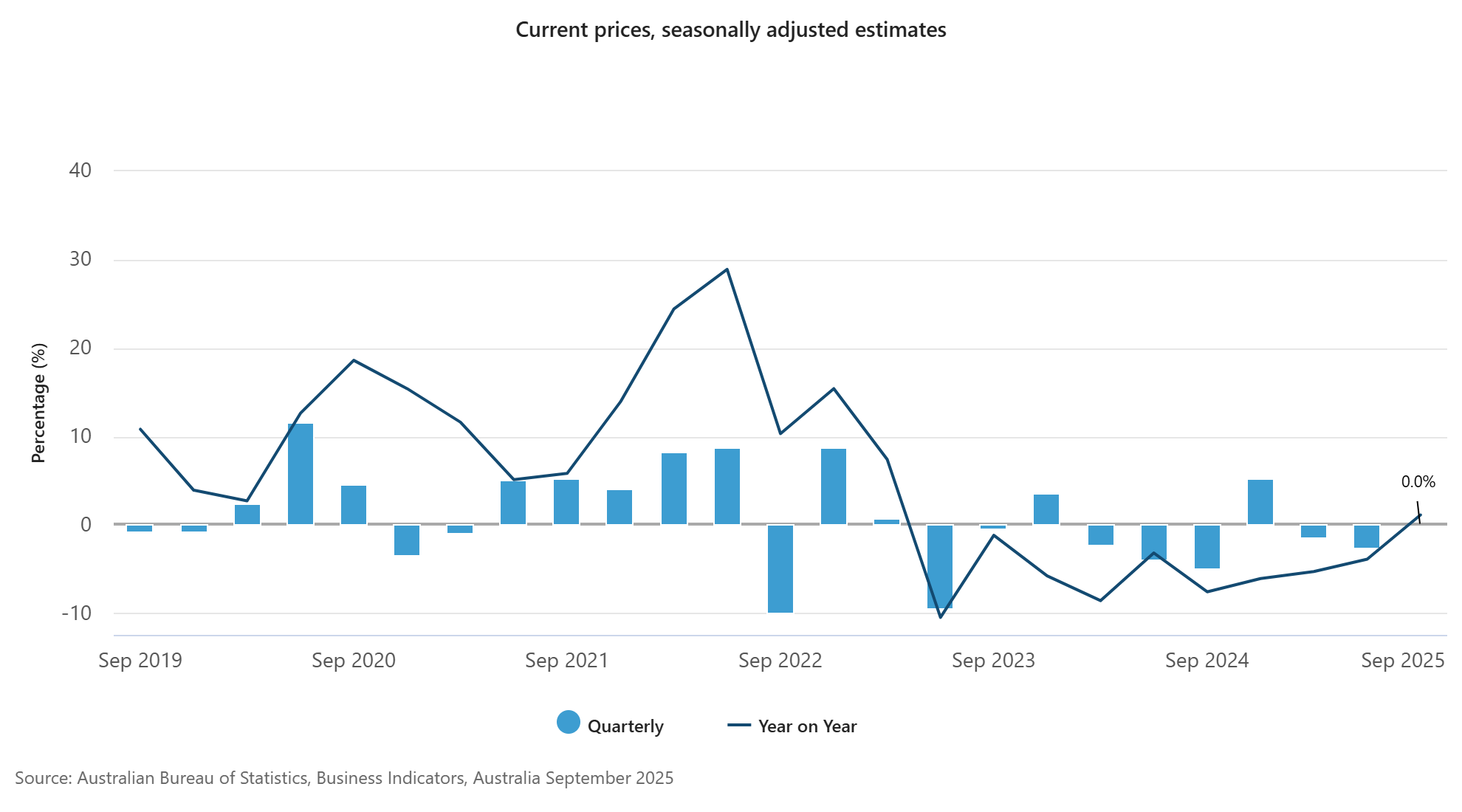

With the release of the latest gross operating company profit data from the ABS, it was revealed that they were flat in nominal terms for the quarter, despite analysts expecting a 1.5% quarter-over-quarter rise.

This result leaves the nation’s gross operating company profits in an undesirable position when it comes to contributing to GDP, up by just 1.1% in nominal terms, while headline inflation is running at 3.8%.

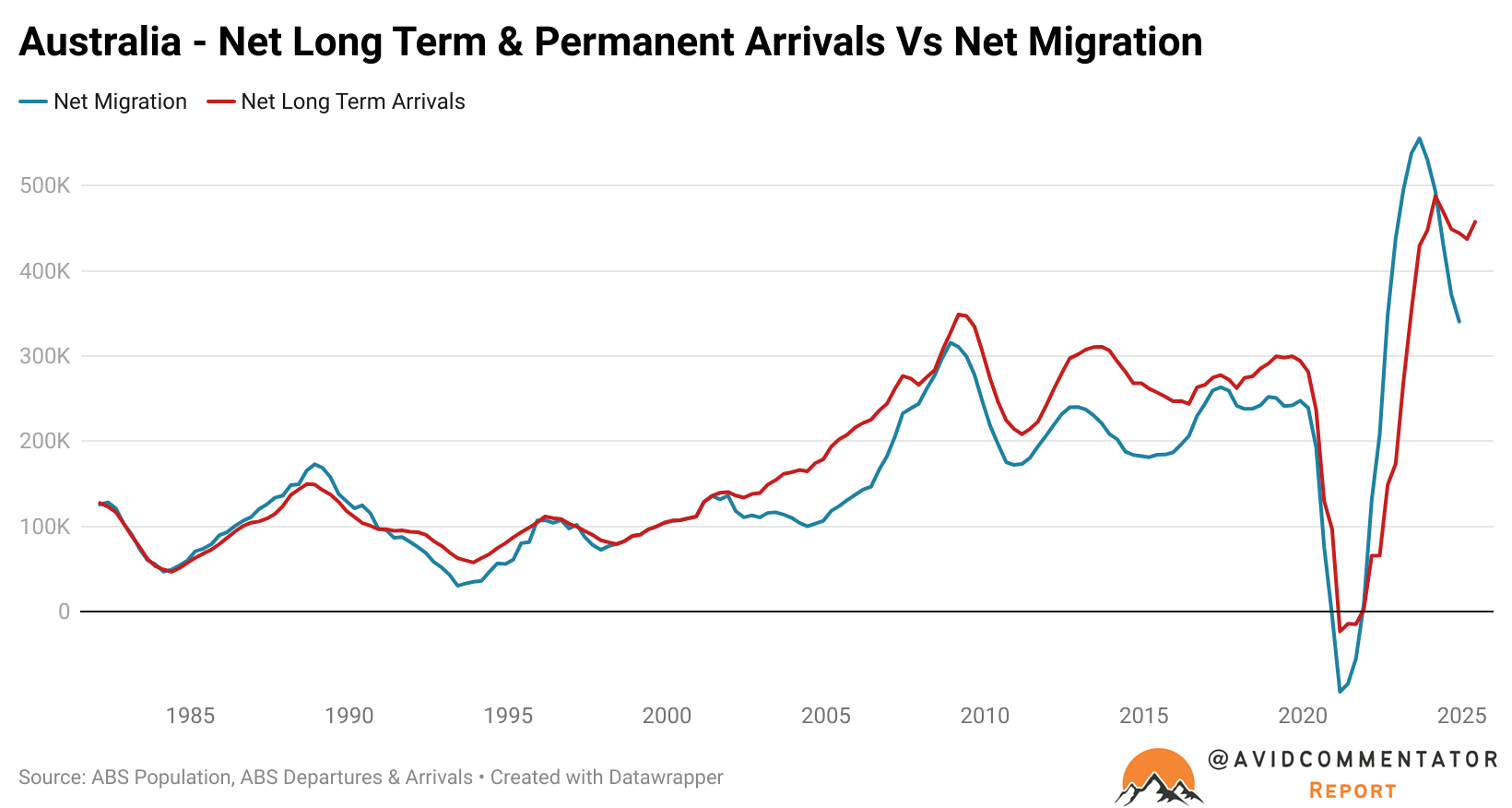

Despite the relatively commonly held narrative that “Big Australia” is good for the nation’s corporations, the strategy does not appear to be performing very well.

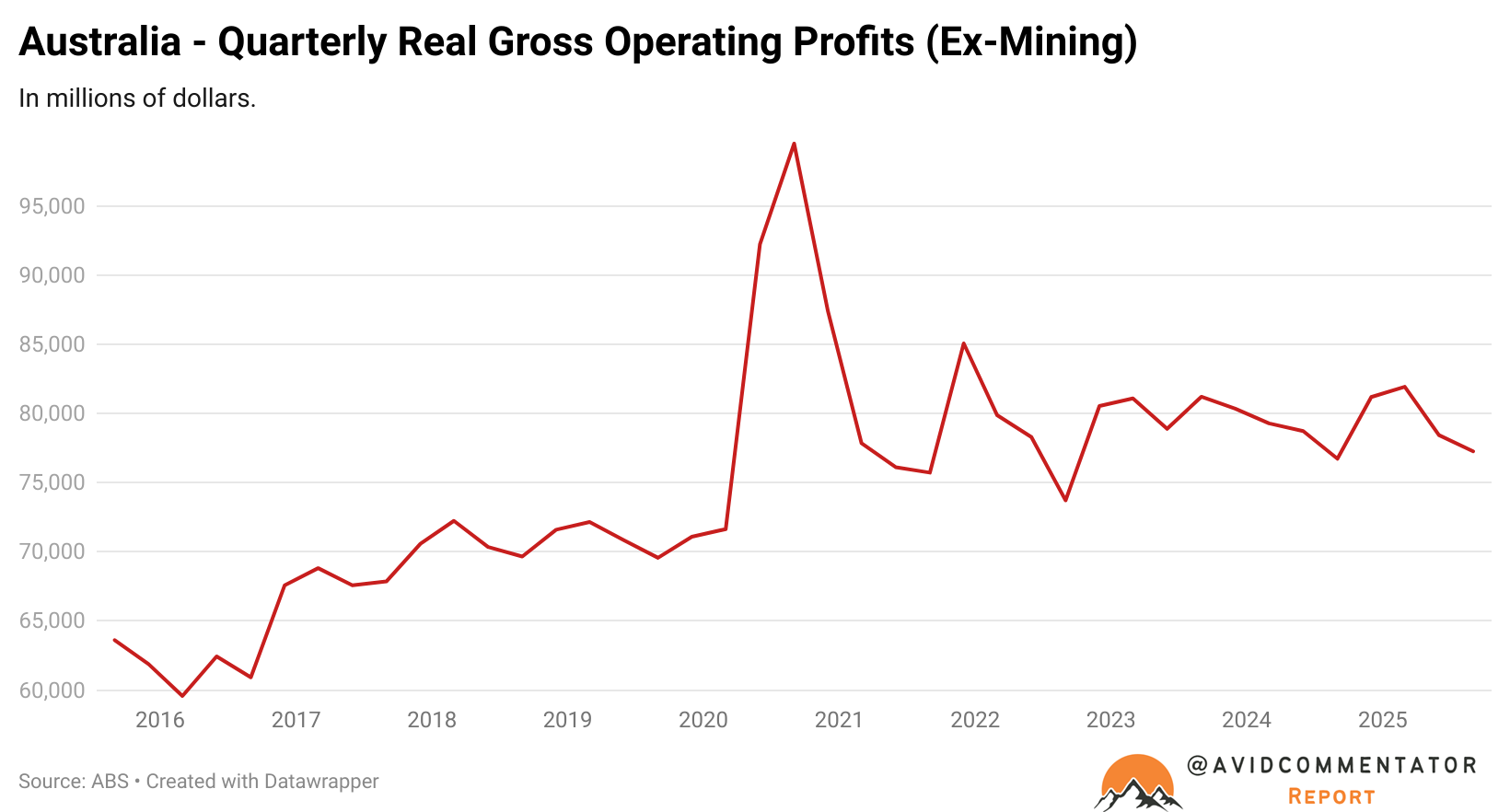

To get the best possible handle on the metric over time, we will look at the numbers excluding the mining and resources sector, since swings in commodity prices can drive dramatically different outcomes to the upside and the downside.

Adjusted for headline inflation, the pre-COVID-19 peak in quarterly gross operating company profits occurred in the March quarter of 2018, with a total of $72.2 billion (2025 dollars).

As of the latest data, which covers up to the end of the September quarter, the total is now $77.7 billion for the quarter.

This represents a 7.0% increase over the past 7-plus years since the pre-COVID-19 peak.

This would be a relatively weak result in and of itself, but when put in the context of the working-age population growing by 13.2% over the same period, it becomes downright abysmal.

Despite rocketing housing prices, a far more affluent cohort of retirees, record-high migration, and record government-driven employment growth, the nation’s companies are seeing highly anaemic real profit growth and, in per capita terms, deeply negative growth.

In fact, if we look back over the decades of data, the level of inflation-adjusted gross operating company profits (ex-mining) is lower today, per capita (working-age adult), than it was in the December quarter of 2006.

The Takeaway

While it’s true that the ‘Big Australia’ strategy has delivered a larger consumer base, it is a consumer base that, at a per capita level, has delivered no real rise in corporate profits in almost two decades.

Meanwhile, prior to the ‘Big Australia’ era, real corporate profit growth in per capita terms was highly robust, growing by 98.5% between the September quarter of 1994 and the September quarter of 2004.

Despite the commonly held perception that high migration is good for company profits, in aggregate it really isn’t, as households get squeezed by diluted wage pressures (to quote former RBA Governor Philip Lowe) and upward pressure on the cost of living.

Ultimately, data from the ABS and private providers such as CommBank iQ show that most households are going backwards in aggregate, with a relative minority of mostly older, more affluent households driving the spending growth outside a larger consumer base.