The latest national accounts, which show the economy grew by just 0.4% and contracted marginally in per capita terms, provided further confirmation of the increasingly significant risk of effective stagflation for the Australian economy.

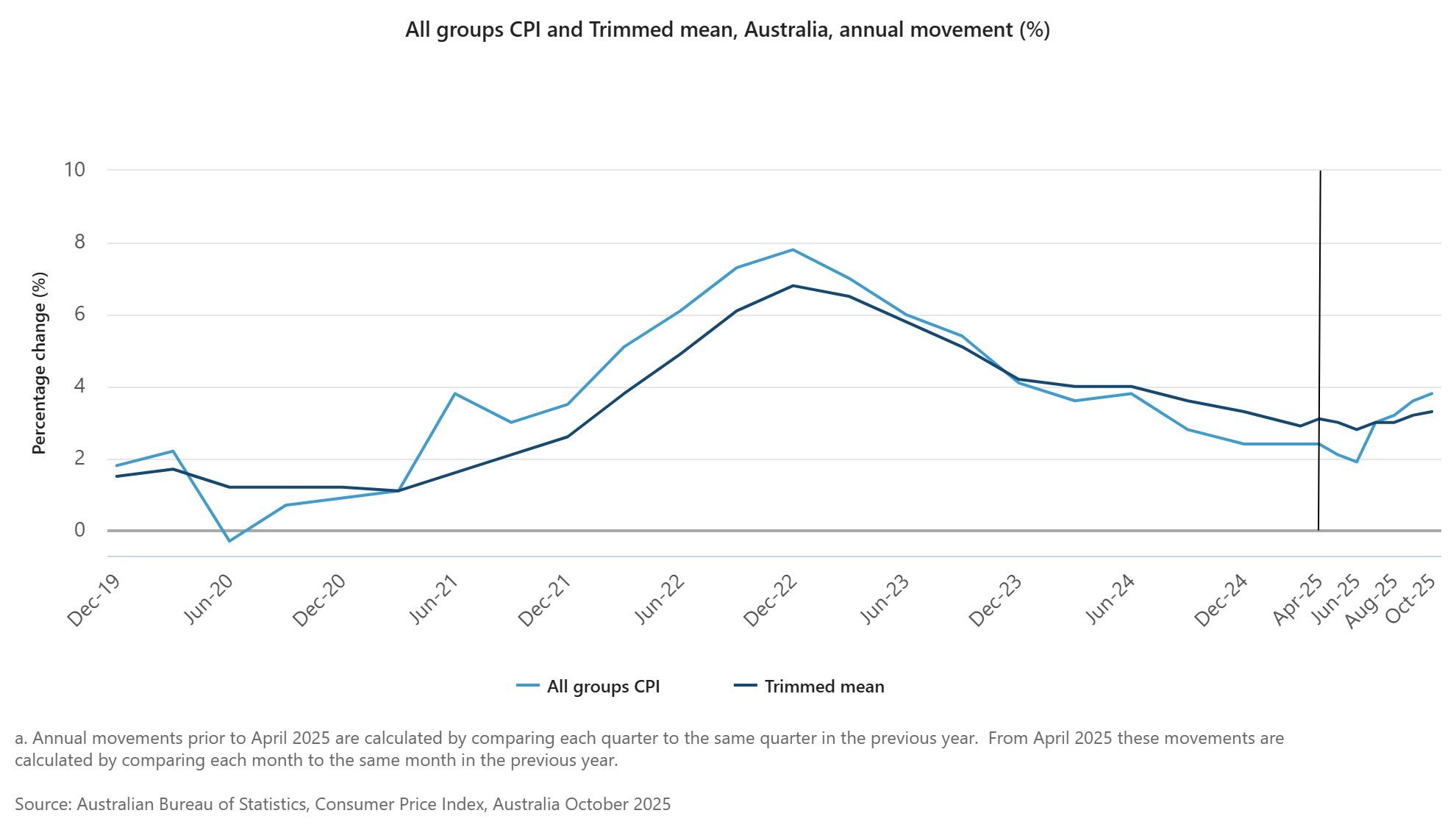

Meanwhile, despite relatively weak headline growth and per capita stagnation, inflationary pressures were resurgent in the first full monthly CPI release from the ABS.

Although the RBA is still viewing this indicator with caution, the headline result of 3.8% annual inflation and 3.3% for the trimmed mean was very unwelcome.

The growing issue of the economy’s low potential growth capacity before inflation becomes resurgent was recently covered in commentary from HSBC Chief Economist Paul Bloxham to the AFR prior to the release of the GDP figures:

“The economy is already growing at, or even a bit beyond, its speed limit”.

“The problem we’ve got is weak productivity, and so just a little lift in growth and once again, we’ve got an inflation challenge.”

“The economic challenge, we as see it, is that productivity is weak and the supply side of Australia’s economy is constrained, such that the potential growth rate is much lower than it used to be,” Bloxham said

AMP Chief Economist Shane Oliver echoed these concerns on social media following the release of the latest national accounts data.

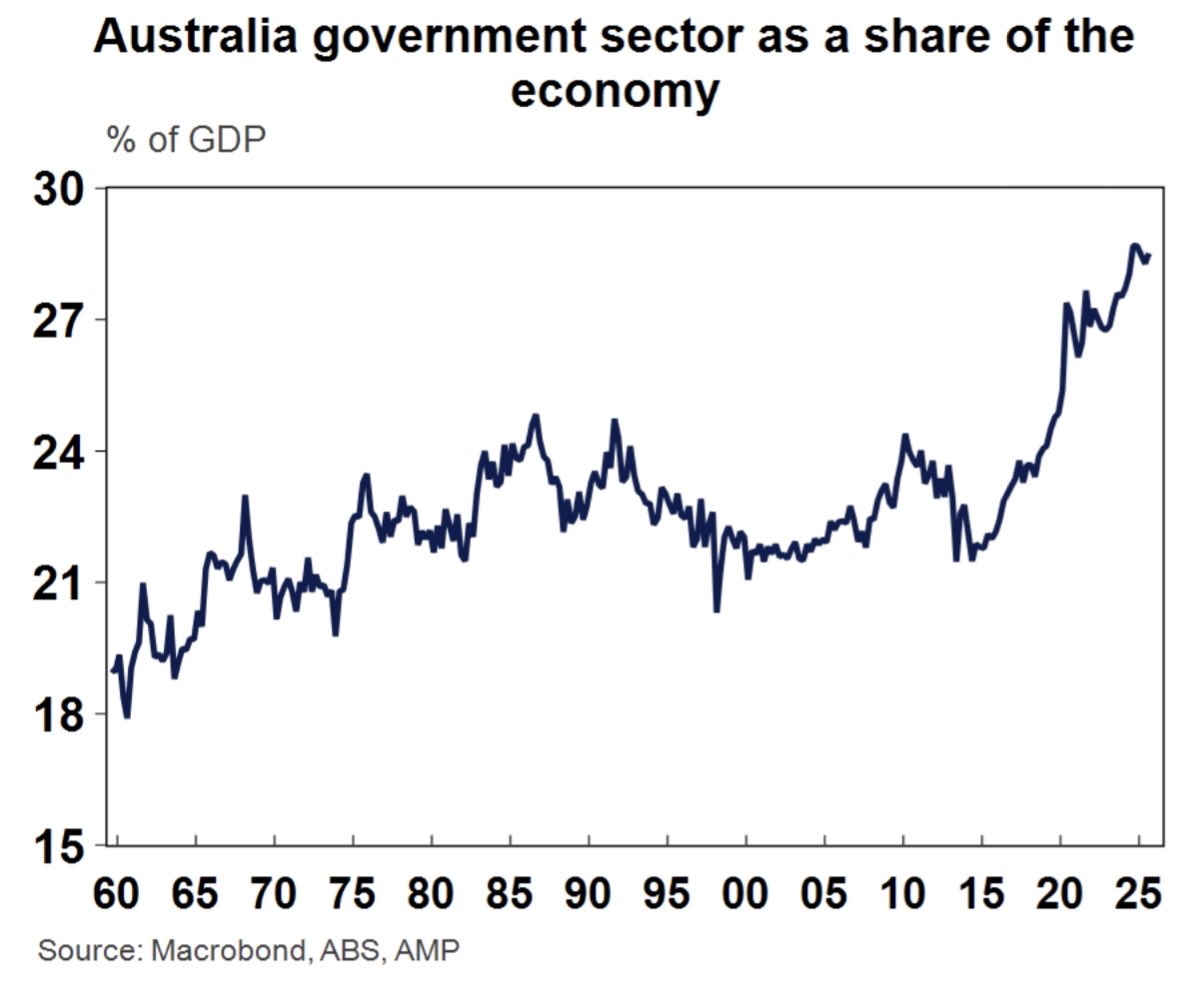

“Public spending as a share of GDP remains around a record high of 28% of GDP. This is not leaving enough room for private spending without causing capacity issues in the economy and higher than otherwise inflation and interest rates”, Oliver wrote, sharing the accompanying graph below.

Concerns about the economy hitting up against its growth potential and creating potential inflationary pressures were also shared by independent economist Chris Richardson in a tweet he entitled: TOO MUCH MONEY CHASING TOO LITTLE STUFF

“And our spending is travelling faster still, meaning that our dollar desires are pressing on the accelerator even though the clapped out engine of the Australian economy is doing the best it can”.

“That gap—too much money chasing too little stuff—is part of why price pressures are lingering”.

“Or, to put that differently, the Australian public hasn’t yet understood the many implications of our poor productivity performance—including slow income growth per person, and a more inflation-prone economy”, Richardson wrote

The big question is what does the Albanese government do going forward?

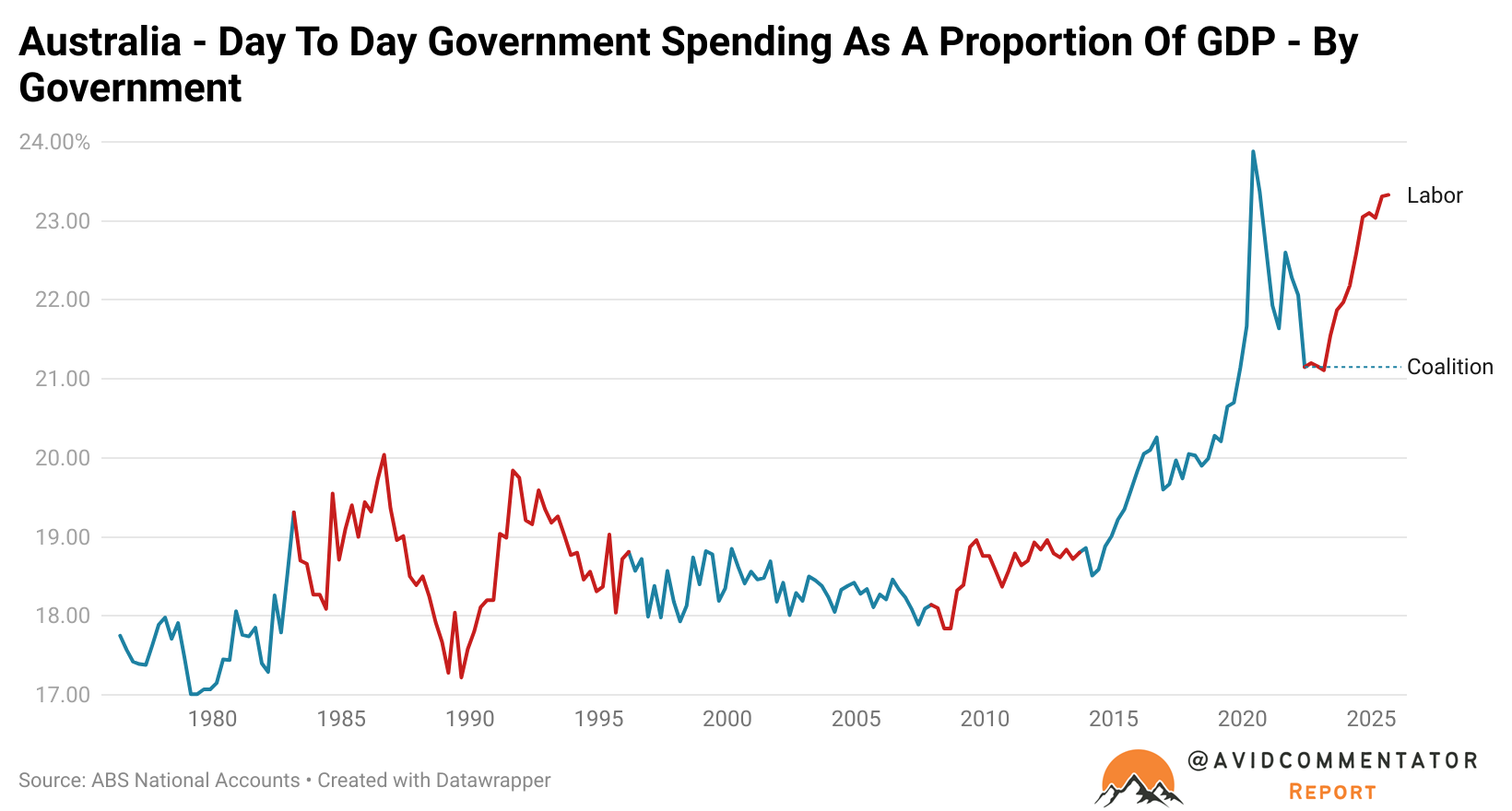

As of the latest data, the role of day-to-day government spending in driving the economy is currently at its third-highest level on record, eclipsed only by the June and September quarters of 2020, which were defined by lockdown and the Covid cash splash.

Attempting to return the role of government to more of a driver of economic activity would be fraught with risk.

Meanwhile, as Chris Richardson noted, growing productivity is a key element in raising the speed limit of non-inflationary growth within the economy.

But when a migration intake is being conducted without sufficient regard for productivity and broader economic health, it represents yet another challenging factor that is supporting headline growth, but whose removal would significantly add to the risk of a recession.

Ultimately, extricating Australia’s economy and the nation’s households from this troubling set of circumstances is a deeply challenging task, and it was the avoidance of potential economic downsides that helped deliver the economy into this mess in the first place.