This sentence is the understatement of the century.

Donald Trump always puts himself at center stage when he travels abroad, but the US president made sure his foray to Davos this week will be particularly dramatic.

He set up his visit to the World Economic Forum in Switzerland by shaking the foundations of both the EU and the NATO alliance, again, and pledging a barrage of new tariffs related to his Greenland ambitions that trample over deals he already struck with the European Union and the UK.

Trump always puts himself at the centre. The end.

Deutsche has an intriguing perspective.

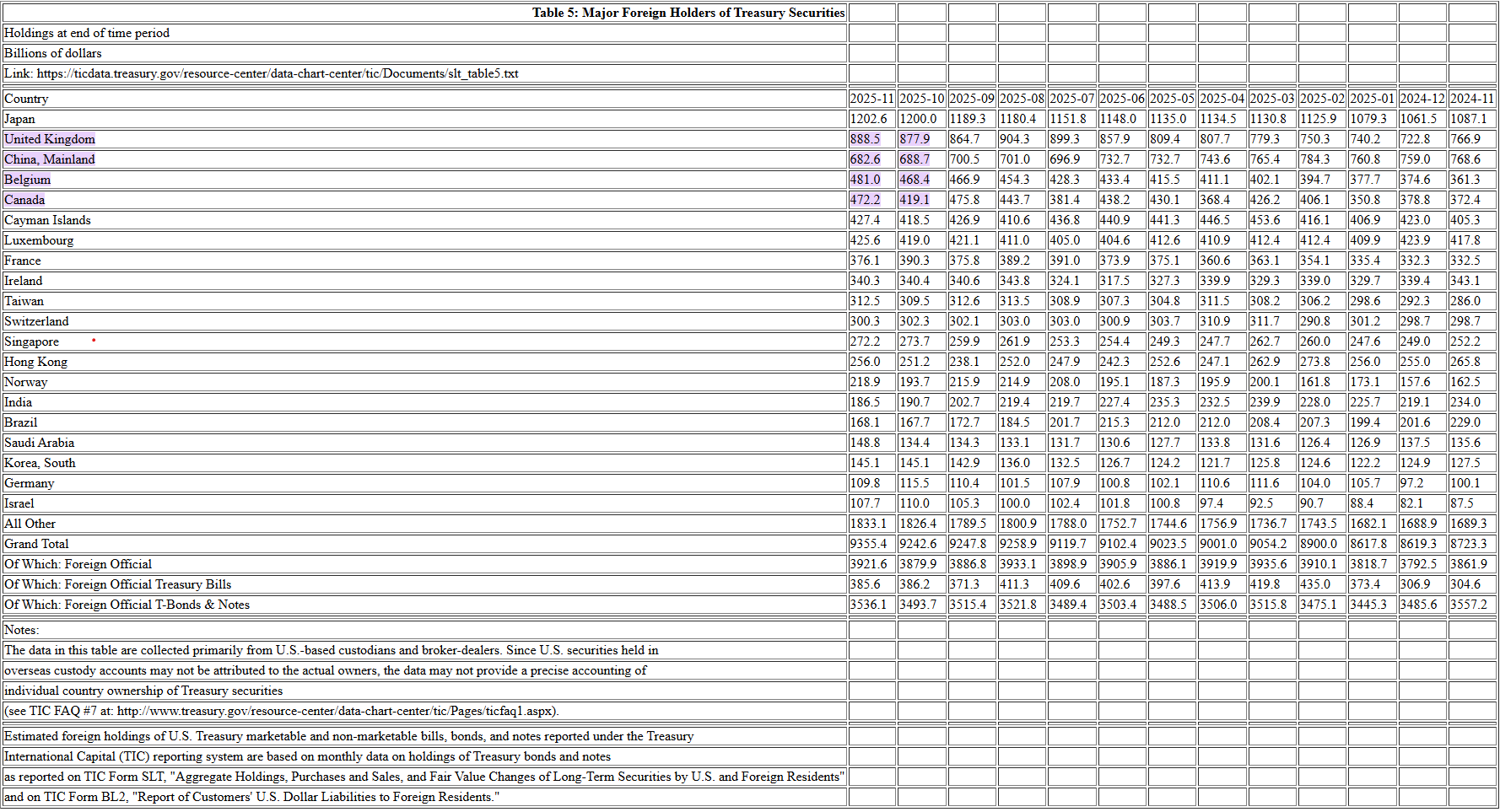

Europe owns Greenland, it also owns a lot of Treasuries.

We spent most of last year arguing that for all its military and economic strength, the US has one key weakness: it relies on others to pay its bills via large external deficits.

Europe, on the other hand, is America’s largest lender: European countries own $8 trillion of US bonds and equities, almost twice as much as the rest of the world combined.

…Could it be Greenland this year that catalyses an acceleration in European political cohesion?

It is notable that the two leaders of the euro-sceptic far-right parties in Germany and France have been highly critical of recent developments.

The extent to which a unified European strategy arises overt he next few days to address US pressure will be a key near-term signal.

Putting the two together, we are not convinced any negative EUR/USD reaction will be sustained this week.

This possibility seems to align with one of Trump’s goals. But I’m not betting on it in the short term for the EUR. I am bearish on the EUR during this period, and consequently, I am also bearish on the AUD, as they are strongly correlated in their trading patterns.

Another important point to consider is that a significant portion of Europe’s large treasury reserves is linked to Chinese money laundering.

Is it plausible to assume that Belgium and Luxembourg possess nearly one trillion in foreign reserves?

China is laundering its grotesque current account surplus worldwide.

This threat will doubtless give gold another kick along, but I don’t think the treasury threat is real.

Even so, AUD is down and sitting right on key support this morning.

A rising DXY will not please many markets today. Everybody is on the other side of the ship.