When Labor was in opposition, then Shadow Treasurer Jim Chalmers was a strong proponent of a wide variety of metrics that are championed by economists as more accurate indicators of economic performance.

This earned him respect, even from his rivals, though only behind closed doors.

But since coming to power, his focus has often turned to whatever metric is favourable for the Albanese government. Whether it be switching from quarterly figures to annual or emphasising the headline economic metrics that he once saw as less than ideal indicators of the nation’s economic performance.

This has earned him the moniker “Spin Jim” from Digital Finance Analytics Principal Martin North.

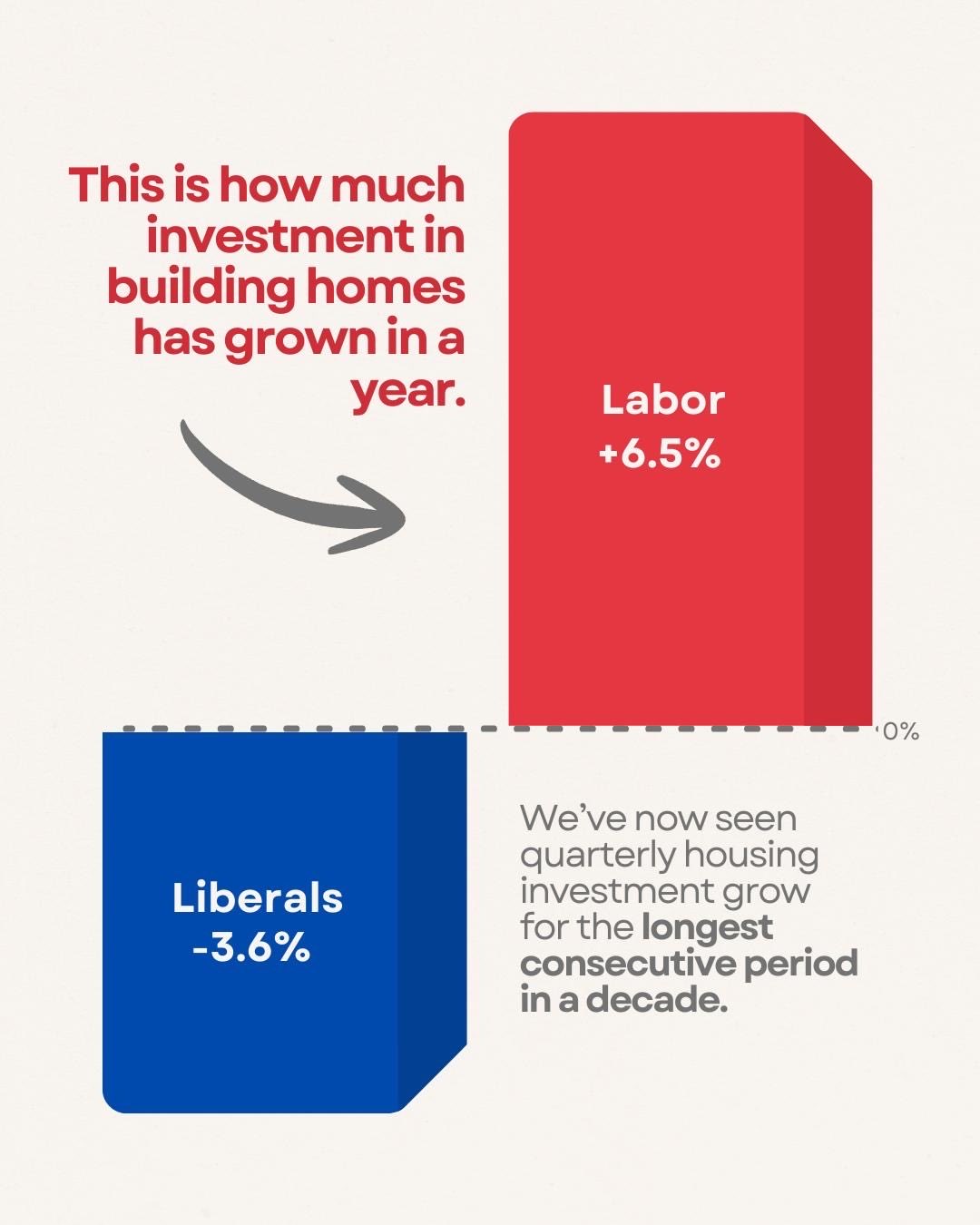

The latest instance of Chalmers spinning the data to suit the government’s political interests comes from a post on social media platform X (formerly known as Twitter).

“The facts: Australia is building more homes, with housing investment growing 1.8% in the quarter, to be 6.5% higher through the year.

When we came to office, investment in housing was going backwards by 3.6% in annual terms, but it’s turning around under Labor.

Our priority is to unlock investment and build more homes for Australians, and these numbers show we’re making progress.” Chalmers wrote

Chalmers’ tweet prompted a tweet from Shadow Housing Minister Andrew Bragg, who replied:

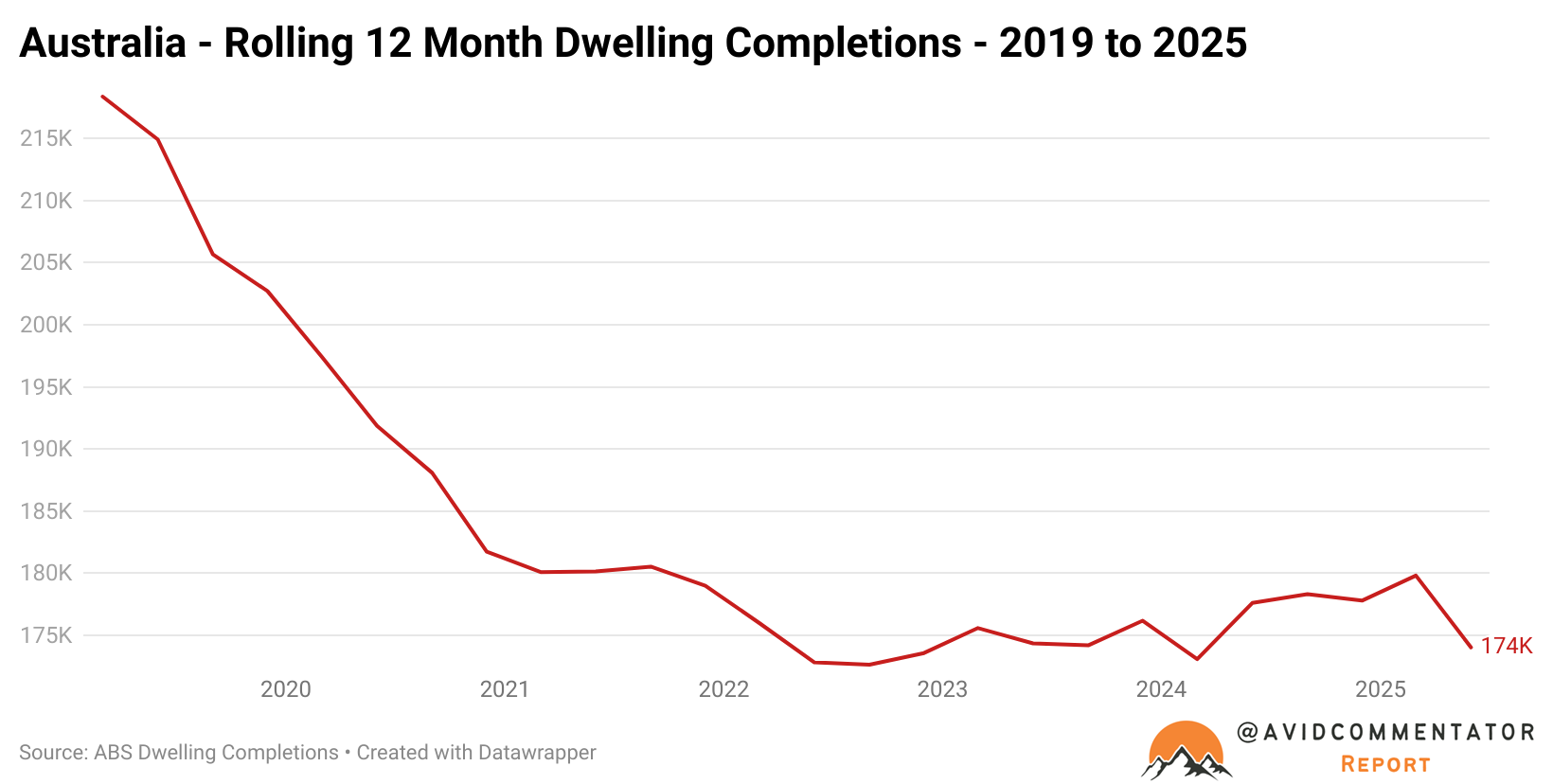

“You’re actually building fewer houses. This is embarrassing”.

The ironic thing about the interaction is that they are both technically correct.

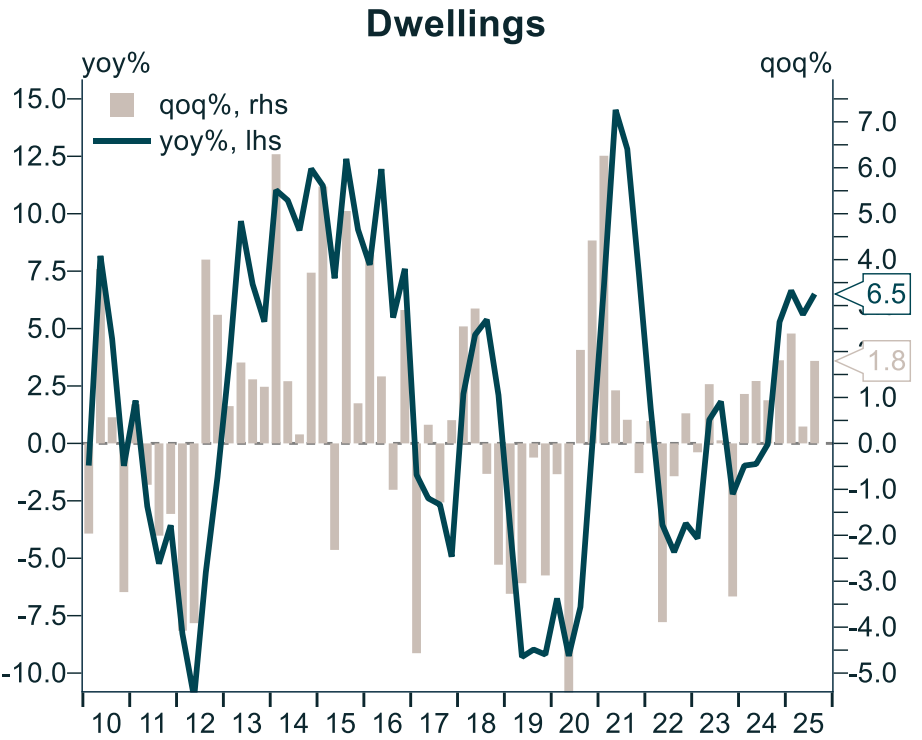

Chalmers is correct that housing investment growth is improving in quarter-on-quarter and year-on-year terms and that it was falling under the Coalition.

Chart: Alex Joiner – IFM Investors

However, as the chart above illustrates, it was falling following a huge spike in investment during the pandemic.

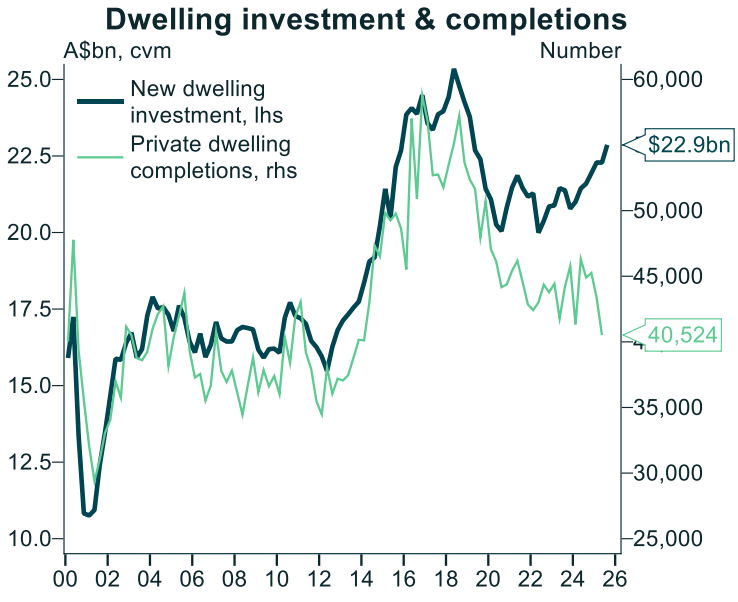

If we shift the focus to the underlying metric Chalmers is referring to rather than its rate of change, it reveals that it has bounced significantly in recent quarters, but that it remains well below the peak recorded prior to the pandemic.

But concerningly, the increase in dwelling investment has not been translating into a greater number of dwelling completions.

Chart: Alex Joiner – IFM Investors