The ferrous complex remains paralysed by iron ore prices that are too high for steel profits.

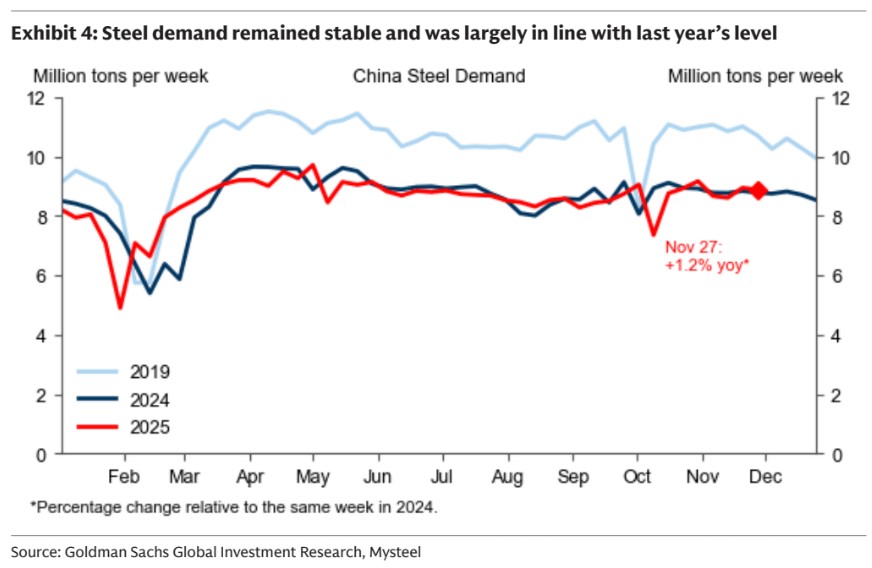

But we are in some equilibrium, as steel demand and supply are locked together.

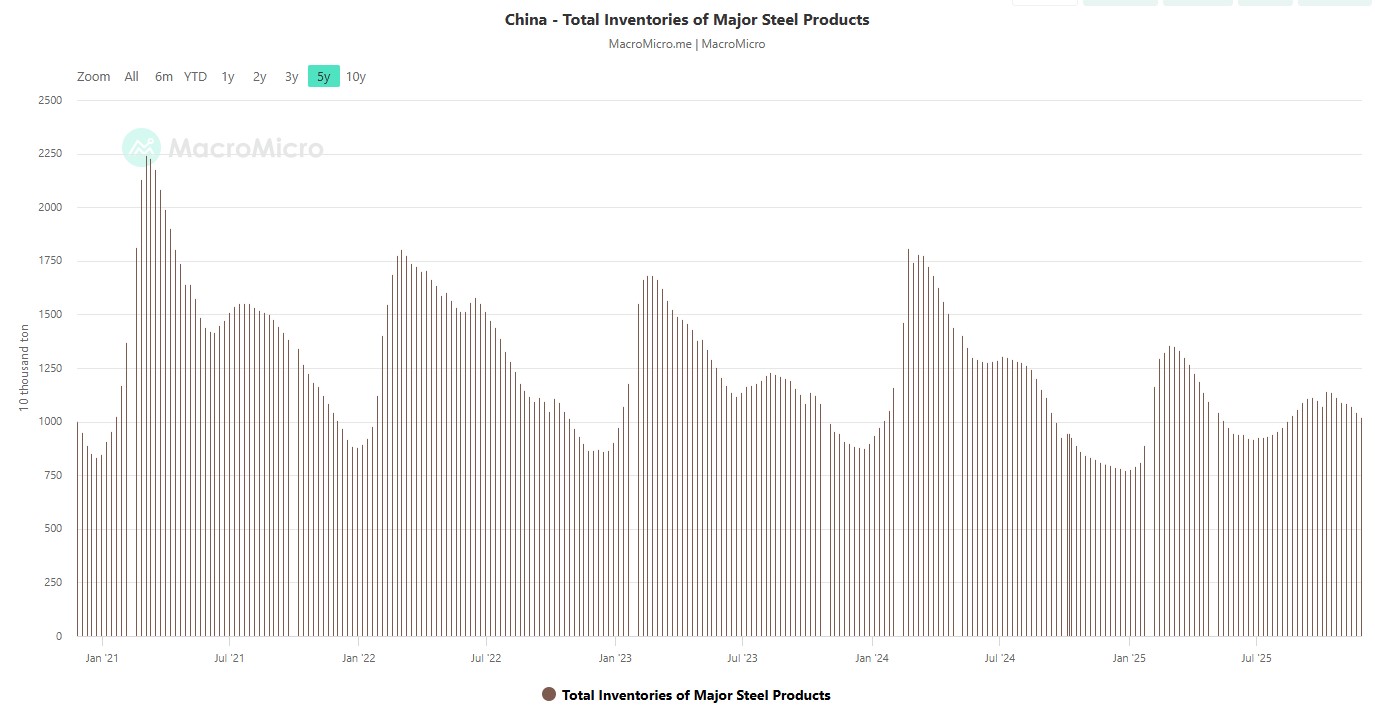

Modestly reduced steel supply has been drawing down inventory.

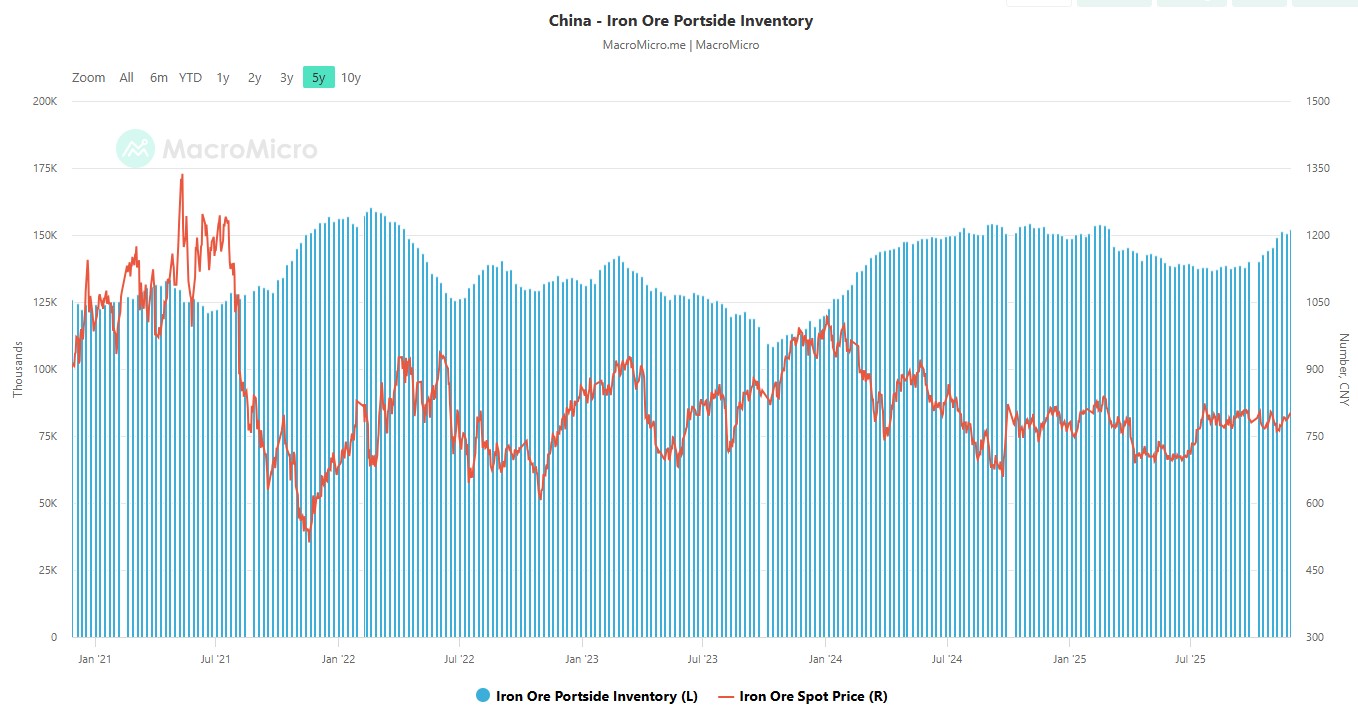

While lifting iron ore inventory at ports.

Something needs to change to rebalance. Either the government provides stimmies, or there is an increase in iron ore supply.

On the latter, the Pilbara killer has so far failed to fire a single shot.

The highly anticipated first shipment from Guinea’s Simandou iron ore project has remains stuck at anchor more than two weeks after loading began, as a dispute over locomotives and rising geopolitical friction stall progress at one of the world’s largest untapped iron ore reserves.

On Nov. 11, Simandou began loading 9,850 tonnes of ore at Marébaia anchorage onto the Winning Youth, a 200,000-ton Capesize bulk carrier operated by project stakeholder Winning International Group. Despite a floating transfer platform capable of moving 5,000 tonnes per hour, the vessel still has not departed.

A shipment of eighteen Chinese-made locomotives was turned away at the port in late 2025.

The reason is that the locomotives had to be manufactured in the United States, especially by Wabtec, according to the project’s co-development agreement. Guinea rigorously enforced the contract when the Chinese forces broke that clause.

As a result, the locomotives manufactured in China were returned. This clouded the project’s first ore production milestone and raised questions about contractor geopolitics, compliance, and delays.

The ramp-up of rail transport capacity may be slowed down by the additional time and logistical complexity required to replace the rejected locomotives with compliant units (Wabtec locomotives).

That said, it’s not clear why the first ship has sailed. Likely to pressure all concerned to fix the problem urgently.

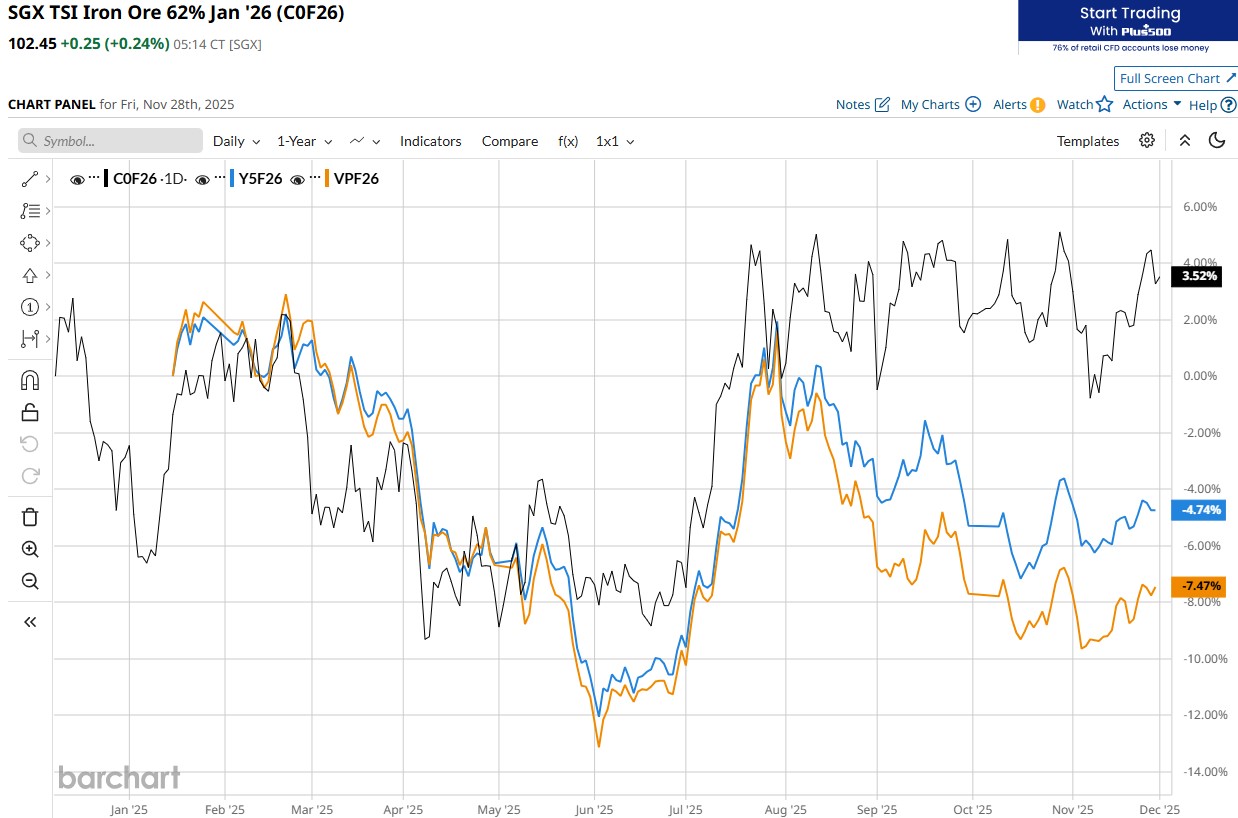

Anyway, iron ore is stable for now in the 100-107 range.