Silver goes ga ga while oil prices remain in a slump despite the new trade blockade against Venezuela announced by the Trump regime as most Asian share markets are beginning to bounce back from a rough start to the trading week. The dual US NFP print overnight showed a slumping US labour market that gave some initial weakness to USD overnight although Yen is seeing a selloff due to some BOJ provocation over interest rates while the Australian dollar is weaker but just holding its own above the 66 cent level.

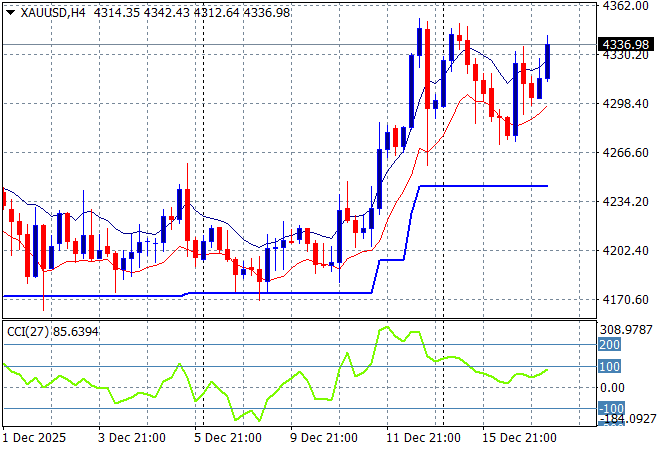

Oil markets remain unstable with Brent crude drifting below the $61USD per barrel level while gold was trying to firm above the $4300USD per ounce level but has recently lost upside momentum for small pullback:

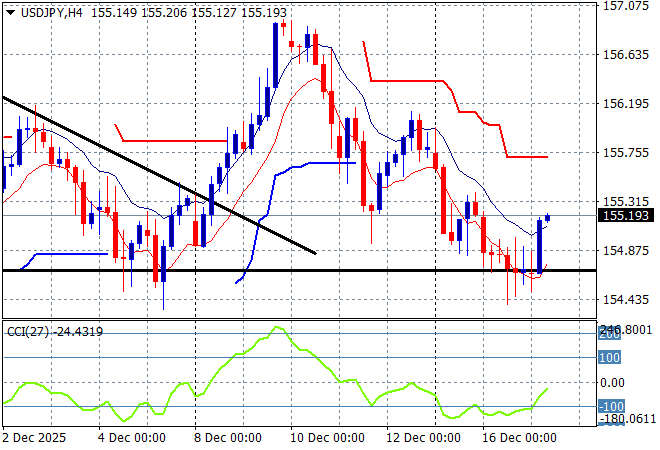

Mainland Chinese share markets are seeing a stronger bid in afternoon trade with the Shanghai Composite up more than 1% to 3872 points while the Hang Seng Index has also rebounded slightly to just above the 25300 point level. Japanese stock markets are having a milder session with the Nikkei 225 up just 0.2% to 49500 points with the USDPY pair bouncing back above the 155 level:

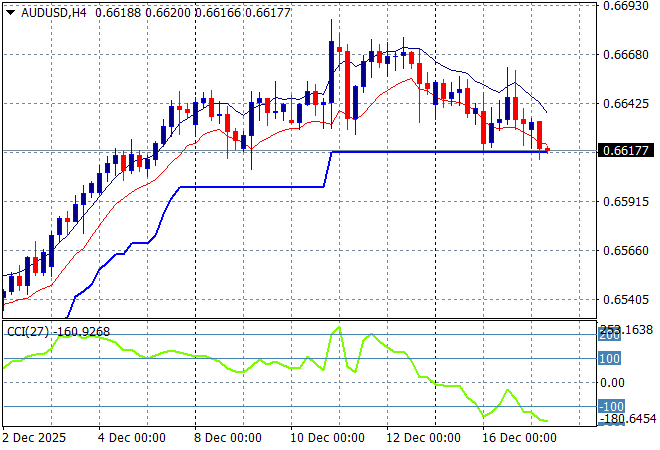

Australian stocks fell back slightly in afternoon trade with the ASX200 losing 0.2% to 8585 points while the Australian dollar has pulled back even further after the MYEFO talkfest as it retreats to short term support just above the 66 cent level against USD:

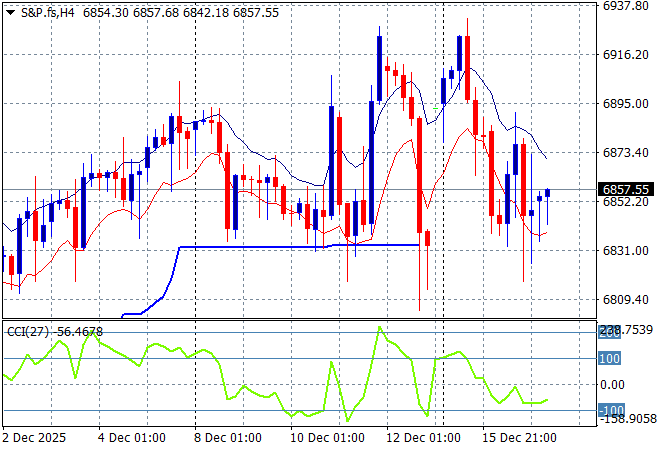

S&P and Eurostoxx futures are struggling to move higher after recent volatility with the S&P500 four hourly chart showing support at the 6800 key level the area to watch in coming sessions:

The economic calendar includes the latest German IFO Survey then a few Fed speeches to keep an ear out for.