All eyes on the RBA in its last meeting of the year today with a hawkish hold the expected outcome which gave the Aussie dollar a small boost but stocks didn’t like the result. Other Asian share markets are on the back foot due to a listless Wall Street as we head into the final trading weeks of the year, with USD still holding somewhat firm against the majors given a potential by the Fed next week into a “hawkish cut” and then a real tackle to fight inflation in 2026.

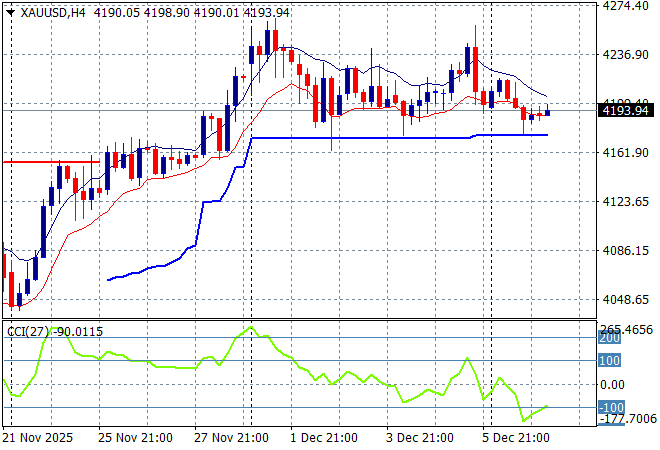

Oil markets are getting a bit unstable now with Brent crude drifting down to the $62USD per barrel level while gold is still hanging around the $4200USD per ounce level but has lost all its previous momentum:

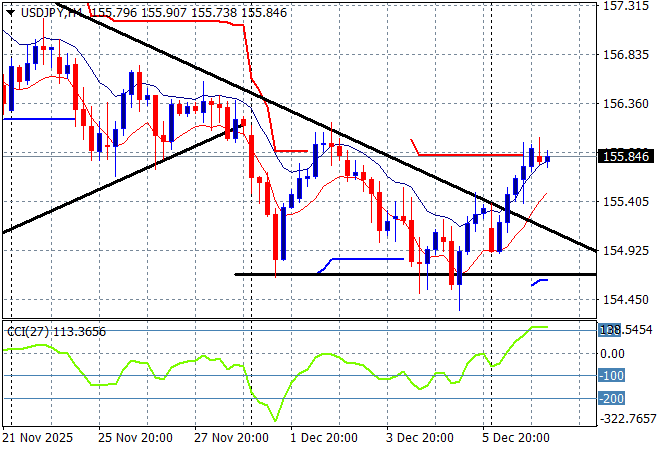

Mainland Chinese share markets are almost unchanged with the Shanghai Composite down a few points but still above the 3900 point level while the Hang Seng Index has continued its recent decline and lost more than 0.7% to 25550 points. Japanese stock markets are the standout but its all relative with the Nikkei 225 gaining just 0.3% to be at 50712 points with the USDPY pair stalling out just below the 156 level after last night’s breakout:

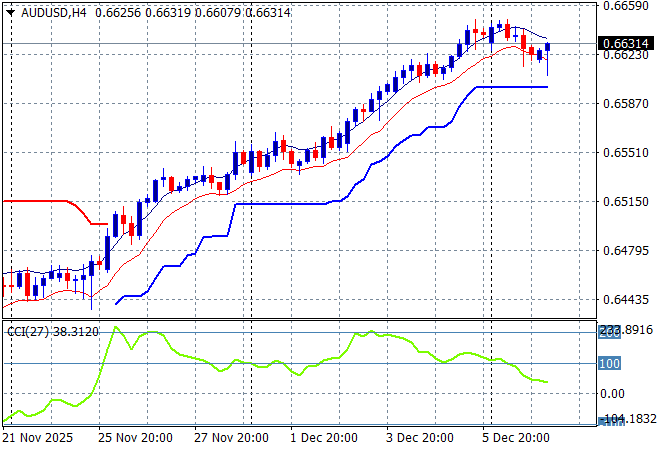

Australian stocks did not like the hawkish hold by the RBA with the ASX200 falling around 0.3% to 8599 points while the Australian dollar has stabilised strongly above the 66 cent level against USD:

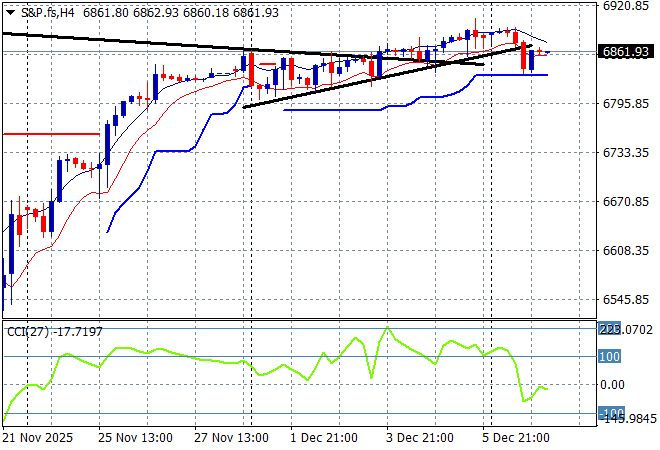

S&P and Eurostoxx futures are stalling out again with the S&P500 four hourly chart showing this creeping trend that just can’t get back to the former highs as traders await the Fed meeting this week:

The economic calendar includes the latest German trade figures then the US Redbook.