In recent times, senior members of the Albanese government, such as Treasurer Jim Chalmers and Housing Minister Clare O’Neil, have argued that housing supply growth is either improving significantly or is rapidly heading in that direction.

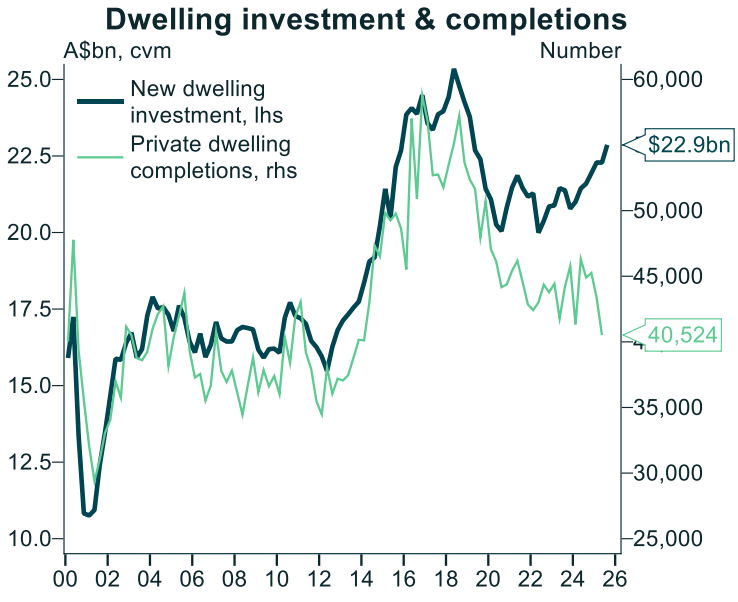

While it’s true that dwelling investment has increased in dollar terms, it hasn’t translated into increased dwelling completions, as illustrated by the chart below from IFM Investors Chief Economist Alex Joiner.

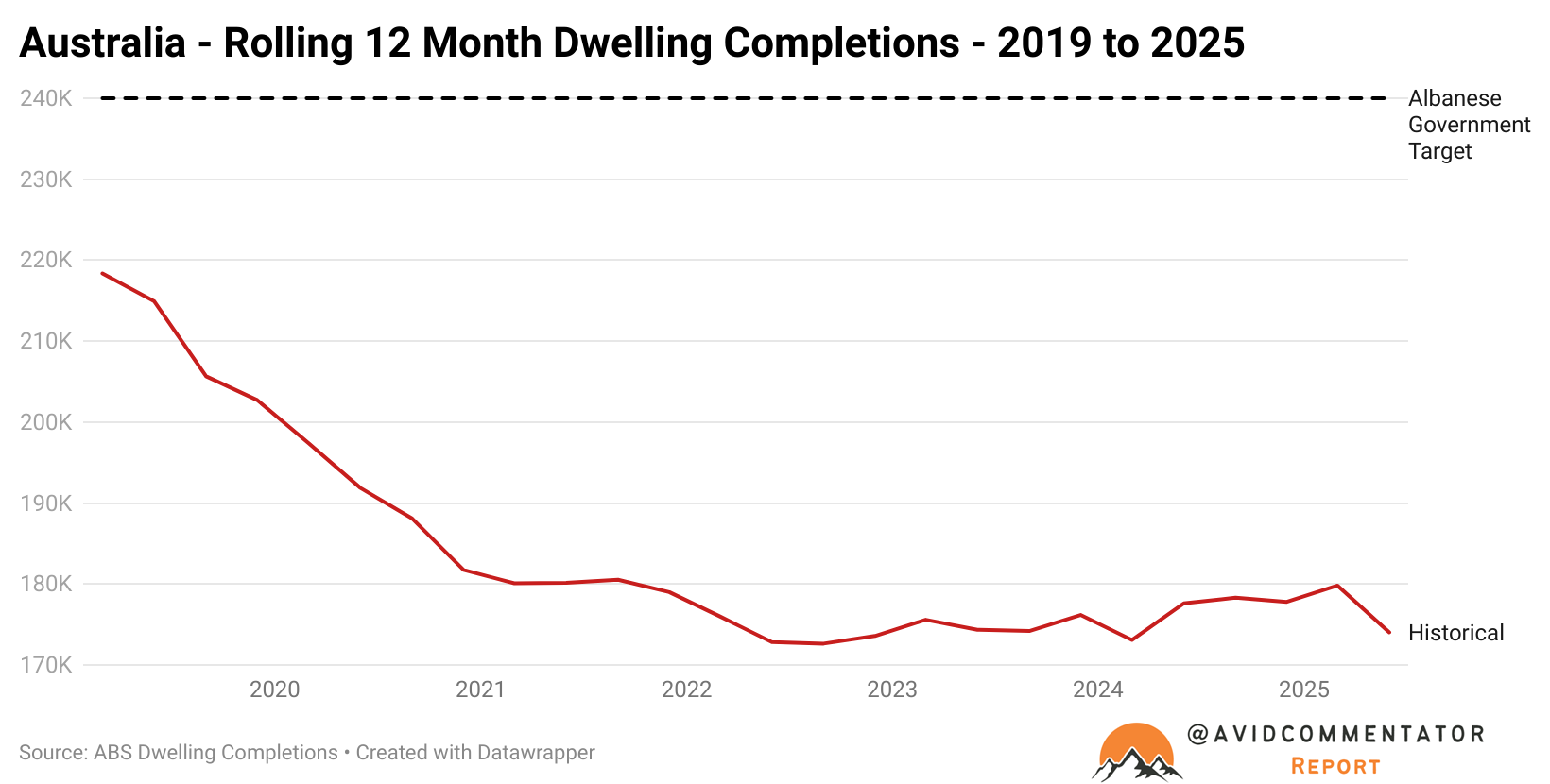

When put into perspective with the Albanese government’s 1.2 million new home target, which equates to 240,000 per year over the 5-year target window, the results are not at all favourable.

Currently, dwelling completions are stuck in the same relatively tight range they have been in since late 2021, with approximately 170,000 to 180,000 homes completed on a rolling 12-month basis over the last four years.

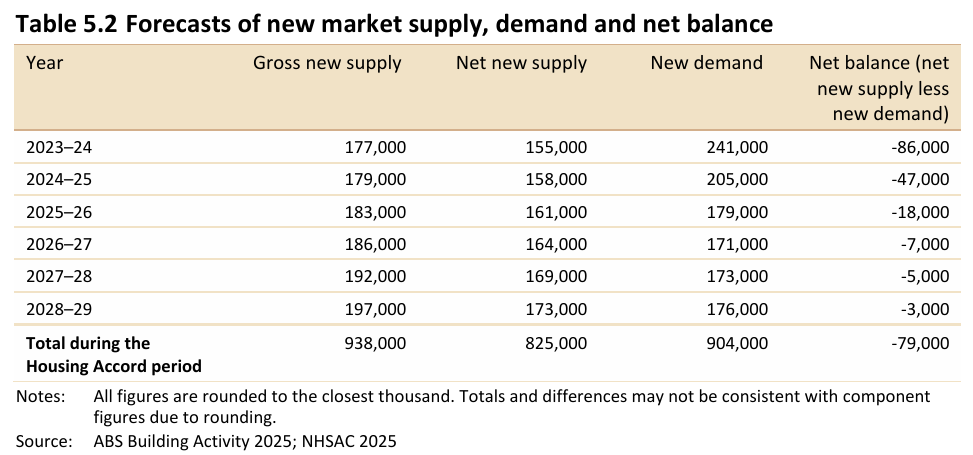

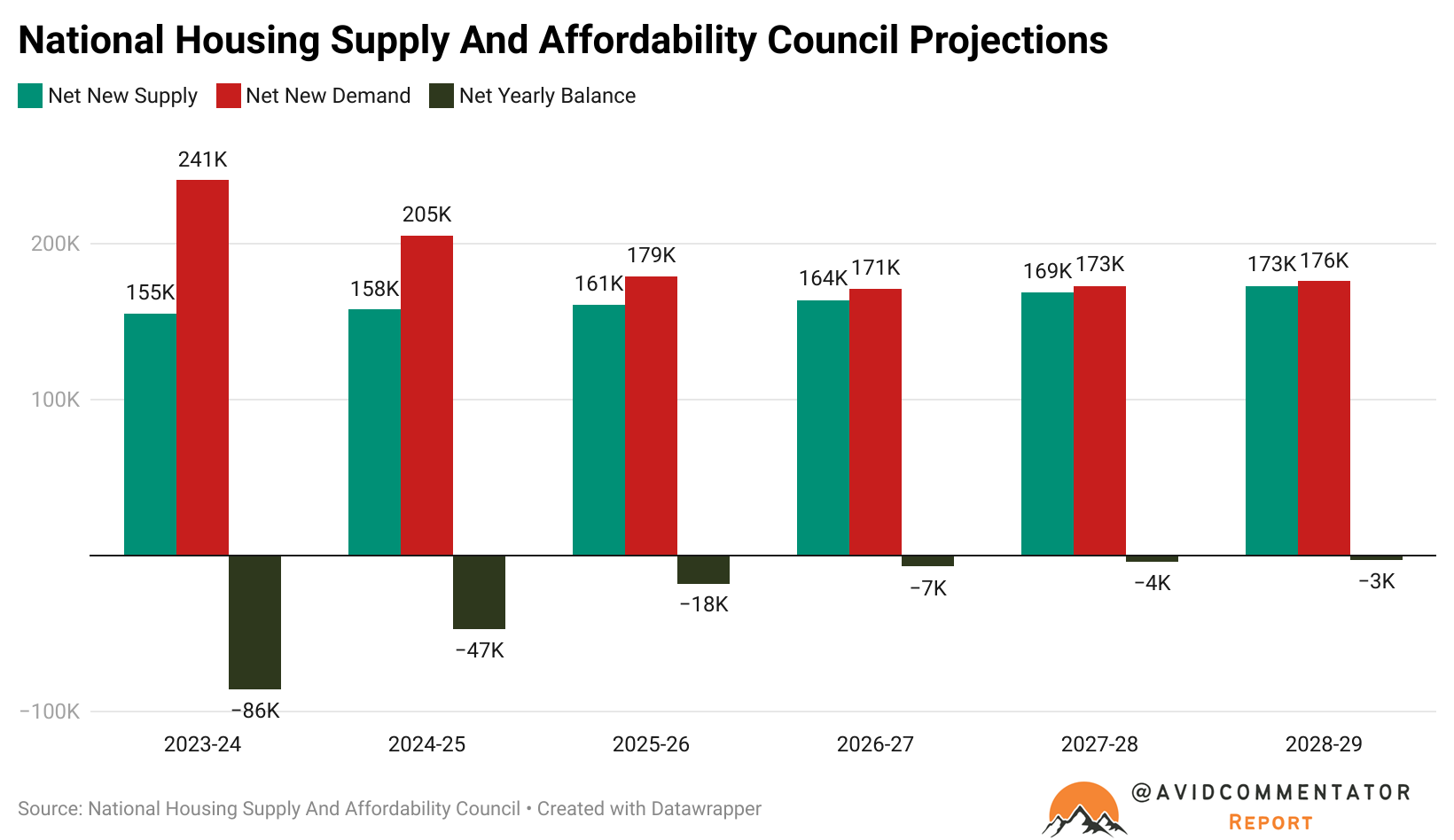

With demand growth already forecasted by the federal government’s National Housing Supply and Affordability Council to outstrip supply growth, coming in below the already relatively anaemic 183,000 completions predicted for 2025-26 would make an already challenging set of circumstances even worse.

With economists now increasingly tipping that the next move in interest rates will be up and financial markets pricing in (INSERT HERE) rate rises for 2026, there is a growing risk that tighter monetary policy and weaker than expected consumer sentiment could hamper what little recovery in home building was on the horizon.

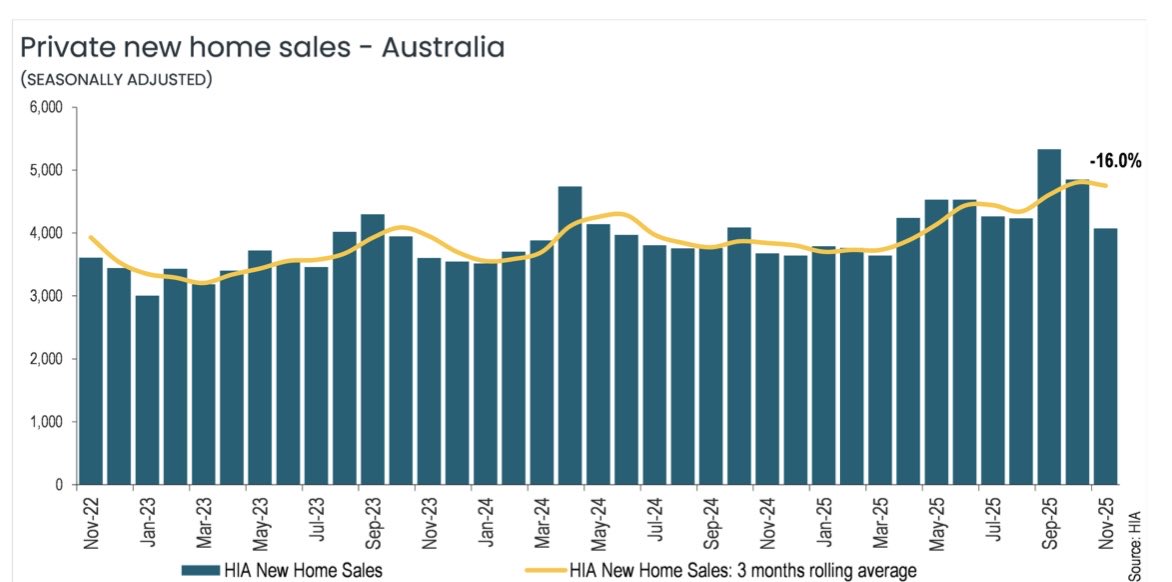

According to the latest Private New Home Sales data from HIA, we may already be seeing something of a pullback in demand.

In the words of AMP Chief Economist Shane Oliver on X (formerly known as Twitter):

“Aust HIA new home sales -16%mom in November after a couple of strong months. Hopefully the trend remains up and it’s not a sign of rate hike talk impacting.”

The early introduction of the Albanese government’s 5% deposit scheme was always going to bring forward demand for new builds to some degree, but the question now becomes to what degree can an upswing in demand for new homes be sustained in an environment of rising expectations of higher interest rates and growing broader economic uncertainty?

With housing demand growth forecasted to outstrip net supply growth until at least 2029, any stall in the growth of new homes being built would significantly worsen an already challenging situation.

With a shortfall of up to 220,000 homes and 1.9 million additional homes required to deliver affordable housing, assuming zero additional demand, it’s clear that major action is required to balance out housing supply and demand in Australia going forward.

It’s not an impossible task, but it is a very challenging one—an endeavour that would almost certainly inherently require the economic growth strategy of much of the last two decades to be abandoned.

To the average person in the street, this would be no great loss; they are already suffering recession-like conditions afflicting their real household income growth and real consumption growth.

But to the political class it would be a very different story.