Amidst the ongoing debate over the future of Ukraine and whether the United States will force peace terms on the war-weary nation, Europe’s leaders are deeply considering ratcheting up the stakes in their ongoing battle with Washington.

According to reports from the Wall Street Journal, European governments are considering a drastic step, dumping huge quantities of U.S. Treasury bonds and bills onto the open market to destabilise the U.S. economy if Washington abandons its commitment to Ukraine.

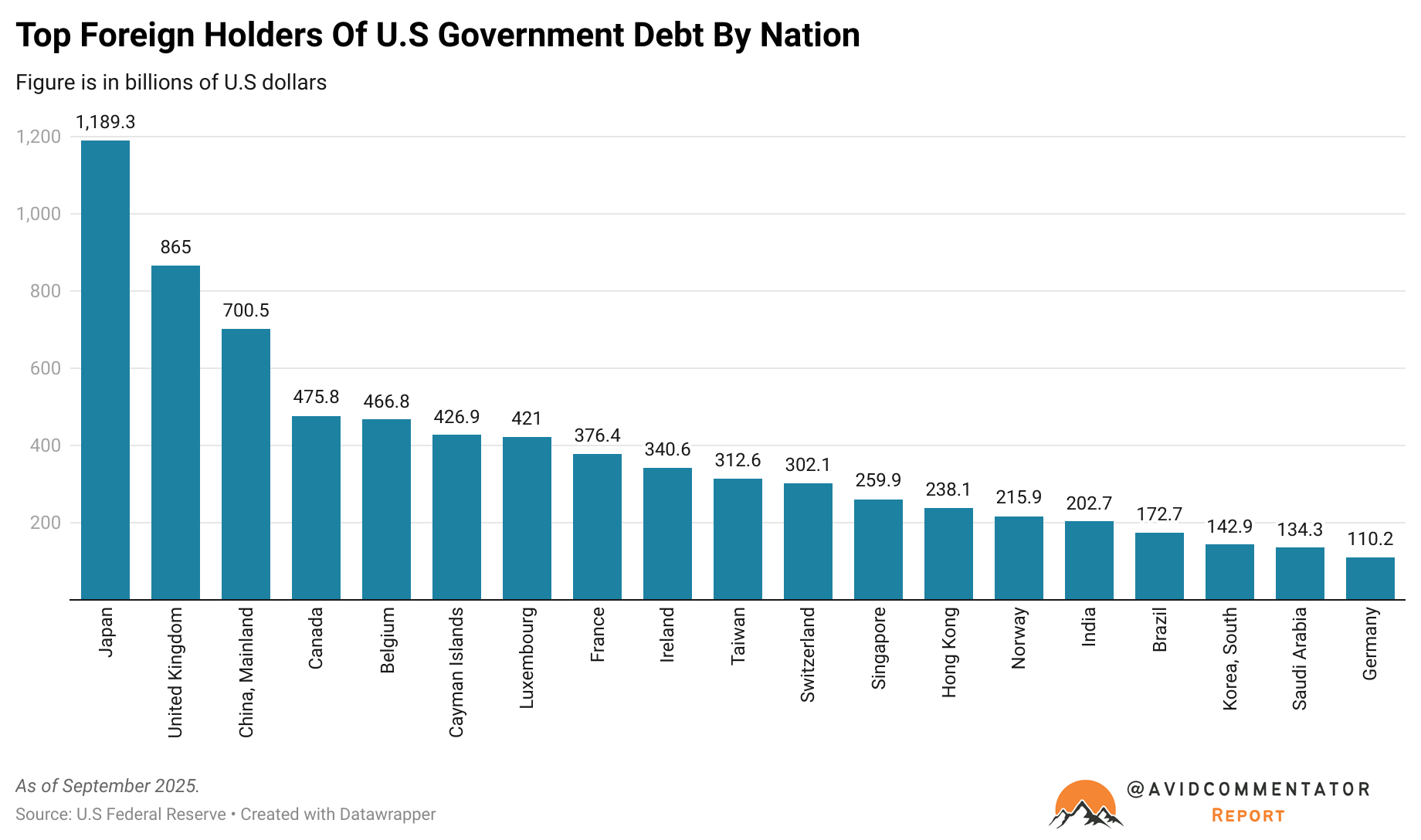

Total European holdings of U.S. government debt across all holders exceed $2 trillion, with over half a trillion held by the Bank of England, the Banque de France, and the Bundesbank.

Leaks to the Wall Street Journal indicate that European intelligence agencies have conducted internal assessments regarding the “commercial and economic plans” that the Trump administration has been negotiating with Russia behind the scenes.

This has sparked concerns in Europe that the Trump administration is preparing to walk away from its commitments to Ukraine in pursuit of its own economic interests.

Sources within Europe’s halls of power suggest plans are being formulated that could, if enacted, pursue creating economic chaos in the United States.

The Consequences

If Europe were to pursue this course of action, it would shatter the existing diplomatic and economic relationship between the United States and Europe, potentially leaving Europe without American military and economic support for the first time in almost eight decades.

While it may seem like an appealing option for Europe to assert itself once more on the global stage, from an economic and financial perspective it would leave Europe without the vital assistance of the United States and the U.S. Federal Reserve, which played an instrumental role in stabilising European financial markets and the Euro during the Eurozone debt crisis.

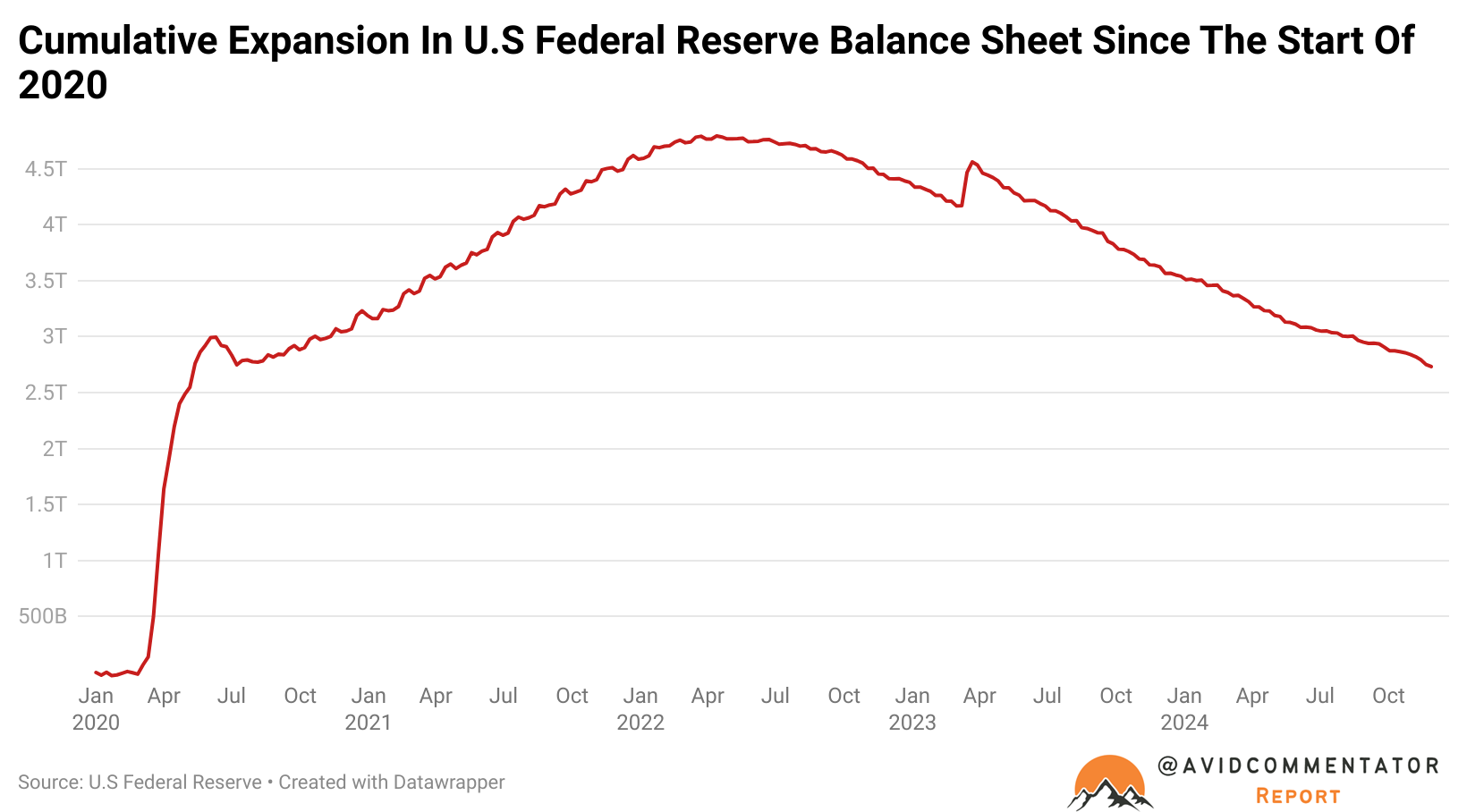

On paper, the U.S. Federal Reserve arguably has the scope to absorb the sales of European holdings of U.S. debt onto its balance sheet, as it did during the pandemic.

In just 6 weeks during the height of the pandemic, the Federal Reserve took $2.26 trillion worth of assets, overwhelmingly U.S. government debt and mortgage-backed securities, onto its balance sheet.

Whatever amount of U.S. government debt the European powers could reasonably sell, the U.S. Federal Reserve could theoretically absorb and, in time, sell back onto the open market.

On the other hand, the U.S. could dump its holdings of European sovereign debt, unleashing its own wave of upward pressure on European borrowing rates and likely forcing the intervention of the European Central Bank and individual nations’ central banks.

The Takeaway

The plans to effectively financially bushwhack the United States are likely to never get past the drawing board, given that they would arguably be far more damaging to Europe than to the United States in the long run.

But if European leaders were so incalculably stupid as to pursue this course of action, it would effectively destroy the American-European relationship that has existed for more than 80 years since World War 2.

They would soon find that despite the perception that Europe is left on its own, behind the scenes it is reliant on the United States for everything from military logistics capacity to U.S. dollar swap lines in times of crisis.

There is also the added dimension that not all European nations may support this course of action, risking a potential fracture within Europe over who supports this extreme action and who effectively sides with the status quo and the United States.

It’s an utterly crazy course of action to even publicly consider, but we seem to live in insane times.