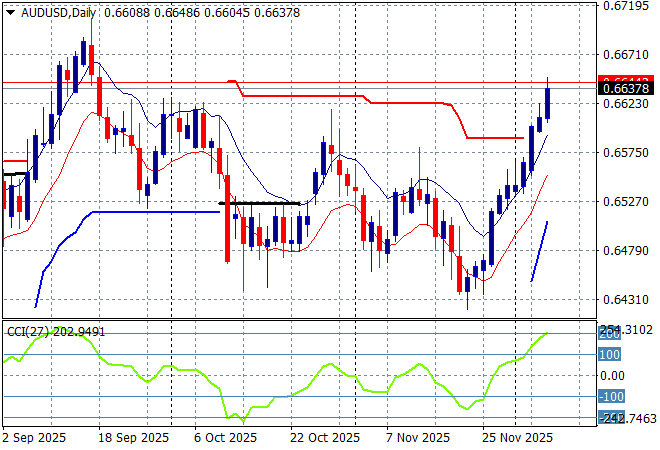

It’s decision day at Martin Place as the Reserve Bank of Australia meets to pull or not to pull – that is the question – the interest rate level. This waiting has seen the Australian dollar lift out of its recent malaise and hit a new monthly high against USD:

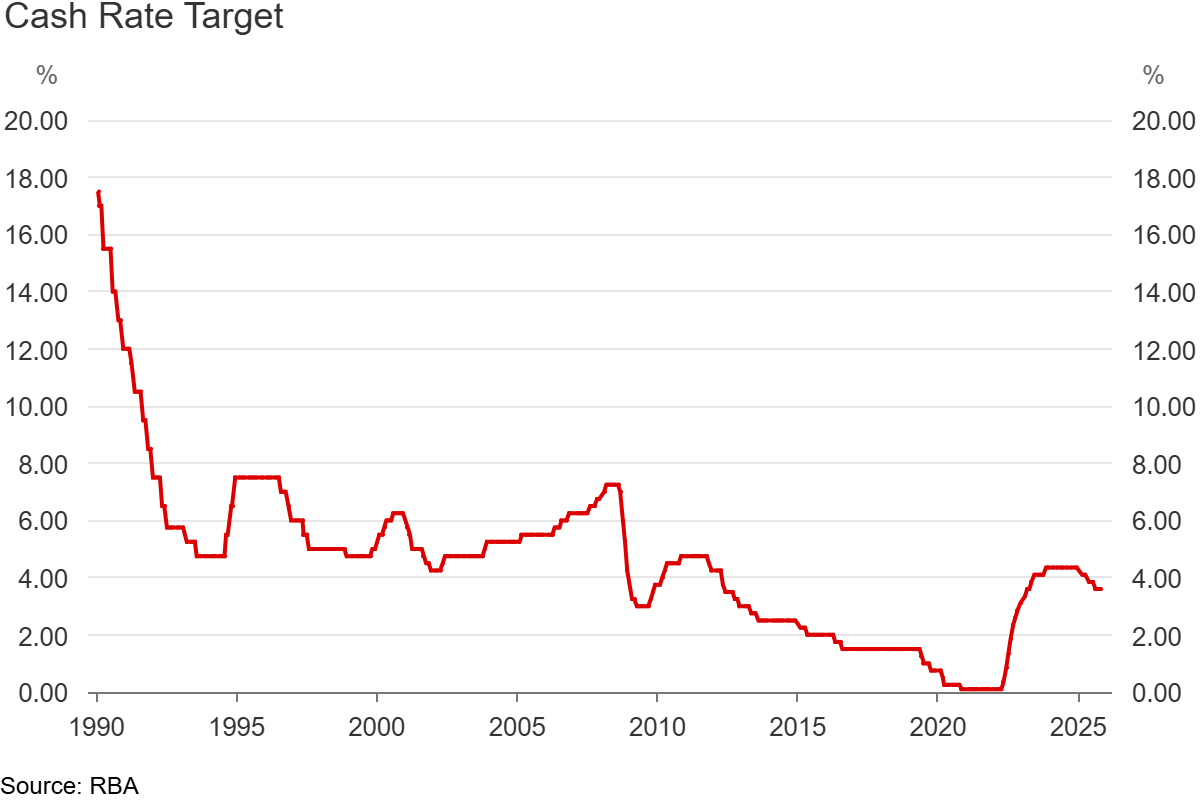

Of course this volatility always gets confused as being a new trend by non trading economists who goose the pig before the inevitable release of the RBA’s intentions, and with a recent hot CPI print and a view to cooling the ever steaming white hot housing market, rate rises are back on the table.

This is after a post-post COVID pullback that has been all too brief:

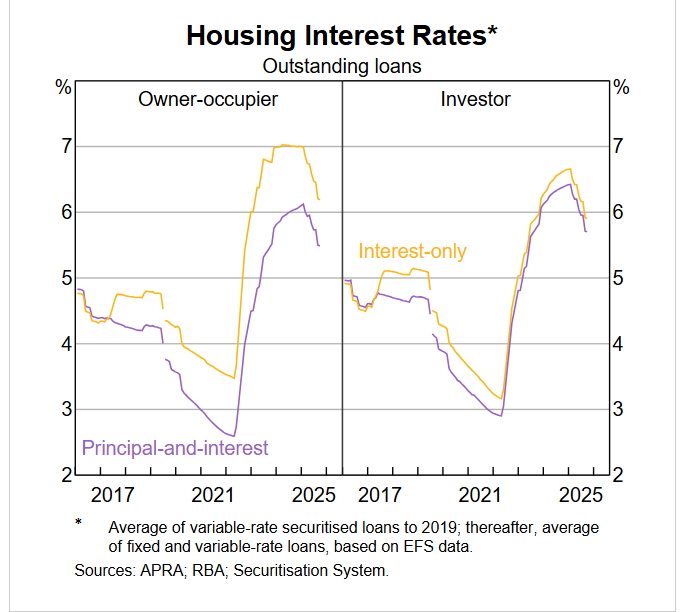

And the resumption of any hawkish tilt on interest rates is going to wipe out the recent relief rally in mortgage rates, and the correlated increase in existing house prices:

I’m watching short term support at the 66 handle at the meeting this afternoon, as it appears the US Fed maybe using a similar “hawkish hold/cut” approach to the RBA and this could squeeze the notion that the interest rate differential is going to widen: