Overnight solid earnings on tech stocks sent Wall Street higher even though NVIDIA is off somewhat with additional US economic data (or lack thereof due to the Trump regime hiding the bad news) reinforcing the notion that the December rate cut from the Fed is firming, giving a general boost to risk markets. The USD was weak against most of the majors with Euro able to firm above the 1.15 level with Yen and Pound Sterling firm also firming. The Australian dollar however remains in a weak position and with the RBNZ expecting to cut today may fall back in anticipation of a possible RBA move as well.

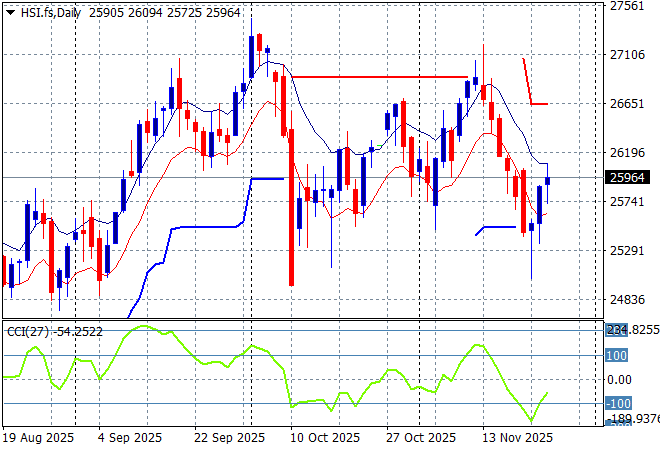

Looking at stock markets from Asia from yesterday’s session, where mainland Chinese share markets were up in afternoon trade with the Shanghai Composite moving nearly 1% higher to 3870 points while the Hang Seng Index finished nearly 0.7% higher at 25894 points.

The daily chart of the Hang Seng Index shows a complete fill of the March/April selloff with a resumption of buying above 26000 points as momentum tried to build but failed to push aside resistance, with this rollover appearing to bounce off support around the high 24000’s:

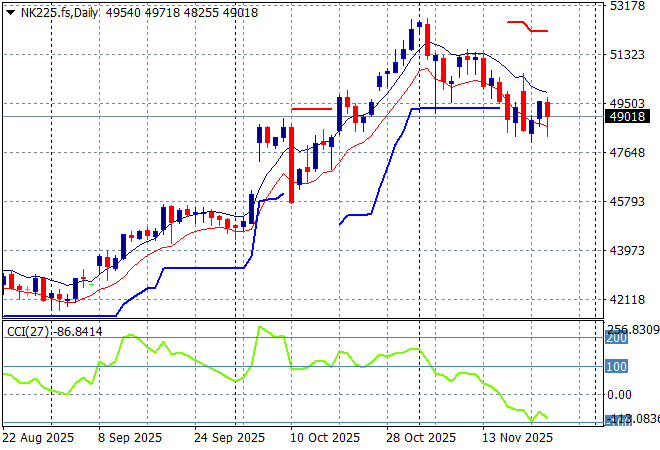

Japanese stock markets reopened from their long weekend – again – with the Nikkei 225 almost unchanged at 48659 points.

Daily price action was looking extremely keen indeed as daily momentum accelerated after clearing resistance at the 42000 point level with another equity market that looks very stretched and breaking out a bit too strongly here. ATR support is now broken at the 50000 point level but daily momentum is not yet considerably oversold:

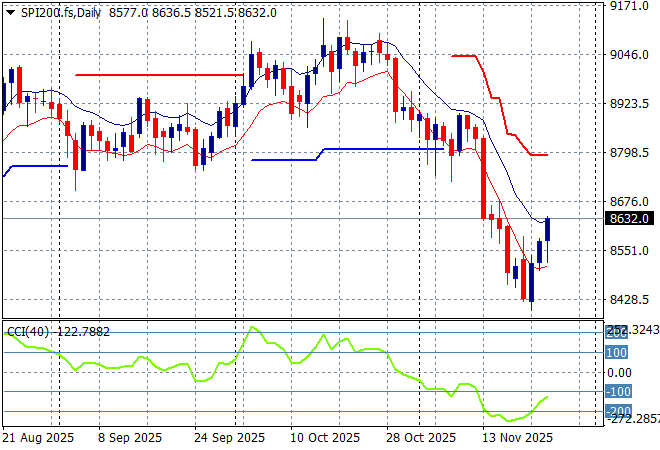

Australian stocks were looking to put in a scratch session with the ASX200 up only a handful of points to 8535 points. SPI futures are up 1% or so due to another surge on Wall Street overnight.

The daily chart pattern was suggesting further upside still possible with a base built above the 8700 point level as daily momentum tried to maintain its overbought status. Short term support has been abandoned, as momentum builds for a broader selloff but watch for some stability that could turn into a bounceback above the 8500 point area:

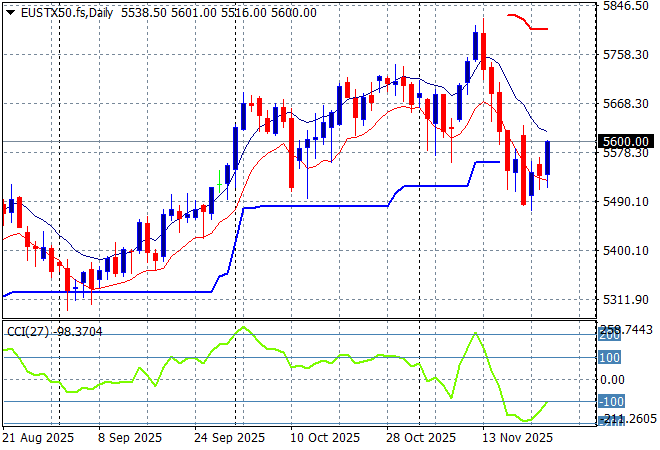

European markets were able to get out of sell mode and build confidence across the continent as the Eurostoxx 50 Index closed more than 0.8% higher at 5573 points.

The market has been failing to make headway here due to the too high valuations but short term support was put under a lot of pressure before finding some buyers to stabilise, but this is early days yet:

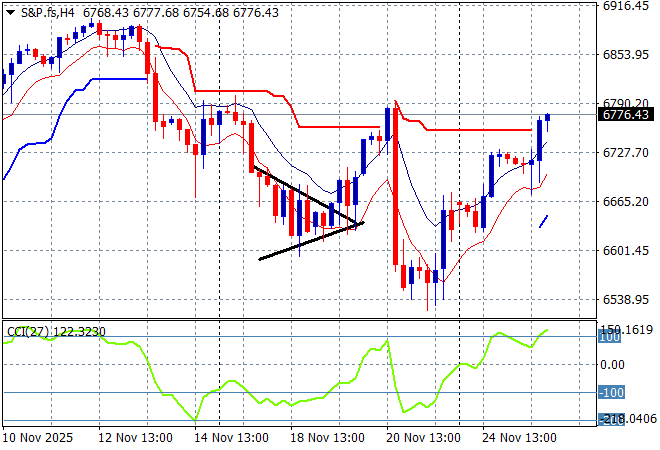

Wall Street extended its bounce back with the NASDAQ up another 0.6% on solid earnings while the S&P500 managed to finish more than 0.8% higher at 6705 points.

The four hourly chart showed that resistance at the 6900 point level was still quite relevant after the bounceback from the end of the US government shutdown rally with recent price action trying to avert last week’s dead cat bounce pattern. Support has firmed at 6500 points, with confidence – aka the Fed punchbowl – returning in full in this shorter trading week:

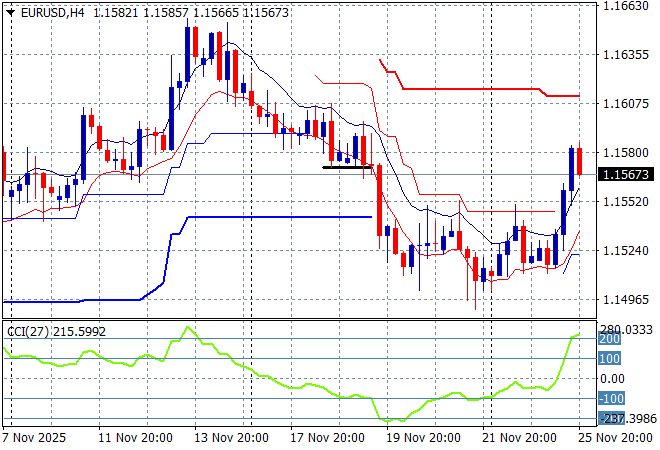

Currency markets are still processing the increased chances of a December rate cut by the Fed plus more weak US economic data pulling King Dollar lower with Euro pushing well above the 1.15 handle overnight, with Pound Sterling and the Canadian Loonie also doing a lot better.

The union currency was building strength as it climbed above previous ATR resistance at the 1.1580 area but momentum has switched to oversold settings in the short term with this weakness below the 1.16 handle probably broadening, but those long tails with tight wicks on the four hourly chart spoke to stability and this breakout:

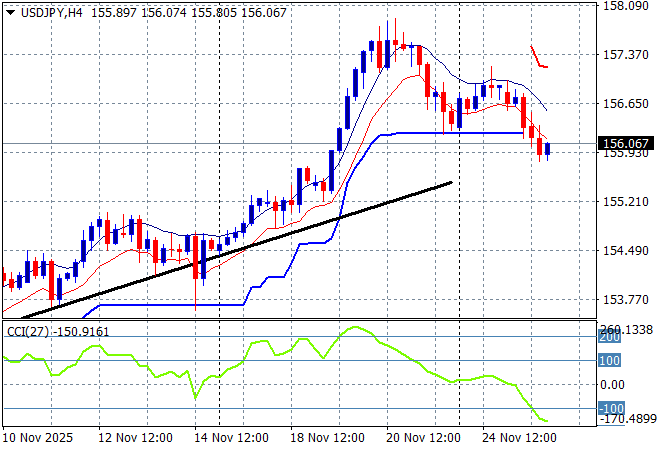

The USDJPY pair was having a cracking move higher helped by a much weaker Yen amid the China/Japan diplomatic stoush last week, but this has ended up with a reversion back to the 156 handle, which accelerated overnight.

The previous price action was sending the pair beyond the March highs and had the potential to extend those gains through to start of year position at the 158 handle and this recent volatility has now repeated this move. Watch for support which must hold here or it may crack below the 155 level quickly:

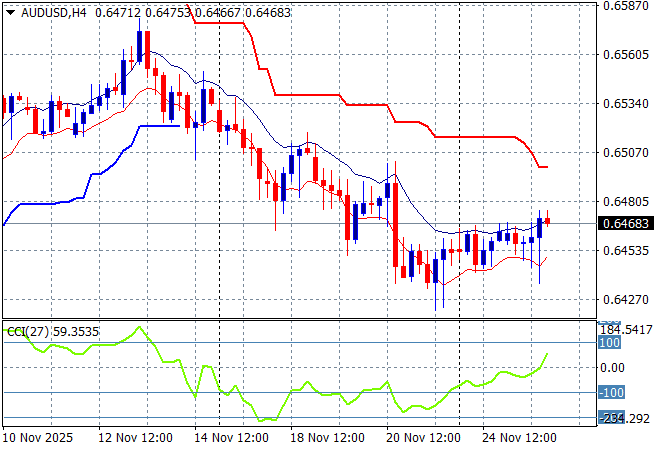

The Australian dollar only had a small reprieve in the previous session before rolling over fully to make a new monthly low, still testing the 64 handle on USD strength but there is some bottoming action going on here as the trading week gets underway.

This is not looking good for the Pacific Peso in the medium term as the interest rate differential squeeze plus the risk off squeeze is sending it back to the doldrums, but watch for the usual monthly volatility to confuse the non technical traders who might consider it a new uptrend, when its likely just going to be resistance at the 65 cent area that will be tested:

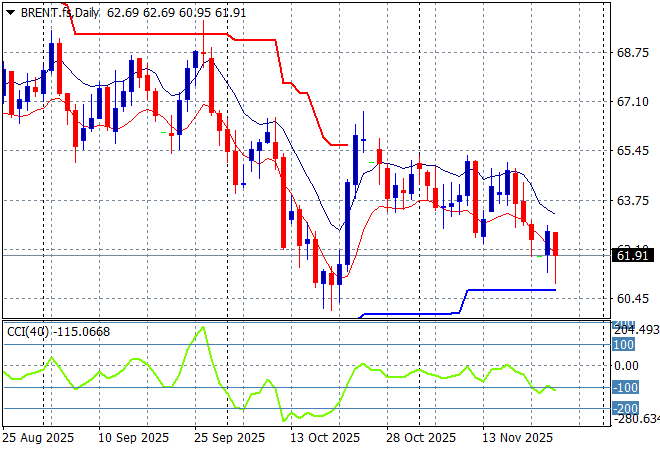

Oil markets have been trying to remain stable with a potential breakout building but the Ruzzian/Trump Ukraine war talks are taking a lot more heat out of the market again with Brent crude pushed down below the $62USD per barrel level overnight.

The daily chart pattern shows the post New Year rally has a distant memory with any potential for a rally up to the $80 level completely dissipating. There is still potential here for a run down to the $60 level next as the floor at the $63 area is melting away:

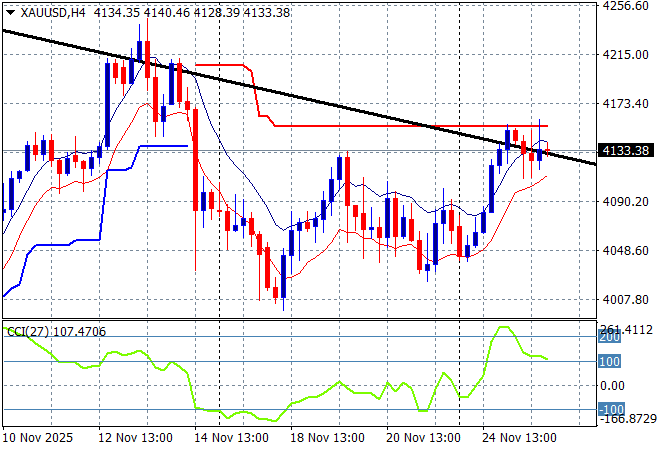

Gold was having a much better run than other undollars and zoomed through the $4200USD per ounce level and is now trying to get back to those levels after a sharp correction last week. Last night saw a hold above the $4100 level after a breakout that looks like having legs.

This could be another slightly overdone in the short term ride but then after some more stability, yet another large upside potential move is looming again for the shiny metal as the desire for USD dwindles. Watch for the $4100 area for signs of a further breakout:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!