Everything is awesome on risk markets again as the US government shutdown appears over due to some spineless and feckless Democrats (but I repeat myself) bend the knee in the Senate. Wall Street rallied taking back most of last week’s losses with other stock markets following suit. This will probably last until the Supreme Court rules on the Trump regime’s tariffs. The USD was relatively stable against the majors with Euro and Pound Sterling unchanged while the Australian dollar is holding on above the 65 cent level.

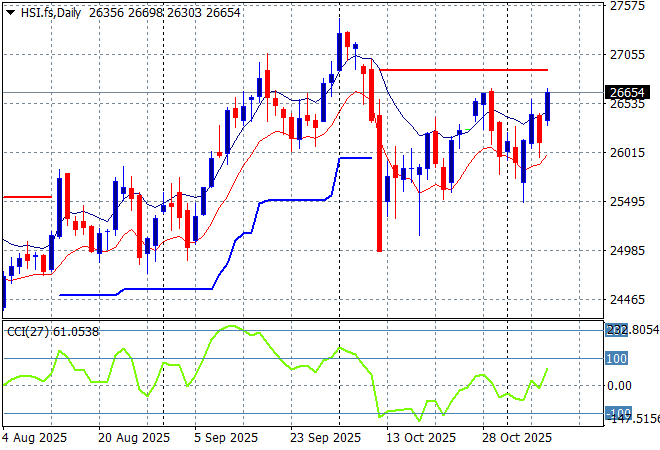

Looking at stock markets from Asia from yesterday’s session, where mainland Chinese share markets accelerated higher going into the close with the Shanghai Composite pushing above the 4000 point barrier while the Hang Seng Index did a lot better, up more than 1.5% to close at 26649 points.

The daily chart of the latter showed a complete fill of the March/April selloff and then some with a breakout above the 26000 point level looking like a sustained move here before the most recent Trump tantrum. A resumption of buying here above 26000 points is slowly underway as momentum builds properly again:

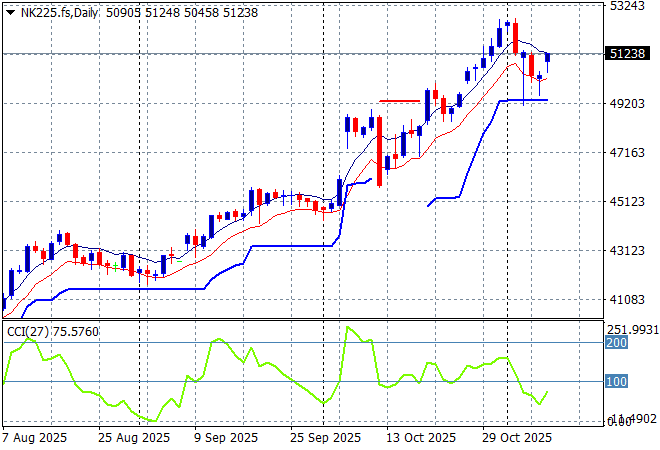

Japanese stock markets were nearly the best performers in the region with the Nikkei 225 up more than 1.2% to get well above the 50000 point level, closing at 50911 points.

Daily price action was looking extremely keen indeed as daily momentum accelerated after clearing resistance at the 42000 point level with another equity market that looks very stretched and breaking out a bit too strongly here. ATR support has been ratcheting up for awhile as the 50000 point level becomes the crucial pivot point going forward:

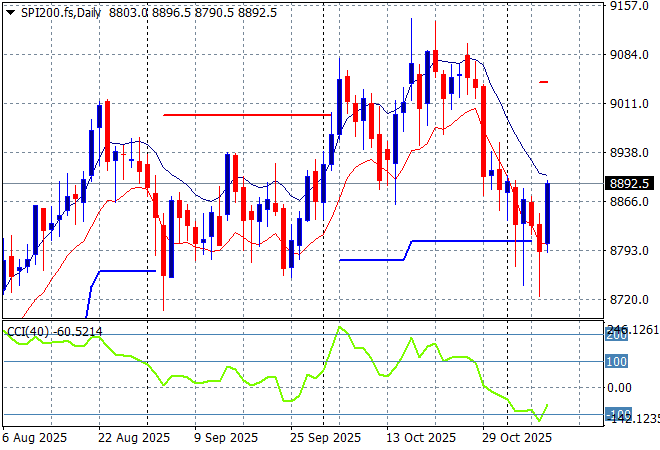

Australian stocks did well with the ASX200 closing 0.7% higher at 8835 points. SPI futures are up more than 0.5% on a strong session on Wall Street session overnight.

The daily chart pattern was suggesting further upside still possible with a base built above the 8700 point level as daily momentum tried to maintain its overbought status. Short term support is just holding on, but the momentum is just not here although watch for a potential violent swing higher evident by those long lower tails:

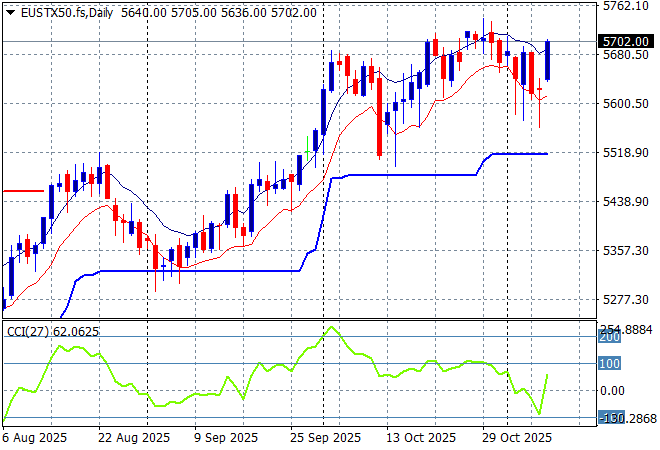

European markets surged strongly across the continent and in Brexitland as the Eurostoxx 50 Index closed more than 1.6% higher at 5664 points.

Weekly support has been respected after a brief touch below the 5200 point level as the recent rebound on Euro weakness shows a complete fill. The market has been failing to make headway here due to the too high valuations but upside potential looks to be building again so watch for a breakout above the 5750 point region:

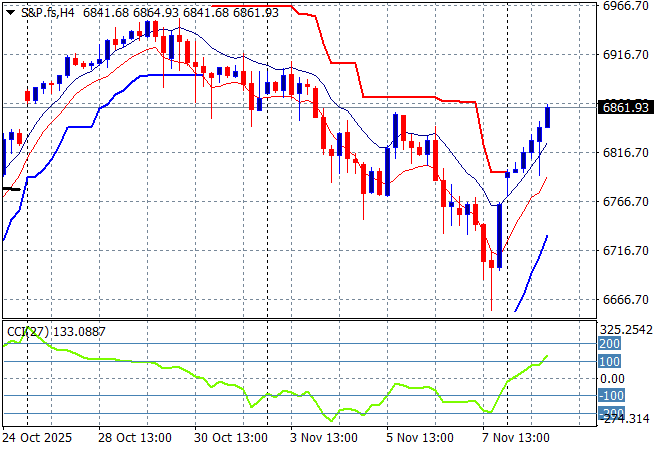

Wall Street made big gains as well due to the end of the shutdown with the NASDAQ launching 2% higher while the S&P500 put on a solid 1.5% gain to close at 6835 points.

The four hourly chart shows how this retracement headed back to the 6800 point level before stabilising. Short term resistance at the 6900 point level has been tossed aside on the one way bet with a substantial move higher so watch for a potential fill up to previous highs next:

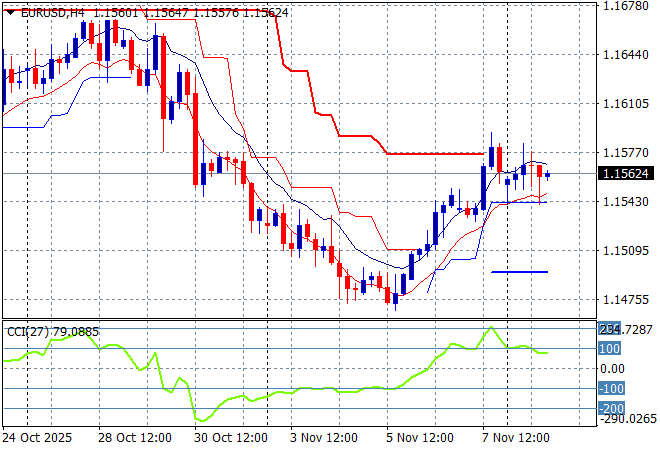

Currency markets are still reeling from the actions and words of the Fed meeting last week, which saw the USD eventually push back against everything after the December cut expectations were almost eliminated. Post the non NFP event, major undollars have held on to their recent nascent gains although Euro is still trying to turn things around to get back above the 1.16 level.

The union currency had been building strength prior to the recent bad domestic economic news from the US overshadowed any continental slowdown but had reversed that trend in recent weeks.Watch for a breakout above previous ATR resistance at the 1.1580 area:

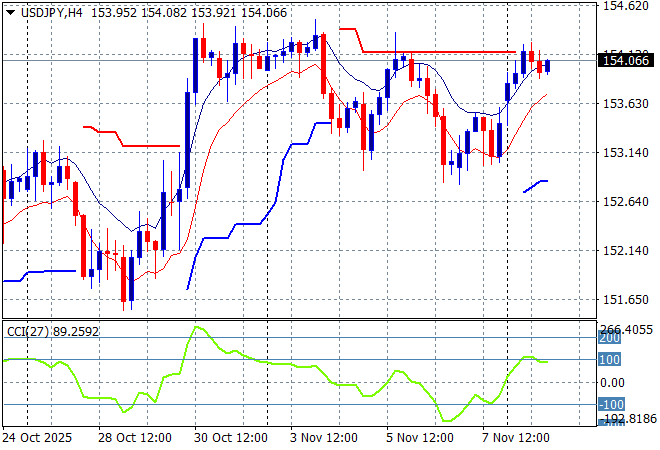

The USDJPY pair put in a consolidation phase before rallying on the Fed cut, but post non-NFP it has almost returned to its previous highs at the 154 handle overnight.

The previous price action was sending the pair beyond the March highs and had the potential to extend those gains through to start of year position at the 158 handle and this recent volatility is wanting to repeat this move:

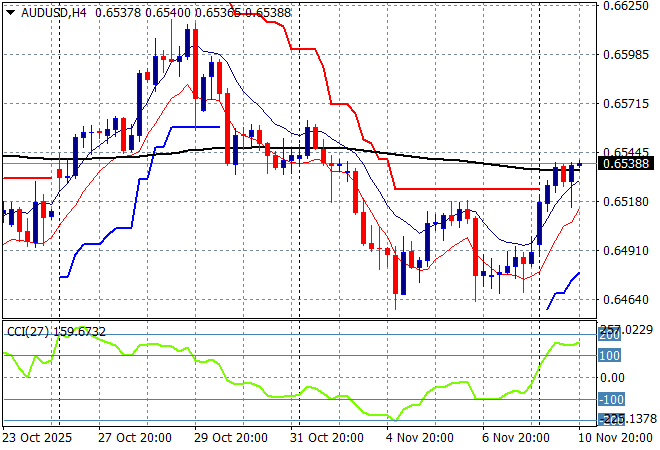

The Australian dollar on Friday night saw only a little life return but it was all about yesterday’s session before the shutdown capitulation vote with the Pacific Peso breaking through the 65 handle before extending those gains overnight.

I was looking for this to become a more sustained breakdown if the China/US trade war heats up but support has firmed considerably in the past week:

Oil markets have been trying to remain stabile but saw more overhead pressure on Friday night on a glut in US stocks with Brent crude again hovering around the $64USD per barrel level.

The daily chart pattern shows the post New Year rally has a distant memory with any potential for a rally up to the $80 level completely dissipating. There was potential here for a run down to the $60 level next so watch for a follow through rollover here:

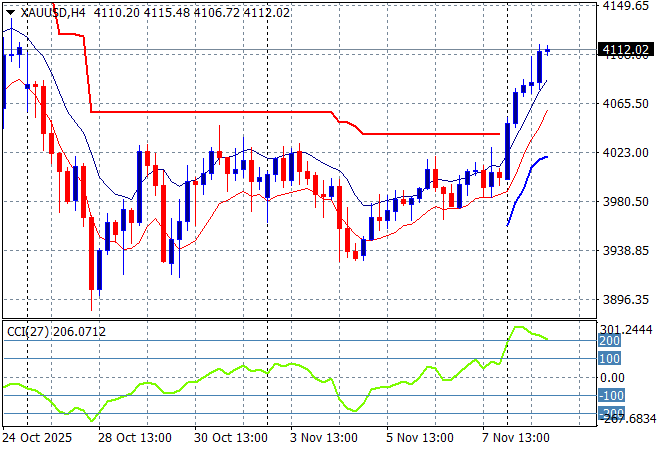

Gold is having a much better run than other undollars with a big move higher overnight, bursting through the $4100USD per ounce level after a slow build up of buying support on Friday night and then a surge on the weekend gap.

This might be slightly overdone in the short term but could lead to more upside potential from here after fully forming a proper bottom pattern.

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!