Not quite a bath of blood on Asian equity markets today but it has been a pretty broad selloff in response to the volatility on Wall Street overnight. Currency land was more sanguine with even the Japanese Yen relatively stable amid a new big stimulus package announced by the Japanese government while local shares hit a new six month low. The Australian dollar fell back again as it threatens to crack below the 64 cent level against USD.

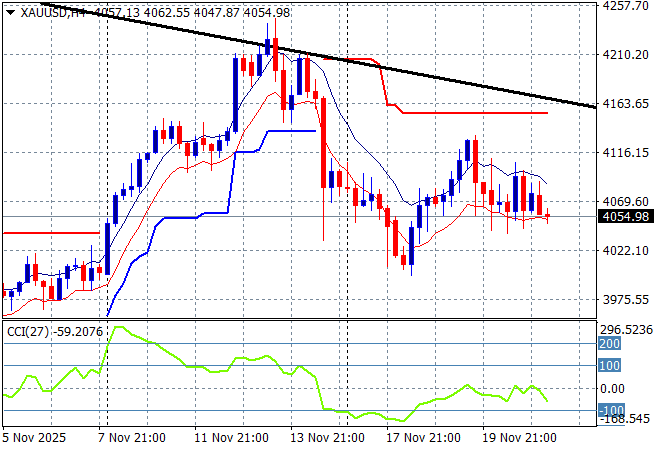

Oil markets are slowly pulling back again with Brent crude drifting down to the $63USD per barrel level while gold is failing to stabilise above the $4050USD per ounce level as Bitcoin hits new lows:

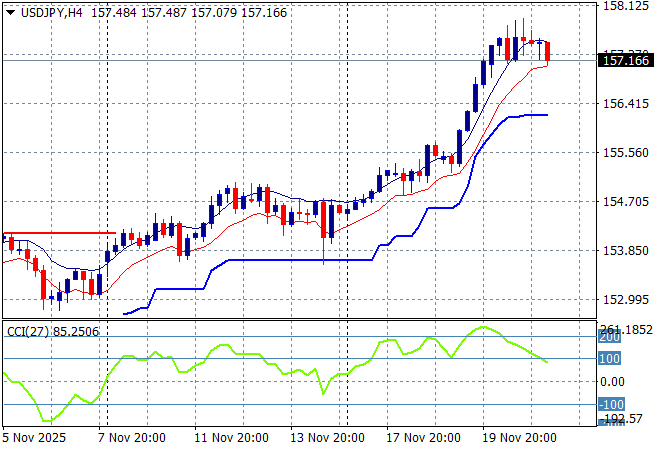

Mainland Chinese share markets are falling sharply in afternoon trade with the Shanghai Composite down nearly 2% to 3855 points while the Hang Seng Index is down more than 1.5%, currently at 25418 points. Japanese stock markets have been the biggest losers with the Nikkei 225 falling more than 2.2% to 48719 points while the USDPY pair has steadied slightly above the 157 handle:

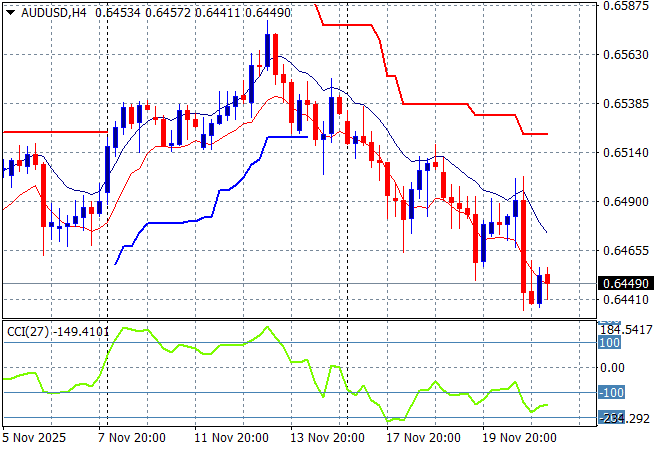

Australian stocks sold off across the board with the ASX200 eventually closing 1.6% lower at 8416 points while the Australian dollar has also lost more confidence, now below the mid 64 cent level against USD:

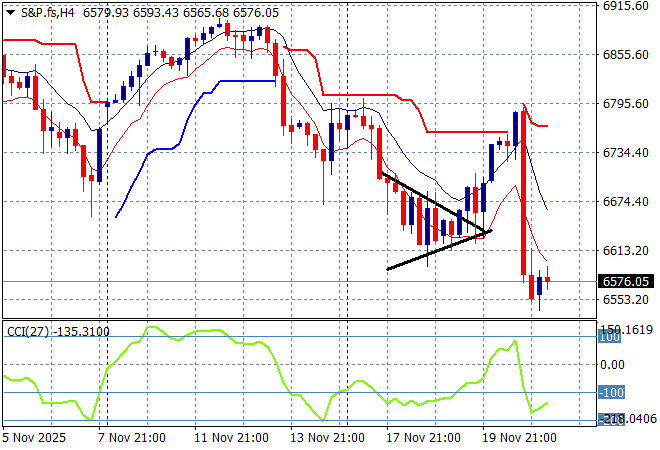

S&P and Eurostoxx futures are struggling to get off the floor with the S&P500 four hourly chart not looking healthy at all after last night’s dead cat rollover:

The economic calendar finishes the trading week with a lot of central bank speeches and flash PMI prints across both sides of the Atlantic.