Not quite a green a day as expected here in Asia with only some markets moving higher in the wake of the news that the Republican shutdown of the US government may finally be coming to an end. While gold continued to push higher, other undollars like the Kiwi and Australian dollar have steadied with Yen weakening in particular as inflation concerns mount in Japan.

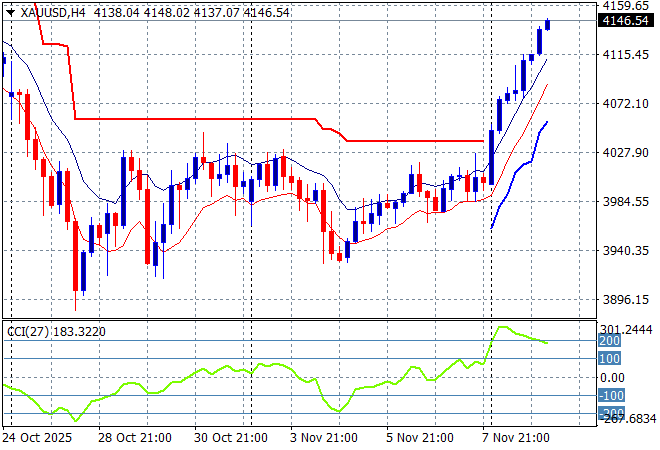

Oil markets are steady with Brent crude holding just below the $64USD per barrel level while gold is getting well back on trend with a surge above the $4100USD per ounce level to make a new monthly high:

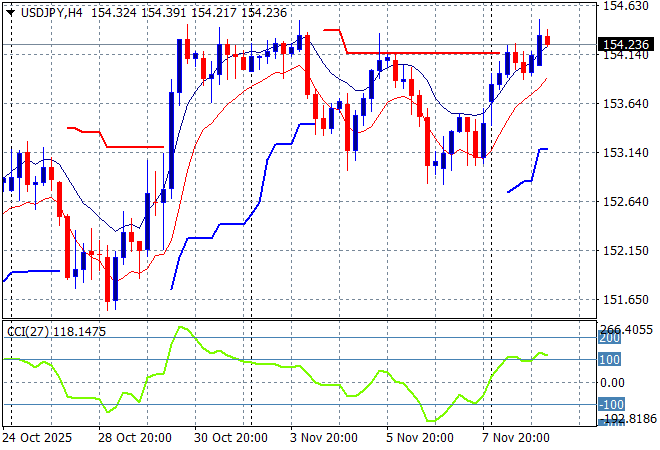

Mainland Chinese share markets are falling back going into the close with the Shanghai Composite retreating just below the 4000 point barrier while the Hang Seng Index is off by at least 0.4% to 26554 points. Japanese stock markets are performing the best in the region with the Nikkei 225 up more than 0.5% to extend above the 51000 point level with the USDPY pair has breached the 154 handle to extend its big weekend gap up move:

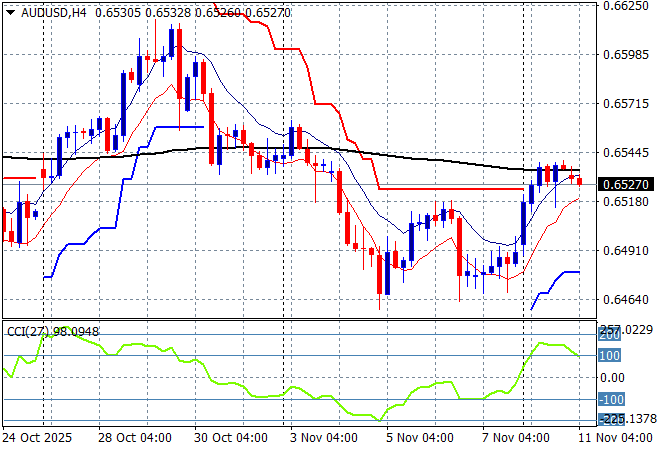

Australian stocks are treading water with the ASX200 down around 0.2% at 8822 points while the Australian dollar has stayed above the 65 cent level against USD but is looking weaker in the short term:

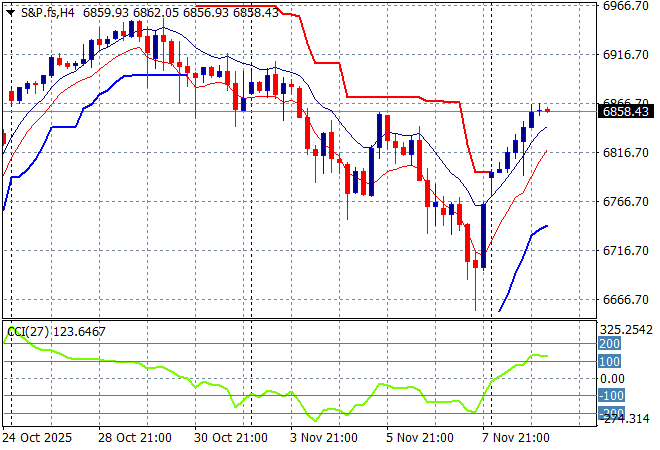

S&P and Eurostoxx futures are steadying but moving higher going into the London session with the S&P500 four hourly chart showing the market wanting to extend above the 6800 point level:

The economic calendar ramps up tonight with the closely watched German ZEW survey.