The fallout from last night’s selloff on Wall Street has hit most of Asian markets in today’s session although local shares escaped the carnage following yesterday’s hold from the RBA. The USD reversed slightly against some of the major currency pairs particularly the Australian dollar although the Canadian Loonie couldn’t find any support as the first Carney budget showed a near doubling of the deficit. New Zealand unemployment continues to climb, taking the Aussie/Kiwi cross to a new 12 year high.

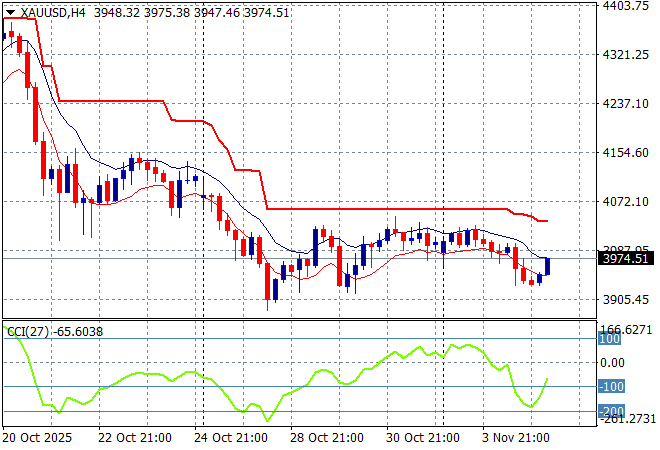

Oil markets are trying to hold on to their recent breakout with Brent crude lifting around the $64USD per barrel level while gold is trying to stabilise after overnight falls, currently lifting above the $3970USD per ounce level after being unable to build some support here for a potential breakout:

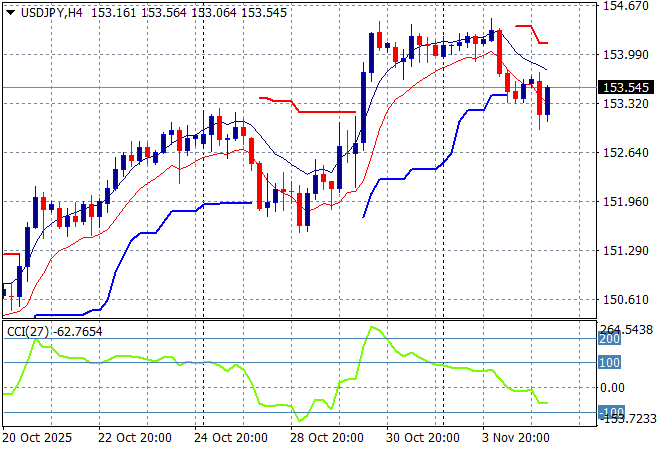

Mainland Chinese share markets are trying to build going into the close with the Shanghai Composite still stuck below the 4000 point barrier while the Hang Seng Index has fallen just 0.2% or so in a lacklustre session. Japanese stock markets however are seeing a very sharp selloff, as are Korean markets with the Nikkei 225 down more than 2.7% to 50085 points while trading in the USDPY pair has seen an oscillation around the 153 handle:

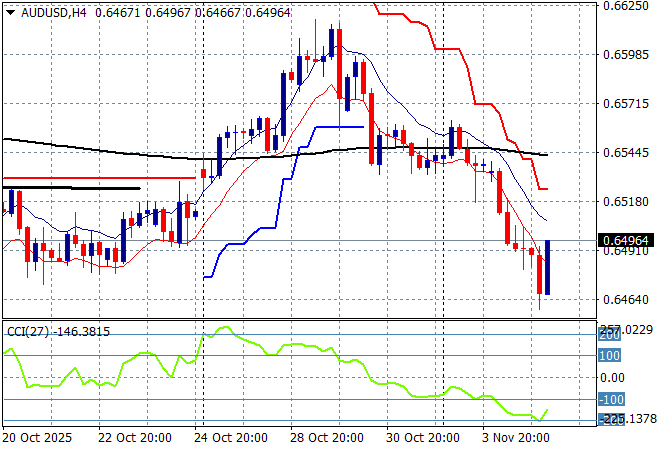

Australian stocks are still unable to find any positive momentum but have escaped major selling with the ASX200 down just 0.1% to close at 8802 points while the Australian dollar has bounced back somewhat on Chinese tariff holds to almost get back above the 65 cent level against USD:

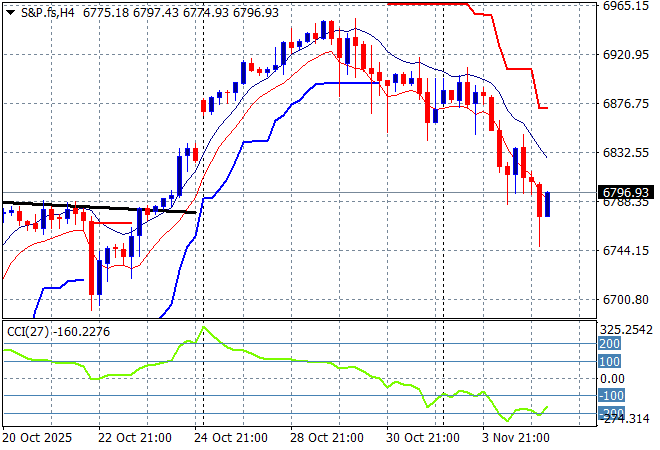

S&P and Eurostoxx futures are drifting around and looking weak going into the London session with the S&P500 four hourly chart showing the market still falling as it builds to a potential breakdown here:

The economic calendar includes private ADP employment numbers and the latest ISM Services PMI out of the USA.