Not much action on Asian markets in today’s session with local markets pivoting on the RBA meeting where as expected the boffins of Martin Place held fire again and put out most chances of further rate cuts in the future. This stabilised the Australian dollar somewhat, in comparison to other undollars which are seeing some weakness, but local stocks took a bit of dive.

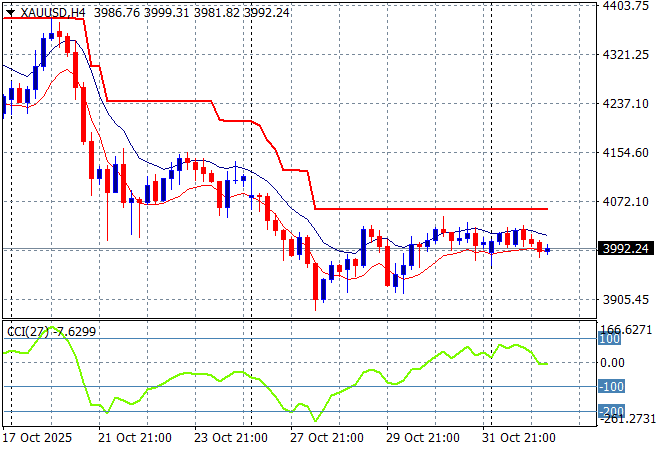

Oil markets are trying to hold on to their recent breakout with Brent crude lifting slightly above the $64USD per barrel level while gold is failing to stabilise after its recent falls, currently sliding below the $4000USD per ounce level after being unable to build some support here for a potential breakout:

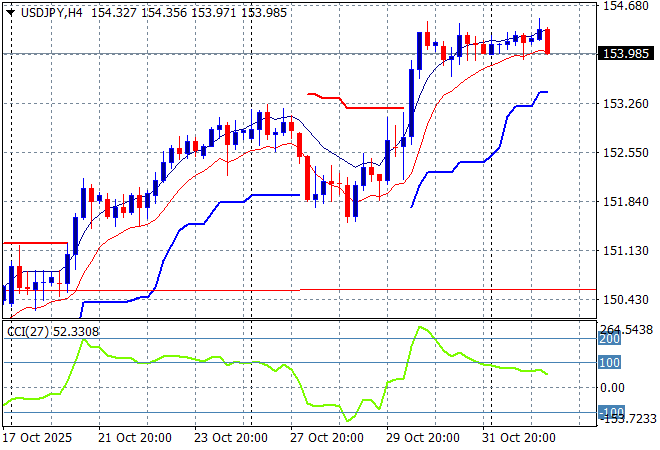

Mainland Chinese share markets are slipping slightly going into the close with the Shanghai Composite still stuck below the 4000 point barrier while the Hang Seng Index has lifted just 0.2% or so in a lacklustre session. Japanese stock markets reopened from their long weekend holiday with a small drop in the Nikkei 225, currently off 0.5% or so while trading in the USDPY pair has seen some Yen strength return to pull just below the 154 level:

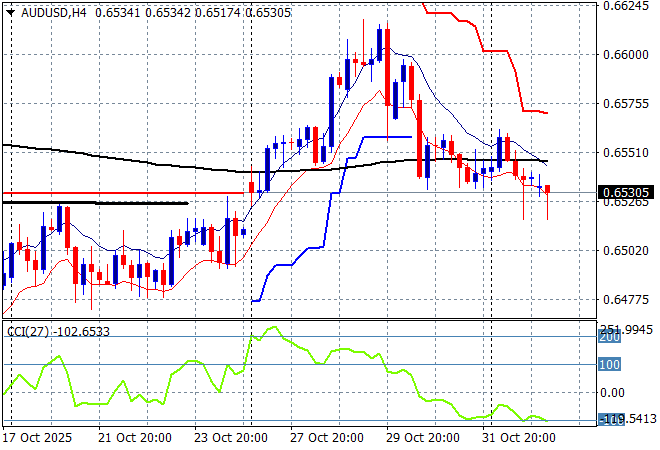

Australian stocks are still unable to find any positive momentum with the ASX200 falling more than 0.8% lower on the RBA hold, currently at 8819 points while the Australian dollar has steadied but looking week at just above the 65 cent level against USD:

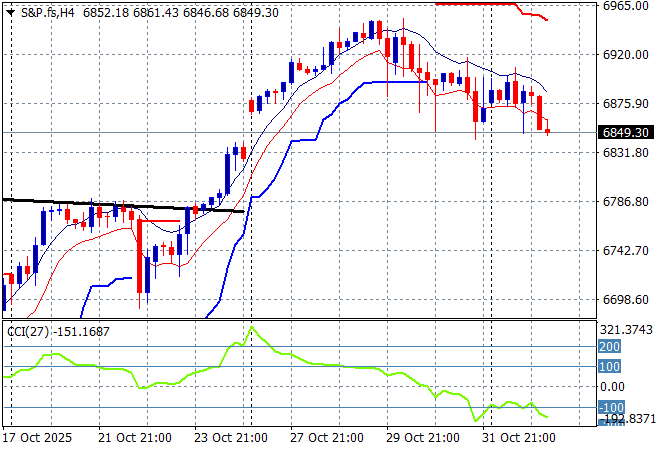

S&P and Eurostoxx futures are drifting further lower as we head into the London session with the S&P500 four hourly chart showing the market unable to get back above the 6900 point level as it builds to a potential breakdown here:

The economic calendar is relatively quiet tonight with the latest US Redbook release.