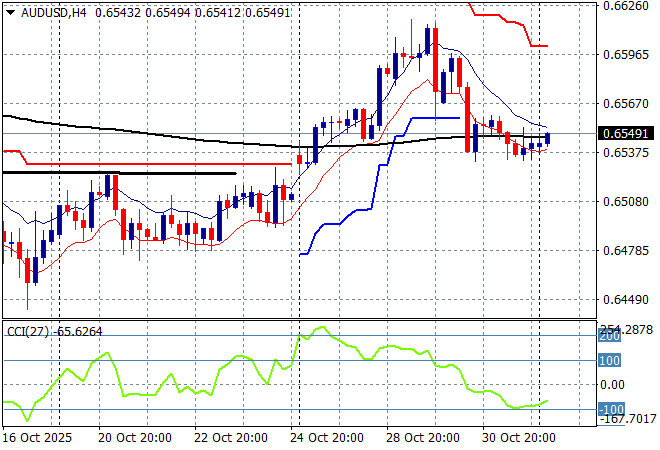

Asian markets are generally steady following the weekend gap with traders absorbing the outcome of the Trump-Xi summit last week amid some other economy releases, not withstanding last week’s Fed meeting which saw a “cut and wait” approach as too much inflation and not enough job growth plagues the Trump regime. This has seen the USD continue to make gains although the Australian dollar has stabilised at the 65 cent level.

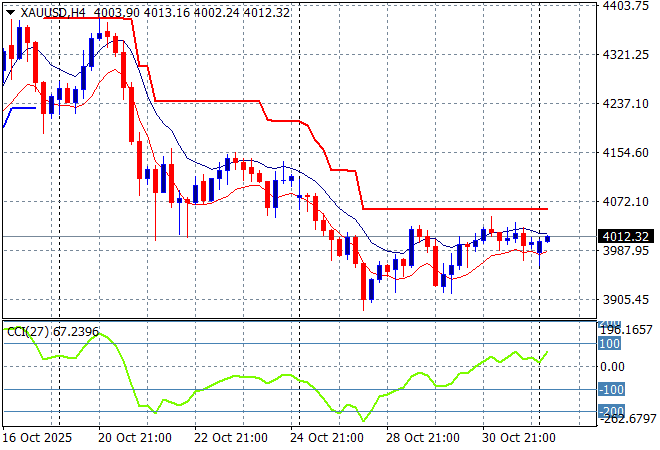

Oil markets are trying to hold on to their recent breakout with Brent crude lifting slightly above the $63USD per barrel level while gold is also stabilisng after its recent falls, currently just above the $4000USD per ounce level building some support here for a potential breakout:

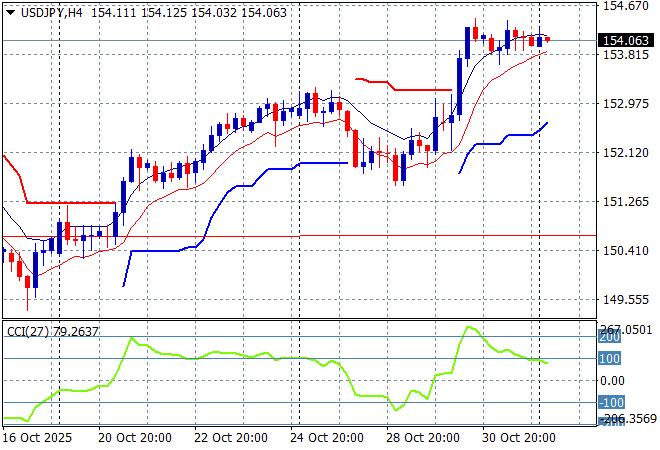

Mainland Chinese share markets are unchanged going into the close with the Shanghai Composite still stuck below the 4000 point barrier while the Hang Seng Index has bounced slightly to be up 0.3% or so. Japanese stock markets are closed for yet another holiday with trading in the USDPY pair quiet with another stable session just above the 154 level:

Australian stocks are still unable to find any positive momentum with the ASX200 dead flat at 8879 points while the Australian dollar has lifted slightly after finding some support just above the 65 cent level against USD as Fed rate cut expectations vanish:

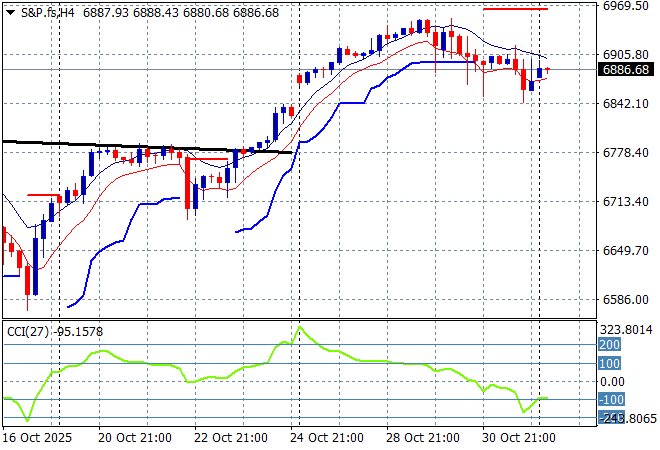

S&P and Eurostoxx futures are drifting lower as we head into the London session with the S&P500 four hourly chart showing the market wanting to get back above the 6900 point level but could be ready to breakdown here:

The economic calendar starts the trading week quietly with the latest US ISM manufacturing PMI survey.