Given that it appears the Albense government is, once again, set to sell you out to the gas cartel with fake domestic reservation, it falls to me to point out one final irony.

Just as Australia moves to do a fake version of what it should have done in 2012, a global gas glut of such immense scale is approaching that it will make imported LNG prices much cheaper than a fake domestic reservation.

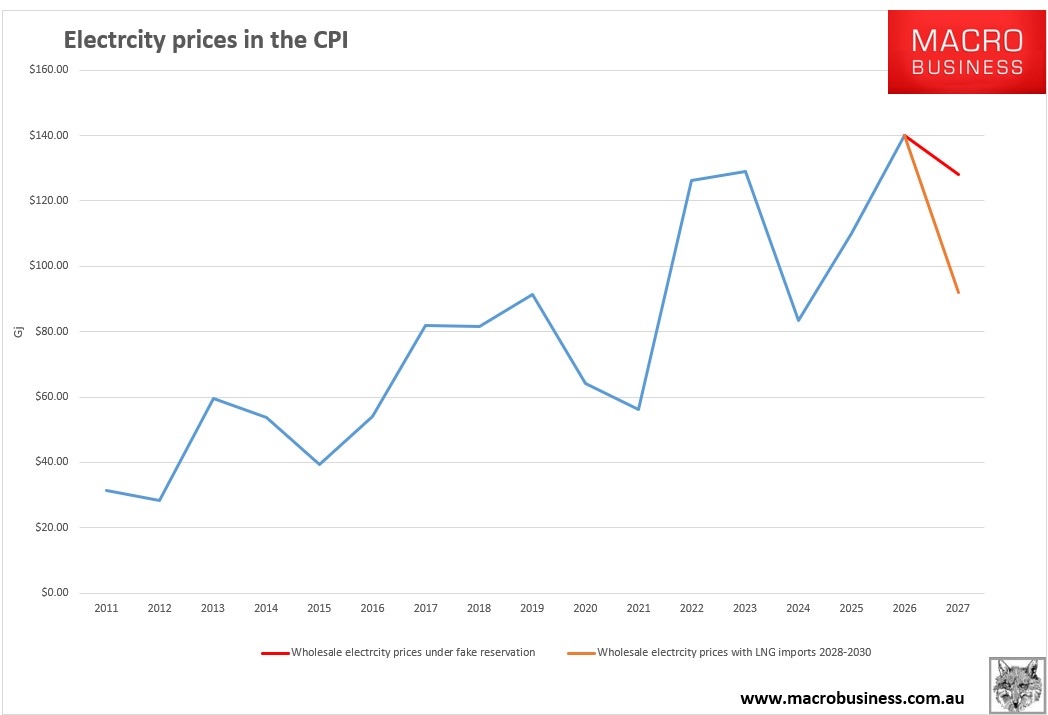

Consider, the proposed export credit system that appears to be the frontrunner for domestic reservation will give us $11-12Gj gas.

On the other hand, Goldman is modelling future imported gas into Australia landing at $7.50Gj, or roughly $8.50Gj delivered.

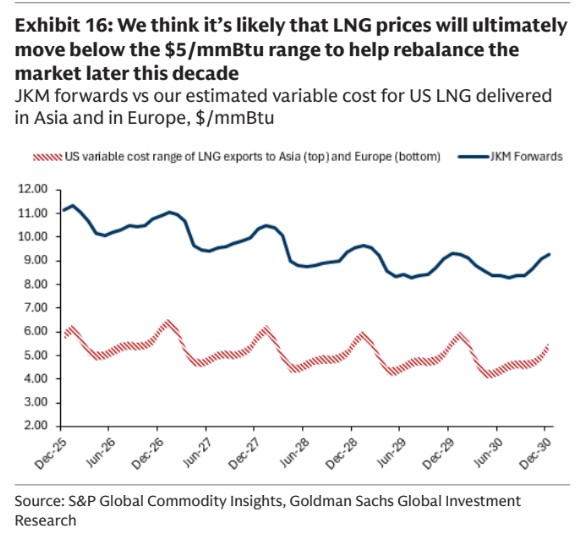

…in the absence of an early decarbonization push that favors China’s natural gas use at the margin, it might take much lower gas prices relative to our $5/mmBtu scenario to balance the market.

Given that we estimate that the US LNG export arb closes when international prices move below the $5/mmBtu range (Exhibit 16), this leaves US LNG export cancellations as the likely solver for the significant global LNG oversupply we expect later this decade, in our view, and particularly in 2028-2029, when our estimated market oversupply peaks.

Assuming Power of Siberia 2 is commissioned, as expected, the glut will be even bigger and of longer duration.

Could Albo’s fake domestic reservation actually prevent Australia from taking advantage of the global glut with cheaper domestic prices? It might.

Suppose the gas export cartel, and GLNG partners in particular, decide that they would rather keep the domestic market tight to gouge.

Or, if it is not allowed to declare force majeur to recontract Australian supplies to cheap US supplies to fulfill contracts to Asian customers.

Albo will have delivered Australians uniquely high gas prices all over again.

Recalling that he and Chris Bowen both voted against domestic gas reservation in 2012, is he now about to deliver fake reservation to ensure no cheap gas flows from offshore?