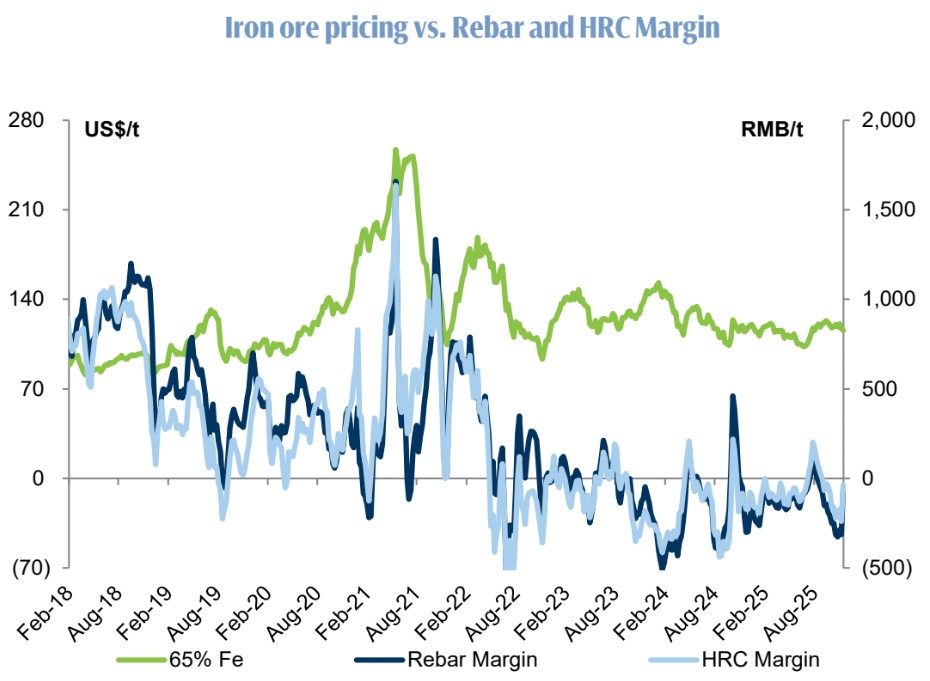

The ferrous complex remains paralysed by overly high iron ore prices. I have switched to Shanghai HRC (purple) prices from the national average, which may help explain some of the stickiness in iron ore prices.

Despite the recent price falls in steel inputs, steel remains unprofitable.

Advertisement

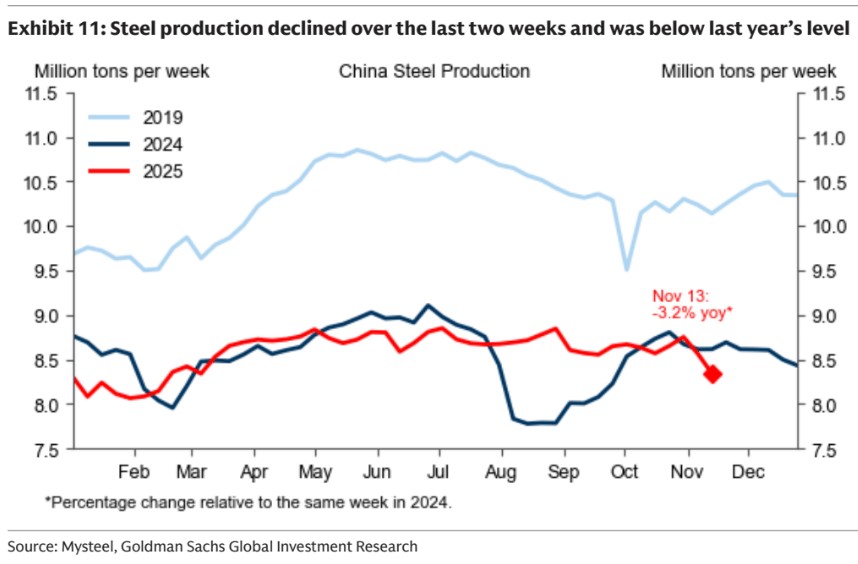

Production is being forced lower.