DXY copped it last night on a swath of bad data.

AUD rose, but in the circumstances, it was pretty subdued.

CNY took off.

JPY reversed with yields, but it’s not persuasive yet.

Gold up, oil down.

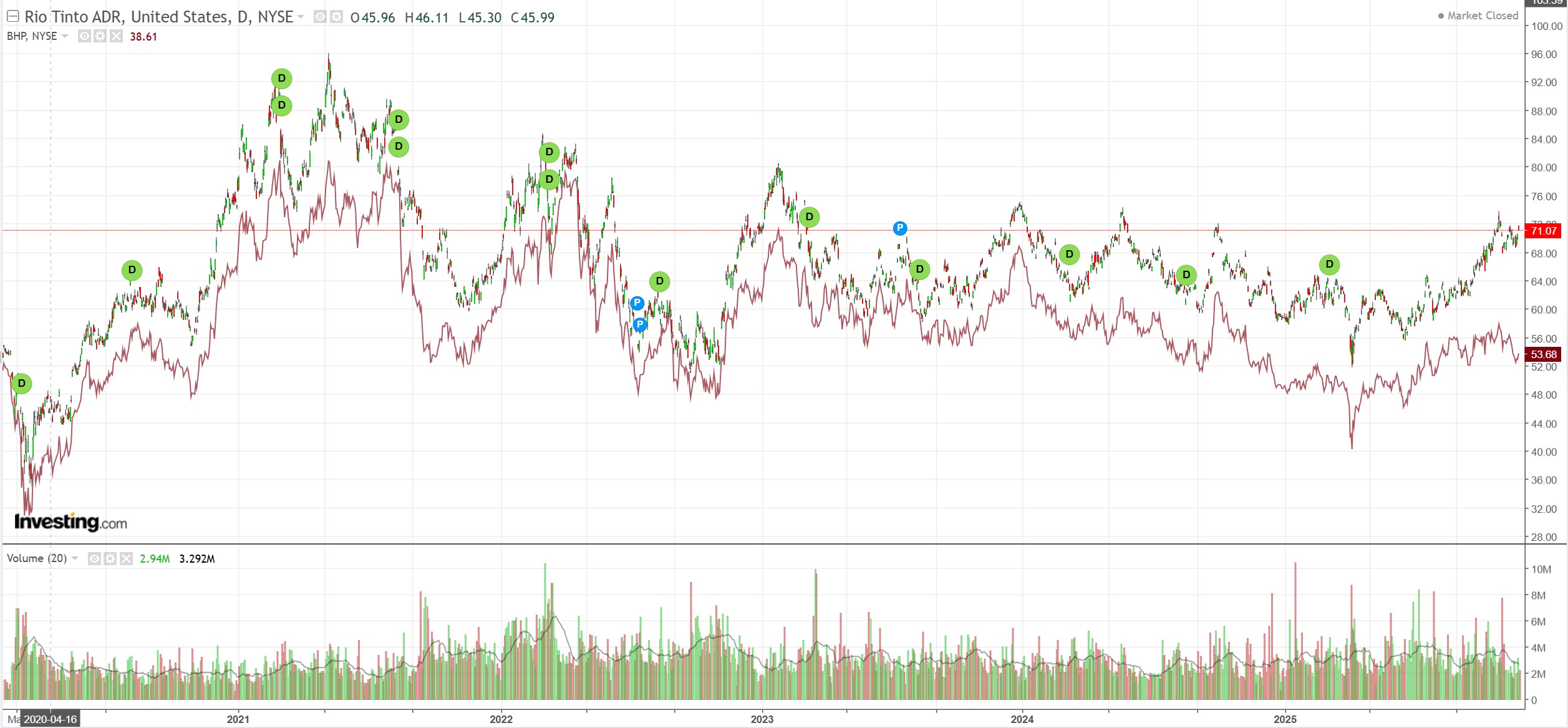

AI metals struggled.

The chosen one launched.

EM too.

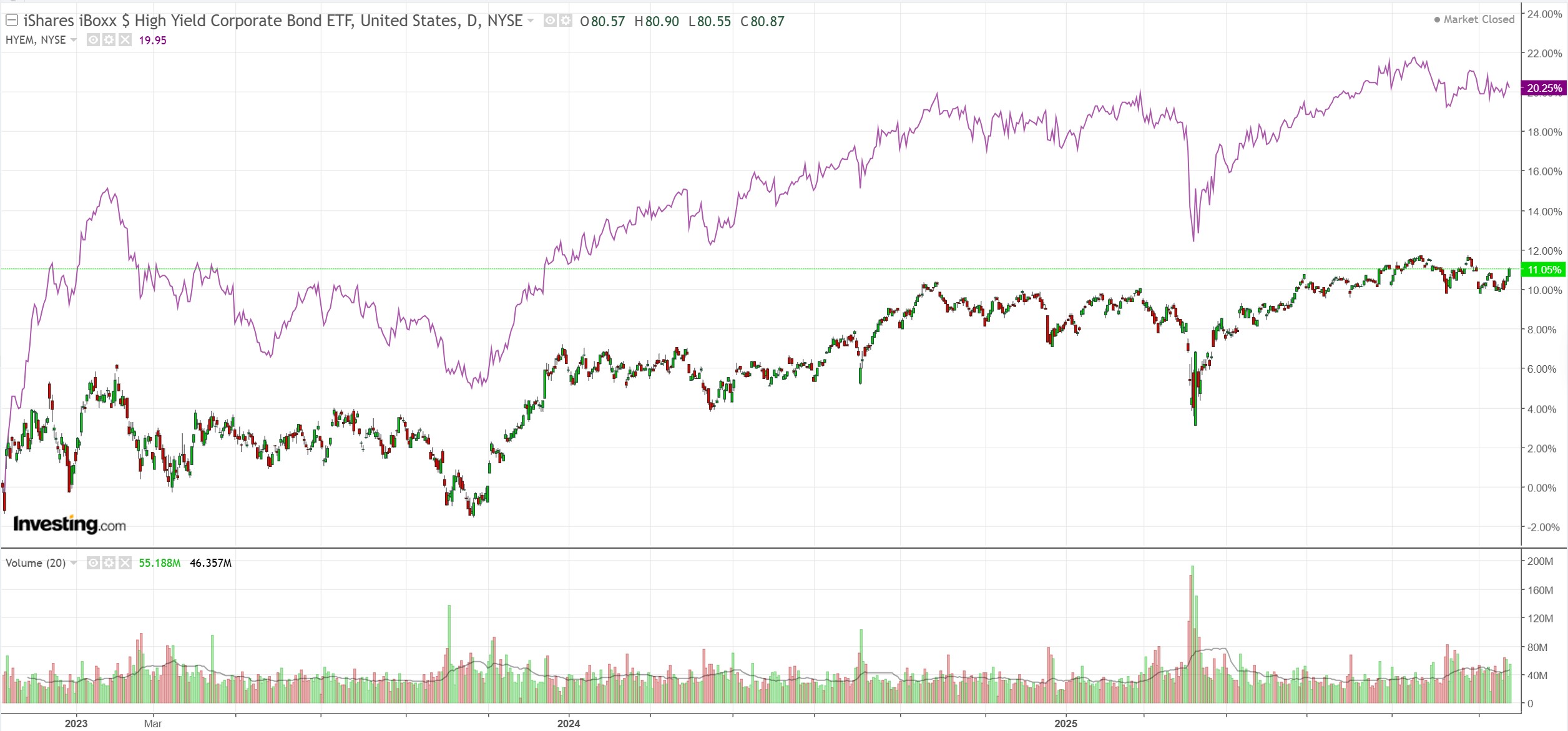

Junk is back.

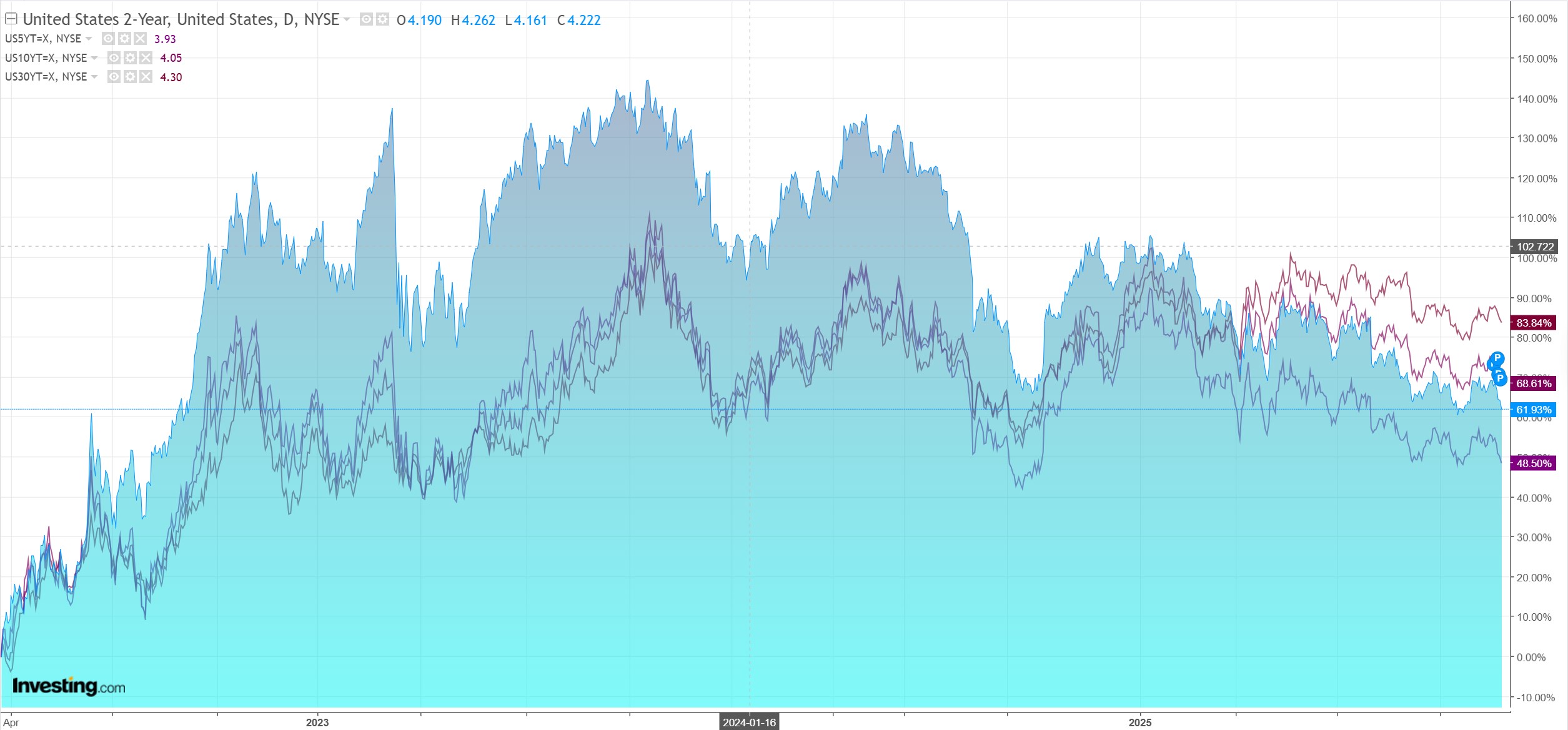

As yields tumble.

Reducing stocks.

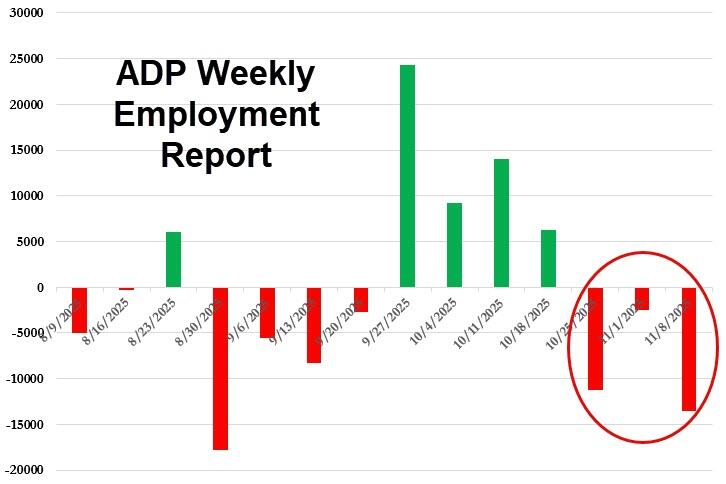

Bad news is good news.

ADP monthly employment data was weak.

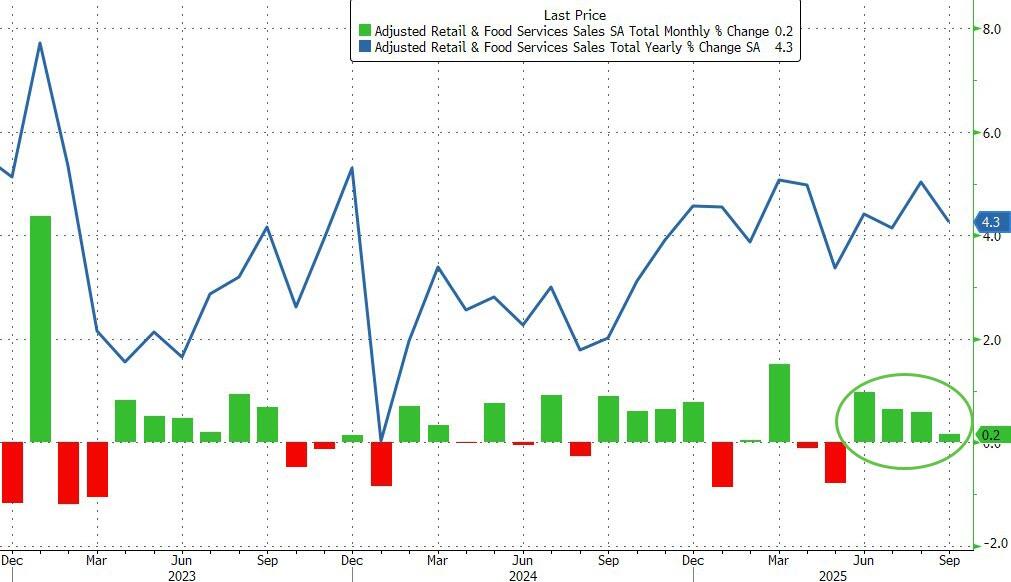

Retail sales and cosumer confidence were weak.

Core PPI is still firm on tariffs but better than feared, which is good for PCE.

Home prices and sales were soft, and the Richmond Fed was weak, though the ISM still looks better.

Trumping it all was letting Fed doves fly.

White House National Economic Council Director Kevin Hassett is seen by advisers and allies of President Donald Trump as the frontrunner to be the next Federal Reserve chair, according to people familiar with the matter, as the search for a new central bank leader enters its final weeks.

Dovish all around, which is enough to short-circuit the Japanese bust for now.

AUD should rise.