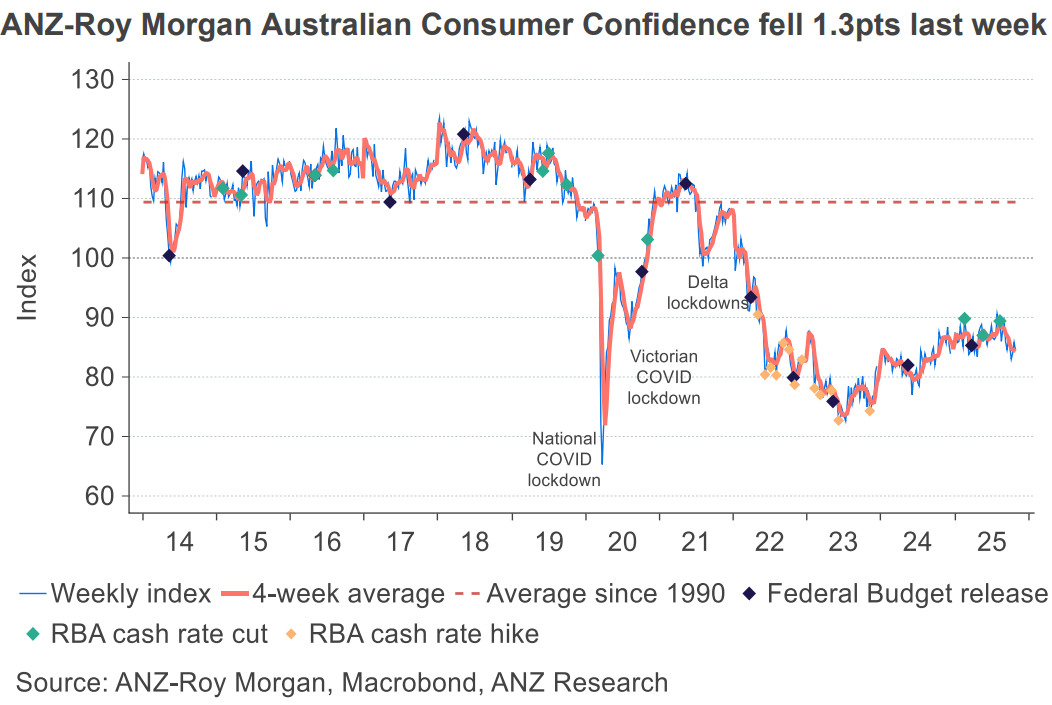

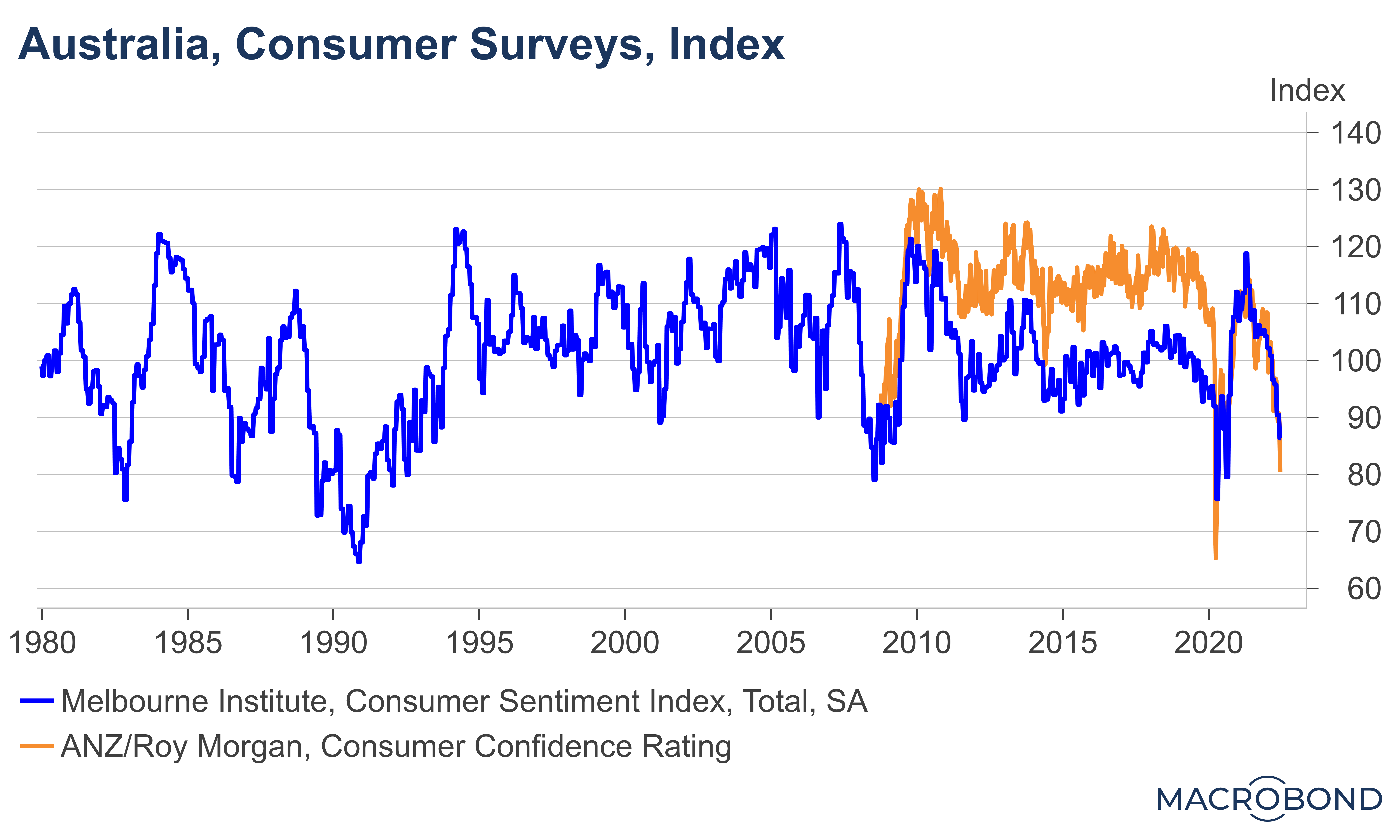

The outlook Australians hold for the future has been deeply sub-par for a long while now, with the ANZ-Roy Morgan Consumer Confidence Index sitting dramatically below the post-1990 level and roughly where it was during the Global Financial Crisis.

While elements of the index have undergone a recovery, the forward-looking subindexes remain in deeply concerning territory.

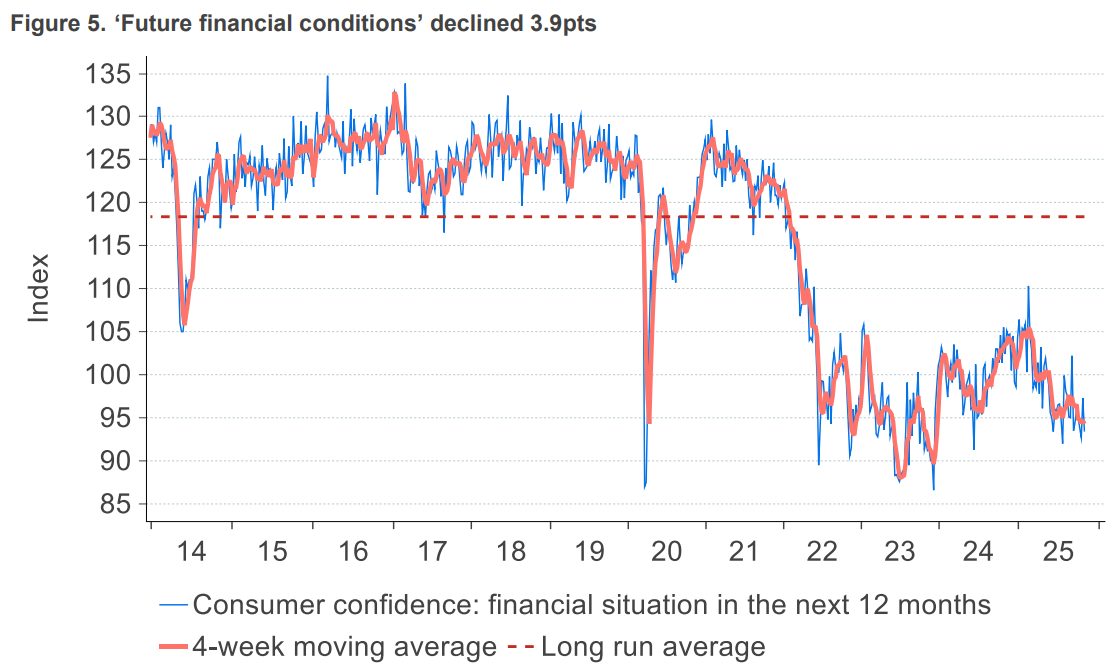

The outlook for personal financial conditions over the next 12 months has fallen back to below the pandemic lows on a 4-week moving average basis.

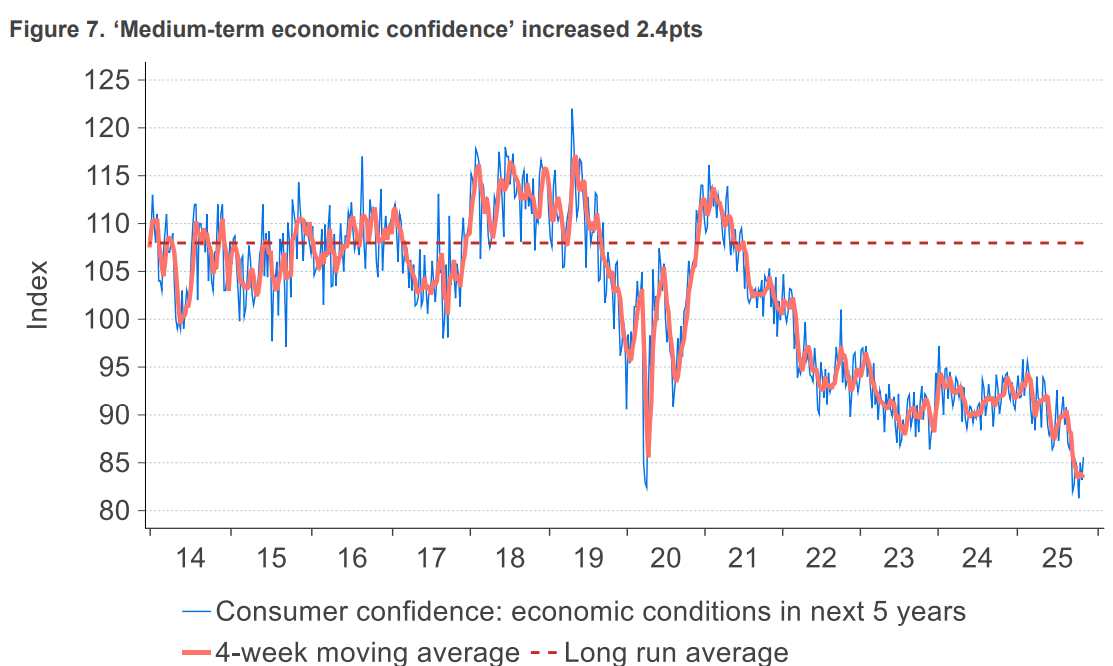

In terms of the outlook for the broader economy over the next 5 years, confidence recently hit a multi-decade low, significantly weaker than even the height of the pandemic.

The latest polling from Resolve echoes the weak outlook for the road ahead.

“Over the next six months, just 20% said the outlook would improve, 29% thought it would stay the same and 42% said it would get worse, and over the next year, 25% of people said the outlook would improve and 42% said it would get worse.”

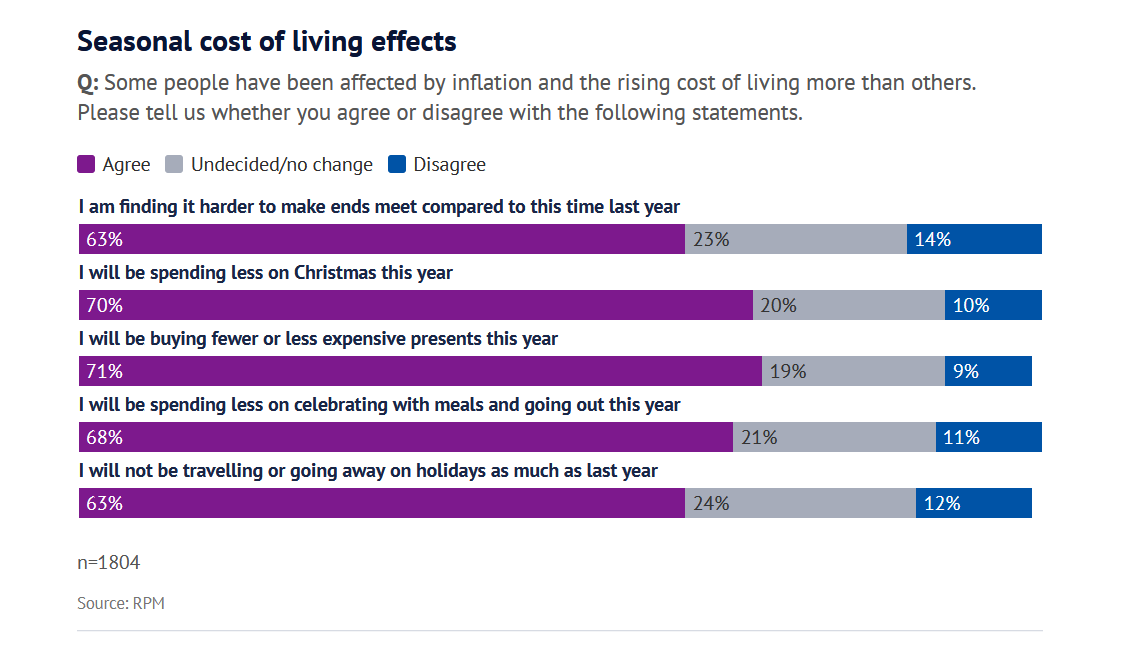

The same poll asked respondents about their Christmas spending plans and the state of their finances.

63% said they were finding it harder to make ends meet compared with this time last year, with 70% stating they would be spending less on Christmas this year.

Chart: SMH

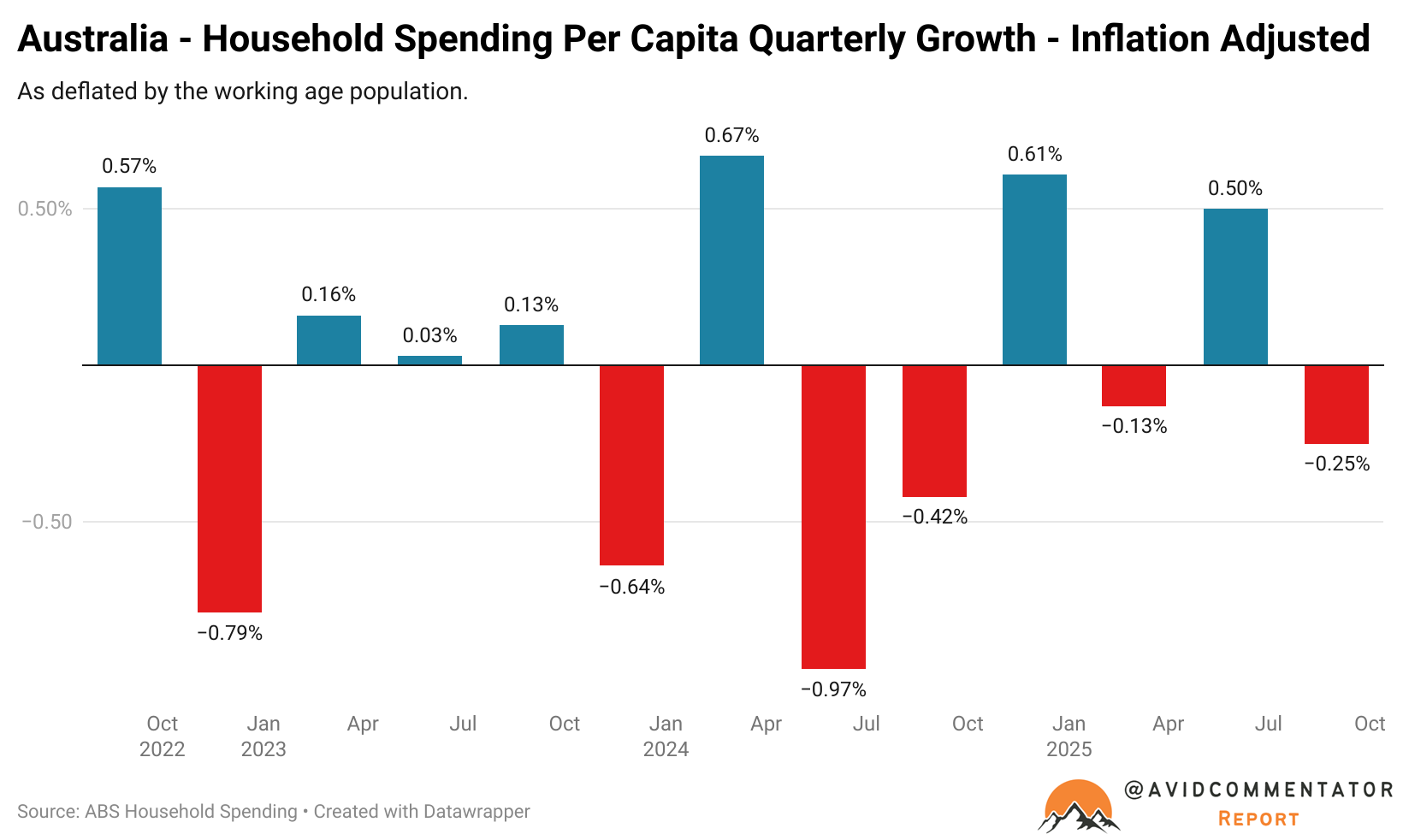

Considering that real per capita household spending is already contracting and growing by just 0.2% quarter on quarter overall, this is a deeply concerning sign for the road ahead for the consumer economy if this poll is in any way representative of reality.

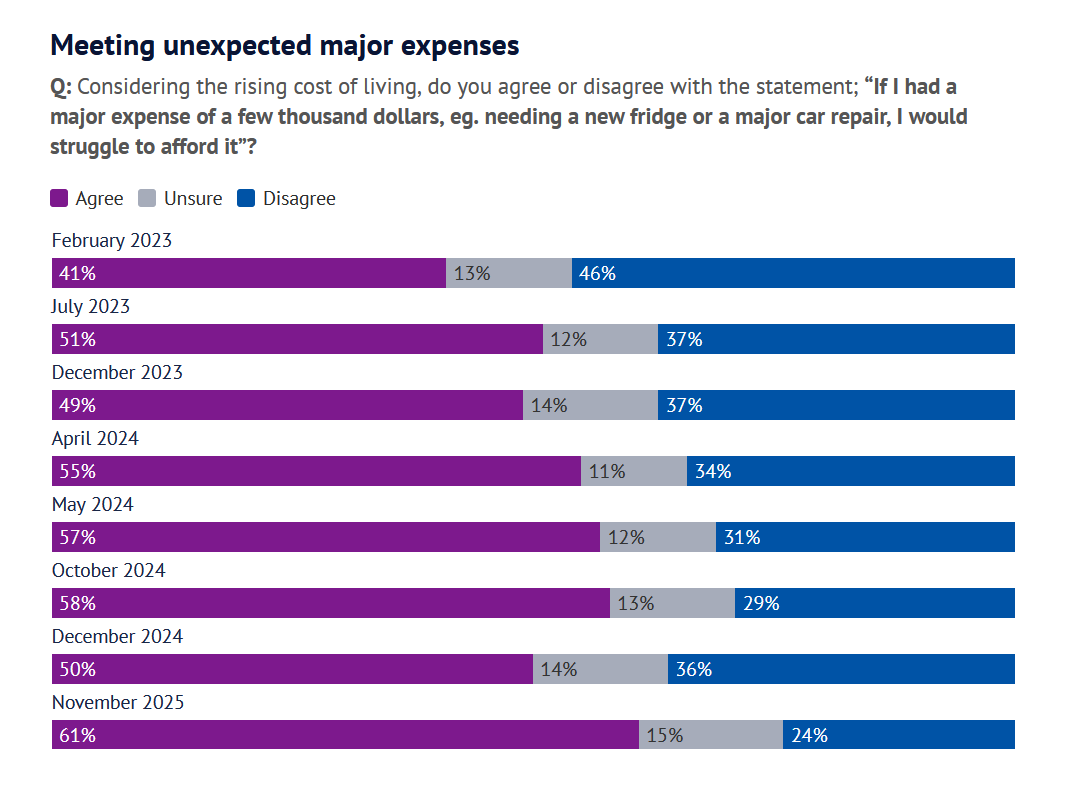

This challenging outlook is reflected in a much longer-run poll from Resolve, which asks respondents if they would struggle to pay for a major unexpected expense of a “few thousand dollars”.

In February 2023, 41% said they would struggle, with 46% saying they would be okay.

As of the latest polling from this month, 61% said they would struggle and 24% said they would be okay.

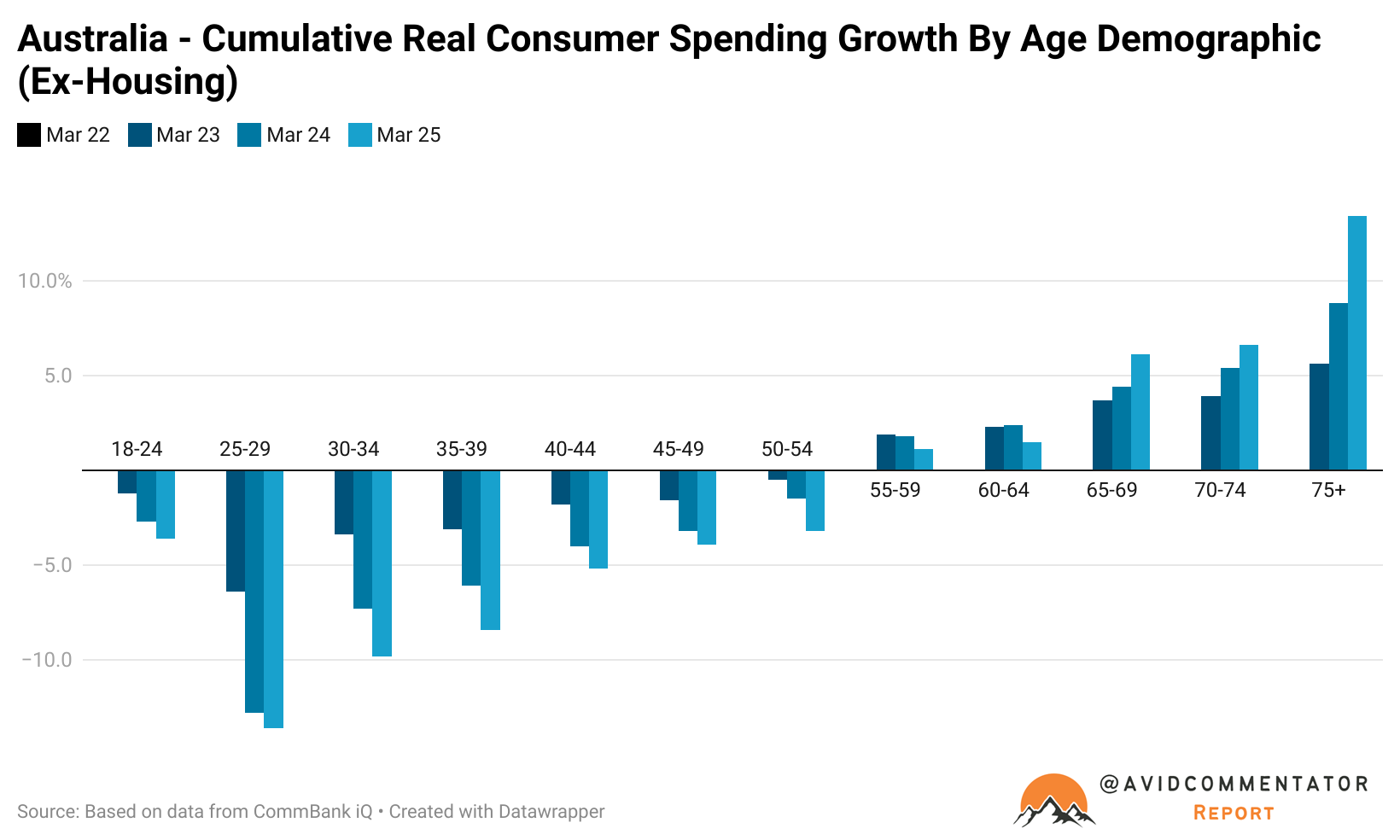

This is a deeply concerning picture for the Australian economy and arguably reflects the trends we have seen in the data from CommBank iQ.

Over time the weakness in real household spending growth has spread from under 55-year-olds at first to 55- to 59-year-olds in 2024 and finally 60- to 64-year-olds in 2025.

With the economy increasingly reliant on government spending and non-market employment growth in recent years, a challenging Christmas could be a major blow to whatever recovery the non-government-aligned private sector of the economy has so far managed.

With the rate cut cycle increasingly tipped to be over in some quarters, already weak levels of confidence for the nation’s households leave them in a vulnerable position.

It’s hard to know if this polling and survey data will be realised in the hard data when it comes out next year, but it should concern policymakers.