Wall Street rallied again overnight on the continued potential US-China trade deal as risk markets pivot towards the expected rate cut from the Federal Reserve this week. The USD pulled back against some of the majors, particularly against the burgeoning Canadian Loonie as PM Mark Carney continues his Operation “Reach Around” while Euro range traded and the Australian dollar continued its breakout above the 65 cent level. Gold however was the standout undollar with another breakdown towards the $3900USD per ounce level while 10 year Treasuries dipped below the 4% level.

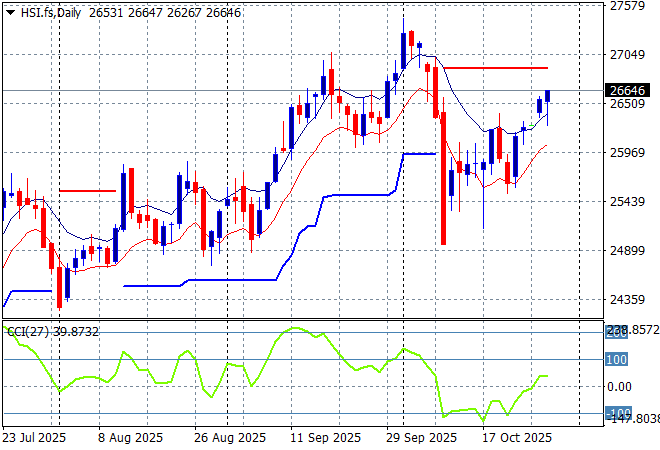

Looking at stock markets from Asia from yesterday’s session, where mainland Chinese share markets were well into the close with the Shanghai Composite holding above the 4000 point barrier before closing 0.2% lower at 3988 while the Hang Seng Index also pulled back slightly to finish 0.3% lower at 26346 points.

The daily chart showed a complete fill of the March/April selloff and then some with a breakout above the 26000 point level looking like a sustained move here before the most recent Trump tantrum. The possible trade deal is seeing a resumption of buying here above 26000 points again:

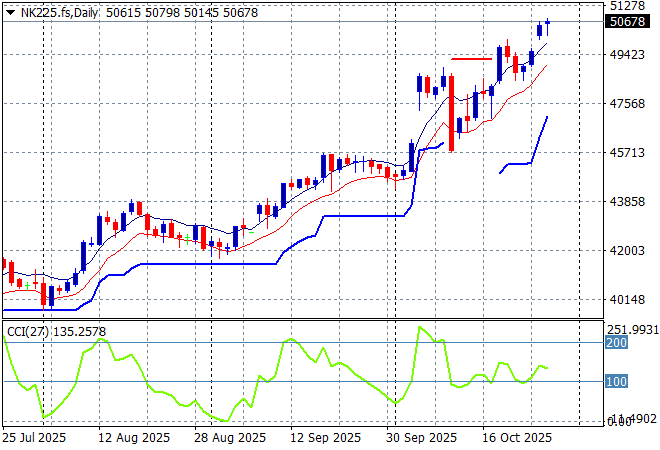

Japanese stock markets also gave up some recent gains on the stronger Yen with the Nikkei 225 down nearly 0.6% at 50219 points.

Daily price action was looking extremely keen indeed as daily momentum accelerated after clearing resistance at the 42000 point level with another equity market that looks very stretched and breaking out a bit too strongly here. ATR support has been ratcheting up for awhile as the 50000 point level is now broken for an extended rally:

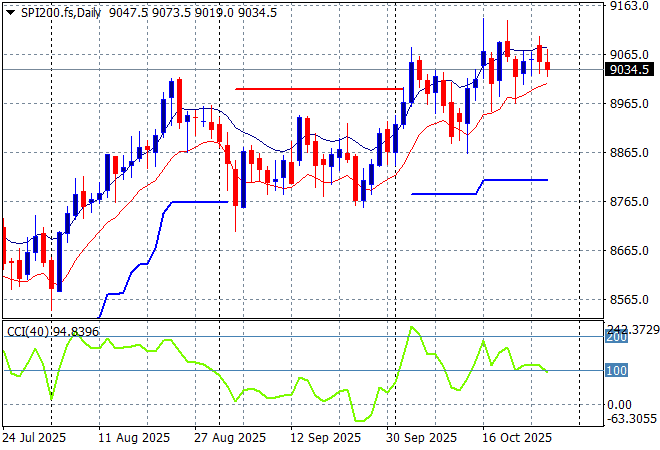

Australian stocks were also off with the ASX200 finishing nearly 0.5% lower at 9012 points. SPI futures however are up slightly given the gains on Wall Street overnight.

The daily chart pattern was suggesting further upside still possible with a base built above the 8700 point level as daily momentum tried to maintain its overbought status. Short term support is holding on, supporting a wider rally, but the momentum is not yet there:

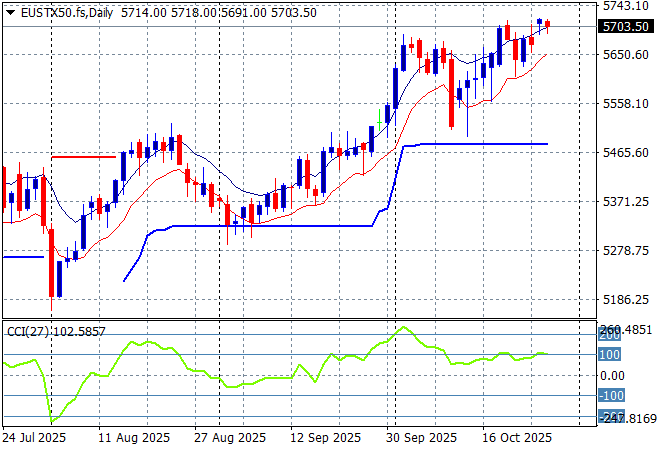

European markets were unable to build on recently found confidence across the continent as the Eurostoxx 50 Index eventually closed 0.1% lower to 5704 points.

Weekly support has been respected after a brief touch below the 5200 point level as the recent rebound on Euro weakness shows a complete fill. However the market was looking to make some good headway here despite the too high valuations (mainly defense stocks) with more upside potential building:

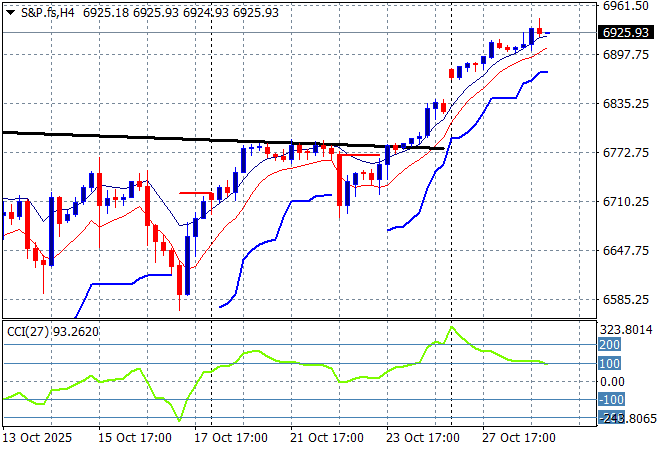

Wall Street continued to see tech stocks leading the way as the NASDAQ gained nearly 0.8% while the S&P500 lifted just over 0.2% closing at the 6890 point level.

The four hourly chart shows the recent breakout after last Friday’s CPI print all but expecting more punchbowl stuff from the Fed this week as the AI bubble continues to expand further:

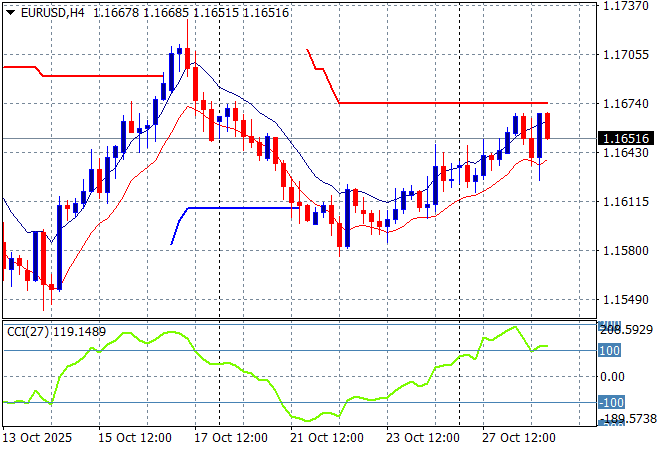

Currency markets are still trying to swing away from recent USD strength in the wake of Friday’s US CPI print with some intrasession volatility around more Trumpian wave handing as Euro range traded around the mid 1.16 handle overnight. Meanwhile Pound Sterling took a hit on a lower inflation report while the Canadian Loonie continues to firm against King Dollar.

The union currency had been building strength prior to the recent bad domestic economic news from the US overshadowed any continental slowdown but had reversed that trend in recent weeks. The potential breakout above the 1.17 level is getting more traction however momentum is slowing down somewhat:

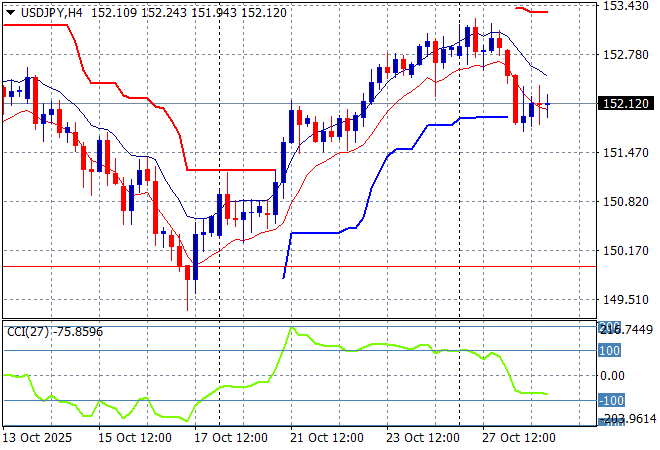

The USDJPY pair has consolidated around the 152 level overnight after its sharp start of week retracement.

The previous price action was sending the pair beyond the March highs and had the potential to extend those gains through to start of year position at the 158 handle but the recent internal political volatility that looks resolved could see some steady trends build from here, but watch for any waning in overbought momentum readings:

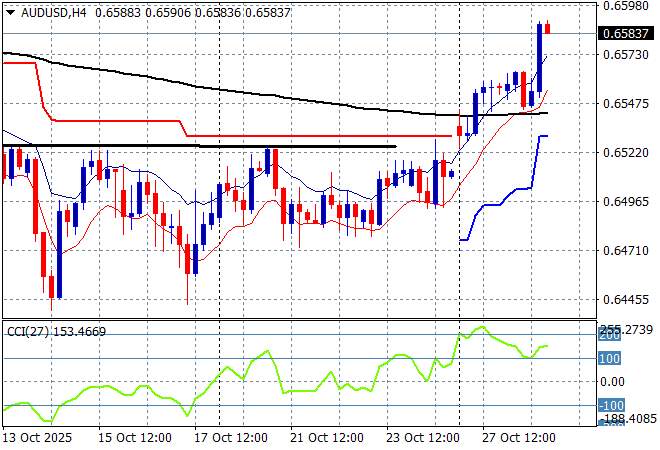

The Australian dollar had been under strain recently with the latest numberwang figures last week suggesting a potential November rate cut from the RBA but the prospect of more China positivity is pushing the Pacific Peso well above the 65 handle with the 66 level now in sight.

This could become a more sustained breakdown if the China/US trade war heats up as I’ve opined that the Pacific Peso is not out of trouble although I’m wary of a lot of volatility here, but a short term double bottom pattern has been formed strongly on the four hourly and daily chart:

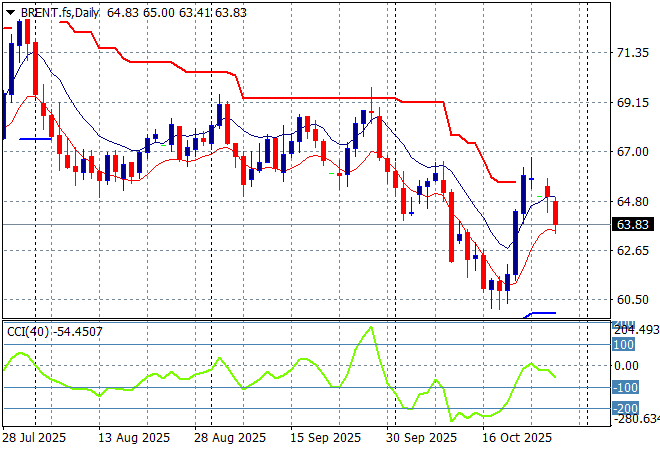

Oil markets got a wriggle on last week due to a surprise drawdown in US inventories but this was pulled back on USD weakness and too much too soon with Brent crude dropping below the $64USD per barrel level overnight.

The daily chart pattern shows the post New Year rally has a distant memory with any potential for a rally up to the $80 level completely dissipating. There was potential here for a run down to the $60 level next but wait and see if this one off bid turns into a trend:

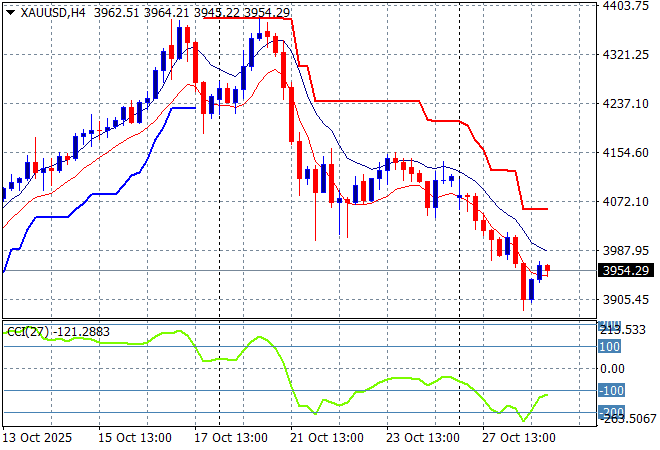

Gold is failing to stabilise after a well needed correction down towards the $4000USD per ounce level recently, with a continued selloff overnight seeing it fall back to the $3950 zone.

This was looking very solid indeed as more central banks indicate more gold purchases and to be frank, confidence in the USD continues to crash but be wary of more downside volatility ahead this week. I noted a short term potential double top pattern forming here on the four hourly chart and these falls could extend well below the $4000 level but watch for some knife catching buying here:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!