Looks like everyone but the Fed is going to raise interest rates soon with the latest local inflation figures surging and cutting all chances of a cut from the RBA in its November meeting while it seems the BOJ is also likely to start raising rates going into 2026. Asian share markets are somewhat mixed with local stocks down the most on the CPI print while Japanese shares are surging, with the Australian dollar almost hitting the 66 cent level.

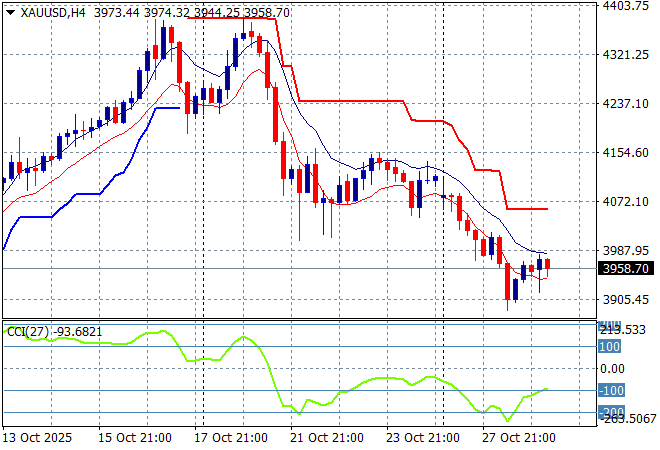

Oil markets are failing to hold on to their recent breakout with Brent crude pulling back to the $63USD per barrel level while gold is also struggling at the $3950USD per ounce level:

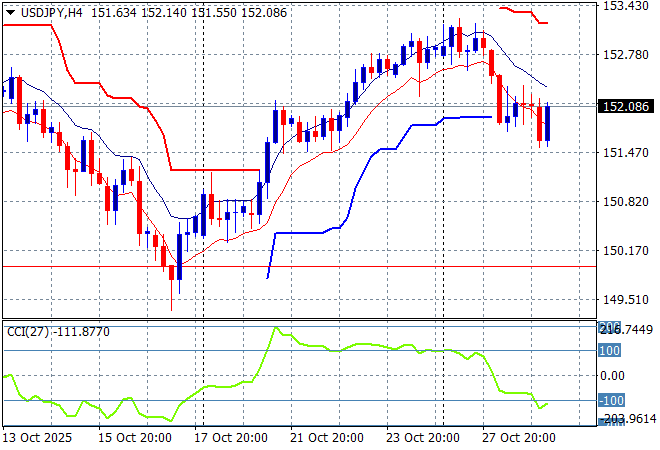

Mainland Chinese share markets are getting back on track with the Shanghai Composite up 0.4% to return above the 4000 point barrier while the Hang Seng Index is down 0.3% to 26346 points. Japanese stock markets are surging following the previous session selloff with the Nikkei 225 up nearly 2% at 51177 points while the USDPY pair has seen a small reversal to get back above the 152 level:

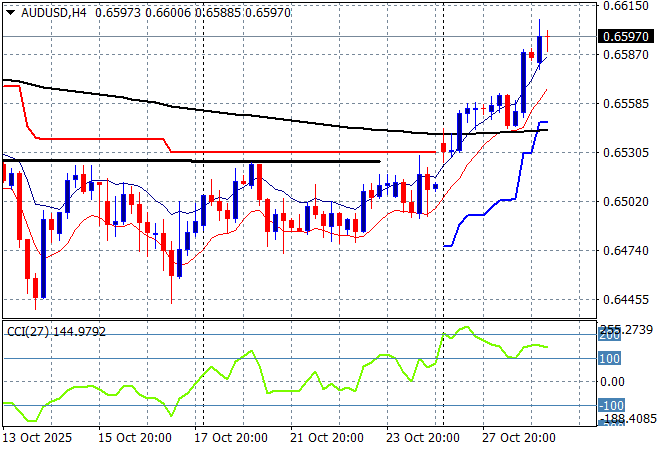

Australian stocks have taken a big hit on the inflation news with the ASX200 losing nearly 1% to 8925 points while the Australian dollar has accelerated its surge above the 65 cent level against USD as rate cut expectations vanish:

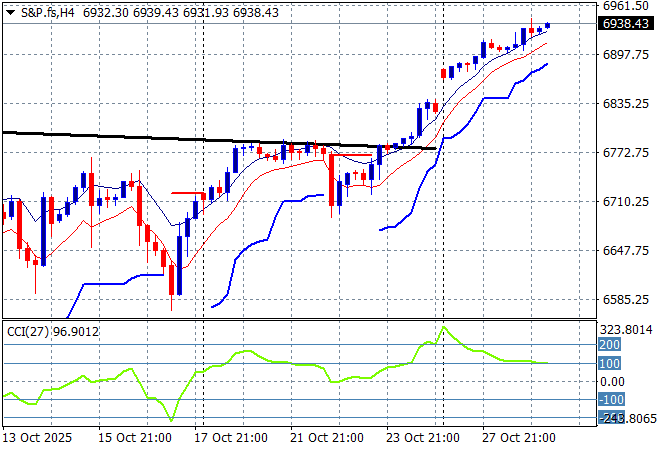

S&P and Eurostoxx futures are climbing slightly higher making good as we head into the London session with the S&P500 four hourly chart showing the market breaking out above the 6900 point level:

The economic calendar will focus squarely on tonight’s US Federal Reserve meeting where rate cuts are expected.