Asian share markets are facing mixed sentiment throughout the region with a squeeze on Ruzzian oil due to sanctions helping the sweet crude market while Japanese politics are seeing a selloff in Yen and in stocks. Currency markets are seeing some strength return to the USD which has been taking back its recent lost ground against the majors with the Australian dollar trying hard to get back above the 65 cent level.

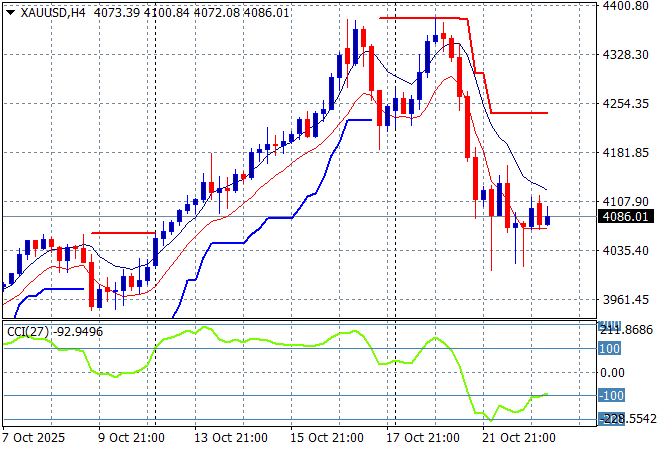

Oil markets are building on their overnight breakout with Brent crude now above the $65USD per barrel level while gold has tried to stabilise after its correction, holding just below the $4100USD per ounce level:

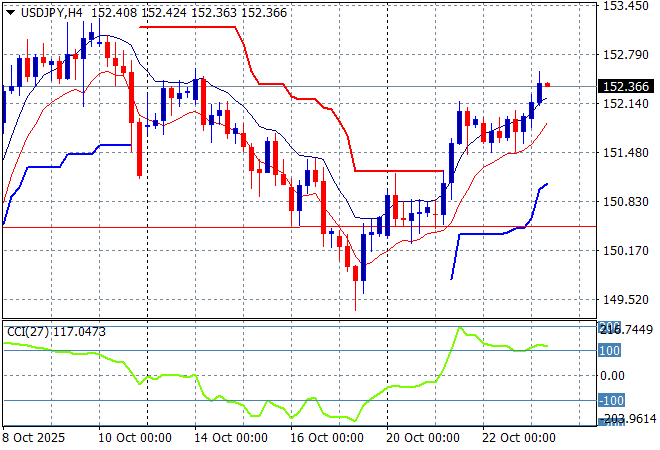

Mainland Chinese share markets are falling going into the close with the Shanghai Composite down more than 0.7% at 3885 points while the Hang Seng Index is down 0.1% to points, taking back some of their recent gains. Japanese stock markets are being sold off quickly with the Nikkei 225 down more than 1.7% to 48449 points with the USDPY pair pushing above the 152 level:

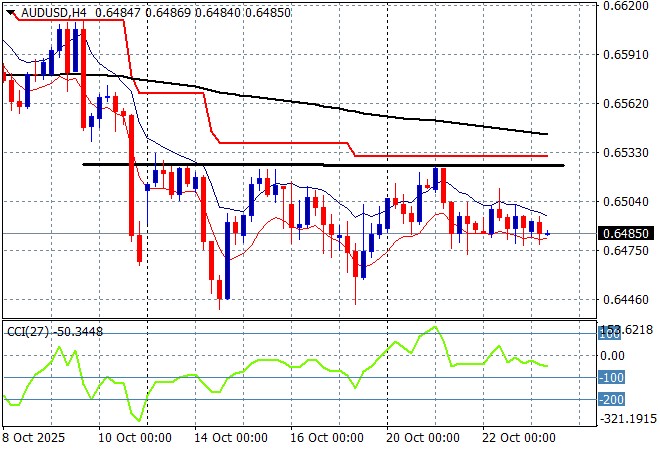

Australian stocks were the standout with the ASX200 actually closing in positive territory – just – finishing at 9032 points while the Australian dollar has further slid back as it can’t breach resistance above the 65 cent level against USD:

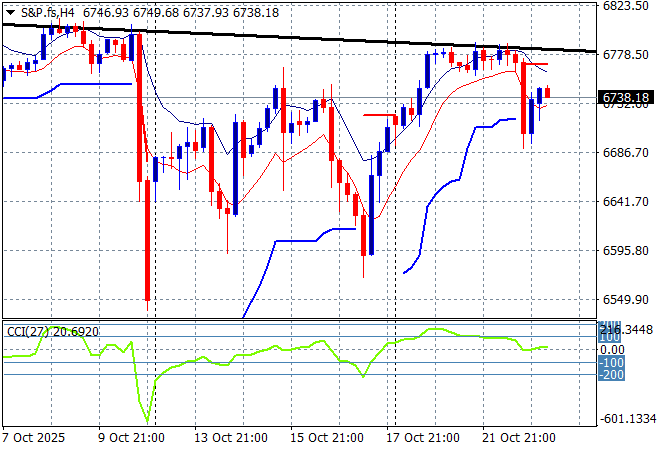

S&P and Eurostoxx futures are heading slightly lower as we head into the London session with the S&P500 four hourly chart showing the market failing to get back on track after the slump from the previous Friday session, as the TACO trade fades slightly:

The economic calendar includes the latest US initial jobless claims and existing home sales data.