A sea of red across Asian share markets in the last session of the trading week in response to the slip on Wall Street overnight, largely due to overstretched financials as they try to absorb the folly of the Trump regime’s tariff campaign. Meanwhile the USD continues to fall against almost everything else with Euro breaking through the 1.17 handle while the Australian dollar is an outlier as it rolls over back to the mid 64 cent level.

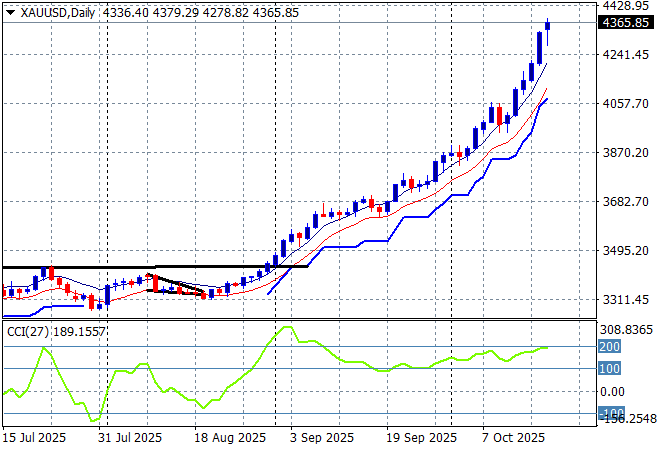

Oil markets are still depressed with Brent crude holding around the $60USD per barrel level while gold has some intrasession volatility but still manages to soar higher as it lifts well above the $4300USD per ounce level with the daily chart going parabolic:

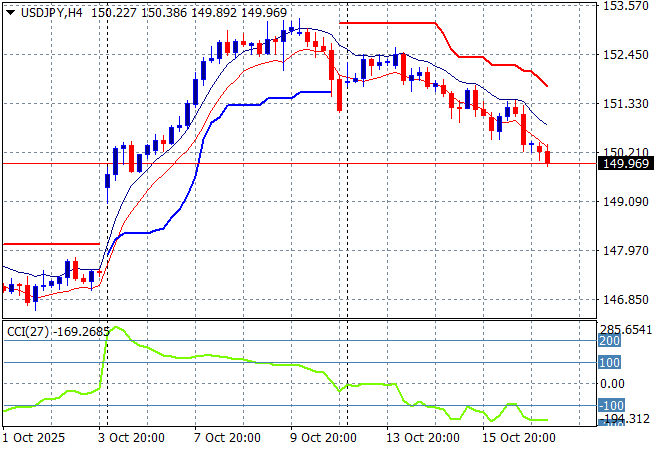

Mainland Chinese share markets are down more than 1% going into the close with the Shanghai Composite at 3873 points while the Hang Seng Index is down 1.3% at 25473 points. Japanese stock markets are doing the same despite the stronger Yen with the Nikkei 225 looking to close more than 1% lower at 47670 points with the USDPY pair sliding back below the 150 level:

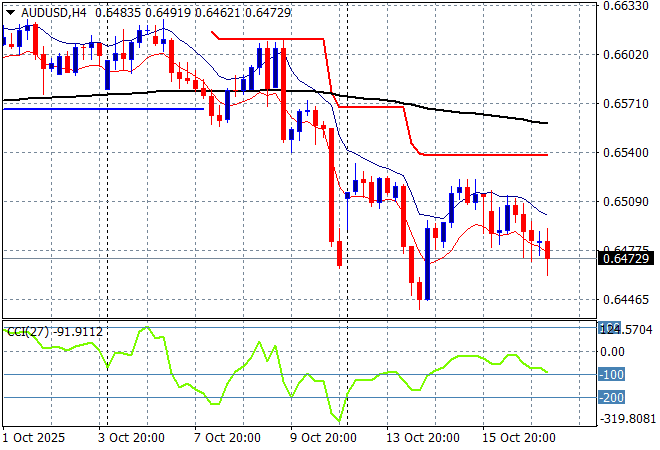

Australian stocks were the best performers relatively speaking, with the ASX200 closing 0.8% lower at 8997 points while the Australian dollar has rolled over on the expectation of another potential rate cut from the RBA as it settles below the 65 cent level against USD:

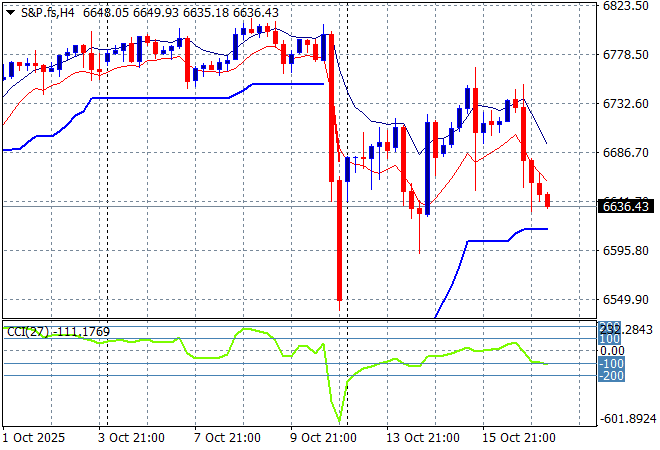

S&P and Eurostoxx futures are falling back as we head into the London session with the S&P500 four hourly chart showing the market unable to get back on track after the slump from the previous Friday session, as the TACO trade sours:

The economic calendar finishes the trading week with some US housing starts data, plus an array of EU and BOE central bankster speeches.