The hyper-taut ferrous complex should not be confused with equilibrium.

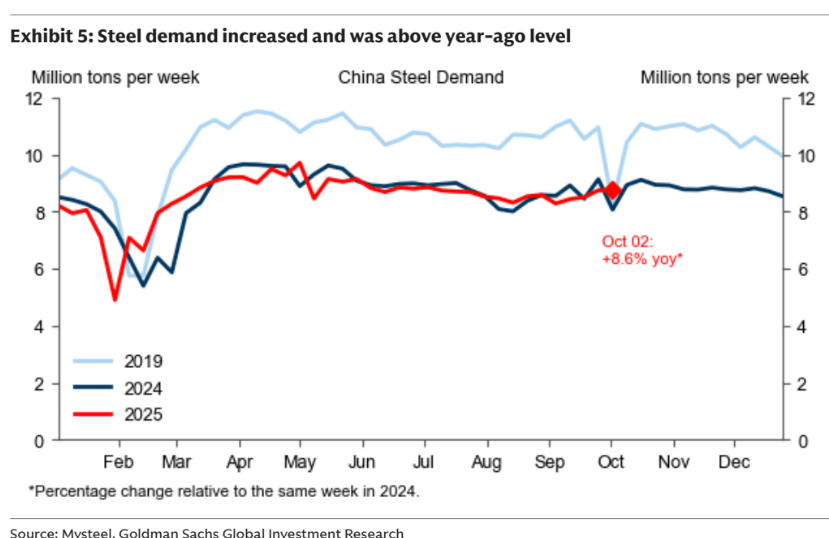

The market is indeed stable, but this is not owing to calm price pressures. Steel demand is stable due to exports.

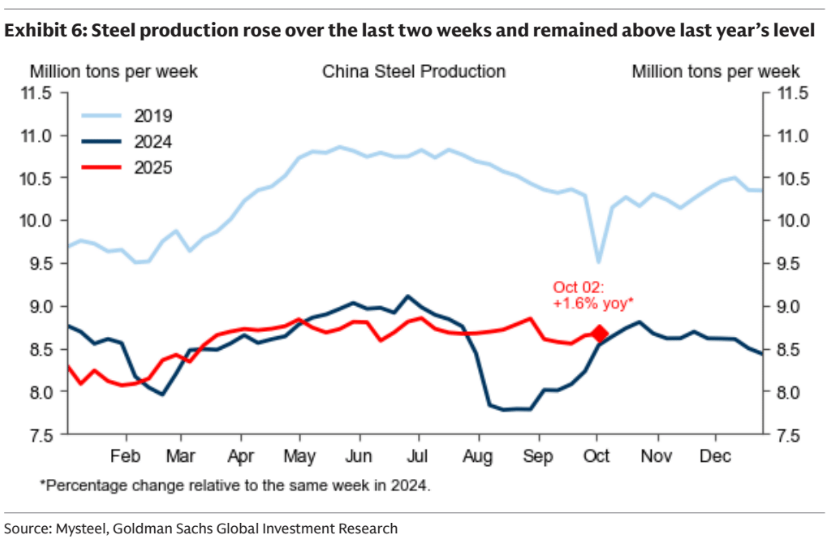

Steel production is far too high on anti-innovation stupidity.

This is a market with Godzilla pulling at one end and King Kong at the other.

It may appear balanced, but the price pressures are much larger than usual, and something is going to snap sooner rather than later.

There is still too much steel, and prices are falling. Yet iron ore won’t budge. This is bearish.

In the blue corner is the behemoth of the iron ore oligopoly. In the red corner is the Chinese buying oligopoly. The stability of prices that this tension has brought to the market since 2022 is about to breed instability as high prices deliver massive new supply.

It has always been thus with miners. They are greedy speculators and never manage prices to suppress future supply. Stupid, really. But that’s the Ivan Grasberg doctrine.

Look to gas to see the future for iron ore. Goldman.

-

First, the front of the curve is balancing the market at a higher price level than what we think we will see down the line when fundamentals soften further, especially from 2027. Because market participants often trade the spreads between contracts, it becomes difficult for the back of the curve to fully express extremely bearish fundamentals ahead of those fundamentals actually playing out, as it would significantly distort spreads along the way.

-

Second, LNG traders that buy US LNG to sell into Europe, which typically hedge by selling the back of the TTF curve, have postponed back-end hedging as much as possible, often hoping that a market event (e.g. cold winter in Europe/Asia) would cause the forward TTF-Henry Hub spread to widen further, to offer them a regional price differential a bit closer to what they saw in 2022 and early 2023.

- Lastly, while there is consensus around our bearish TTF and JKM view for later this decade, there’s still uncertainty about when upcoming LNG export projectswill come online. In particular, we expect the Qatari capacity expansion, composed of eight trains of 8 mtpa (1.1 Bcf/d or 11 Bcm/y) each, to start coming online in 4Q26, in line with market consensus. If that first train is delayed, the whole sequence of eight trains will likely be delayed.

While there are details that are different in terms of delivery risks, these principles hold just as well for iron ore. The iron ore market is also refusing to price back-end price falls.

The notion that full production from Simandou and a bulging pipeline from Gara Djebilet will deliver $91 iron ore is about as likely as my butt turning to gold.

And while these market frailties play out, they keep incentivising more supply, which will eventually break the whole market.

I will finish by noting that this setup is gratuitously bad for Australia’s iron ore boganaires.

Many have waded into eastern gas markets as a hedge against iron ore weakness, but the looming cycle sees both falling simultaneously.

A deeply corrupt Albo can expect his boganaire bailout phone to be running hot.