RBA governor Michelle Bullock did a fireside chat last night, which was pretty dull but it did have a few moments of interest.

Bullock made it pretty clear that the board is unlikely to cut rates next week, putting the recent unemployment surge down to one month of data.

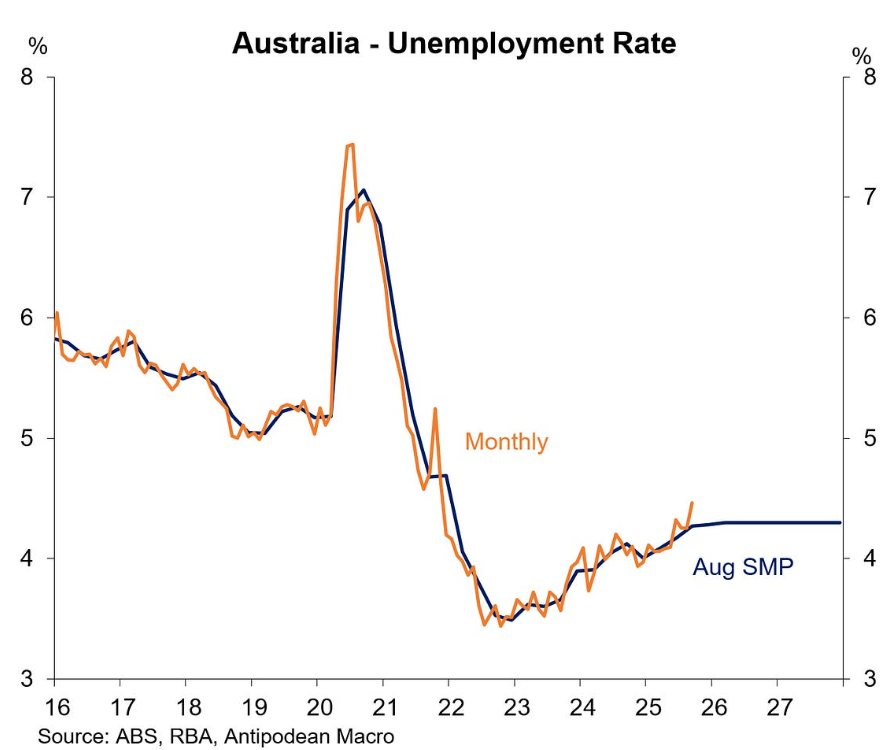

Of course, it is a clear trend, not one month, but, hey, driving through the rear vision mirror is no picinc!

Second, Bullock was very proud of bringing inflation down while preserving gains in the labour market, which is somewhat unusual given that those gains are now evaporating before our very eyes, with 5% and a complete reversion to pre-COVID levels now in sight.

Third, Bullock was quite defensive when asked about being so backward-looking, which she denied with reference to the bank’s forward indicators, such as business liaison.

I can only say that having forward-looking indicators, or a windscreen, is only useful if you look through it, which this central bank does not do.

Fourth, Bullock repeated that the bank sees the labour market as a little bit tight and put the blame for sticky services inflation on it.

Fifth, Bullock was hawkish on a one-quarter inflation miss of 30bps.

Sixth, there was no mention of raging energy prices or immigration, though Bullock intimated that labour supply had slowed, which is pretty useless given it has only slowed from ludicrous to preposterous speed.

The bond market materially underperformed global movements overnight.

Tomorrow’s CPI will have to hit 0.6% or 0.7% to make the RBA even consider a cut.