God knows why. They can have my place. Machetes and all.

Overseas buyers bought 2606 properties in Victoria last year compared with 1703 in 2021-22, a more than 50 per cent increase over two years, figures from the Australian Taxation Office’s inaugural Register of Foreign Ownership report show.

I guess it’s still worse in the Third World.

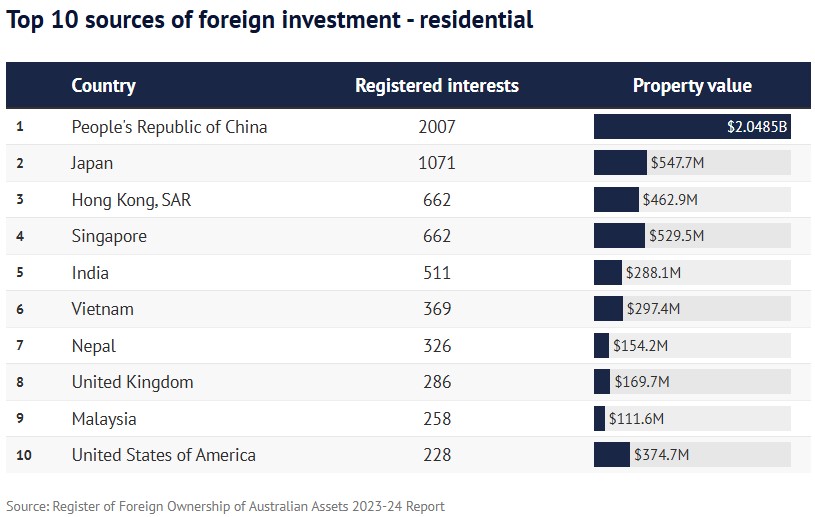

As we know, the foreign trade in Aussie housing is much larger than the FIRB figures. These do not account for the smurf trade that smuggles in billions from China to purchase property.

The NAB quarterly survey of industry insiders says as much.

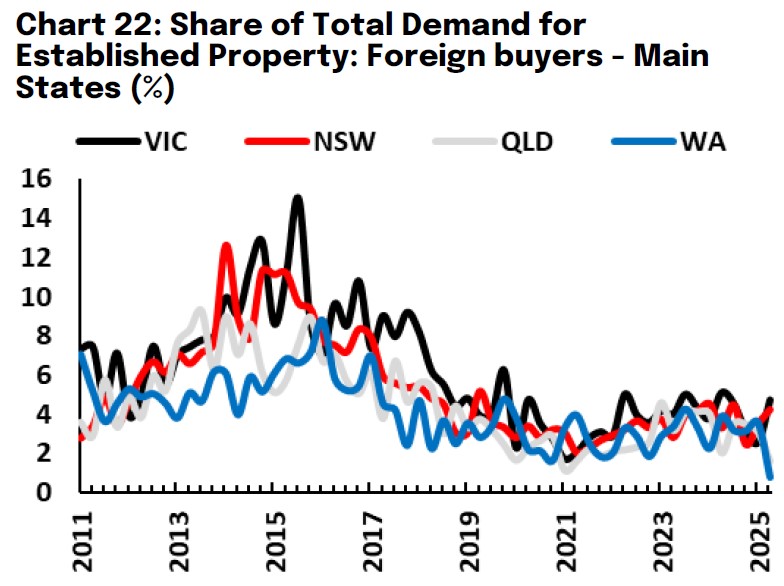

ViC tops the charts on established property purchases, above 10%, and clearly material for prices. China’s own falling property market is probably playing a role here.

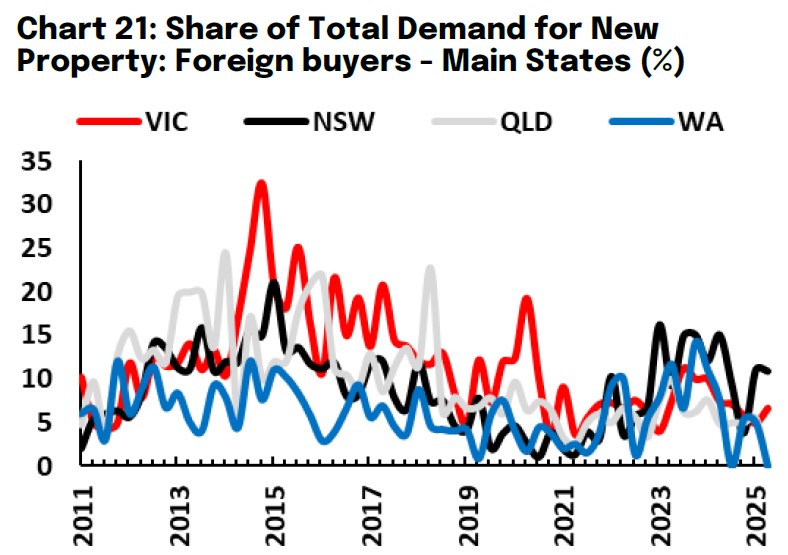

Foreign buying of new property, which makes much more sense for Australia, is much lower.

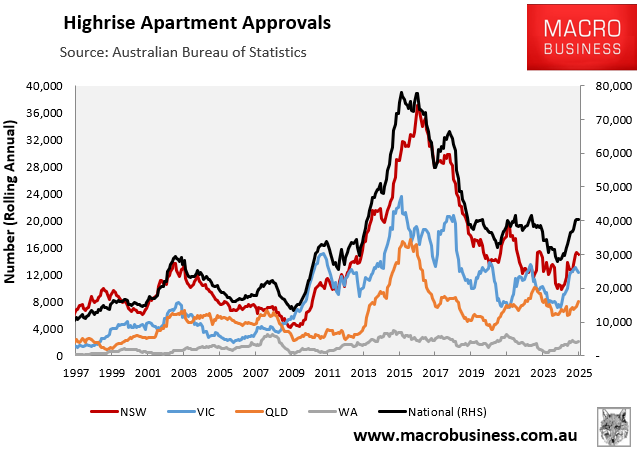

It was the boom in foreign buyers in 2015 that imported the capital from China to build massive numbers of defective shoebox apartments that temporarily squashed rents.

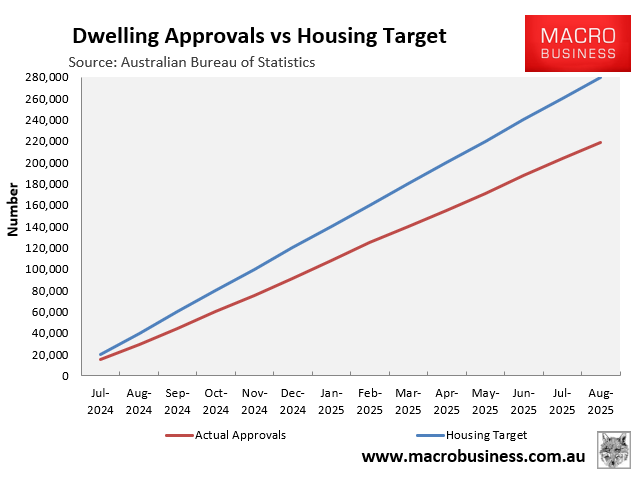

Without that, Albo’s pathetic centrally planned target for dwelling construction has failed dismally, and rents are off to the races for native Aussie youth.

All of the bad and none of the good is the Albo way.