What we are seeing in many markets today is exactly what I expected to see when I made my 40 cents AUD call a few years ago.

American exceptionalism is alive in the AI bubble but severely crimped by anti-Trumpian capital flows.

The Chinese economy is slowly dying, but propped up as it pours money into AI and experiments with all manner of failing economic supports.

We are not, therefore, seeing excessive moves in FX to reflect the underlying conditions of a rising US and falling China.

That said, DXY appears to have bottomed out.

AUD is really labouring.

CNY is rising very slowly.

Gold OMG.

AI metals are melting up. Not AI, not so.

RIO is threatening the big bear. Good luck with that as Simandou arrives. BHP not so much.

EM old school!

There’s a junk skunk in the room.

Which is odd given the complaint yields.

The bubble grows.

Don’t confuse the broadening AI bubble with underlying strength.

The Chinese economy hasn’t grown since COVID.

The US economy is still very strong.

These are not the conditions of a strongly rising AUD, even if clouded by Chinese and US fiscal and politics.

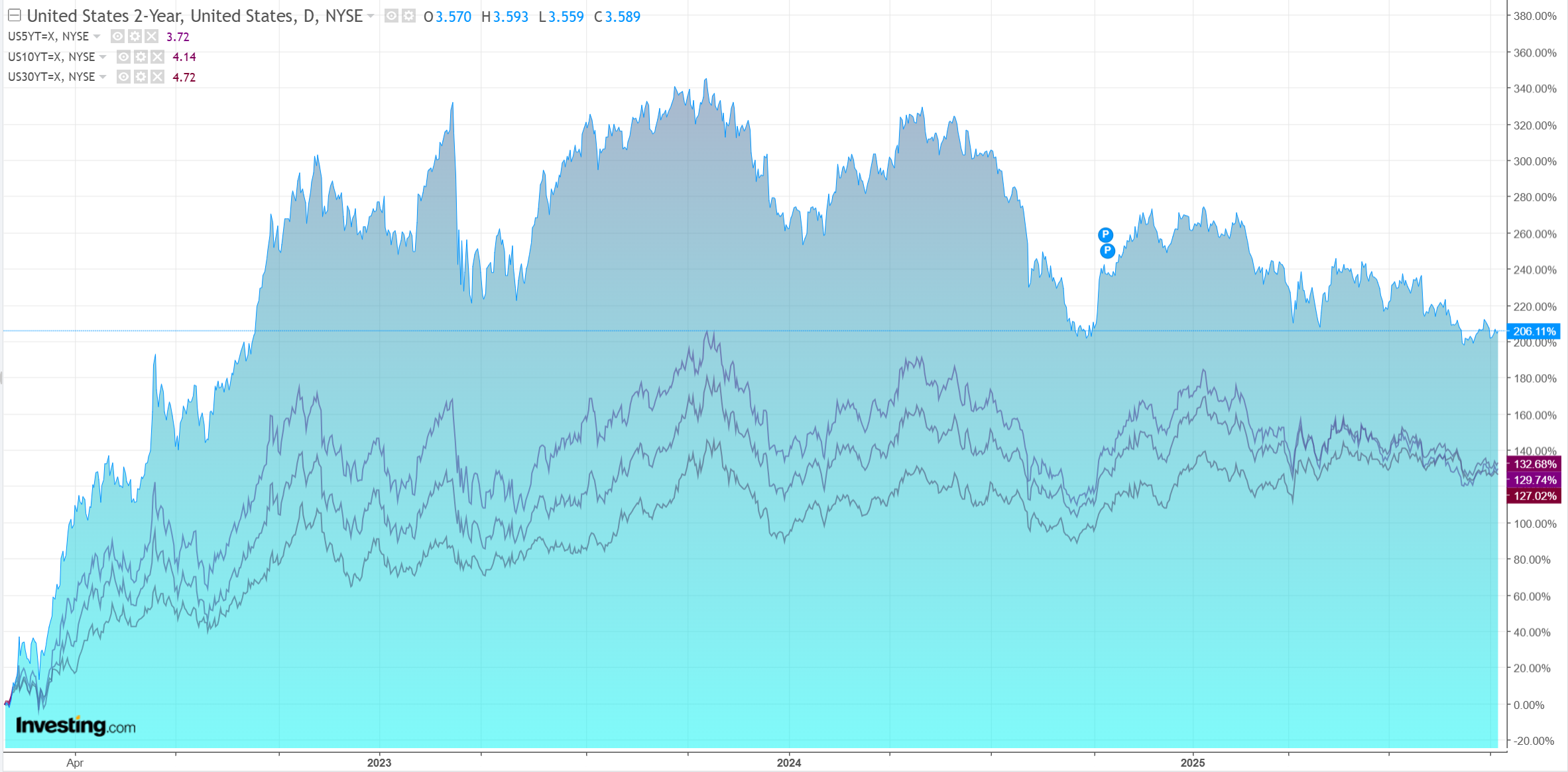

Nor do markets have the RBA right. There is more easing to come as the labour market falls away.

The AUD rising trend has been flattening out for good reason.

The meek bull market of 2025 may be drawing to a close as we approach the iron ore endgame of 2026.