U.S. freight sector signals recession

In the world of traditional metrics of economic activity, there are few indicators that are more important than the volume of freight moving through a nation.

Perhaps one of the most notable metrics to quantify these days is the Cass Freight Index, which has been producing data since 1955.

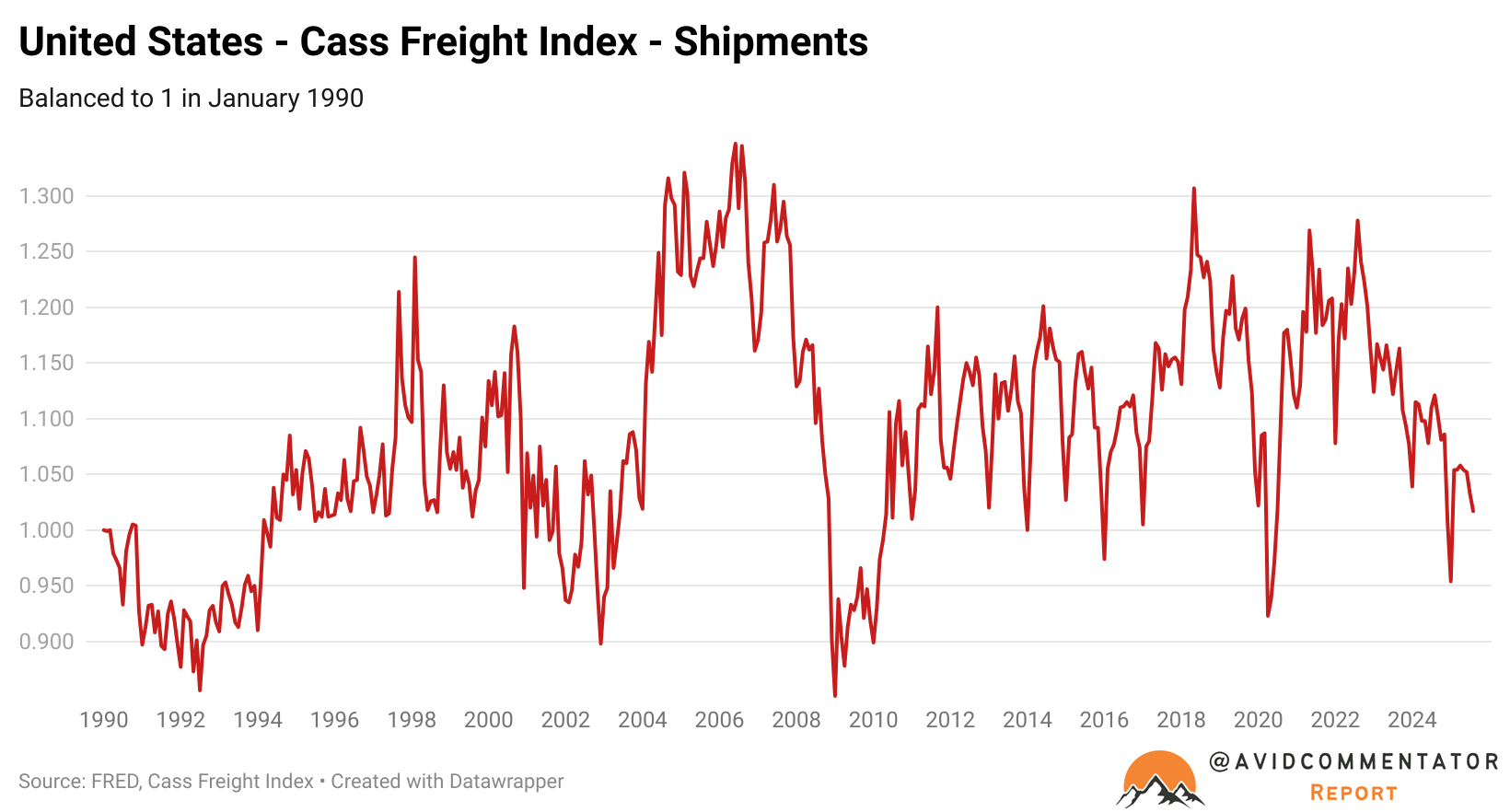

The Cass Freight Index – Shipments subindex is particularly useful, as it is simply the number of freight loads being moved across the United States relative to 1990 levels.

Before we begin the analysis, it’s worth noting that the index is not seasonally adjusted, so this factor must be taken into account.

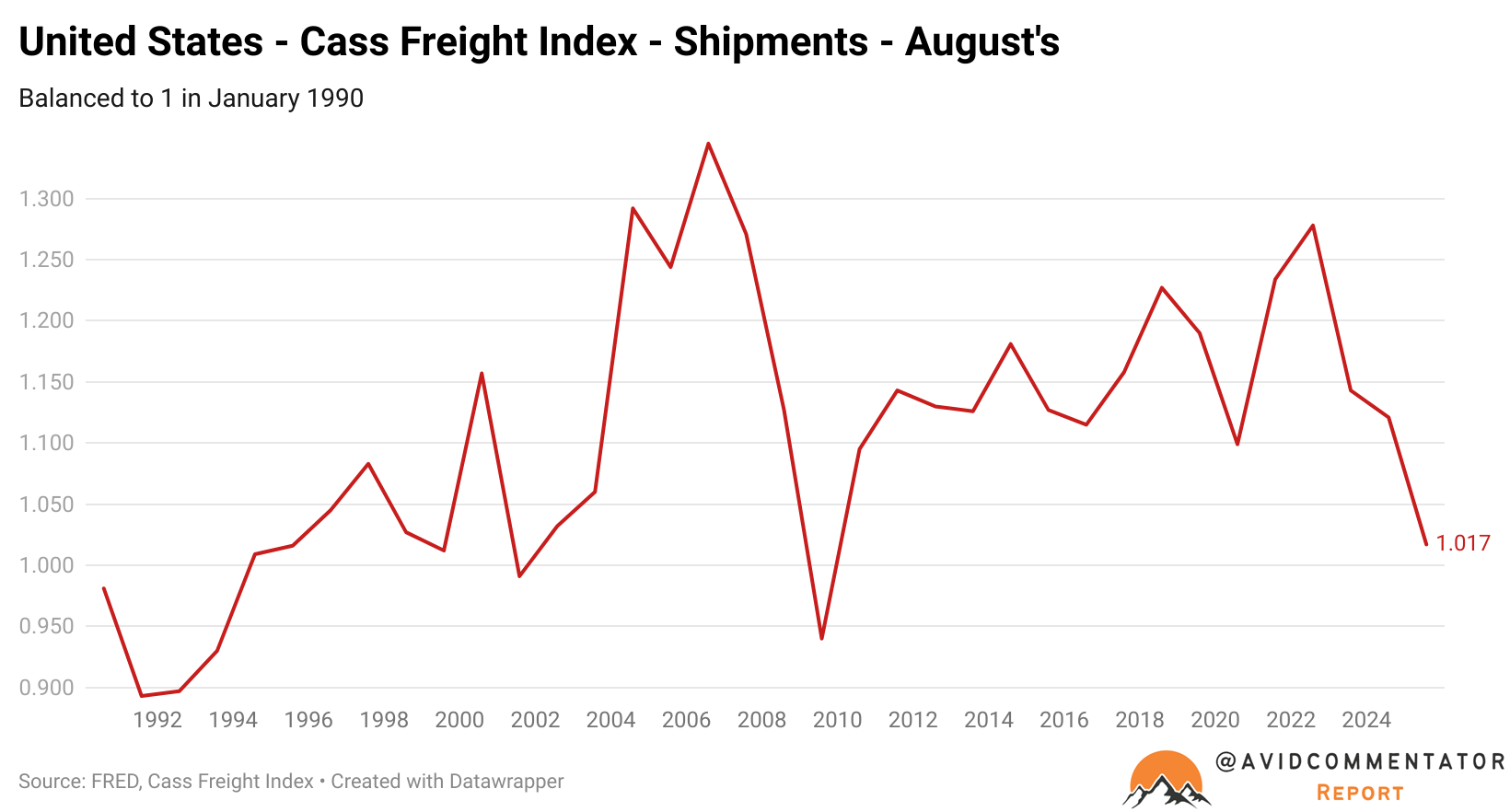

Comparing August’s (the latest data) across the 35 years of data on this metric, it reveals that the latest figure is at the lowest level for this time of year since 2009, at the height of the Global Financial Crisis Recession.

Prior to that, the last time it was below this level was in 2001, during the Dot Com Bust and subsequent recession.

From a longer perspective, the index has been declining since its post-pandemic peak in August 2022.

There is also an argument to be made that the index was artificially propped up for several months following the announcement of President Trump’s “Liberation Day” tariffs back in April, which is potentially now resulting in additional downside due to frontrunning by importers.

Freightwaves founder Craig Fuller recently summed up the state of the U.S. trucking cycle on Twitter:

“Trucking has been in my family since the 1960’s. We’ve lived through multiple cycles:

Trucking deregulation, oil crisis, stagflation, the S&L collapse, Gulf War, Sept 11, and the financial crisis.

I’ve spoken to dozens of trucking veterans with 40+ years of experience—almost all agree.

This is the worst freight market in their lifetime.”

When asked by a follower why the U.S. economy and labour market wasn’t seeing greater fallout from the downturn, Fuller replied:

“Great question… healthcare, services and government jobs have been picking up a lot of the slack… at least until recent months”.

The Takeaway

The U.S. transport and logistics sector is pointing to what would in previous eras be recession-like conditions.

While this may come to weigh more heavily on the broader U.S. economy in time, particularly when revisions are made to GDP growth and employment figures, for now it appears that still elevated levels of government spending and record high levels of capital expenditure on data centres and associated infrastructure are acting like Atlas and holding up the economy.

However, in the long term, the freight cycle is still a vital economic indicator for the health of the U.S. economy, and challenges in this sphere will eventually propagate throughout other parts of the economy.