Back in the day, the iron ore trade was governed by annual contract negotiations between Australian miners and a collection of Chinese steel mills under the aegis of CISA.

These negotiations would set the price for contract iron ore for the next year.

This fraught structure was broken down in the post-GFC environment when BHP’s Marius Kloppers refused to do anything other than sell his scarce iron ore on spot markets.

It wasn’t a bad outcome for either side. Allowing markets to set the price dynamically was much more objective for price discovery.

For a while, the price skyrocketed, then it crashed as the supply response arrived. This is how it should work.

However, after a series of supply-side accidents, compulsive stimulus by China, and campaigning by Glencore’s Ivan Glasenberg that the majors should artificially manage supply, the market-based system began to break down around 2019.

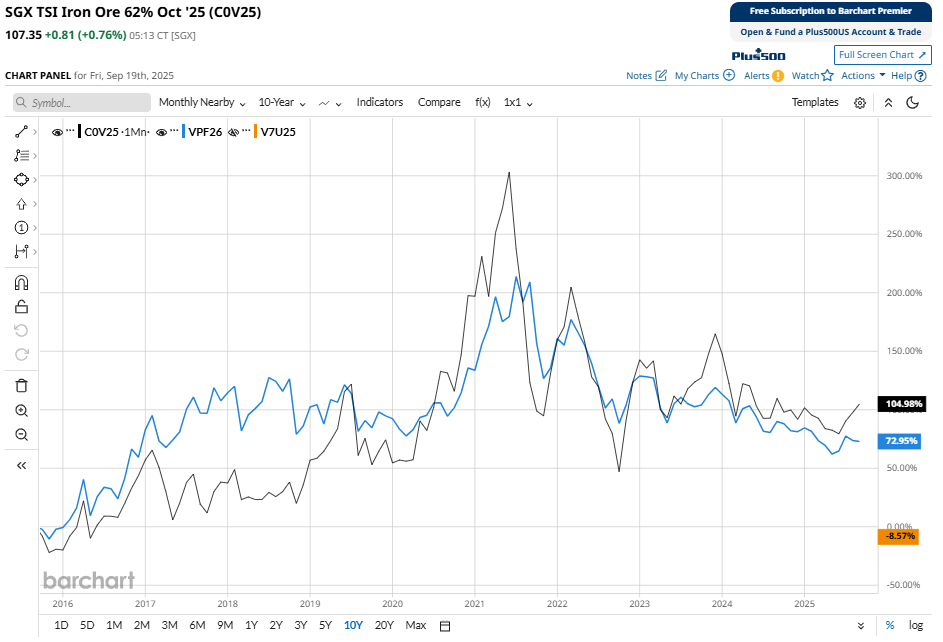

Iron ore became sticky to the upside while steel prices kept falling. Profitability collapsed in the latter.

Note that the blue line should always be above the black, but it hasn’t been for five years.

Now, we are going back to the future.

China is playing hardball with BHP and instructing steel mills to adhere to bans as it moves to drive down iron ore prices across the industry.

A powerful state-run iron ore trader has told steel mills to stop using a BHP product known as Jimblebar fines mined in Western Australia, amid an impasse in long-term supply contract negotiations. It is understood the ban is temporary but may stay in place until BHP gives ground in the talks.

CMRG was set up by Beijing in 2022 in a bid to consolidate its bargaining power with the likes of BHP, Rio Tinto and Fortescue, and with Vale in Brazil.

Jimblebar produces about 60mt of ore per annum. It is fines and lump, but the majority is likely the former, so this is material is for markets if the ore doesn’t go elsewhere.

The rest of Asia absorbs about 70mt of Pilbara ore per annum, so it may not be able to take it all, even if BHP discounts it.

So, the likelihood is that while the dispute transpires, markets will read it as a modest supply shock, and the price will rise a little. That said, at current prices, Indian ore will rush in to fill any Chinese gap.

Moreover, the move is a pretty serious warning shot across the bows of the major miners and may prefigure more conflict aimed at squashing the price of Australian iron ore in particular.

The timing of it is surely not random, as Simandou, Capanema and Gara Djiblet are about to ramp up with another 150mt of iron ore over two years.

Accidentally or on purpose, China may be beginning a concerted campaign to use the Pilbara killers to…well…kill the Pilbara.

BHP can’t have 40-50mt of its iron ore offline for long, and if it sells it elsewhere, it will be discounted.

Whichever way this goes in the short term, it is a bad sign for how China views the role of its emerging captured iron ore supply in the long term.