The Market Ear on this mightiest of bubbles.

King AI

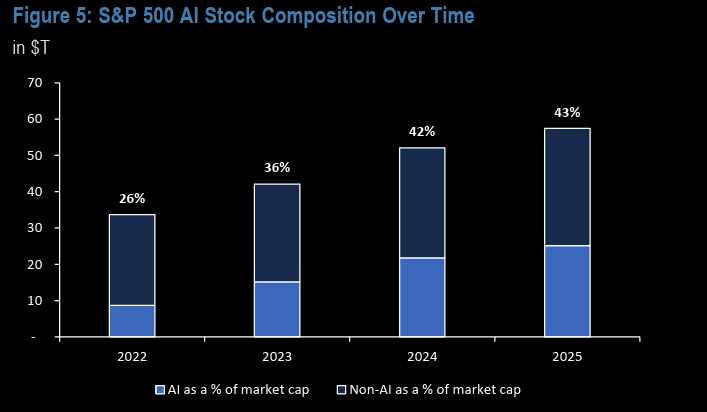

“The 30 or so AI stocks in S&P 500 have a combined 43% of market cap. Even more compelling, these names have driven almost all of the returns and most of earnings growth since ChatGPT / Nov 2022”.

Source: JPM

Pulse on AI

“…it couldn’t be more apparent that both corporate & investor bullishness around AI remains VERY high… Most highlighted a “healthy & expanding” AI end-market, which is driving sustained CapEX investments as well as innovations (and disruption) in Software & Hardware offerings…NVDA didn’t knock anyone’s socks off, but their comments around continued strong demand signals from hyperscalers & non-traditional players (including Sovereigns) provided the necessary fuel for the AI train to keep chugging along” (Peter Bartlett from the GS Communacopia conference). Chart shows NVDA trading inside the range that has been in place since mid July. Note we are trading above the 50 day again.

Source: LSEG Workspace

Size sigma

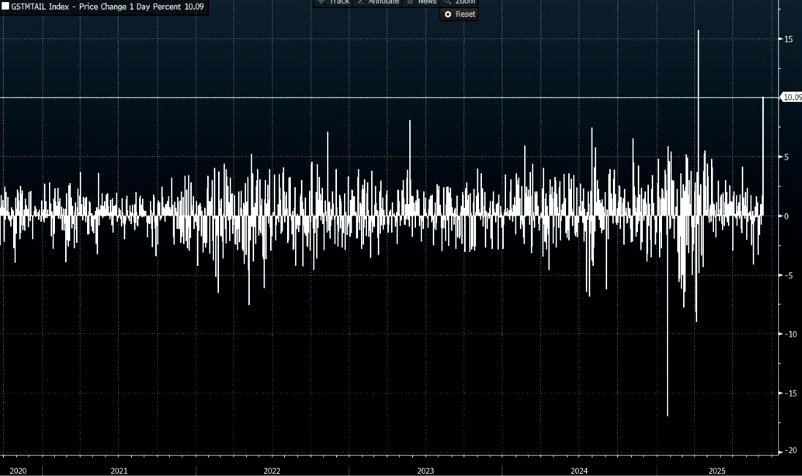

Goldman’s chart of the day shows their AI leaders basket, +10%, having it’s 2nd best day in the past 5 years.

Source: Bloomberg/GS

Huge

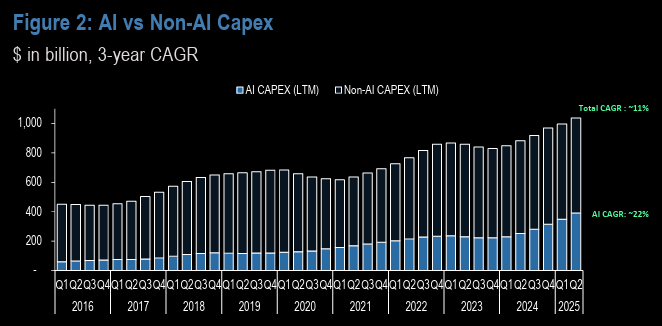

“….~$800B in Capex and R&D over the past year (~50/50 split), with investment spending expected to grow by 33% over the next twelve months”.

Source: JPM

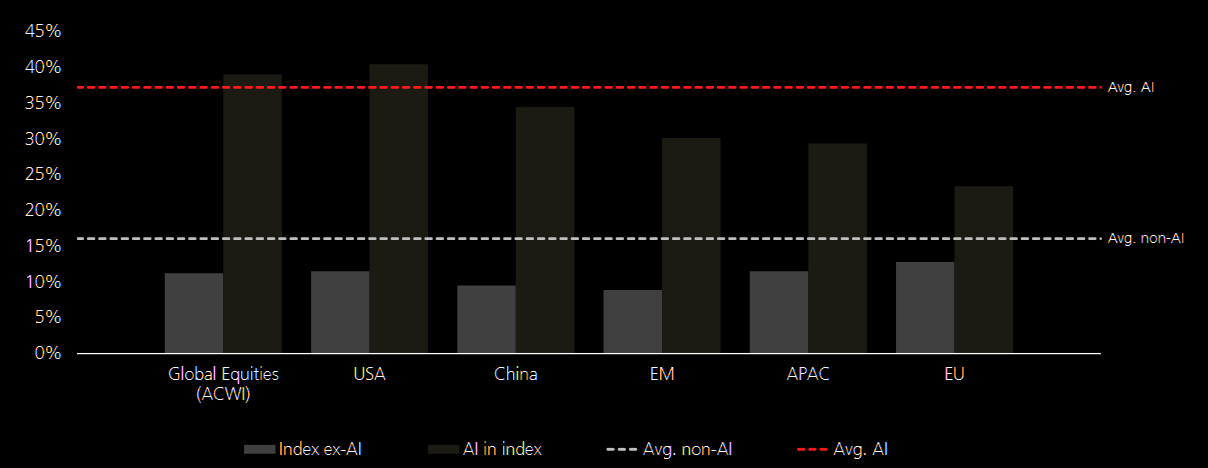

AI is all the rage

US and China have a lot of it, Europe not so…Chart shows annualized returns since the launch of ChatGPT, in %.

Source: UBS

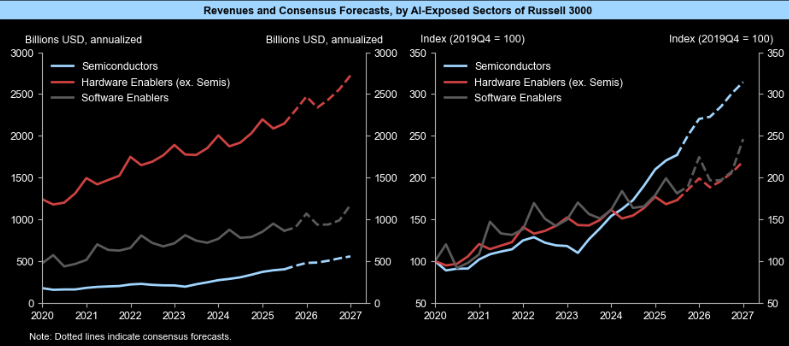

AI-driven investment is surging…

…with semiconductor firms leading the way. Analysts now expect 38% revenue growth by 2026, with upgrades of $203bn for chips and $123bn for AI hardware since ChatGPT’s launch. US AI hardware and software spending also accelerated in Q2, partly on tariff frontloading. (GS)

Source: GS

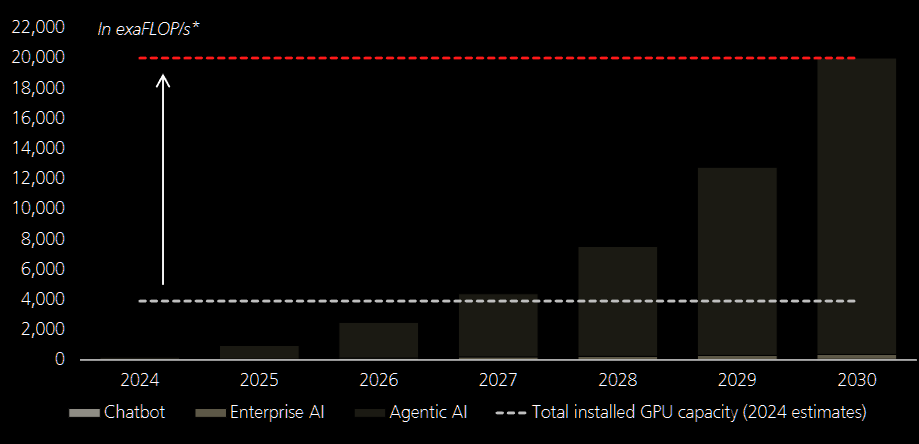

Compute needs…

…are huge. Chart shows UBS estimated compute needs for inference in chatbot, enterprise, and agentic AI vs. total GPU installed computing power.

Source: UBS

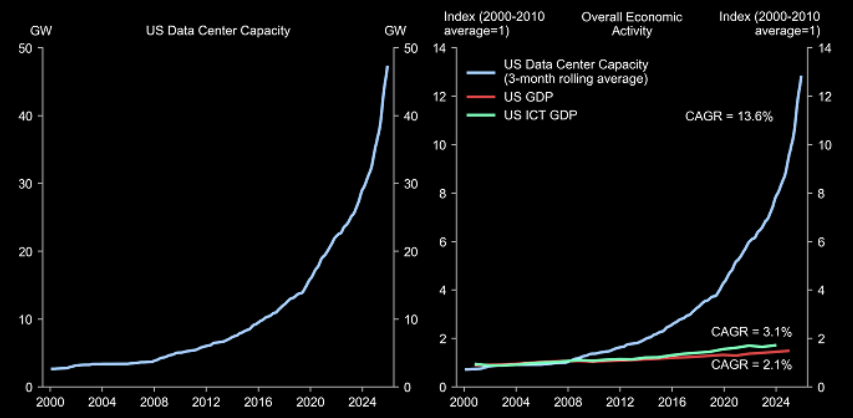

Beyond parabolic

Data center capacity growth needs a bigger chart, asap.

Source: GS

Hello 1990s TTM bubble. Spectrum, mobile towers, fibre optic cable, Enron, Worldcom, Pets.com, Fucked Company…

Somebody should start FuckedAI.com today.

Be aware it will also be stuffed eventually, but it’s a great way to hit the coke and hookers for a few years.