In the world of United States economics, it has been said that “the construction cycle is the economic cycle”.

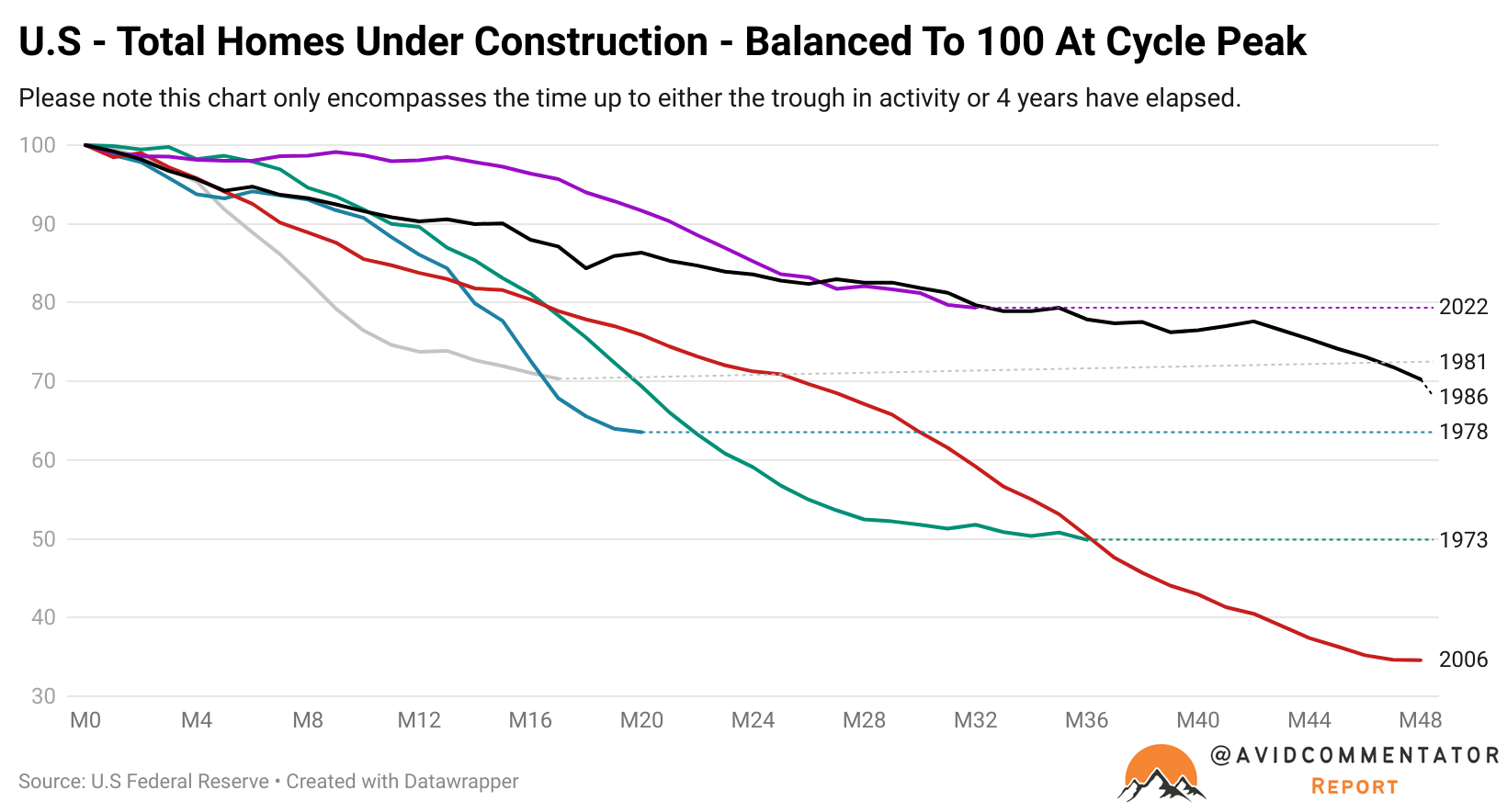

Looking at the data, there is certainly a degree of truth to that, with the number of homes under construction peaking and then falling significantly prior to 4 of the last 6 non-pandemic-related recessions.

Perhaps the best example of this is the Global Financial Crisis, with the total number of homes under construction falling by over a quarter before the recession technically began and dropping 36.5% before Lehman Brothers collapsed and the market rout truly began.

In the 55 years of home construction data available, the drop in activity prior to and following the Global Financial Crisis is by far the largest decline on record.

The construction sector overall lost 2.3 million jobs, accounting for 29.6% of its total headcount.

Fast forward to the present day and the total number of homes under construction in the United States is once again falling significantly.

Since the peak in October 2022, the number of homes under construction has fallen by 354,000 or 20.6%.

Yet despite the sizable falls in the total number of residential worksites across the United States, the total number of workers in the sector has continued to grind toward new record highs.

There are several reasons for this development, but two of the most notable are the surge in commercial property construction, in particular data centres, and the once sizable pipeline of unit and apartment blocks still under construction.

Apartment Building Boom

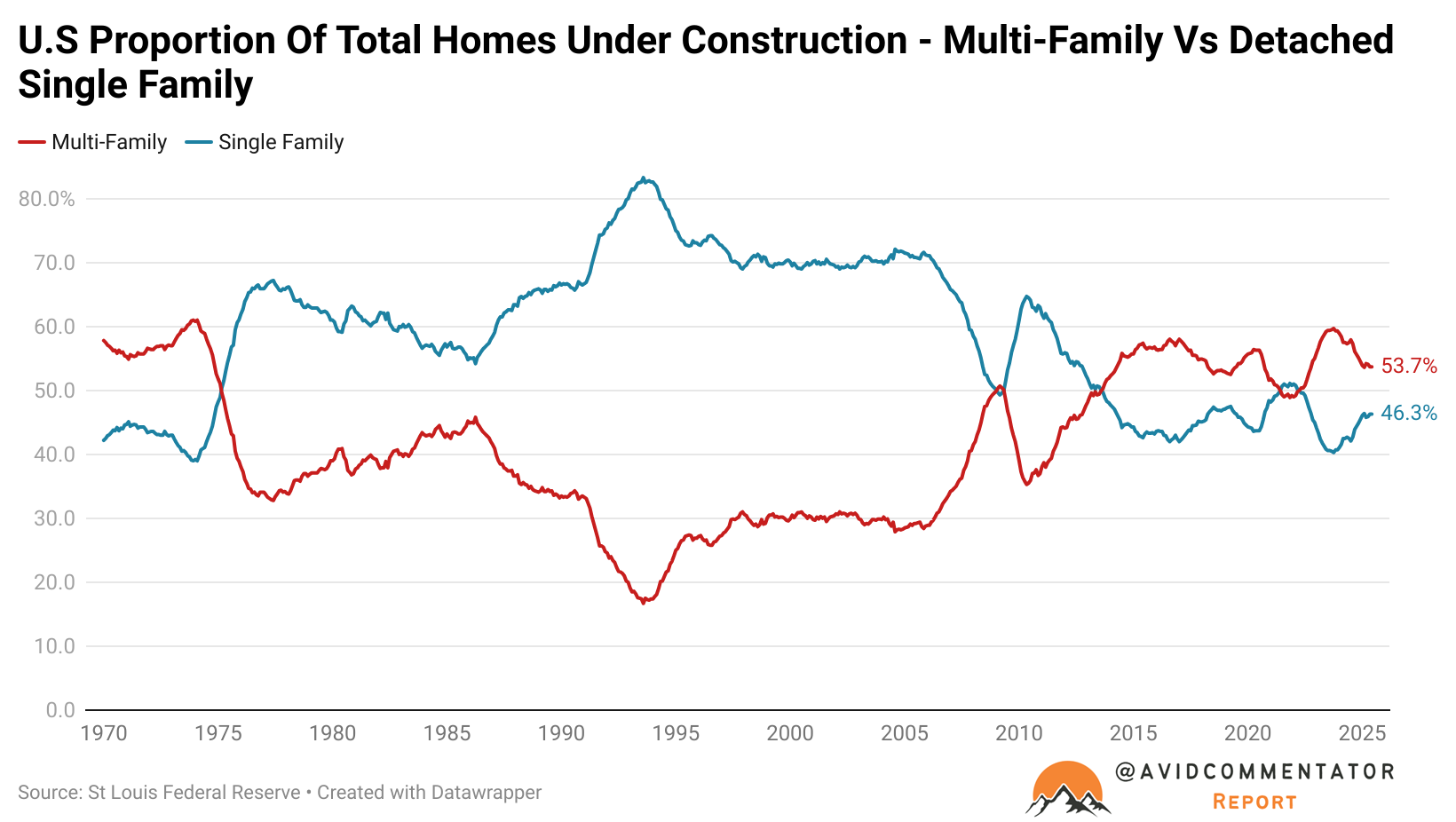

Historically, residential construction in the United States has generally favoured detached family homes. But the construction cycle seen in the wake of the recovery from the GFC has been very unique, with the balance of overall homes under construction favouring unit complexes of five homes or more.

A combination of completion times for this type of project blowing out to as much as two years and the more time-intensive nature of building a multi-home complex has helped to slow the deterioration in the pipeline of work for the United States construction sector.

Overall, the number of units in multi-home complexes is still 9.6% above where it was prior to the pandemic, but the figure has been falling fast.

There is also a lag between the relative peak of homes under construction and a contraction in construction sector employment.

Prior to the GFC, there was roughly a year between a sizable decline in the number of homes under construction and significant job losses being felt.

ChatGPT Enters the Equation

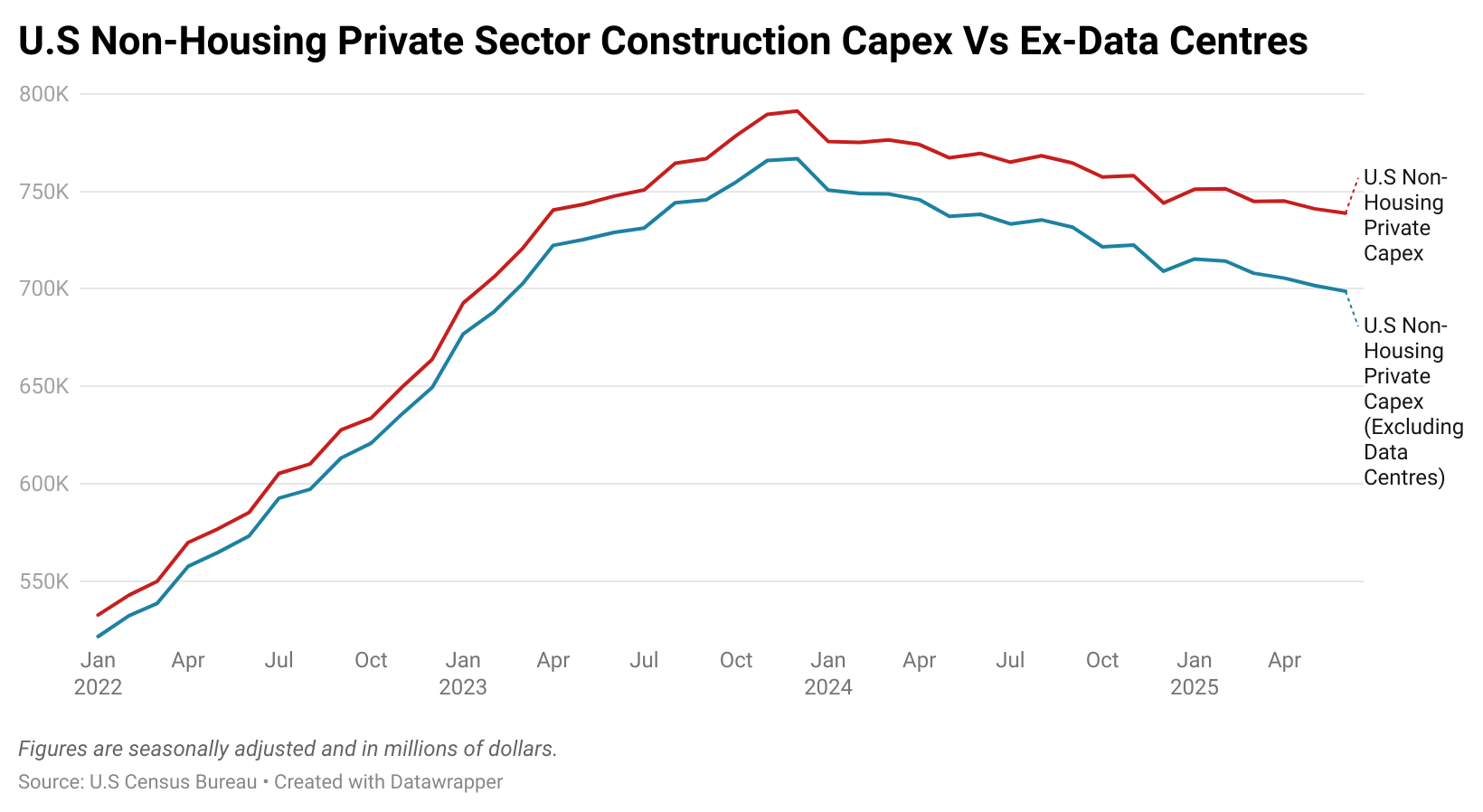

In the final quarter of 2023, the overall level of private non-residential housing construction capital expenditure peaked.

But in the 18 months since, the drop hasn’t been nearly as large as it might have been without one major factor: data centres.

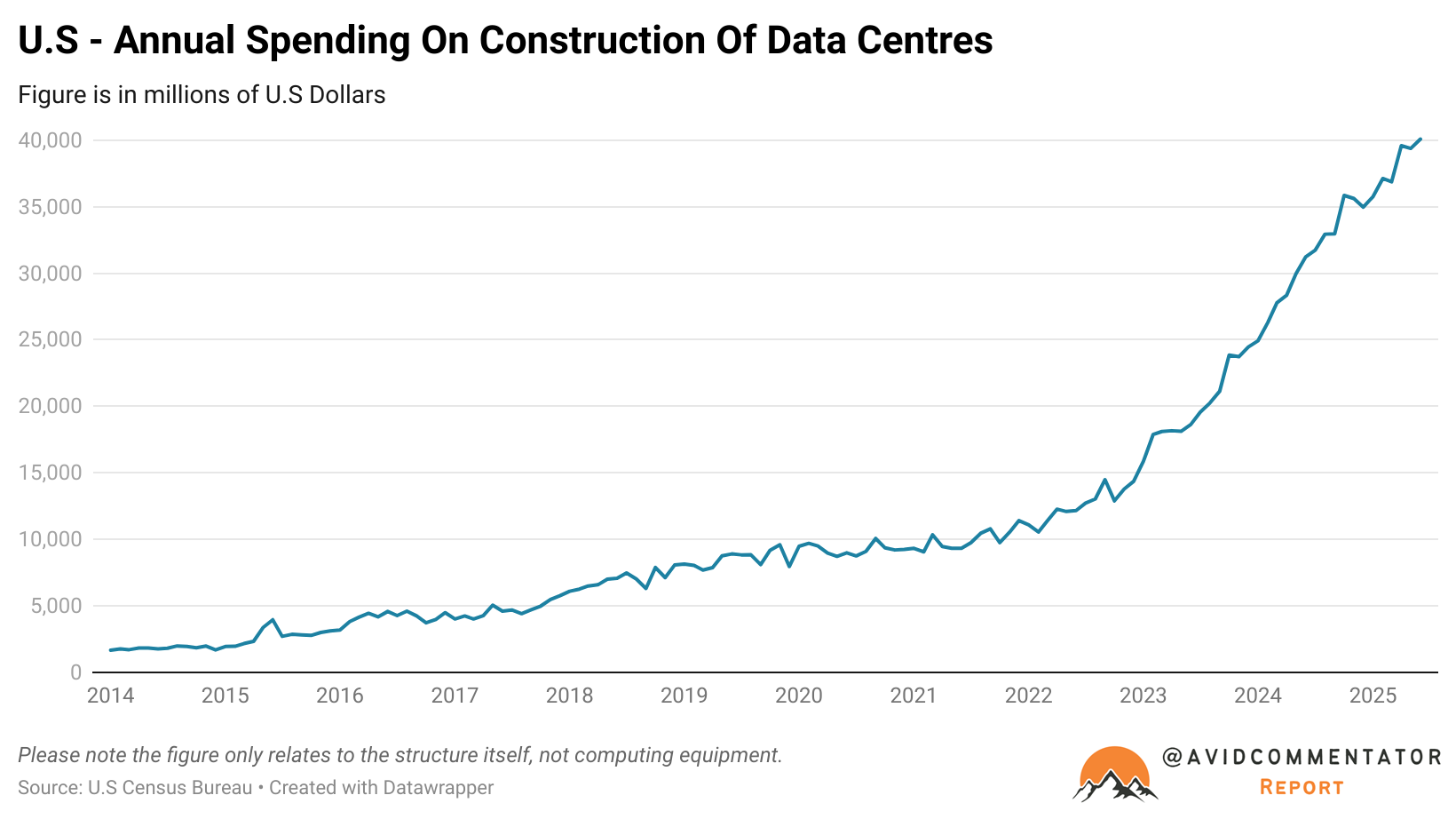

Amidst the ongoing fever pitch surrounding AI, the total level of construction spending on data centres has skyrocketed.

Compared with this time in 2022, spending on the construction elements of data centres has risen by 230%.

This has served to significantly smooth the glide path down for the United States construction sector.

The Outlook

Going forward, it appears likely that the construction cycle will remain a major contributor to the timing of the conclusion of the economic cycle, but what is different today compared with previous eras is what is driving that cycle.

For now, the currently insatiable appetite for data centres is playing a significant role in supporting construction sector employment.

However, whether or not it can act effectively as Atlas and hold up the construction sector even as the capital expenditure impulse driven by Covid-era stimulus and low interest rates fades is another question entirely.