With the release of the Reserve Bank of Australia’s (RBA) latest Statement on Monetary Policy last week, the media focus was swiftly placed squarely upon the RBA’s forecast that productivity growth would be anaemic 0.7% per year on a long-term time horizon.

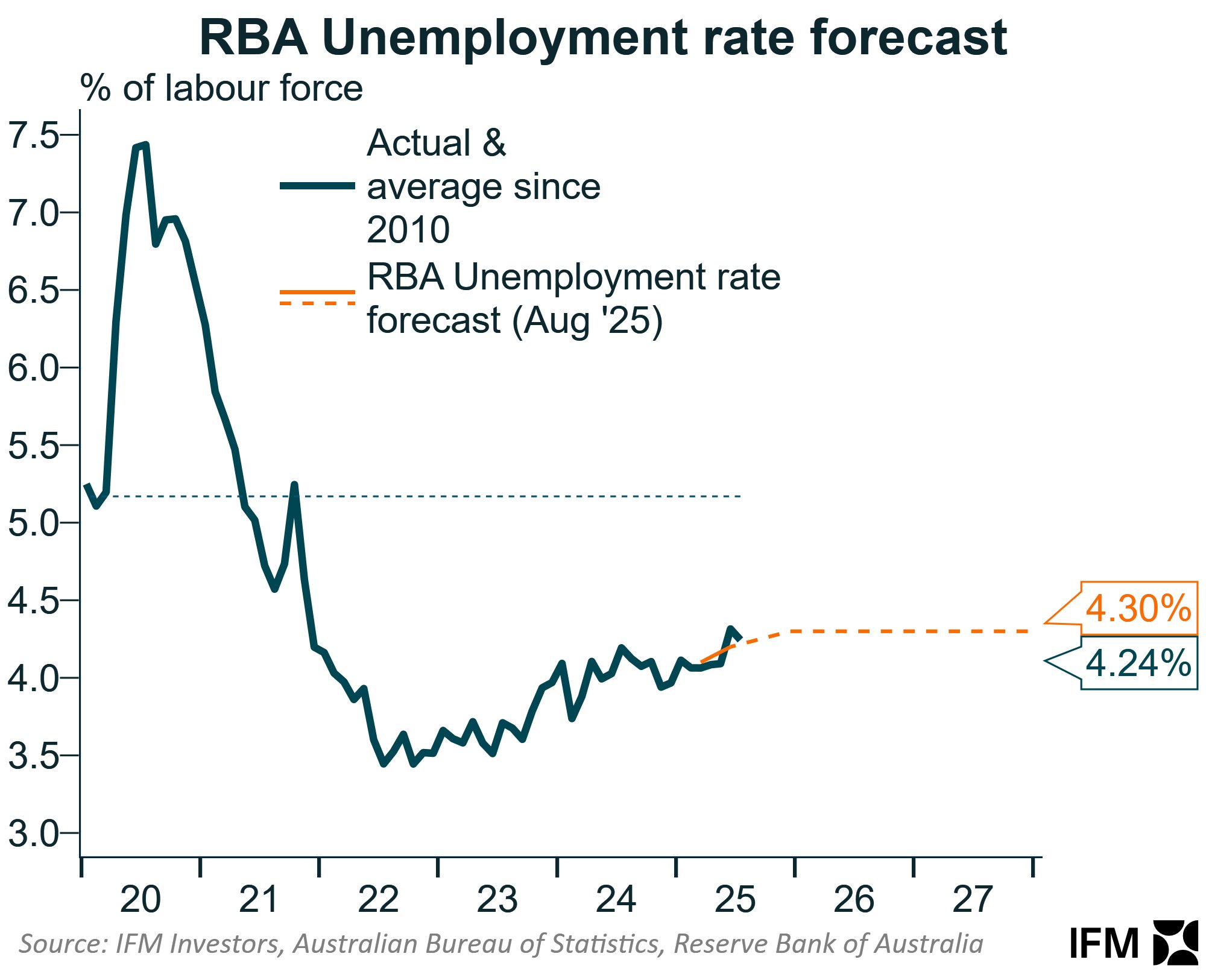

But buried in the RBA’s lengthy forecast table was perhaps an even more surprising prediction of the nation’s economic future: that unemployment would remain at 4.3%, just slightly above the current level of 4.2%, until the conclusion of the forecast period at the end of 2027.

Given the challenging backdrop of global trade tensions and the labour market consensus being surprised to the downside recently in Australia, Canada, and the United States, this seems rather optimistic.

Chart: Alex Joiner IFM Investors

With the bar for exceeding the RBA’s unemployment forecasts just a rise of 0.16% in headline unemployment away on a seasonally adjusted basis, risks to the course of the cash rate are arguably heavily skewed to the downside of the current market-priced low of 2.98% (from its peak of 4.35%).

Forex.com market analyst David Scutt summed it nicely in a video posted to his Twitter (also known as X).

“I think the bar for further easing has been lowered substantially relative to three months ago. So if we see any weakness coming through in the labour market, especially that unemployment rate, it could go and bring forward the pace and scale of rate cuts on the RBA.”

Scutt went on to note that the rise in youth unemployment was concerning and could be an indicator of more broad-based weakness in the labour market.

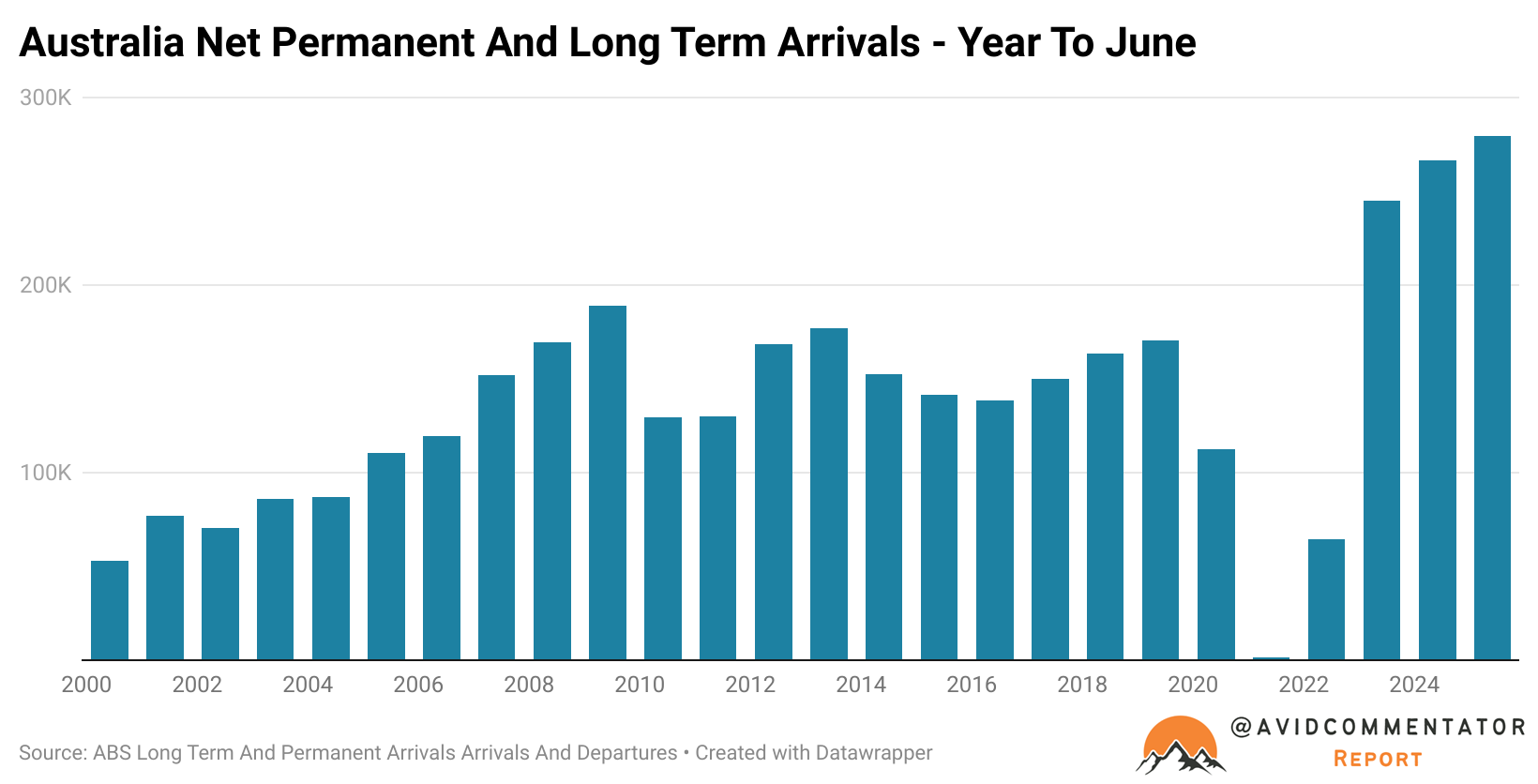

Amidst a record high level of net long-term and permanent arrivals in the year to date, pressure will be on for employment growth in the market sectors of the economy to significantly accelerate to prevent a rise in the unemployment rate.

Amidst recent revelations from the Australian Financial Review of a federal budget black hole driven by clever pre-election accounting and several major states looking to put their budgets on a more sustainable fiscal path, the path forward for the nation’s labour market could be a challenging one, despite the expected positive impact of further rate cuts from the RBA.

Comparing the relative priced in pathway of mortgage rates with historic rate cut cycles, what we are seeing is still very much in the realm of the so-called and much hoped for “soft landing”.

But if a more challenging scenario comes to pass, where unemployment rises to significantly above the RBA’s forecast range, then a cutting cycle more akin to those consistent with a recession or crisis may be on the cards.

With more than a few Australians hoping for a much larger rate cut cycle than the one priced in, it may end up being a case of “Be careful what you wish for, you might just get it”.