According to Goldman Sachs chief economist Andrew Boak, a reduction in long-term NDIS spending growth to 5% is expected to subtract 0.1 percentage points from annual GDP growth.

In the years since the final benefits of the mining boom were felt throughout the economy, the relative size of the government’s role as a driver of economic growth has grown to unprecedented post-war heights.

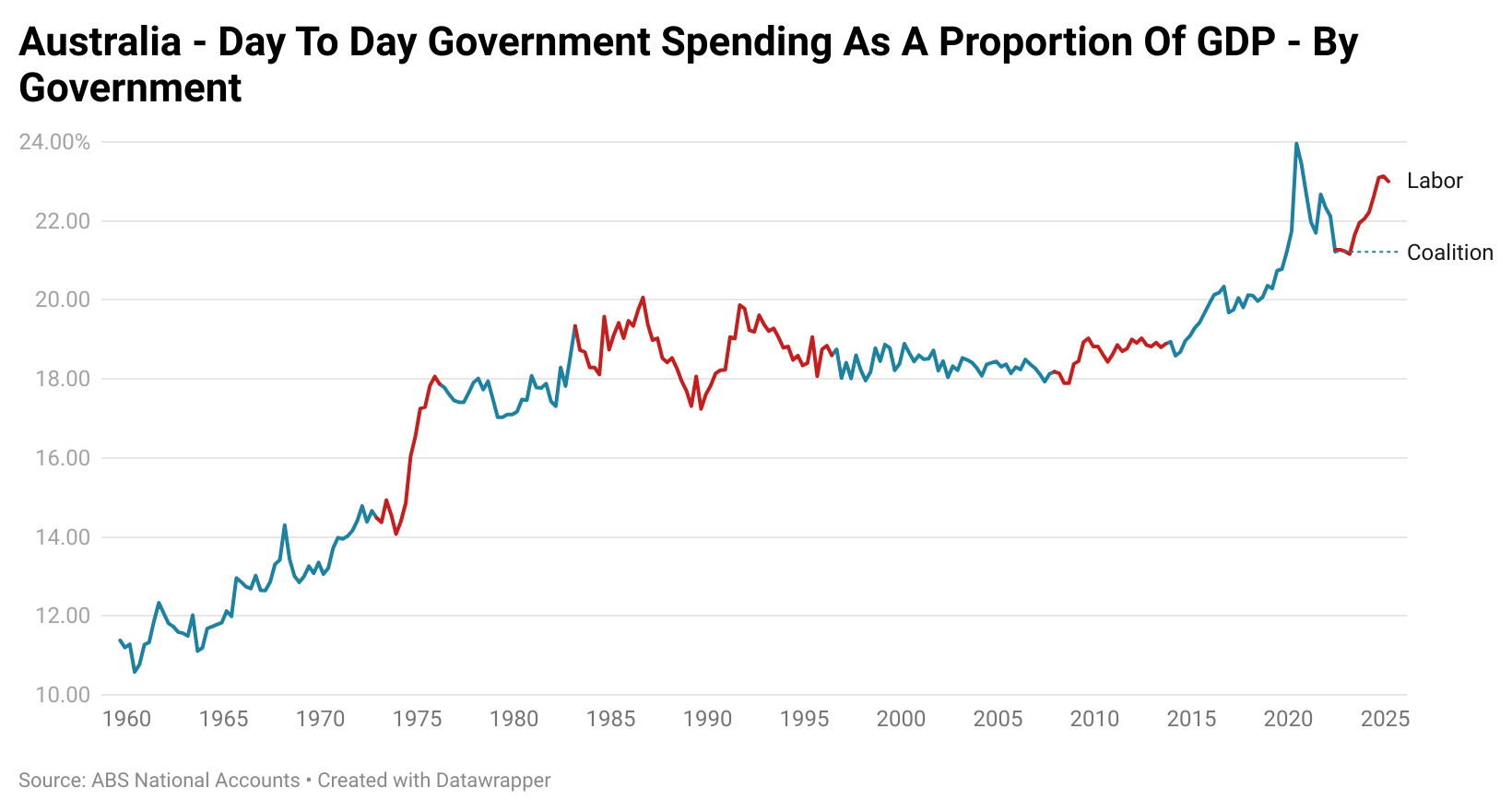

It is here that an important distinction needs to be made. The overall size of government spending as a proportion of GDP can vary significantly over time due to fluctuations in government investment levels.

For example, if a program of mass infrastructure construction on a grand scale is being pursued, as it was in several instances in past decades, it can significantly increase the relative size of government within the economy.

For this reason, the focus is placed on the government’s day-to-day spending to better capture the change in the government’s role as a driver of economic activity, excluding any trend in investment spending.

The chart below illustrates day-to-day spending across all levels of government as a proportion of GDP since immediately comparable records began.

As you can see from the time of the conclusion of the positive impulse from the mining boom, the size of day-to-day government spending relative to the rest of the economy has continued to get larger and larger.

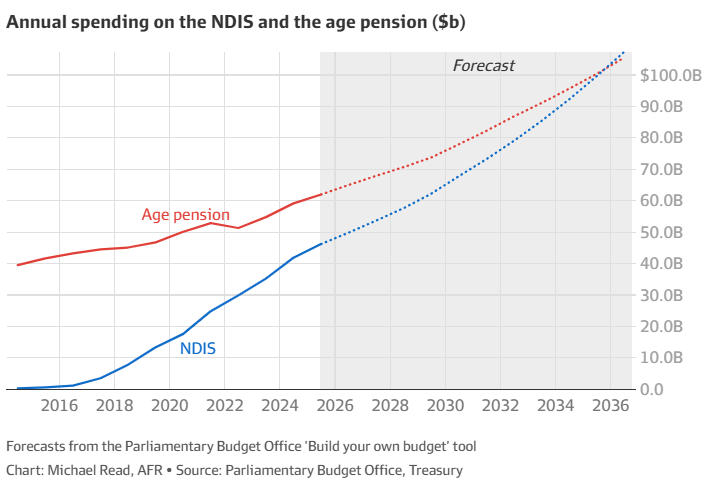

While the National Disability Insurance Scheme (NDIS) has not been the sole driver of the expansion of government within the economy, it has coincided with the start of a meteoric rise in its size, which is tracking at around $50 billion currently.

Source: AFR

Amidst the Albanese government’s announcement that children with mild autism and/or other developmental conditions would in time be diverted onto a separate program called ‘Thriving Kids’ and away from the NDIS, Goldman Sachs has projected that this shift will detract from economic growth.

With long-term NDIS spending growth set to decline from a forecast 8% per year to 5% per year, Goldman Sachs estimates that this will subtract 0.1 percentage points from annual GDP growth.

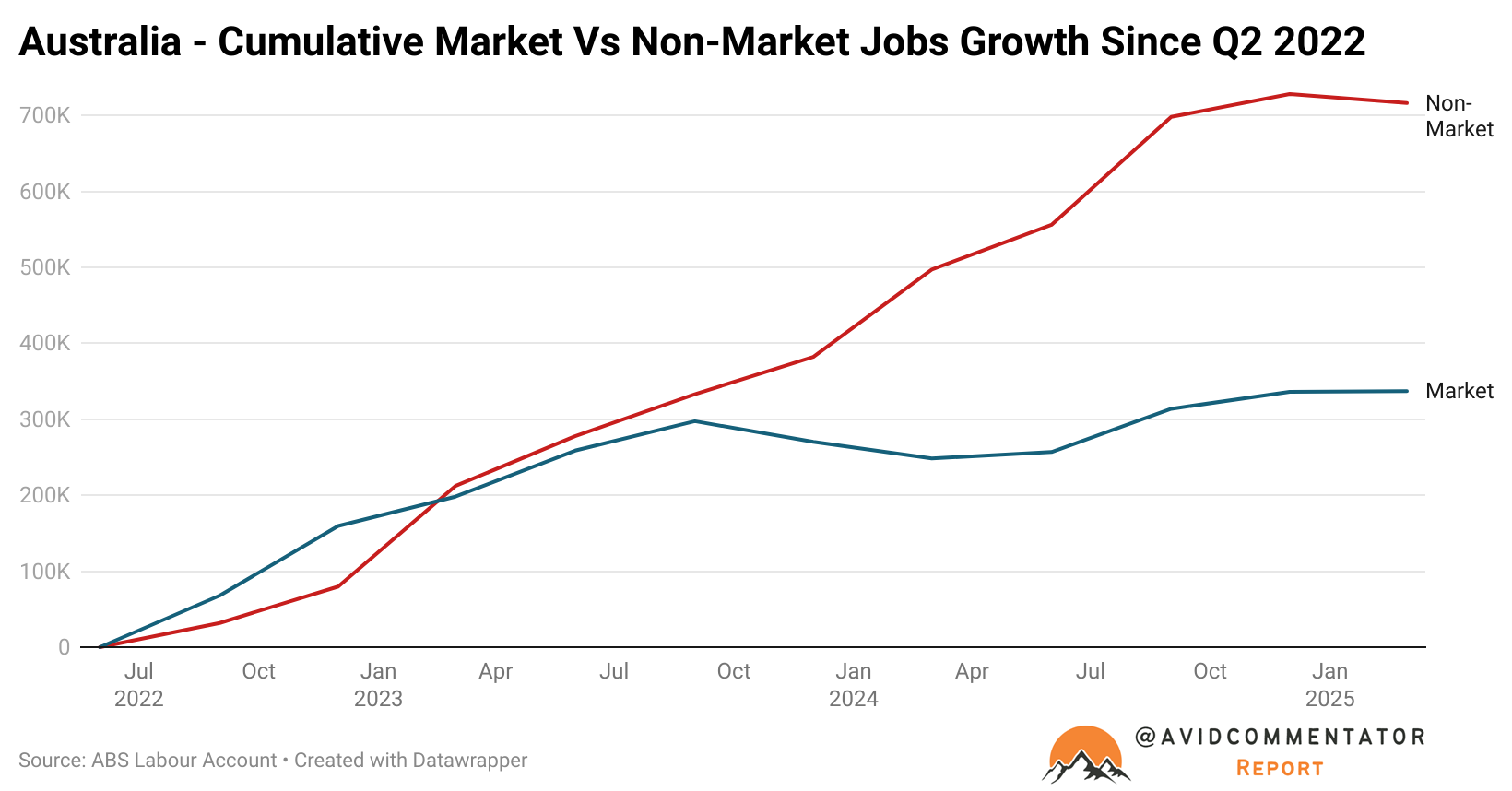

Looking at a chart of market vs non-market jobs growth, with non-market jobs being those in public administration and safety, education, healthcare, and social assistance, it’s clear the role being played by taxpayer-funded employment since the strong economic growth impulse from pandemic-driven stimulus began to fade from mid-2022 onwards.

In the words of Jarden economist Anthony Malouf quoted in the AFR:

“Ultimately, without the boost in public spending, in particular the NDIS, we find the labour market would be far weaker than it currently is.”

The challenging reality is that while the employment growth driven by the NDIS is a relatively new phenomenon, the shift to taxpayer-funded employment taking over as a main driver of employment growth has been a long time coming.

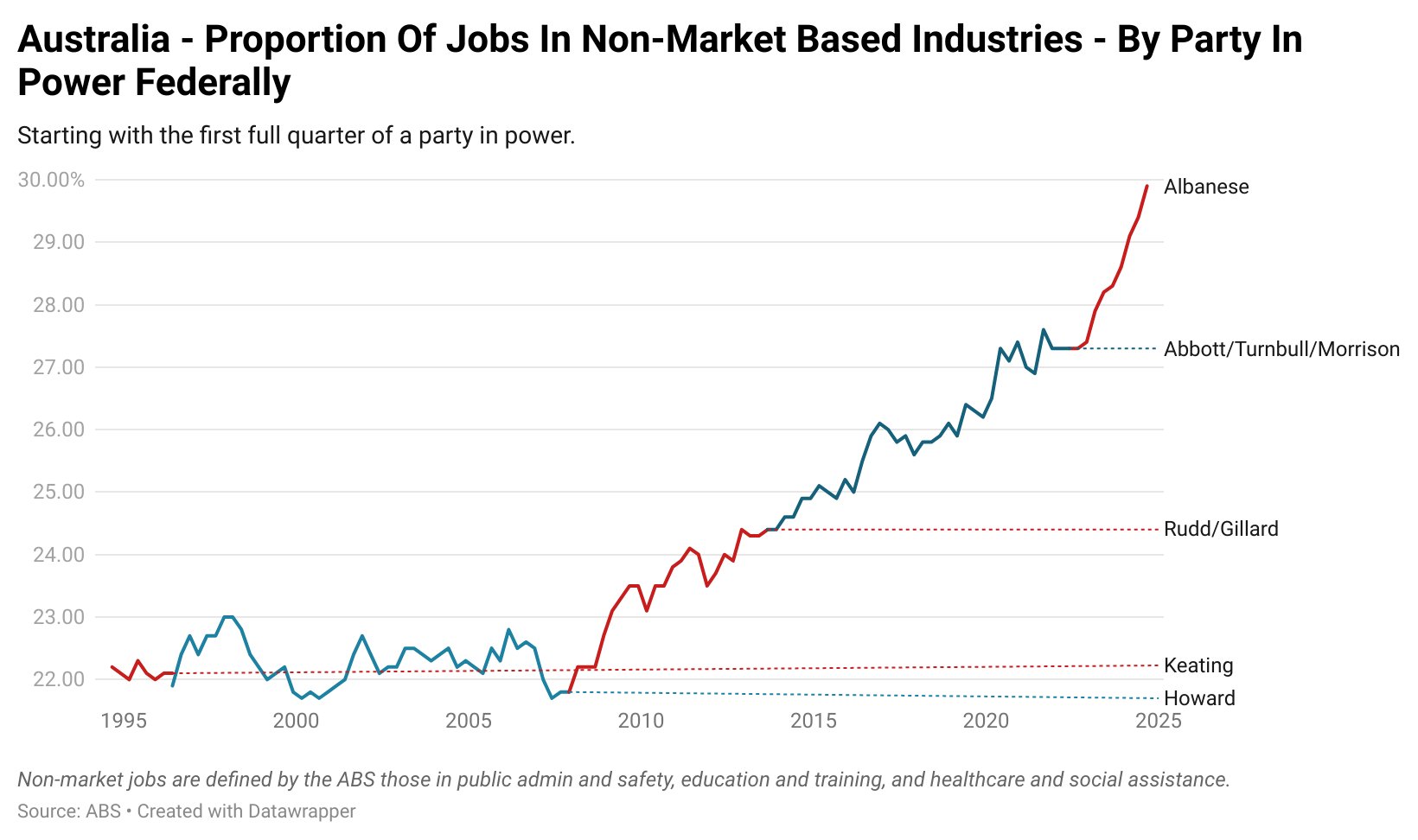

For over a decade, the proportion of jobs in non-market sectors of the economy bounced around in the range of roughly 22% to 23% of overall employment.

In the years since the GFC, however, the proportion of overall jobs in non-market roles has continued to rise regardless of which of the major parties has been in power at a federal level.

For better or worse, government has taken the wheel as the primary driver of employment growth and a major driver of economic growth more broadly.

Of the 1.3% increase in GDP in the year to the end of the first quarter of this year, 1.0 percentage point was driven by government spending.

Now the nation is confronted with the challenging task of getting the market sectors of the economy to sufficiently refire to support a sufficient level of employment growth to keep up with still elevated levels of labour force expansion.

The RBA is publicly hopeful that this can be accomplished, but amidst the slowing of taxpayer-funded employment growth resulting from attempts to rein in the NDIS and states looking to pursue budget repair, it will be a challenging road ahead.