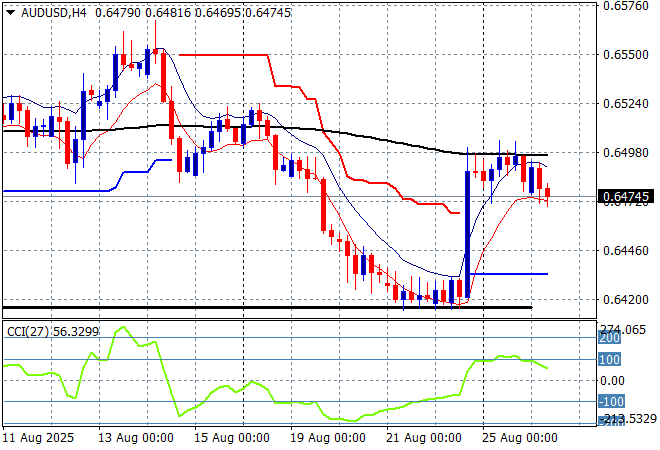

Asian share markets are failing to translate the Friday night gains on Wall Street due to the seemingly dovish pivot by the US Federal Reserve as risk markets patiently wait and see what the Trump regime is up to with trying to fire members of the Board, adding to currency volatility at least. The USD has been trying to claw back some of its losses, but this is really about internal politics in France affecting the Euro and not much else as the Australian dollar remains robust just under the 65 cent level.

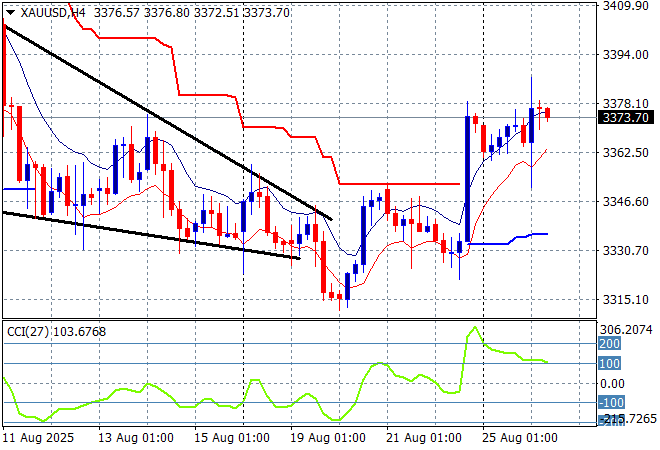

Oil markets are getting out of their recent depressed mood with Brent crude now up above the $68USD per barrel level while gold is doing well to hold on to its Friday night breakout as it steadies at the $3370USD per ounce level:

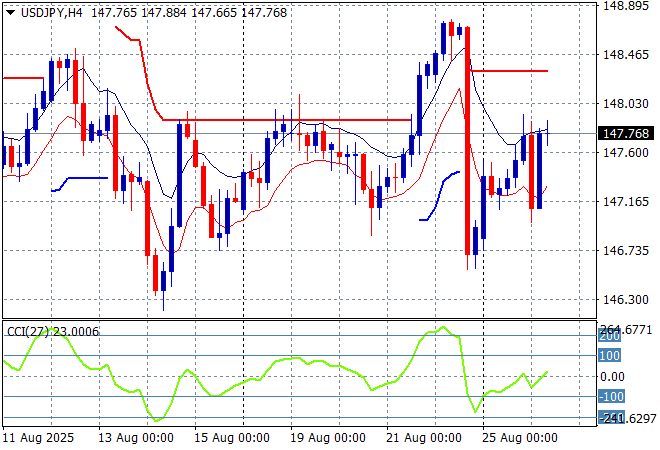

Mainland Chinese share markets are falling back going into the close with the Shanghai Composite losing nearly 0.4% but staying above the 3800 point level while the Hang Seng Index is down exactly 1% to close at 25572 points. Japanese stock markets haven’t performed well either with the Nikkei 225 also losing nearly 1% to finish at 42394 points with the USDPY pair swinging between the 147 level all day to recover nearly half of its Friday night losses:

Australian stocks also fell back but not as much as its peers with the ASX200 closing 0.4% lower at 8935 points while the Australian dollar has held on to most its gains although it has decelerated in the afternoon session to remain below the 65 handle:

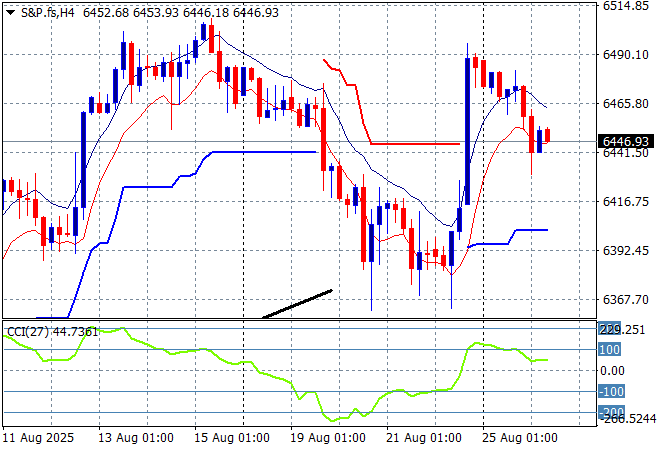

S&P futures and Eurostoxx futures are down going into the London session with the S&P500 four hourly chart showing the market likely to pullback somewhat further on the open tonight after the big returns on Friday that fell just short of the early August highs:

The economic calendar is US focused tonight with the latest durable goods orders, house price index and consumer confidence figures.