The ferrous complex is kidding itself, which is its usual state of being.

Trading right now is suspicious. During the day, prices fall due to market dynamics. At night, they spike in an illiquid market. Somebody is playing silly buggers.

The mushrooming gap between steel and iron ore is going to close one way or another.

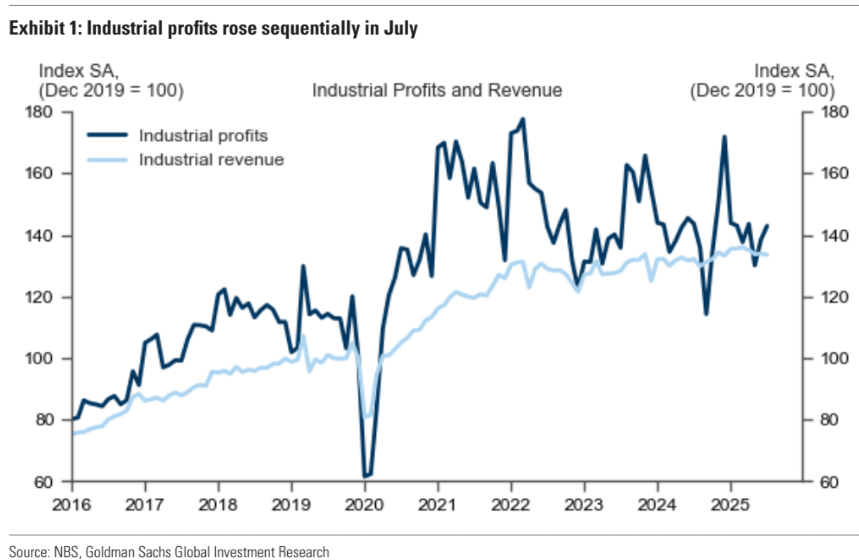

That the underlying conditions for the market are terrible is not in question. Yesterday we had Chinese industrial profits, which are supposed to roughly track nominal growth. Goldman.

Industrial profits: -1.1% yoy in July (sequential growth: +3.2% non-annualized, seasonally adjusted by GS); June: -4.4% yoy (sequential growth: +6.5% sa non-annualized).Industrial revenue: +1.0% yoy in July (sequential growth: -0.3% non-annualized, seasonally adjusted by GS); June: +1.5% yoy (sequential growth: +0.2% sa non-annualized)

There is no better demonstration of how weak Chinese growth truly is, and steel is the worst, not the best, part of it.

Collapsed steel recycling and exports are protecting iron ore for now, but ferrous is on a collision course with China’s golden depression, and there is no turning it as Simandou approaches.