Nobody wants to talk about how bad it is because, you know, it’s China.

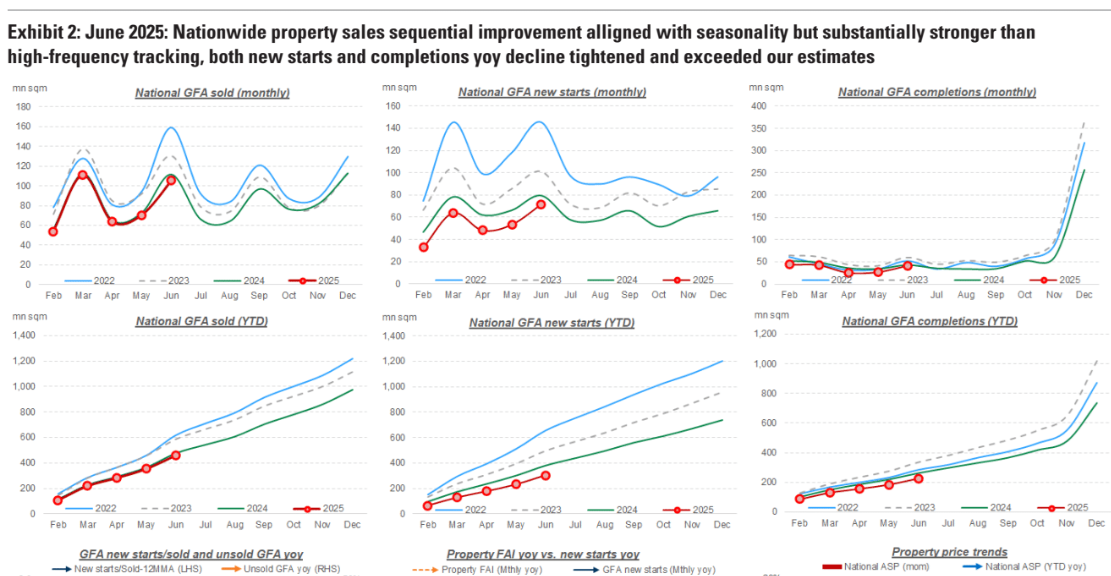

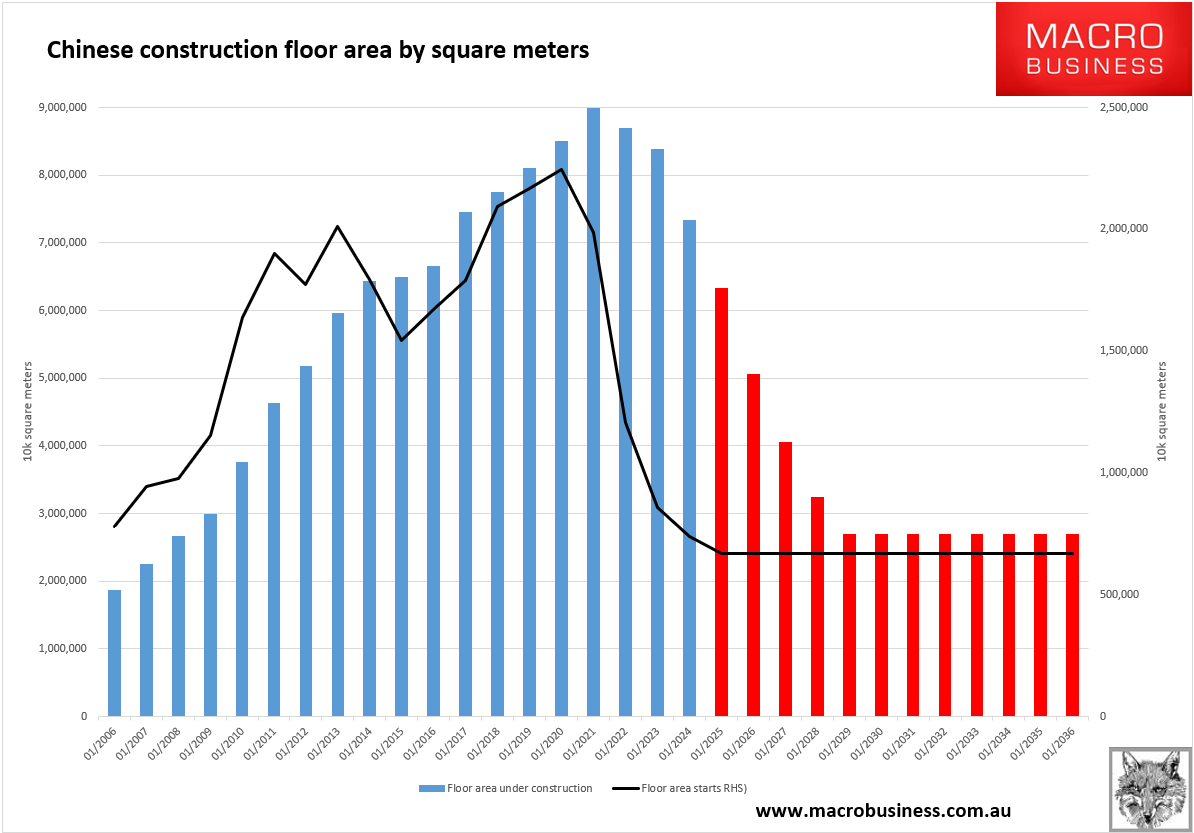

It’s a shame because the greatest crash in the history of property is underway and has another five years to run yet.

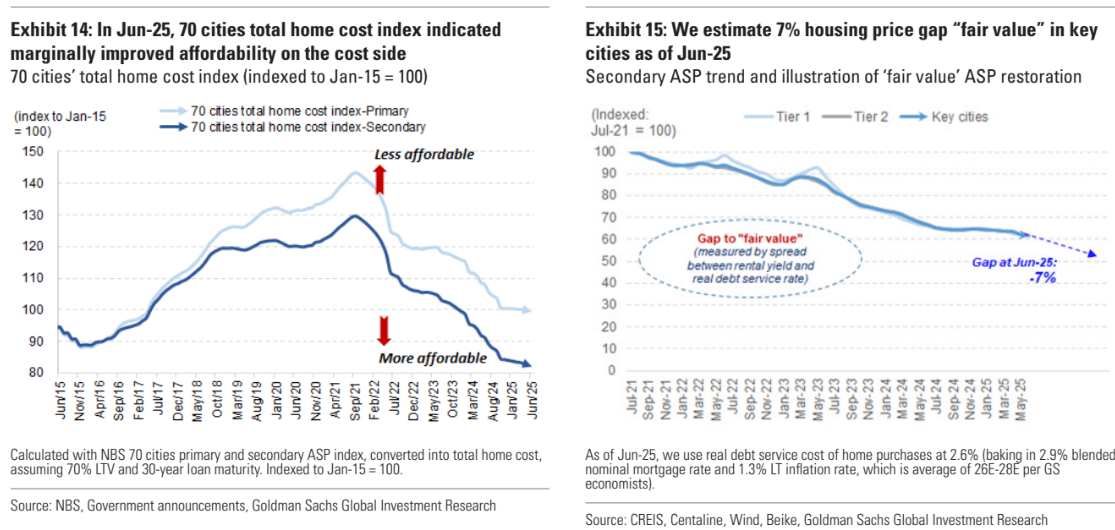

Property keeps getting cheaper in real terms with mortgages included.

Yet nobody wants to buy it.

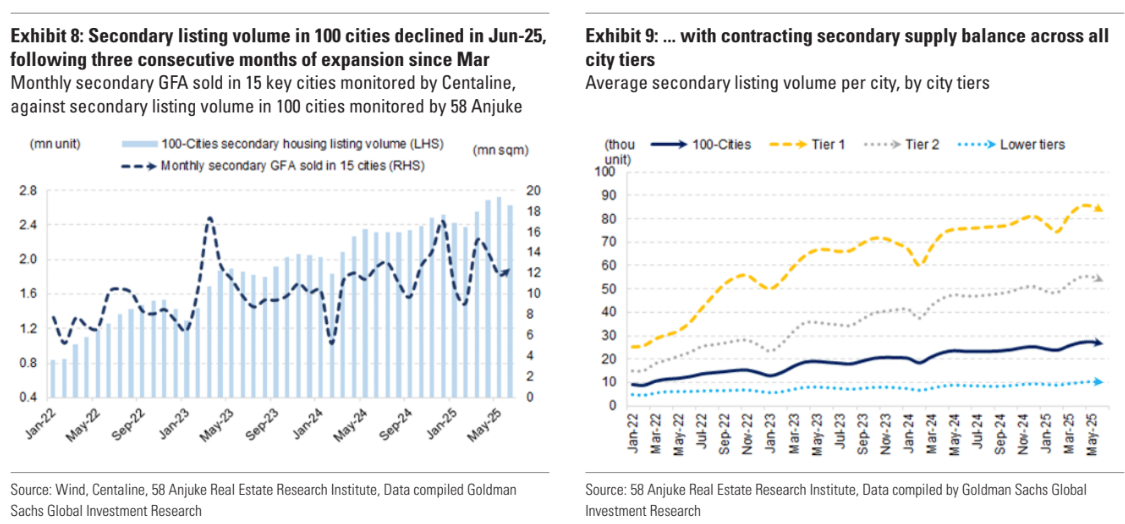

In fact, everybody is selling it as new property inventory falls, but only shifts into accumulating secondary listings, rising at an alarming rate.

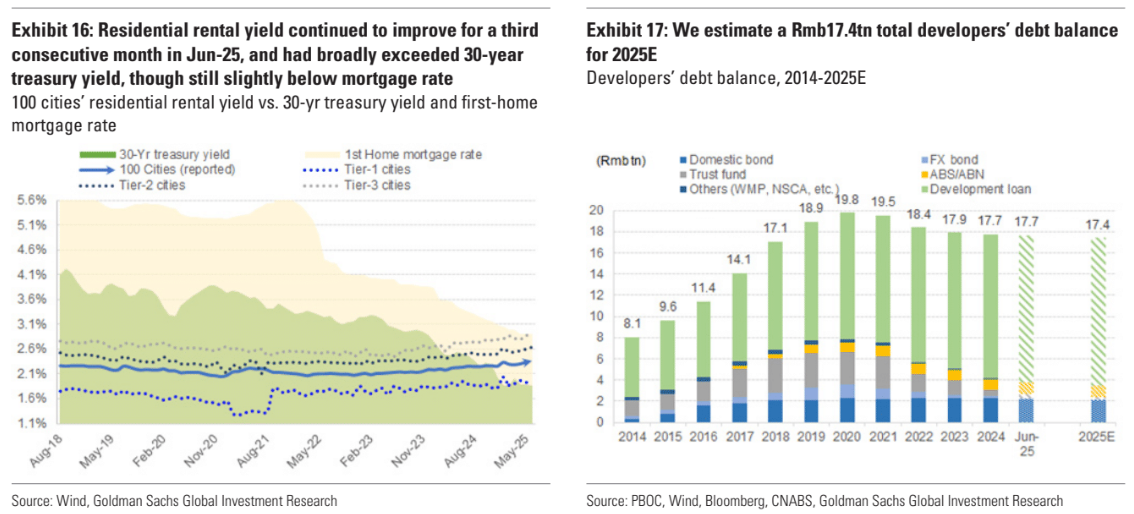

Yields are not enough to tempt anybody. They don’t even cover the mortgage. Negative gearing needed!

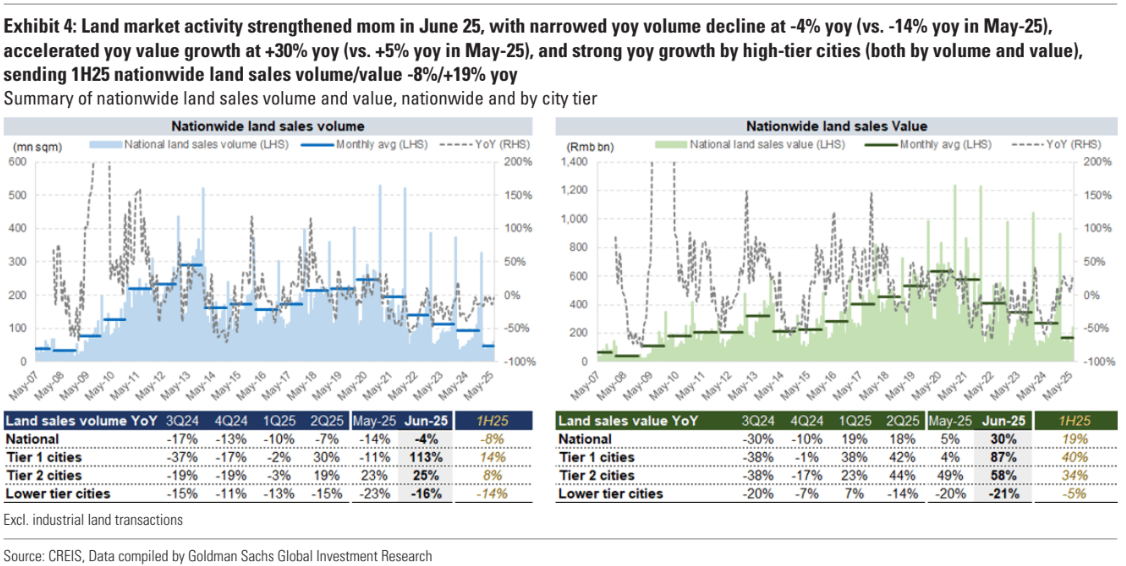

Developers are still not buying land.

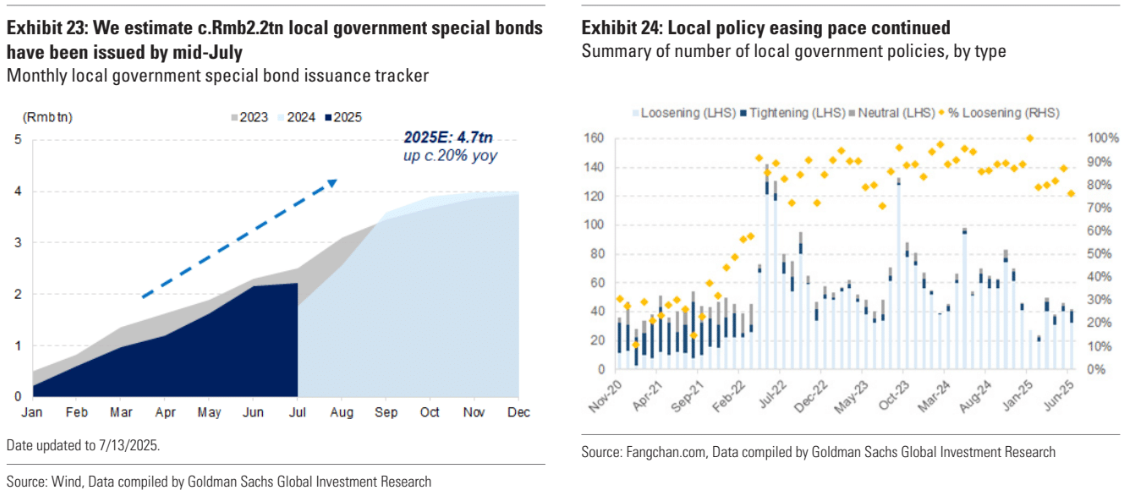

Meaning debt, debt, debt for local governments.

There are only five years to go.

As extend and pretend overtakes the banking system, according to Bloomberg.

China Vanke Co. is seeking to extend some of its domestic bank loans by as much as 10 years, according to people familiar with the matter, a move that could help the state-backed developer reduce liquidity risks.

The Shenzhen-based builder, one of China’s largest by contracted sales, has made a preliminary proposal to several major Chinese banks in recent weeks for the extension, according to the people, who asked not to be identified as the matter is private.

It could probably be ended in six months if the PBoC cut rates to where they should be: deeply negative.

Without that, nothing can stop the train wreck from permanently hobbling the Chinese economy with deflation as far as the eye can see.