A wise man once said that “Hope is not a strategy.”

But that isn’t entirely correct.

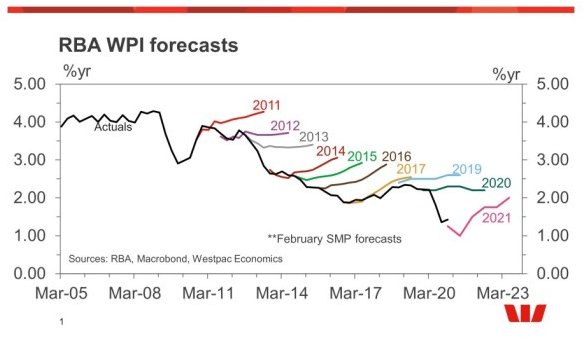

As the chart below of historic Reserve Bank wage growth forecasts reveals, hope can be a strategy; it’s just not a particularly good one.

The latest hope from the Reserve Bank is that the market economy can generate sufficient jobs to prevent rising unemployment, as employment growth in the overwhelmingly government-funded sectors of Public administration, healthcare, social assistance, and education pulls back.

This was expressed in the latest RBA minutes:

“Employment growth in the non-market sector—which includes health care, education and public administration—had started to ease in early 2025 from a rapid pace, while employment growth in the market sector had picked up a little in year-ended terms.

Members noted that a key consideration for the economic outlook was the extent to which any further slowing in growth in non-market sector employment and activity would be offset by stronger growth in the market sector.

They observed that the unemployment rate could hold steady even if this transition occurs with somewhat lower overall employment growth, depending on developments in labour force participation.”

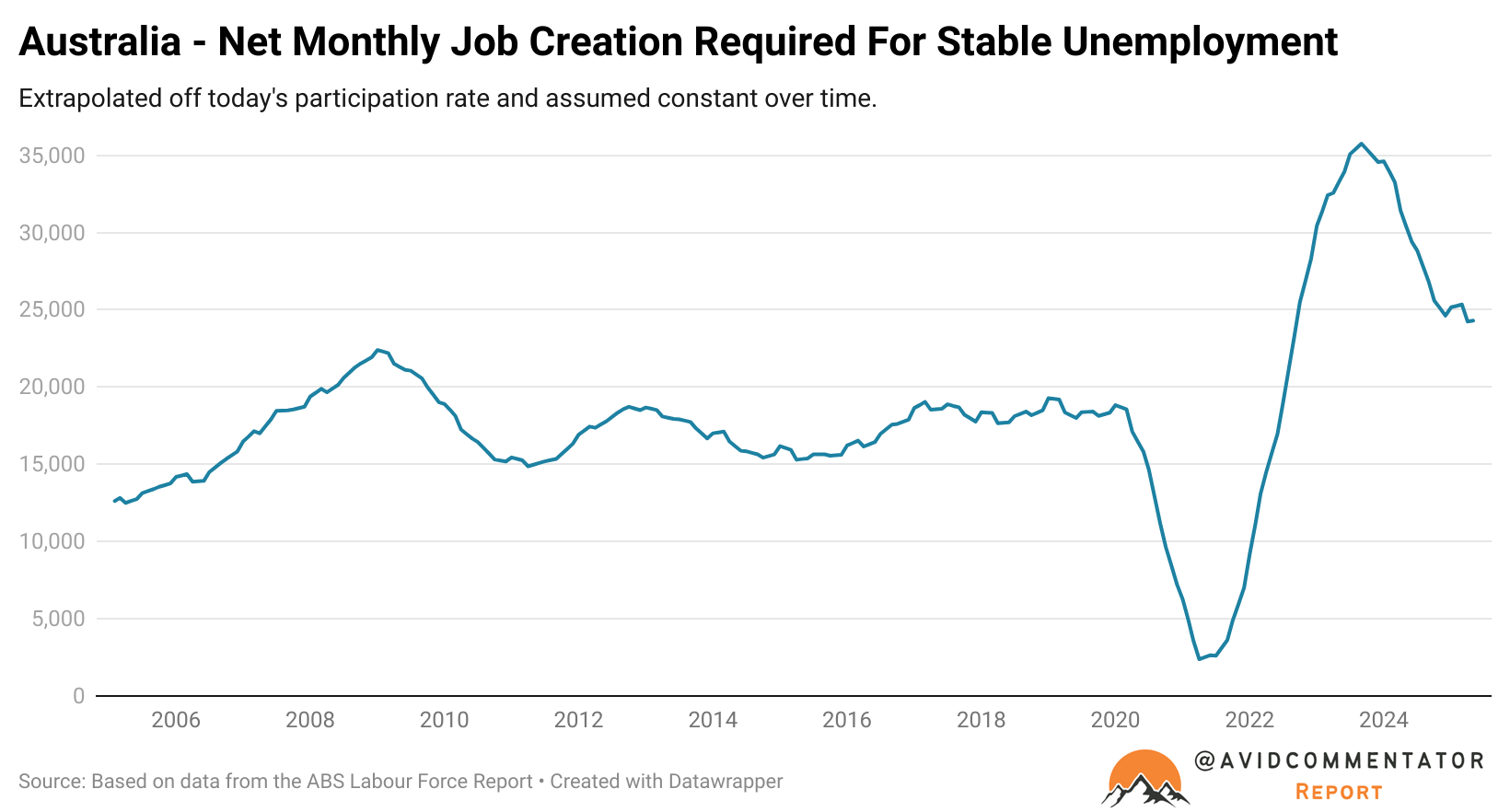

Considering that the economy needs to generate around 24,000 jobs per month to keep the unemployment rate stable, assuming a stable participation rate, the market sector of the economy seeing this level of acceleration in employment growth is a big ask.

The early evidence from the latest labour force data has not been promising.

In June, the economy created just 2,000 new jobs in net terms, which followed a disastrous May report in which 2,500 jobs were lost.

In terms of the full-time versus part-time split, 38,200 full-time jobs were lost, while 40,200 part-time jobs were created.

Overall, the unemployment rate rose to a 4-year high of 4.3% on a seasonally adjusted basis.

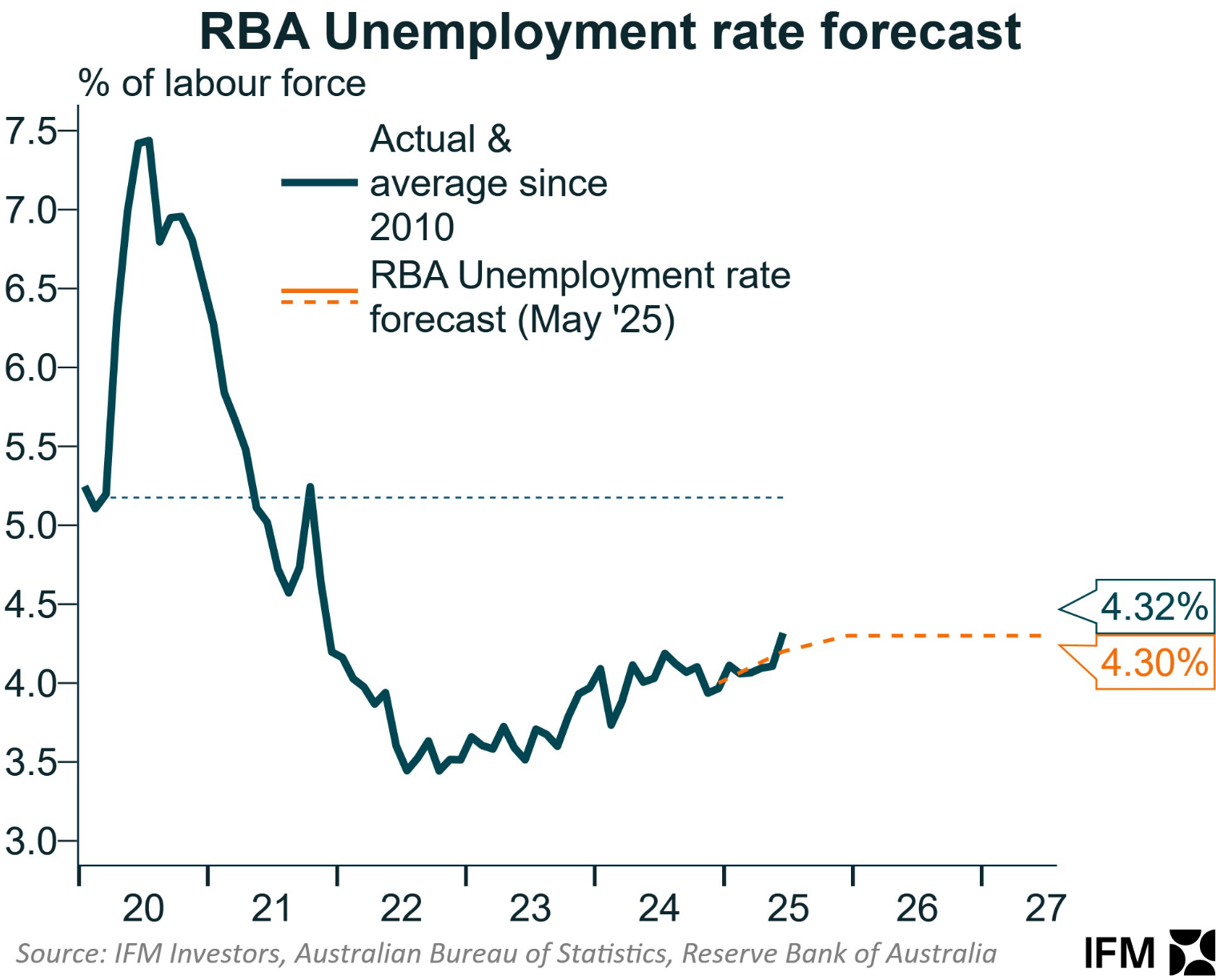

For the Reserve Bank, this is something of an issue. Its forecasts had the unemployment rate rising to 4.3% at year’s end and then staying there out to the end of forecast period in 2027.

Source: Alex Joiner IFM Investors

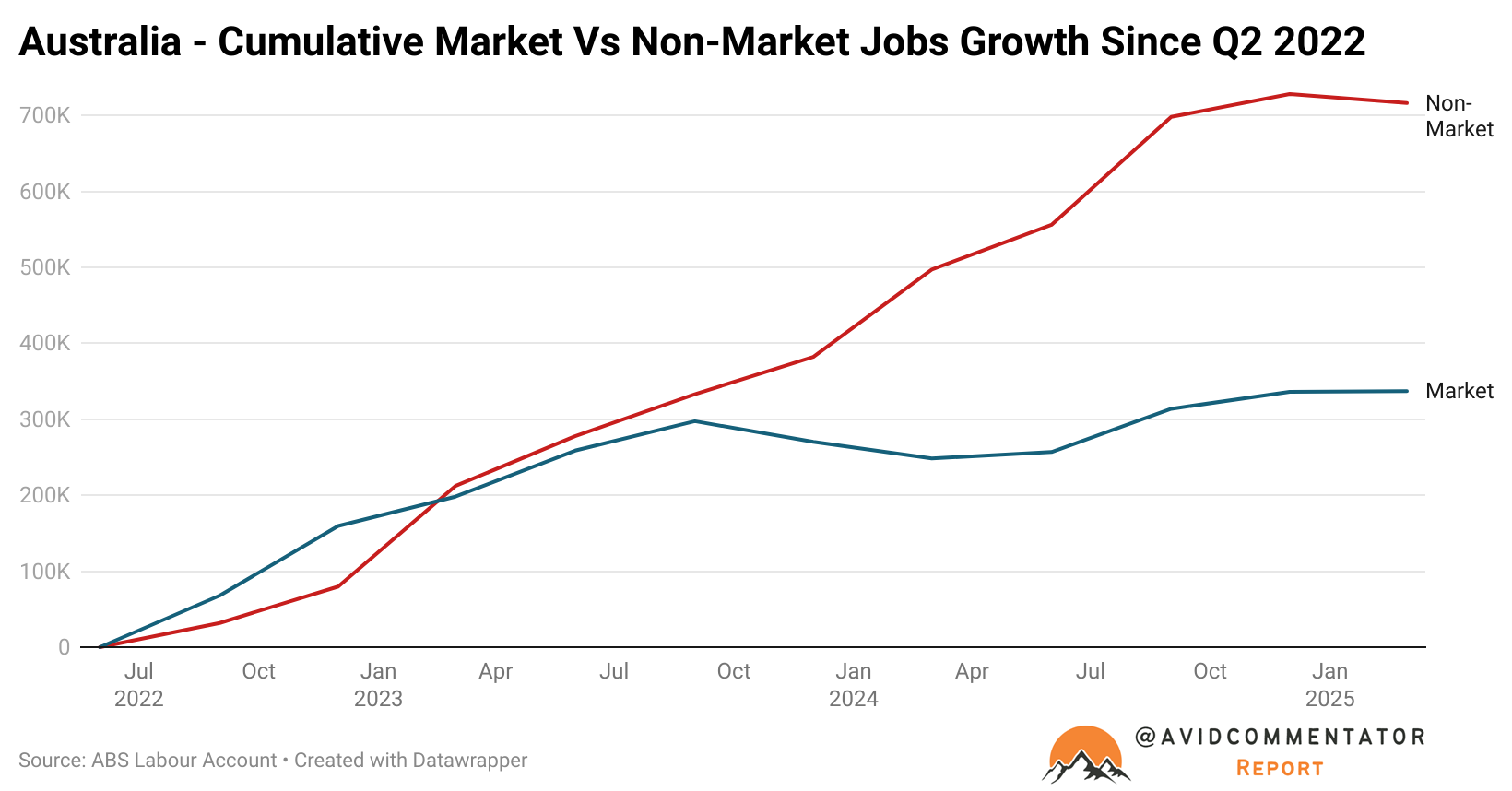

Looking at a breakdown of market versus non-market employment growth, the trend is not favourable.

Despite net non-market job growth slowing dramatically from an average of 86,000 positions a quarter in the 12 months prior to the latest data to a net loss of 11,800 jobs, market jobs only grew by a little over 1,000 in the first quarter of this year.

Some economists have made the case that the growth in non-market employment has been crowding out other industries and suppressing employment growth.

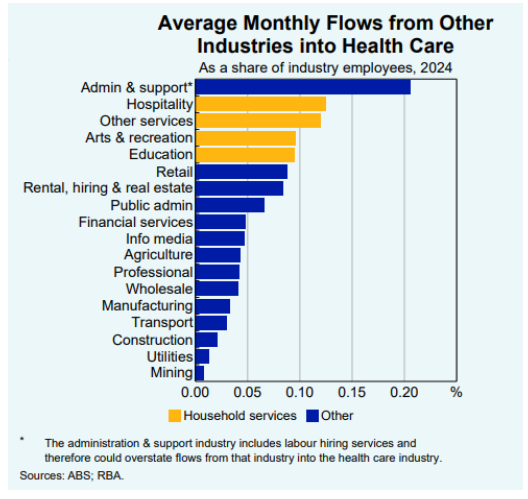

According to figures from a Reserve Bank report, there is evidence that the healthcare and social assistance sector is seeing net inflows from other sectors of the economy, particularly administration and support and hospitality.

While state and territory governments appear set to pull back on funding employment growth as they pursue more sustainable paths for their respective budgets. The National Disability Insurance Scheme (NDIS) is forecast to continue to grow significantly, which will continue to support non-market employment growth in a vacuum.

Going forward, the NDIS and recovering demand in the construction sector are likely to play a role in boosting the prospects of the nation’s labour market.

But whether that is going to be enough to prevent rising unemployment as other parts of government pull back on funding jobs growth and the market sector attempts to refire is very much an open question.