When Cotality starts talking about specific suburbs, you know the boom is not here yet.

Almost 45% of all suburbs across Australia are now at a record high in value, according to Cotality’s latest Housing Chart Pack.

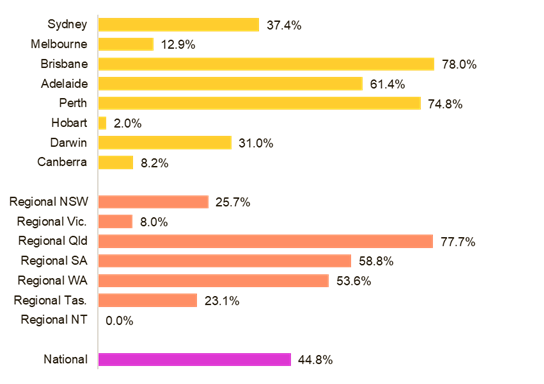

The suburb-level analysis reveals the broad-based nature of the current housing upswing, with values across 44.8% of the 3,722 suburbs analysed sitting at a peak at the end of June – a share expected to rise in coming months.

Portion of suburbs with dwelling values at peak – By capital city and rest of state region

Markets in Queensland and Western Australia have led the charge.

Brisbane and Regional Queensland recorded the highest share of suburbs at peak, at 78.8% and 77.7% respectively. Perth followed with 74.8% of suburbs recording all-time highs, while Adelaide, Regional SA and Regional WA saw 61.4%, 58.8% and 53.6% of suburbs at peak respectively.

Although the majority of suburbs nationwide are not currently at a record high, momentum is building. At the end of June, values across 329 suburbs were within 0.5% of their previous peak, with 290 of those recording value rises over the quarter.

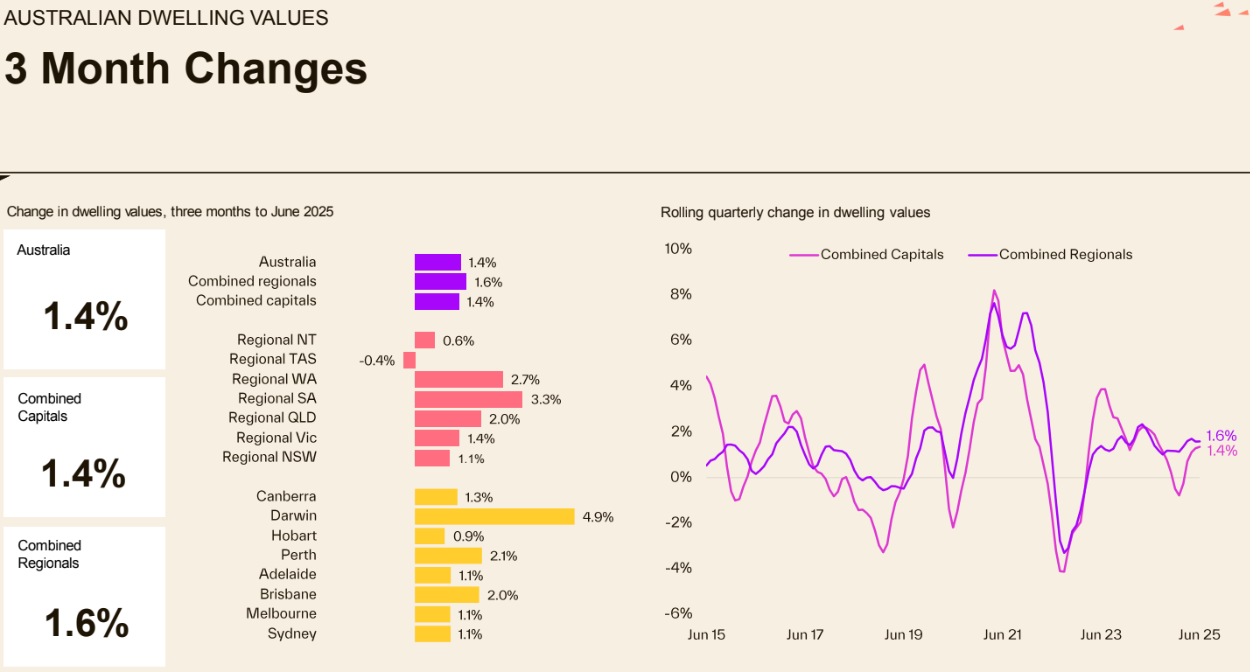

With national dwelling values up 0.6% in June, the proportion of suburbs at peak is expected to climb above the 50% mark in the coming months.

Nor is it here. Momentum has lifted but is hardly tearing the roof off.

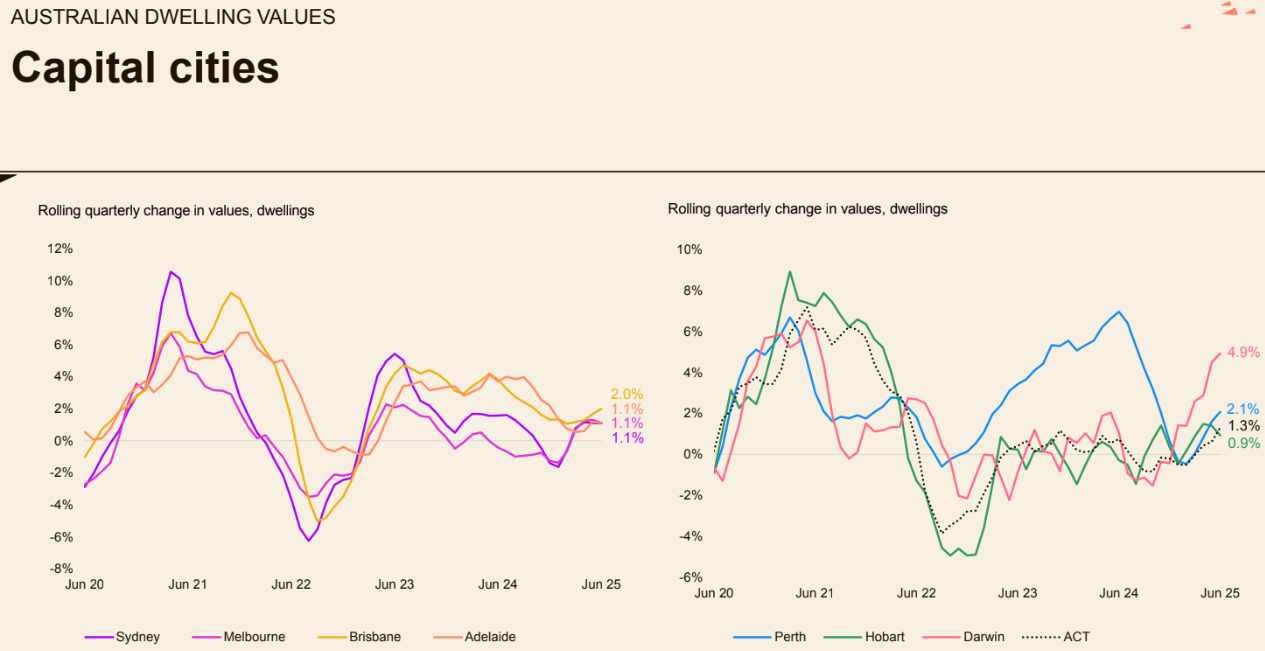

Indeed, major cities look a bit toppy.

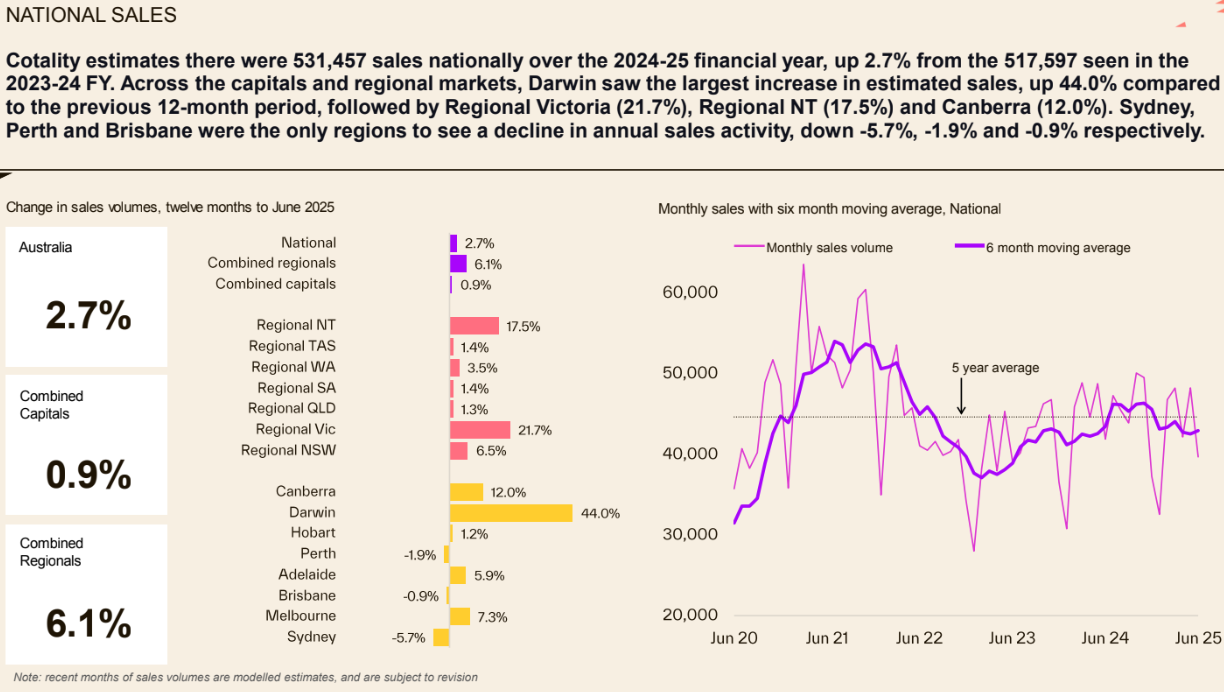

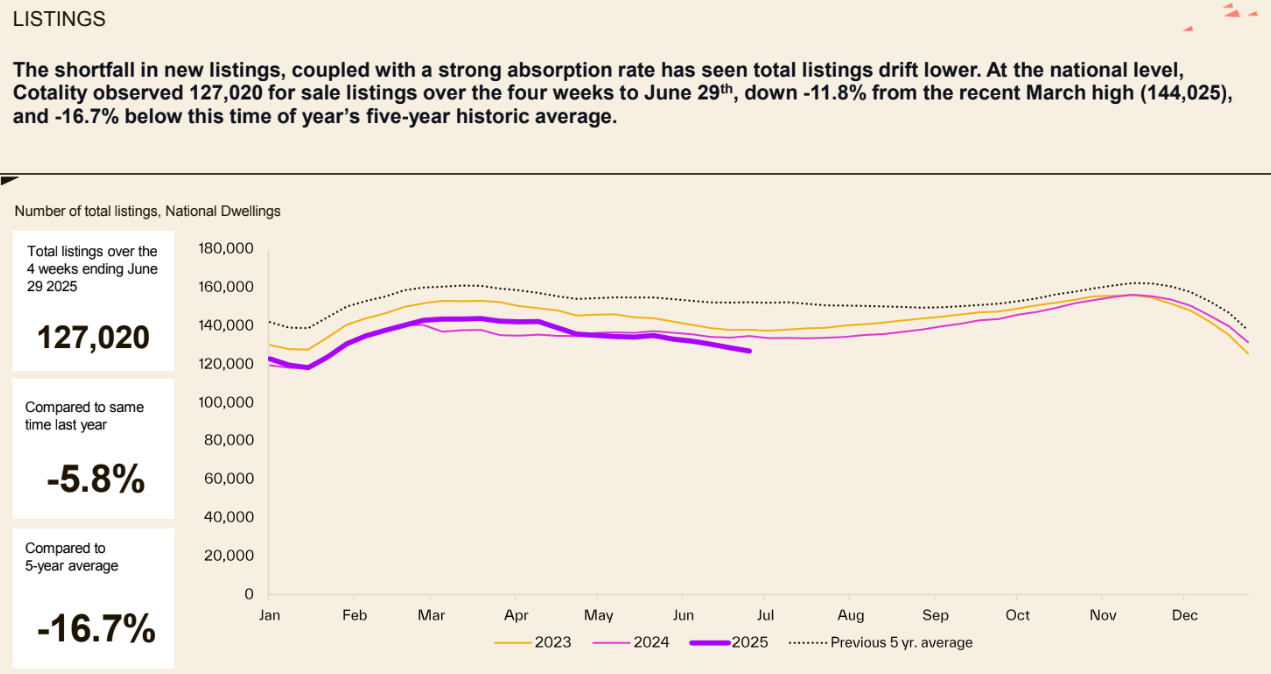

Price follows volume, and it is fading too.

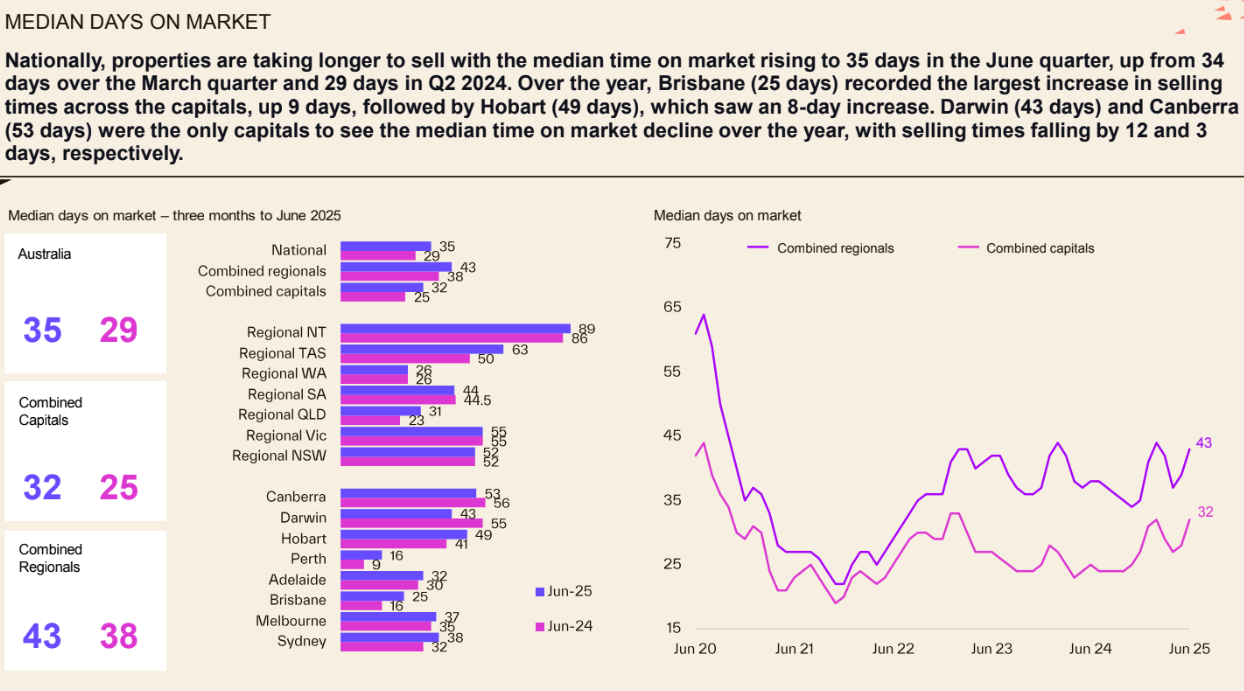

Some idle property.

Falling listings will help.

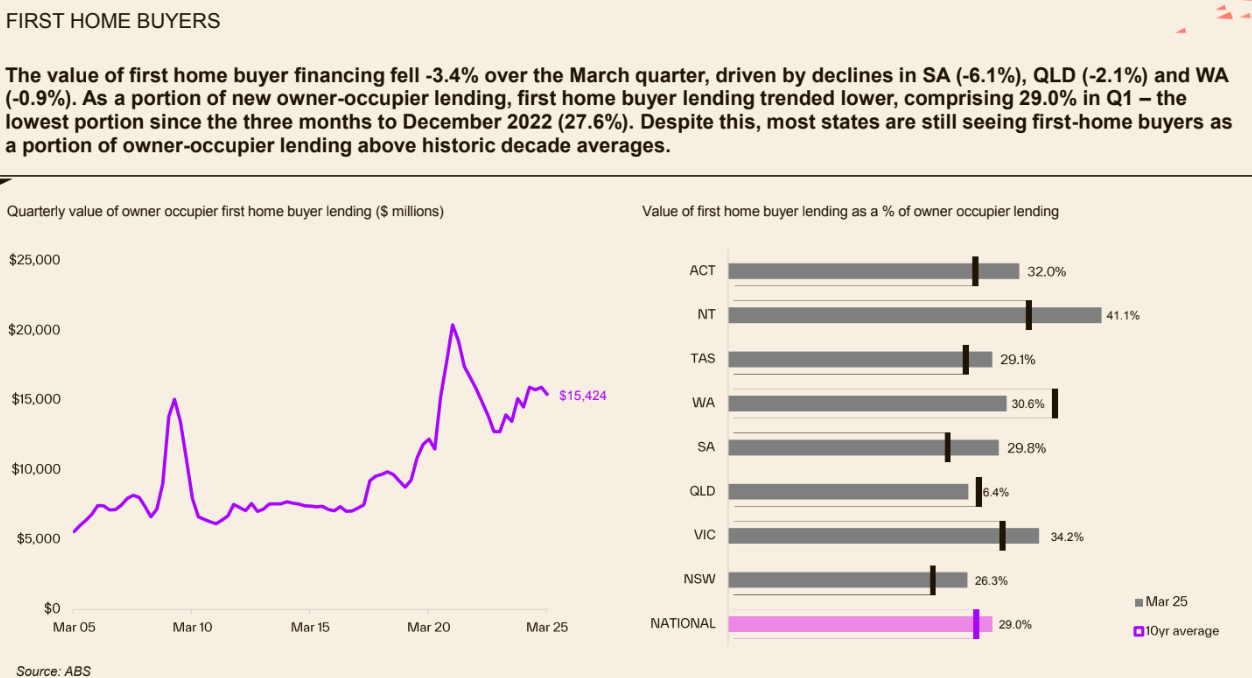

FHB’s need more rate cuts as the debt load required climbs.

And they will have them in due course. This is a pretty paltry start to any new housing cycle, but have no fear.

The RBA will keep cutting this year as inflation disappears and once the terms of trade smash intensifies into 2026, there will be nothing else to stimulate to get us over demolished national income.

It will be back to houses as holes fill with water and debris.