Stock markets were doing well in Asia until it seemed like a leak of tonight’s US unemployment print by Trump spitting his dummy calling for Fed Chair Powell’s resignation. This saw most equities pull back alongside S&P futures while the USD firmed against the undollars, with Yen easing off as speculation the BOJ may raise rates soon.

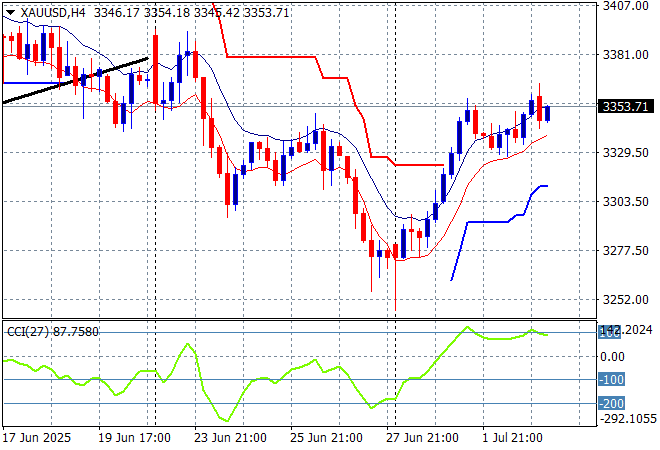

Oil markets held on to their overnight gains with Brent crude trading just below the $69USD per barrel level while gold is trying to make a comeback as it sits above the $3350USD per ounce level:

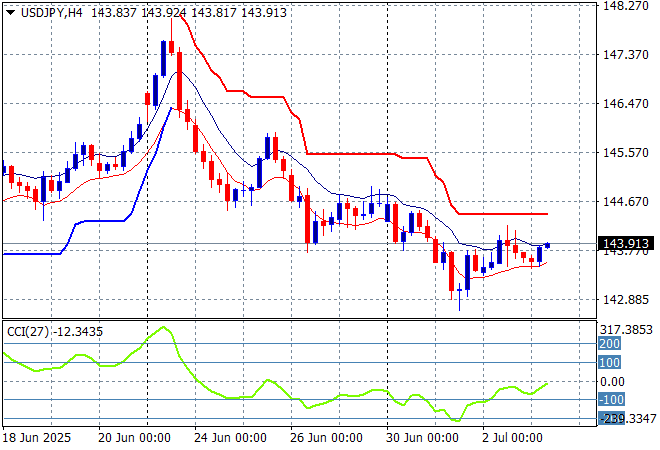

Mainland Chinese share markets are up slightly with the Shanghai Composite remaining above the 3400 point level while the Hang Seng lost nearly 1% to slip back below the 24000 point level. Meanwhile Japanese stock markets are treading water with the Nikkei 225 steady but still just below the 40000 point barrier with the USDPY pair is seeing a small blip higher to sit just below the 144 level:

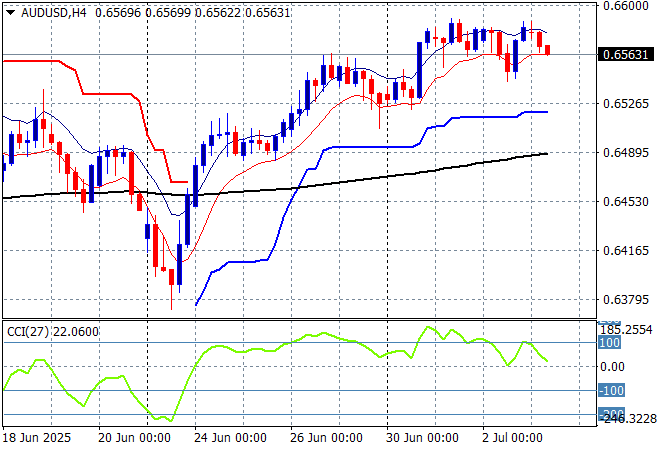

Australian stocks were looking good before the latest trade figures with the ASX200 about to close slightly lower at 8586 points while the Australian dollar slipped back to the mid 65 cent level against USD:

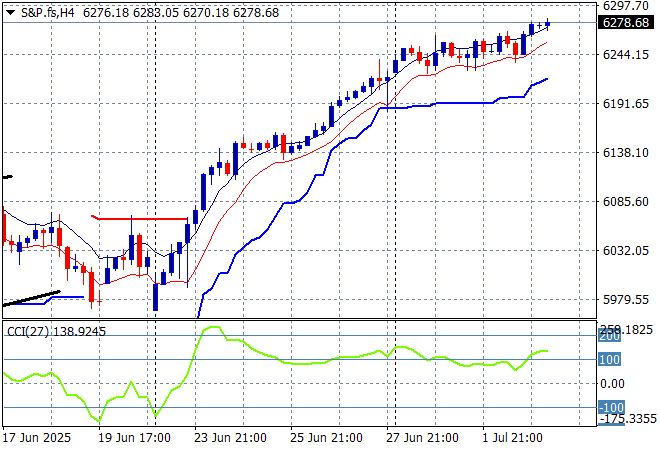

S&P and Eurostoxx futures are down slightly going into the London session with the S&P500 daily chart showing the market clearly overextended but still turning any news into positive returns after breaking right through the 6200 point level:

The economic calendar will focus squarely on the early non-farm payroll print from the US tonight.