A relatively calm session here in Asia with only slight movements in currency markets as the Australian dollar had a small blip after some disappointing retail sales numbers while share markets are absorbing the passing of the “End of the Empire” bill in the US senate.

Oil markets continue to steady after their recent correction with Brent crude trading just above the $66USD per barrel level while gold is trying to make a comeback as it gains only slightly above the $3300USD per ounce level:

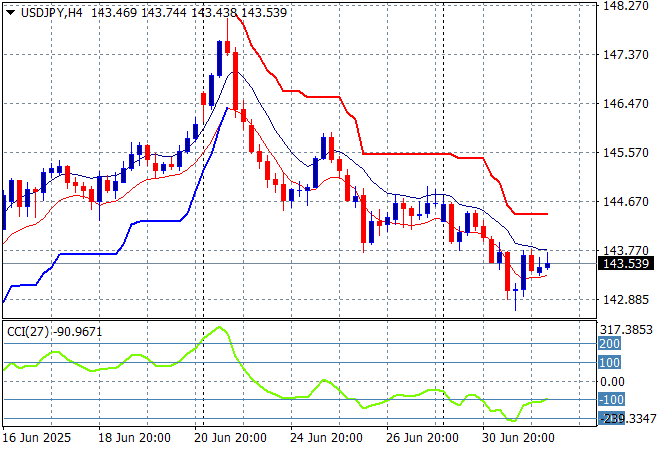

Mainland Chinese share markets are down slightly with the Shanghai Composite remaining above the 3400 point level while the Hang Seng lifted after its holiday in the previous session, currently up 0.6% to get back above the 24000 point level. Meanwhile Japanese stock markets are down again on more inflation and trade concerns with the Nikkei 225 off by more than 0.5% to retreat below the 40000 point barrier with the USDPY pair is seeing a small blip higher but is still well below the 144 level:

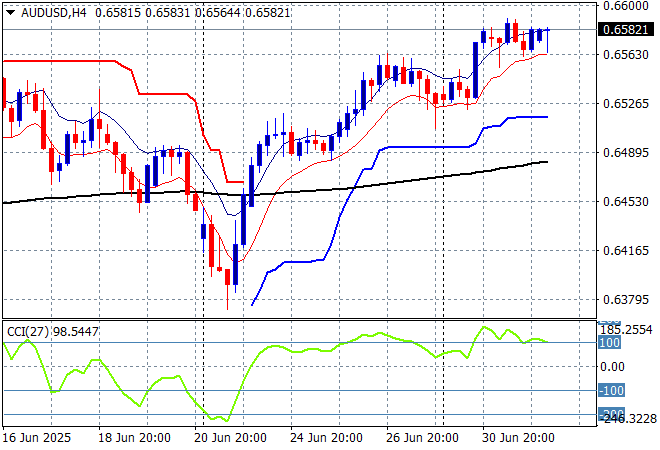

Australian stocks were the best performers with the ASX200 about to close 0.6% or so higher at 8595 points while the Australian dollar was able to hold on to its overnight gains despite a mid session blip on the retail sales numbers to remain just below the 66 cent level vs USD:

S&P and Eurostoxx futures are up going into the London session with the S&P500 daily chart showing the market clearly overextended but still turning any news into positive returns after breaking right through the 6200 point level:

The economic calendar includes some European unemployment data followed by a preview of the NFP with the US ADP employment numbers.