The Chinese economy remains mired in a depression. Led by the property crash, the economy is barely growing.

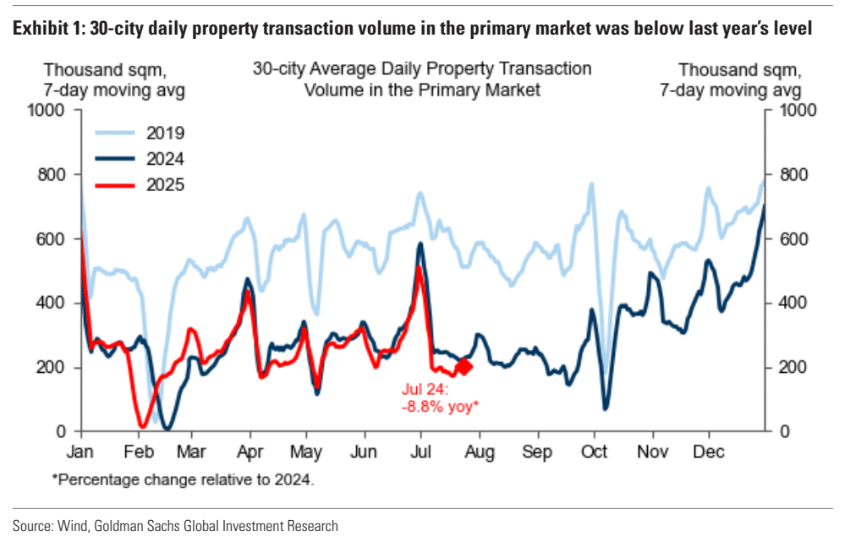

New home sales are still terrible.

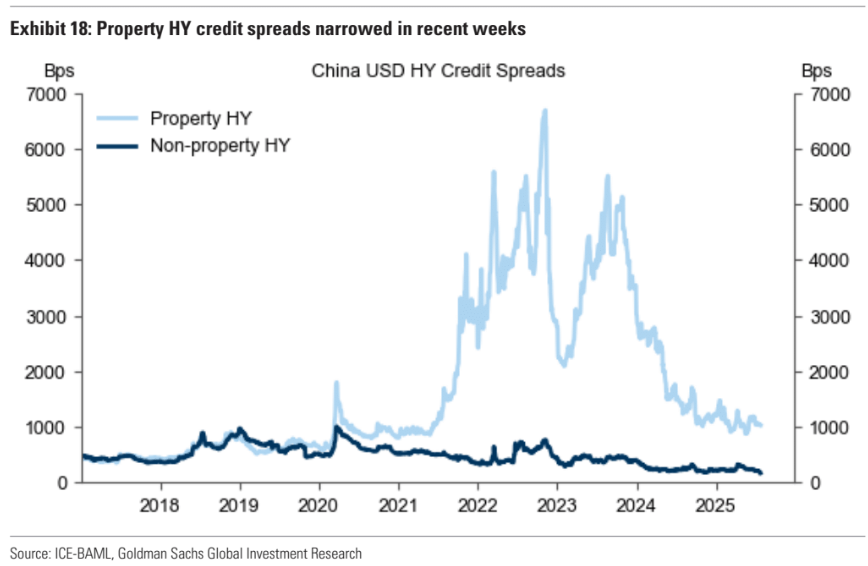

Liquidity is still tight for developers.

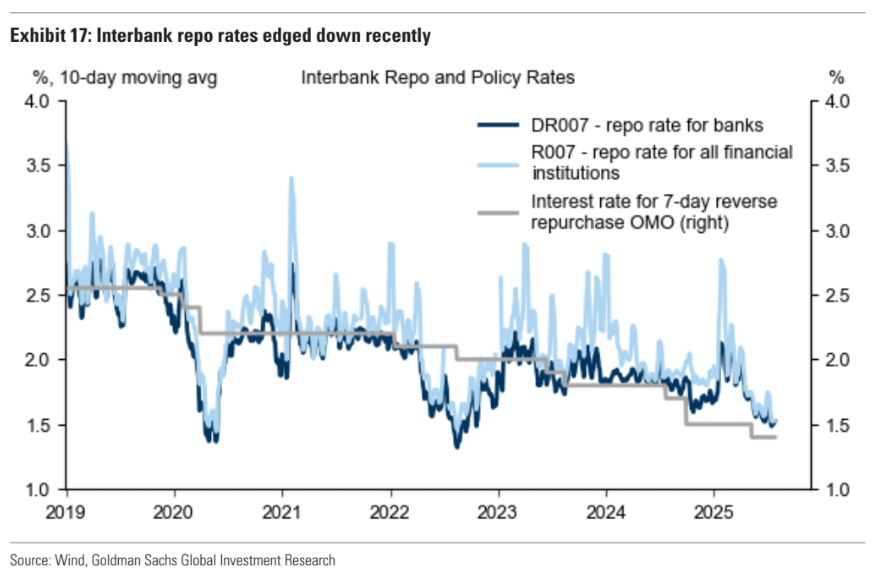

Liquidity trap!

Advertisement

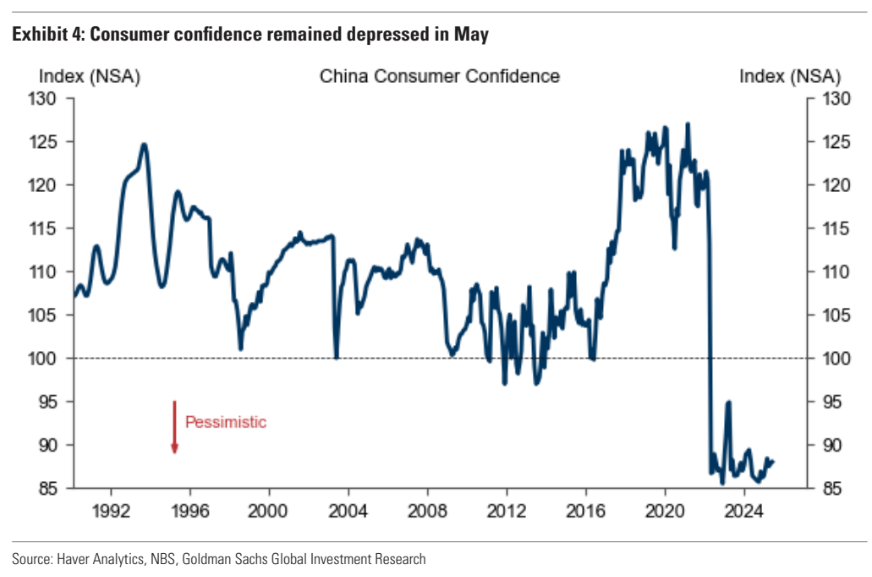

The consumer-led recovery is a joke.

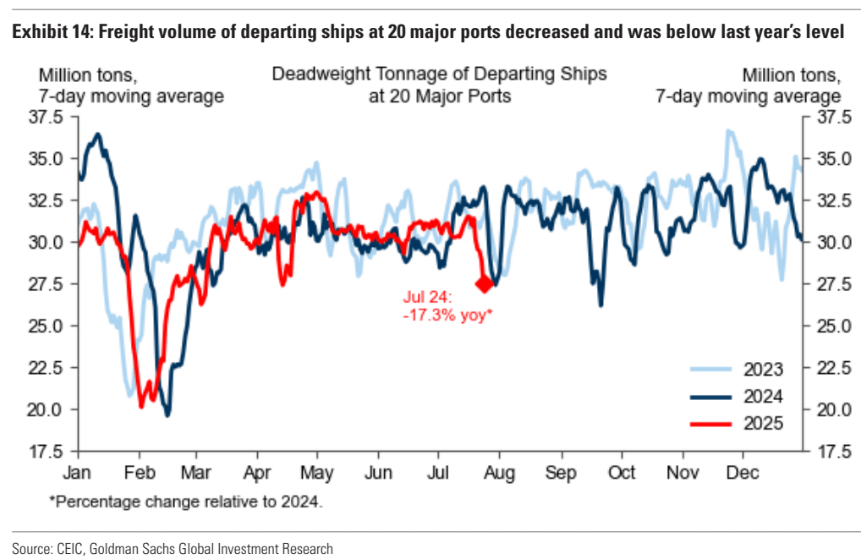

It appears there’s a shock underway in external demand as well.

Advertisement

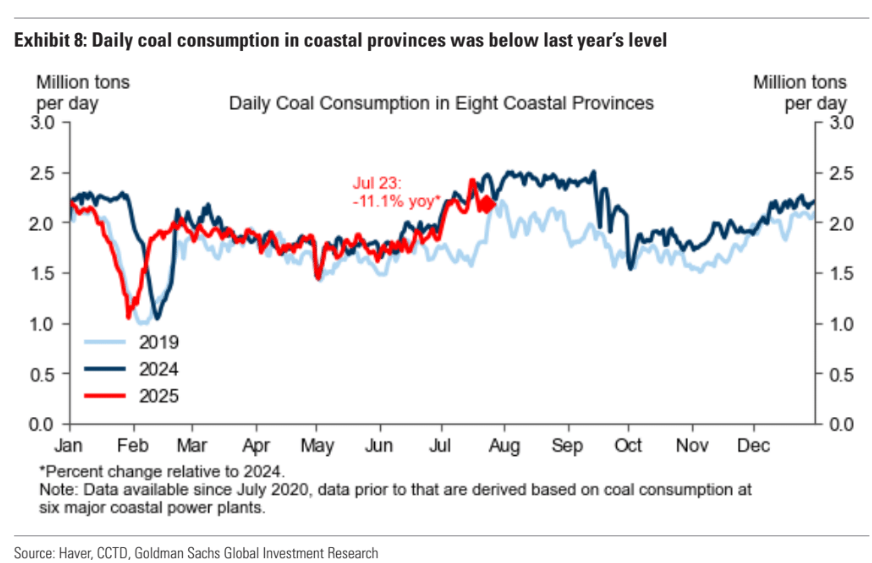

On the supply side, the economy is stalled. Coal usage is falling.

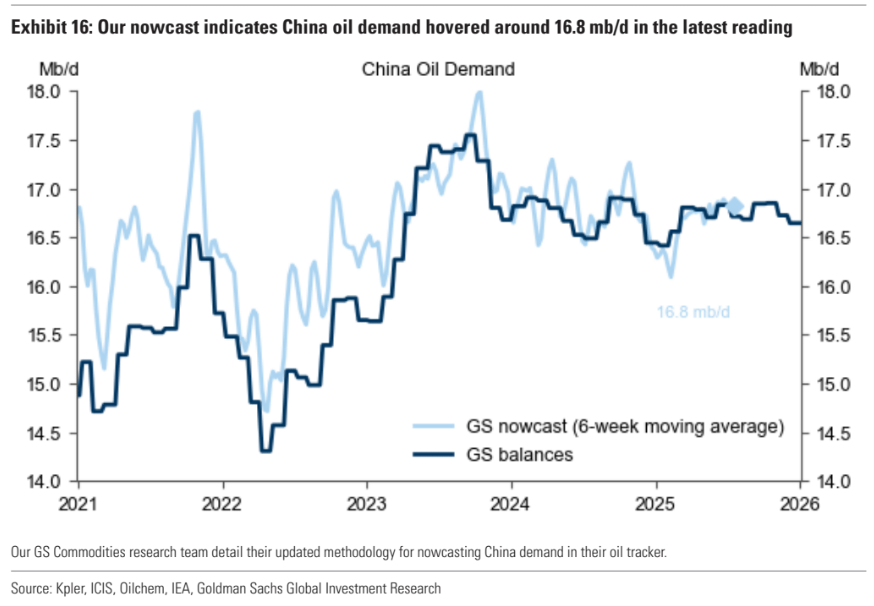

Oil usage is falling.

Advertisement

Both of these will be impacted by green policies, but still.

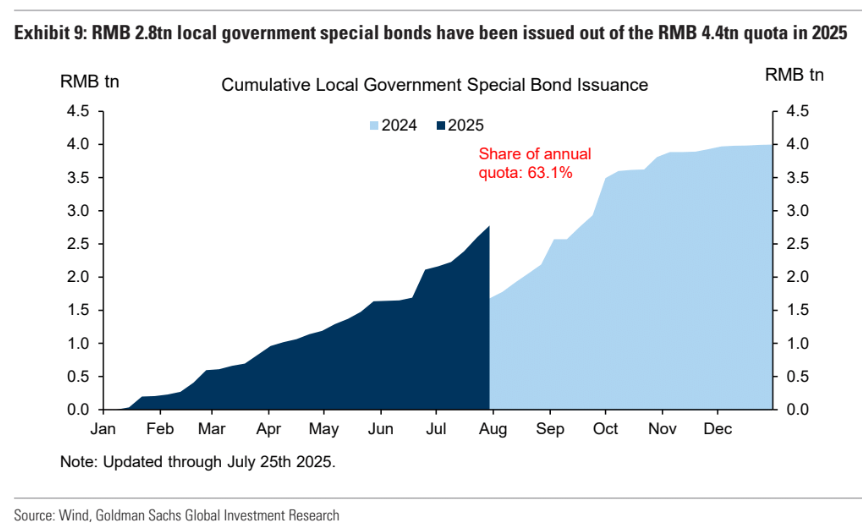

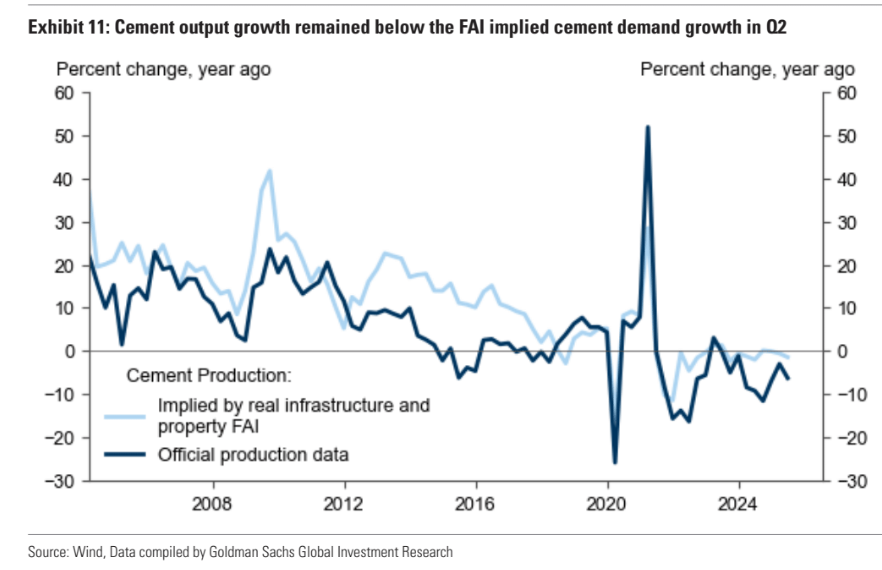

Local government investment bonds are booming.

But with deleveraging part of the point, it does not seem to be having much impact on real investment.

Advertisement

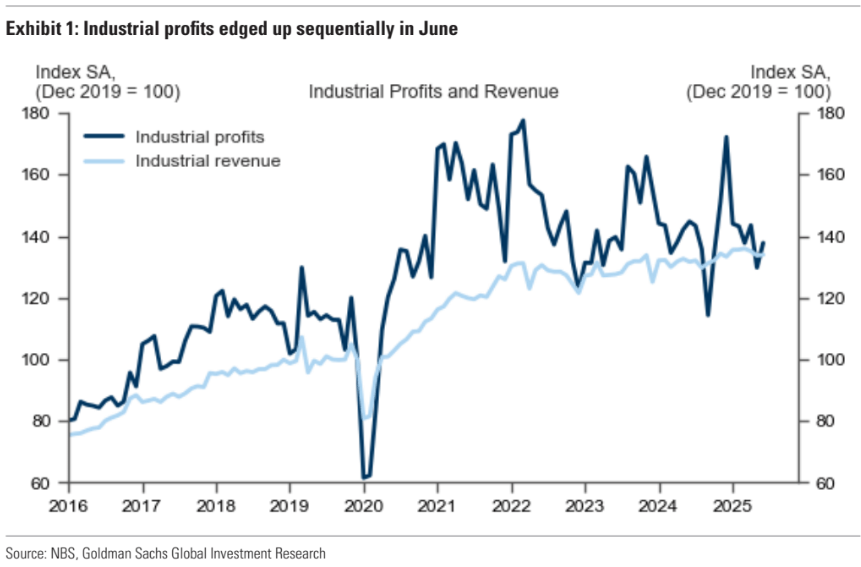

Industrial profits have not grown in six years.

This economy is not growing at 5%.

Advertisement

It’s not growing at all.