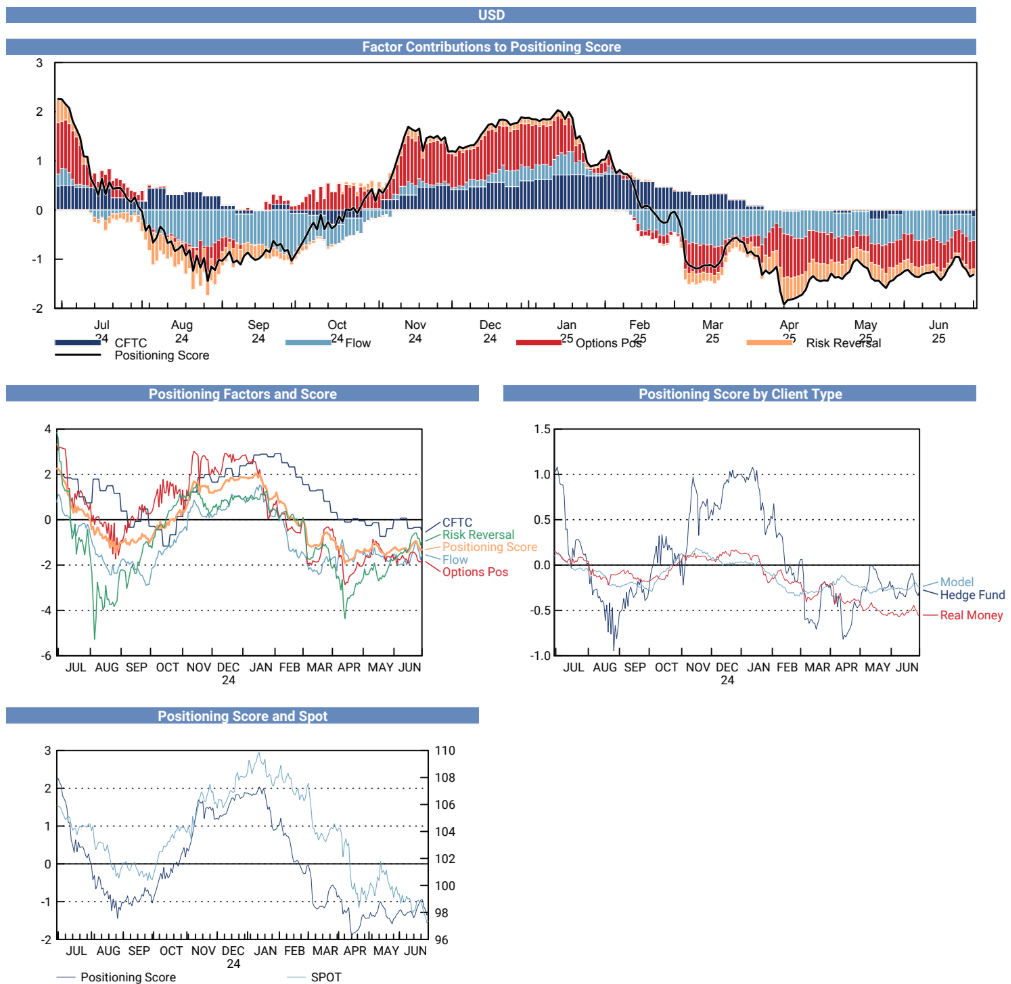

DXY is breaking down.

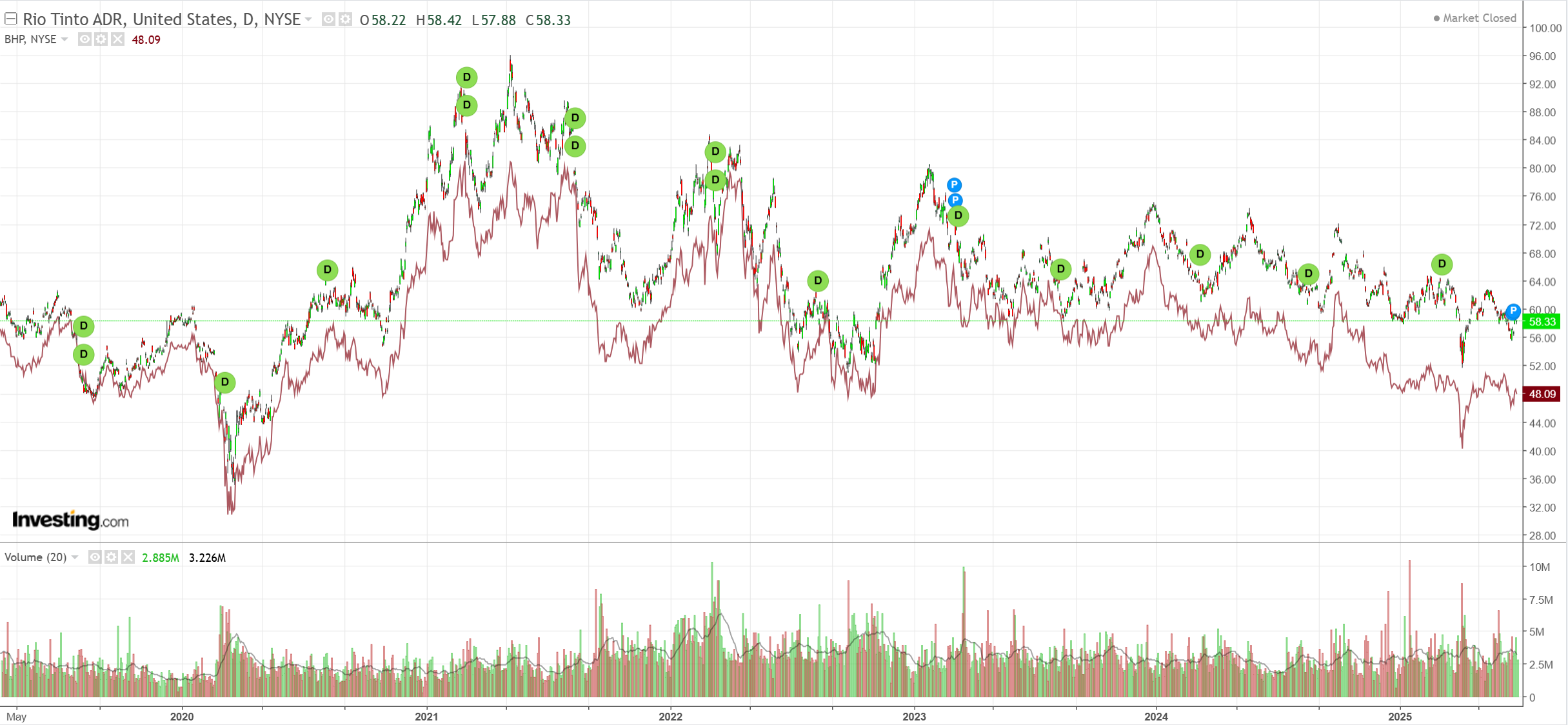

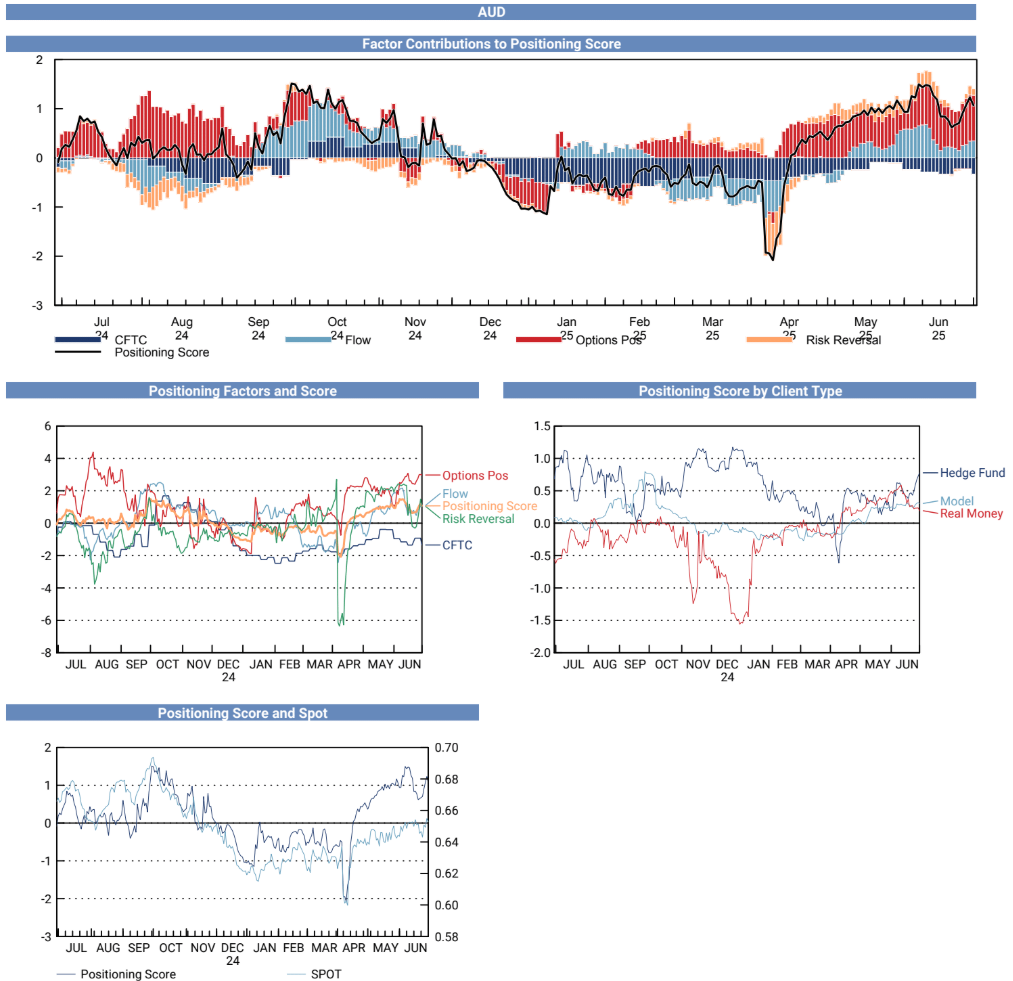

The unusually subdued AUD rally continues.

Lead boots plodding along.

Gold shaky, signalling DXY last leg down?

Metals flamed out.

The big bear rolls on.

EM yawn.

Junk leading the rally is bullish.

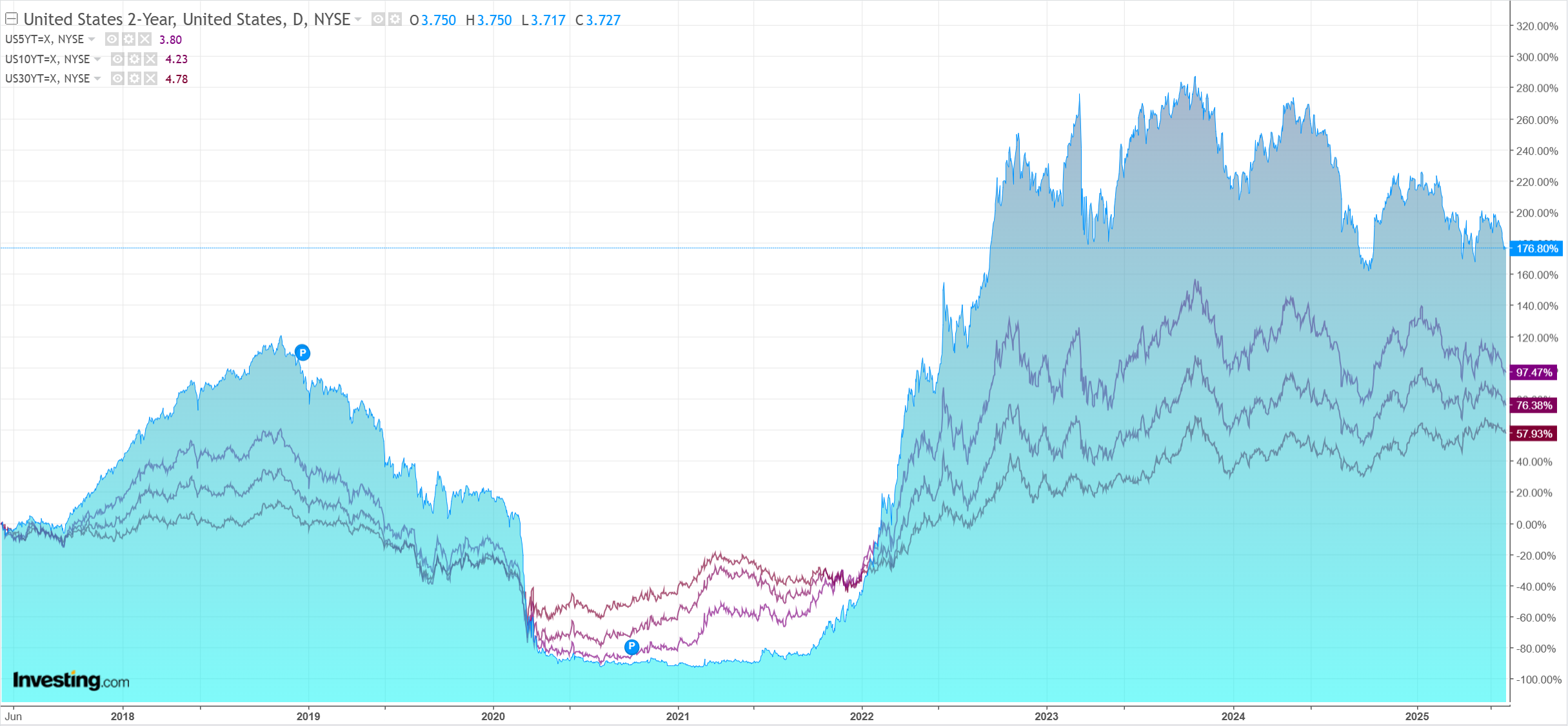

Yields still easing.

Stocks only go up.

In my view, this is the last leg down for DXY, which is not to say that it will not be material. Once the Fed rolls to cuts, I see the USD smile returning.

The market is very short, but speculators can be shorter yet.

AUD is the opposite, with derivatives very long. But physical positioning is still short. More room to run here.

As the year wears on, I expect the so-called Chinese recovery to be exposed as a non-entity and the EUR to weigh heavily on Europe.

As the Fed pivots, US growth will become the new market-leading story, and DXY will bottom out.

AUD will roll over.