In the debate surrounding the so-called “Mortgage Cliff” and the impact of inflation and higher interest rates on households, the possibility of a strong rise in mortgage arrears has been written off in many quarters.

Yet with the release of the latest Residential Mortgage Backed Security (RMBS) data from ratings agency Fitch, that is exactly what we have seen.

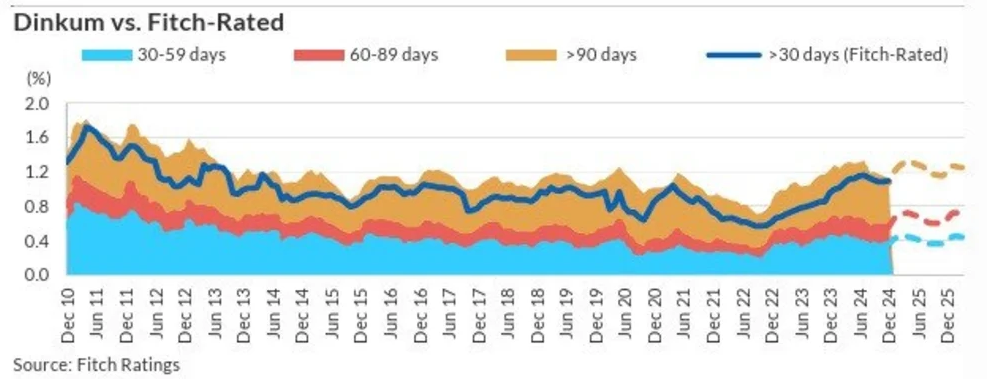

“Australia’s 30+ day conforming mortgage arrears rose by 23bp qoq to 1.36% in 1Q25, while non-conforming arrears rose more sharply by 39bp to 5.32%,

Fitch Ratings says. First quarter arrears typically rise due to post-holiday financial pressure, but this quarter’s jump was almost 3x the historical average of 8bp. Fitch attributes the larger-than-usual increase to the cumulative strain of prolonged higher interest rates on households and persistent inflation stretching household budgets.”

With 1.36% of conforming loans now 30 days or more in arrears, this marks the highest level of mortgage arrears on this metric in over a decade, with this level last being hit back in 2013.

The chart below illustrates their path since 2010 and covers up to the data point prior to this week’s data.

Source: Fitch Ratings Dinkum RMBS Index

The reality is that the lag time between major difficulties showing up in arrears can be significant, particularly in the absence of the end of a business cycle or another economic shock.

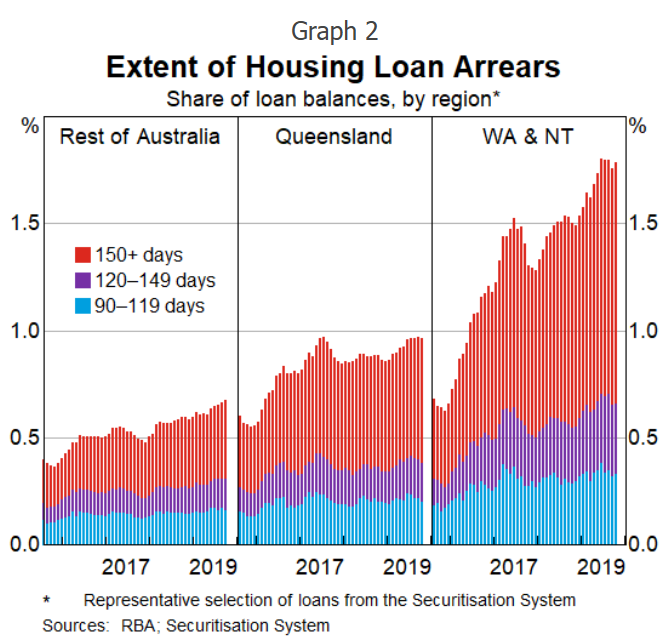

A good example of this is the performance of mortgage arrears in Western Australia, which was covered in a 2019 paper from the Reserve Bank. Despite the peak in trend unemployment in WA occurring in 2016, the peak in mortgage arrears would not come to pass until 2019.

In the absence of the pandemic, this may not have been the peak and the situation may have deteriorated further.

The simple reality is that Australia’s era of extending and pretending has never truly ended. With hundreds of thousands of mortgage holders in hardship provisions, the true scale of the number of delinquent mortgages has been obscured, making comparisons with previous eras challenging, to say the least.

With fiscal pressures on various state governments threatening to jam the taxpayer-funded jobs printer, which has taken over as the overwhelming driver of employment growth in the last 18 months in particular, the peak in mortgage arrears for this cycle may lie well into the future and be significantly higher.