Westpac states the obvious.

Soft GDP data for Q1 has again raised questions of whether the RBA is behind the curve and has left policy too tight for too long. As we have been highlighting for some time, underlying growth in Australia remains weak and sensitive to pauses in the expansion in the care economy. With inflation in the 2–3% target range already, and likely to stay there, why wouldn’t the RBA cut further and faster than previously believed?

A year ago, the RBA’s view was coloured by surprisingly convergent estimates of r* well above 3%, implying that monetary policy was restrictive, but perhaps not that restrictive.

However, new models were introduced between November last year and February this year that were at the lower end of the existing range of models. The average of all these estimates is now in the high 2s rather than the low-to-mid 3s range we have favoured for both the US and Australia.

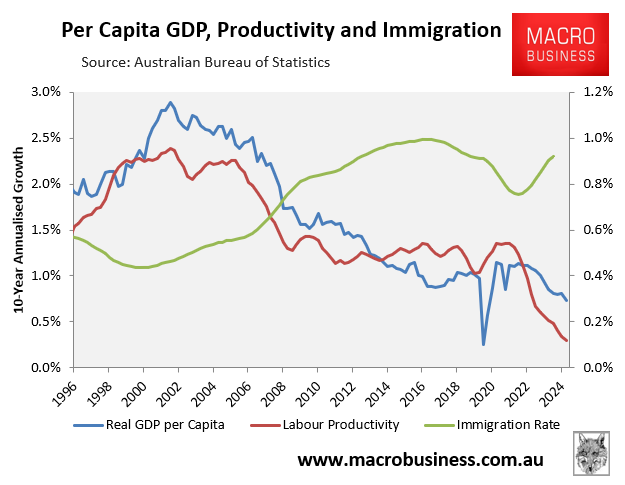

That’s more like it. As the immigration-led labour market economic model runs through its paces, we will see devolving weakness in wages and productivity which results in pancaked inflation It is the nature of the beast.

For now, I do not expect price and inflation weakness to be as weak the last cycle. But once the Pilbara killer opens through 2026, and iron ore takes the odd plunge below $50, the r* will collapse right along with it.

As the budget hemorrhages and is reined in, price and wage disinflation will intensify and ye auld Aussie r* will resume its one way trip to Hades.