DXY held Friday night, but EUR is a runaway locomotive.

AUD fell and is eating European dust.

Lead boots were made for climbing.

Gold is in a spot of bother; improving geopolitics outweighs a falling DXY.

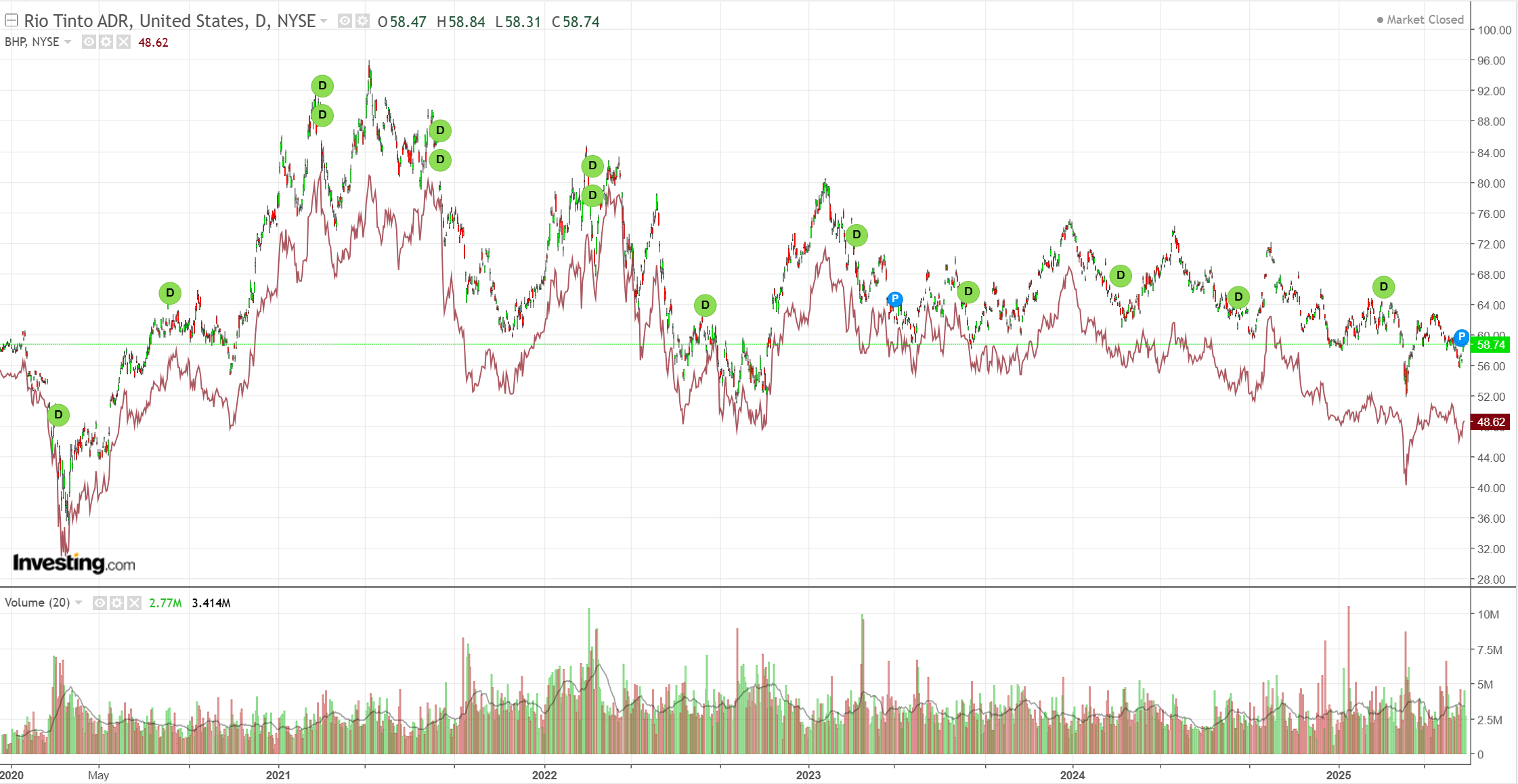

Metals reflation is go.

Another chance to short the world’s greatest bear market.

EM meh.

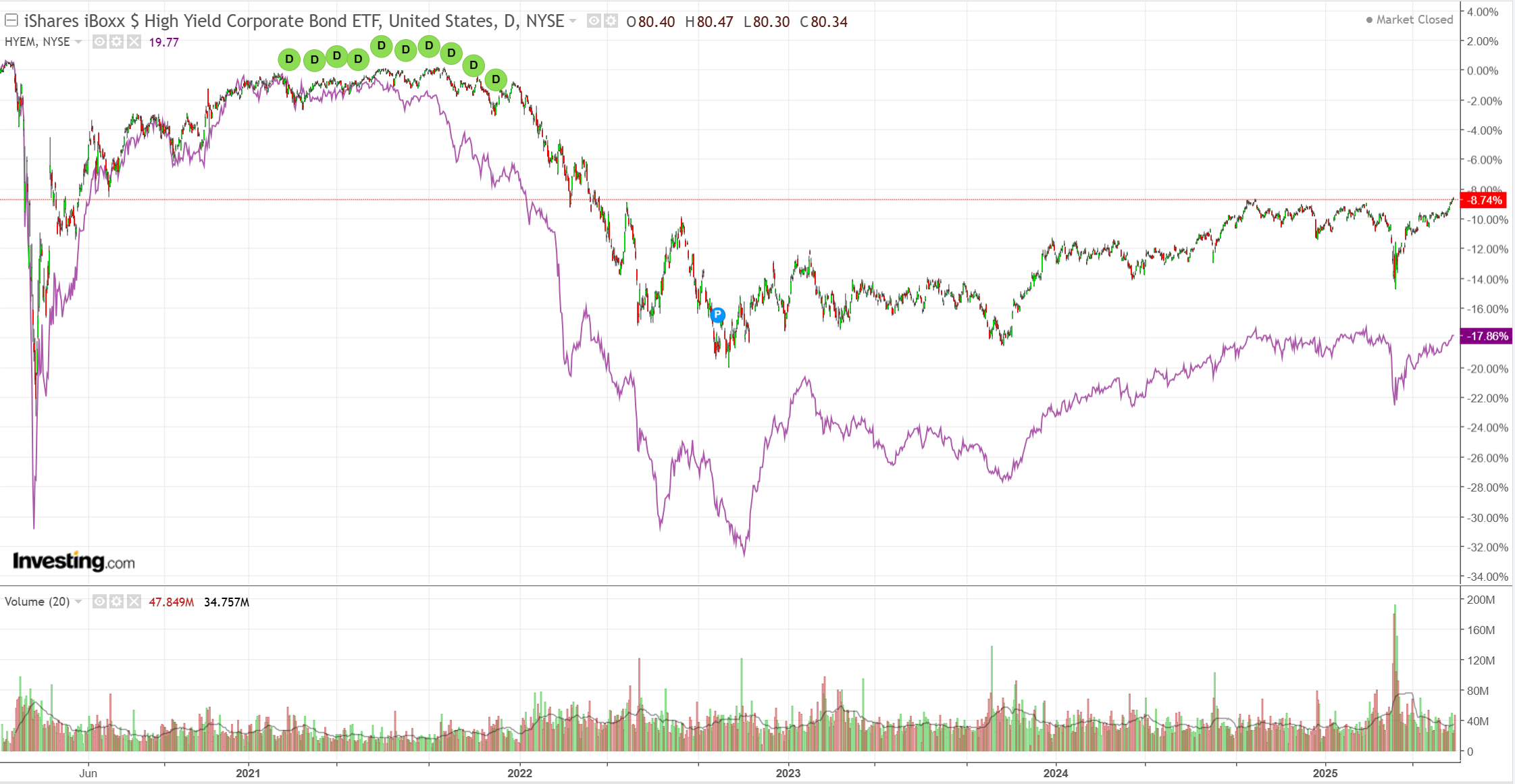

Junk stalled.

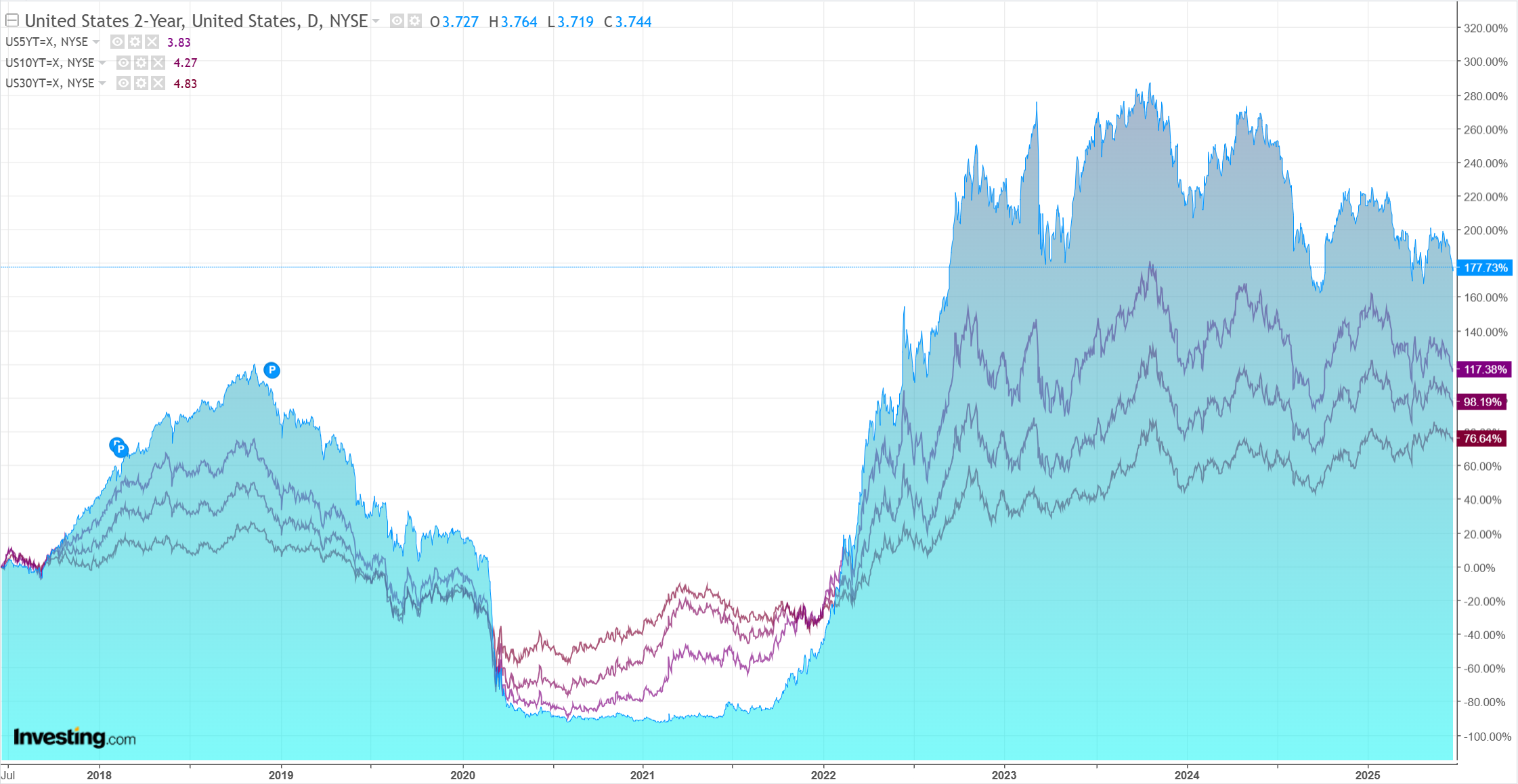

As yields firmed.

Stocks don’t care.

Goldman has the tale.

The last week brought yet another reminder of the soothing role that inflation relief can play.

Buttressed by the early week oil selloff, recent Fedspeak has opened the door a bit wider to cut pricing for a US rates market that remains largely relaxed about medium-term inflation risks.

The potential for an early Fed Chair nomination may introduce an added wrinkle to that dynamic, and we continue to see value in belly and long-end traded inflation.

While front-end pricing skews dovish versus our economists’ baseline Fed path, it’s closer to fair on a probability-weighted basis, and we think the likely reaction function favors steepening exposure into next week’s jobs report.

In Europe, the more front-loaded boost implied by the recent German fiscal update should lift 10y Bund yields and sustain a reflationary dynamic in market pricing via steeper curves and higher traded inflation.

Steepening global curves typically go hand in hand with a rising AUD, given they signify better growth ahead.

That the AUD can’t keep pace with the EUR is a function of two things:

- The EU’s pivot to fiscal spending.

- The AUD terrible underlying economy, fateful China dependence, and a tsunami of coming rate cuts.

I still expect the AUD to rise for now, but it will be a grind and not as long as it usually would be.

It is the new EUR trash currency.