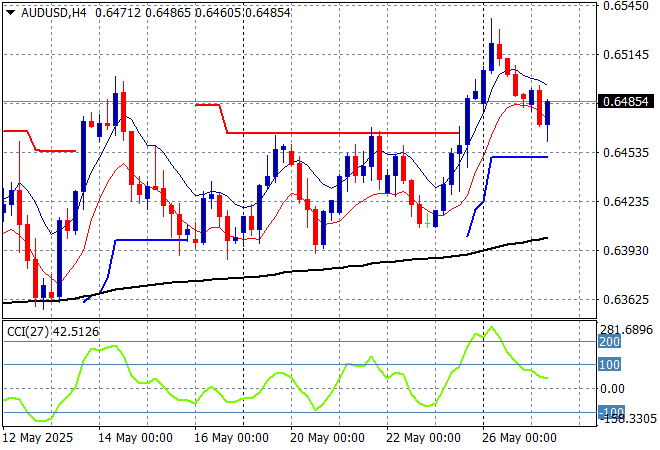

Risk markets in Asia are doing a little better despite the lack of a lead from a closed Wall Street with the focus on positive Chinese industrial production numbers. However currency markets are still wanting to push the USD down further with a somewhat hawkish talk from the BOJ not helping the USDJPY pair while the Australian dollar is almost back at its recent five month high above the 65 cent level.

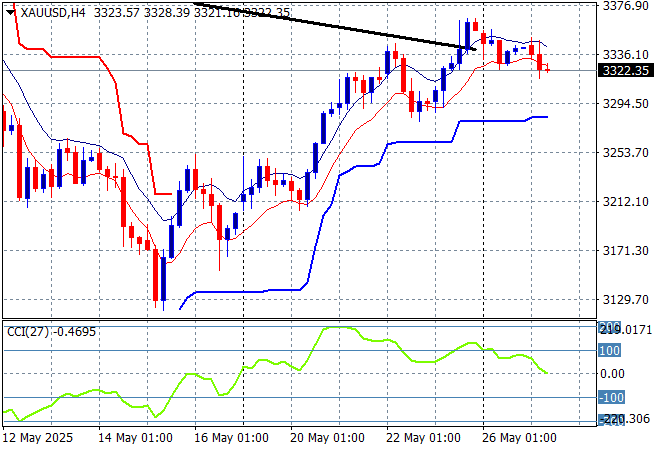

Oil markets are trying to stabilise with Brent crude still oscillating around the $64USD per barrel level again while gold is also consolidating after its Friday night surge above the $3350USD per ounce level with a small selloff this afternoon:

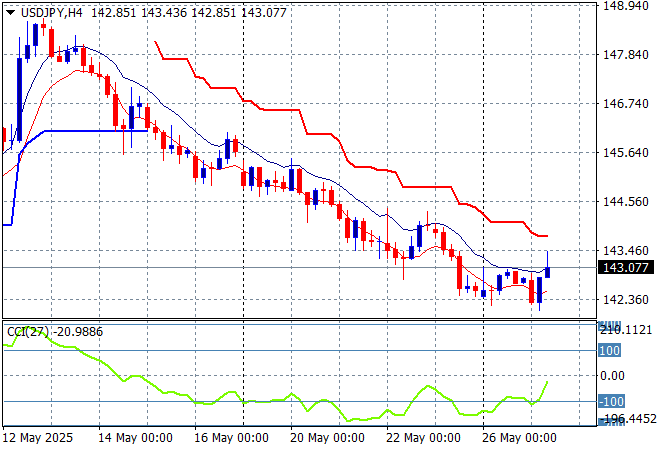

Mainland Chinese share markets fell slightly in the afternoon session with the Shanghai Composite still down 0.2% or so while the Hang Seng Index is up a similar amount as it oscillates around the 23000 point level. Japanese stock markets are doing a lot better with the Nikkei 225 up more than 0.4% to 37707 points while trading in the USDPY pair has seen a return back above the 143 level, but only briefly:

Australian stocks were able to continue the recent upward momentum with the ASX200 up 0.5% to 8407 points while the Australian dollar has tried to return above the 65 level after exceeding its post RBA meeting move:

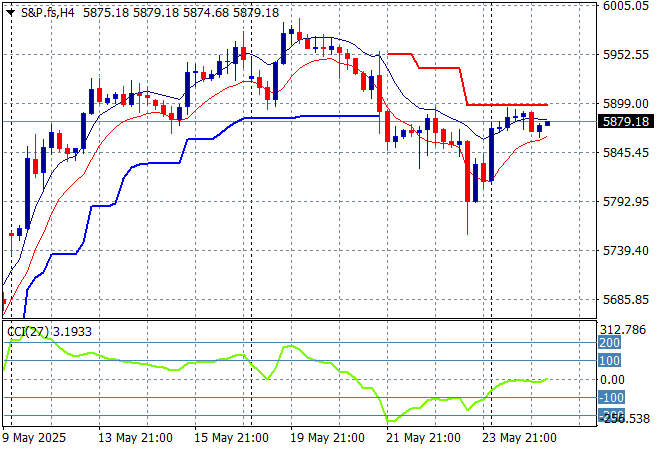

S&P and Eurostoxx futures are steady going into the London session with the S&P500 four hourly chart still showing a slowdown here in short term momentum as price comes up against resistance at the 5900 point level:

The economic calendar returns to a US focus tonight with durable goods orders and consumer confidence numbers.